Algorithmic Market Check-Up: Pfizer

Confira nosso último artigo (23/06/2014 )no Seeking Alpha: Algorithmic Market Check-Up: Pfizer

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Pfizer is trading at a price range that makes it currently a “buy”.

- The progressive philosophy at Pfizer’s new R&D center in Cambridge, Massachusetts will encourage innovation that will reward shareholders over the long term.

- Palbociclib, a breast cancer medication, has an estimated peak sales of over $5 billion and can potentially get an early date with the FDA.

- The I Know First self-learning algorithm has a strong bullish forecast for PFE in the 1-month, 3-month & 1-year time horizon.

News about Pfizer’s (PFE) failed pursuit of AstraZeneca dominated the headlines last month, however this premium biopharmaceutical company can still be an attractive investment. Growth over the past few years has been steady and the current balance sheet is salubrious, allowing the company to take advantage of new opportunities that arise. If this opportunity is not created through an acquisition, Pfizer’s new research center in Kendall Square, Cambridge, Massachusetts is experimenting with a new approach to conducting research, which may be just what the company needs. The 280,000-foot facility will have open working spaces, and encourage sharing ideas with their academic and biotech neighbors. Senior vice president Jose-Carlos Gutiérrez-Ramos downplayed the risk of eavesdropping by competitorsstating, “there are a few things – the chemical structure of a drug or the protein sequence of a therapeutic antibody – where we need to take precautions… However, those are only 10 percent of our activity. The other 90 percent can be shared.”

One of Pfizer’s biggest hurdles to overcome is its sheer size with a market value that exceeds $187 billion. In order for this massive conglomerate to grow, it must be able to consistently introduce multiple blockbuster drugs that generate sales of at least $1 billion or more. No doubt that this is a herculean task, but that’s exactly why Pfizer’s strategy is to make the research center that will collect some of the most brilliant minds in Cambridge including scientists from local universities, teaching hospitals, and biotech start-ups as well as patient advocates that are willing to advise and help fund research into some of today’s most debilitating diseases.

Pfizer will be filing for the accelerated approval of Palbociclib, a breast cancer drug; with estimated peak sales over $5 billion and can potentially get an early date with the United States Food and Drug Administration (FDA). The company will be filing accelerated approval based on strong Phase 2 data. The drug is considered one of the most promising experimental breast cancer drugs in Pfizer’s arsenal today, and works by blocking a pair of enzymes known as cyclin-dependent kinases 4 and 6.

Goldman Sachs resumed coverage of PFE with a buy rating and a price target of $35 representing an approximate upside of 17% from PFE’s current price. This price target is likely to be realized as our advanced self-learning algorithm based on predictive analytics has a strong bullish signal for the premium biopharmaceutical conglomerate. At I Know First, we endorse algorithmic trading through predictive analytics as one investment strategy that will help assuage risk and enhance returns.

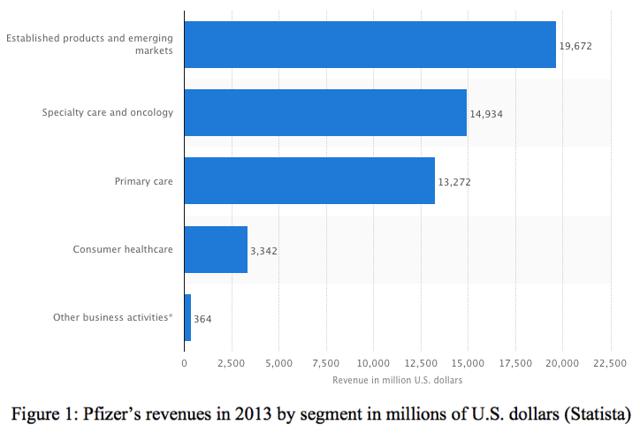

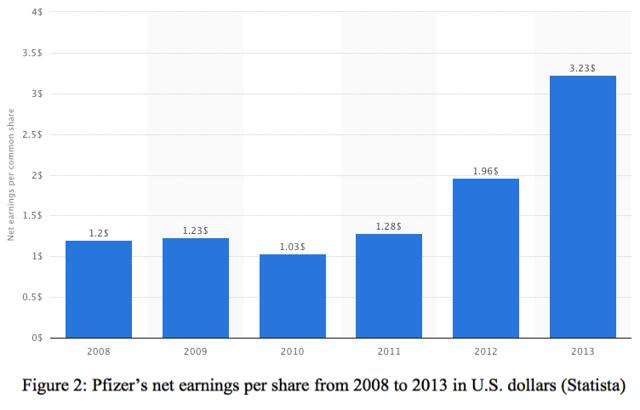

While a deal with AstraZeneca could not be reached, Pfizer has other prospects that shareholders can prosper from. With shares trading lower lately and PFE carrying an enticing dividend of 3.5% as well as diversified revenue streams with new prospective blockbuster drugs in the works, the downside is limited compared to the forecasted potential. Figure 1 showsPfizer’s revenue’s by segment in 2013 and figure 2 displays the company’s net earnings per share from 2008 to 2013 in U.S. dollars.

New Research Facility in Kendall Square, Cambridge

This new research center is unique for Pfizer. The company is utilizing a collaborative culture and open architecture of entrepreneurial start-ups that are located in Kendall Square. This approach is completely different from the traditional pharmaceutical industry of in-house drug development. The idea is that this will encourage fresh ideas and initiate new innovation. In fact, no one actually has an office according to Gutiérrez-Ramos. He explains, “we want interaction between scientists inside and outside. We really want to have a strong laboratory culture, with experimentation and collaboration at the center of everything. Collaboration and innovation is what we came here to do.” Scientists will be working in a state-of-the-art lab space on a range of clinical programs across several therapeutic areas, including immunology, inflammation, rare diseases, neuroscience as well as cardiovascular and metabolic diseases.

This research center has been under construction for three years now at the site of a former Massachusetts Institute of Technology parking lot. There will be 1,000 researchers and support staffers that will be working in partnership with local university and industry scientists. To enhance innovation, the company has taken a philosophy of supplementing its own research with collaborations. President of worldwide research and development, Mikael Dolsten explains that the new Kendall Square lab is crucial for Pfizer’s goal of winning regulatory approval of two new medicines a year. Locating the facility here was far from random chance, in fact Dolsten expressed his confidence to The Boston Globe that the area “is a real recognition of our confidence in Cambridge, Mass., to become one of the leading hubs of biomedical research for us in the future… Every year, we hope to see discoveries coming from Cambridge that will help us to bring medicines to the market.” In addition to the new Cambridge R&D center, Pfizer also has a research and manufacturing site in Andover, which is also the global headquarters for Pfizer’s Centers for Therapeutic Innovation (CTI) in Boston.

Both, the local universities and Massachusetts governor Deval Patrick have welcomed Pfizer with open arms. MIT President L. Rafael Reif, Ph.D. stated, “we could not ask for a more exciting tenant for these spaces. MIT and Pfizer have established a tradition of working together to advance science, research and education, through strategic initiatives like MIT’s Synthetic Biology Center. With this extraordinary core of Pfizer research teams now right next door to our labs at MIT, we can capitalize on the power of proximity to speed progress towards solutions to urgent challenges in human health.” Collaborations with institutions utilizing CTI’s model that is intended to construct a pioneering network for drug discovery, will help Pfizer bring new drugs to the market faster and help patients who need the treatments. This philosophy is also guiding sister research sites in Groton, San Diego, the San Francisco Bay Area, and Cambridge, England, which work in areas ranging from cancer to diabetes. While this facility is brand new, we may need to wait a little while before the first blockbuster drug emerges. However, Pfizer already has a progressive drug being filed for accelerated approval that can service an underserved market that will help millions of women suffering from breast cancer.

A Promising Blockbuster Drug

Last month, Pfizer announced it would submit a New Drug Application (NDA) with the FDA for Palbociclib combined with Letrozole based on strong Phase 2 data. In April, the company presented data regarding the drug. In the study, 165 women with advanced, hormone-sensitive breast cancer treated with Palbociclib and another drug called Femara, or Femara alone. The cancers were estrogen receptor-positive, which means that their growth was fueled by that hormone. According to an investigator in the study Dr. Dennis J. Slamon of U.C.L.A., about 60% to 65% of breast cancers fit that description.

Primary endpoint of progression free survival was ten months better at 20.2 months versus 10.2 for the control group. Overall survival rate was better but not significant at 37.5 months versus 33.5 months for the control group. The overall survival rate is positive but not statistically significant, which does raise some questions about accelerated approval, although the medicine did prove to be effective in halting the spread of the cancer. While the FDA is always cautious, there is an unmet need for this drug and many analysts agree that this is still the most promising data ever seen in this population of breast cancer patients. The FDA usually requires bigger Phase 3 studies, but on occasion it makes exceptions for drugs for cancers and other life-threatening illnesses. For example, back in 2008, the FDA permitted the accelerated approval of Genentech’s (DNA) Avastin as a treatment for breast cancer based on a single trial in which the drug hindered disease development by about five and a half months.

One of the study’s principal investigators, Richard S. Finn, M.D. told The New York Times that the drug was “ground breaking” and “the magnitude of benefit we are seeing is not something commonly seen in cancer medicine studies.” Breast cancer specialists not involved in the study were also encouraged. Dr. José Baselga stated “These results are strikingly positive and with a large potential impact to patients.” David Risinger, an analyst with Morgan Stanley, estimates annual sales of the drug to be around $5.5 billion by 2020 if regulators approve the drug. While accelerated approval would be ideal, even if it were not, it will only accelerate the conception sales up by a year or two and will have a limited effect on long-term value of the medicine. It should be noted that Novartis (NVS) and Eli Lilly (LLY) are playing catch-up to develop competing cancer drugs but are at much earlier stages in development.

Algorithmic Prescription Based on Predictive Analytics

I Know First utilizes an advanced self-learning algorithm based on Artificial Intelligence (AI), Machine Learning (ML), and incorporates elements of Artificial Neural Networks and Genetic Algorithms in order to model and predict the flow of money in almost 2,000 markets from 3-days to a year. The market prediction system is entirely empirical and not based on human derived assumptions. The human factor is limited to building the mathematical framework and initially presenting the system with the “starting set” of inputs and outputs, which is also utilized for recognizing almost 2,000 other market opportunities. The algorithm then repetitively proposes “theories” and recurrently tests them automatically on years of daily market data. It then validates them on the most recent data, which prevents over-fitting. By separating the predictable part from stochastic (random) noise, the algorithm is able to create a model that projects the future trajectory of the given market in the multi-dimensional space of other markets. The output of the predicted trend is a number, known as the signal, which is used by traders to identify entry and exit points in the market. While the algorithm can be used for intra-day trading, the predictability tends to become stronger over longer time-horizons such as the 1-month, 3-month and 1-year forecasts, making this market prediction system ideal for longer-term trading.

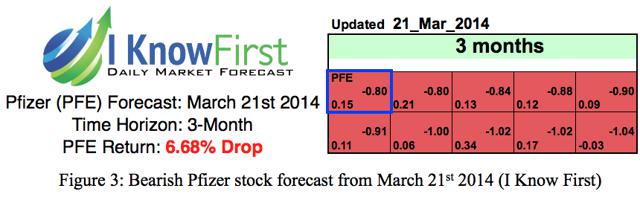

The color-coded forecast is very easy to read where green indicates a bullish signal and red indicates a bearish signal. Deeper greens signify that the algorithm is very bullish and vice-versa for deeper reds. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset, while the predictability is the historical correlation between the prediction and the actual market movements. In other words, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence. These are two independent indicators but consider both as you make your own analysis. Figure 3 shows an algorithmic prediction for Pfizer from 3 months ago. Algorithmic traders utilizing our Pfizer stock prediction received this forecast. Ticker symbols for other assets have been removed; however, you can still see their signal and predictability.

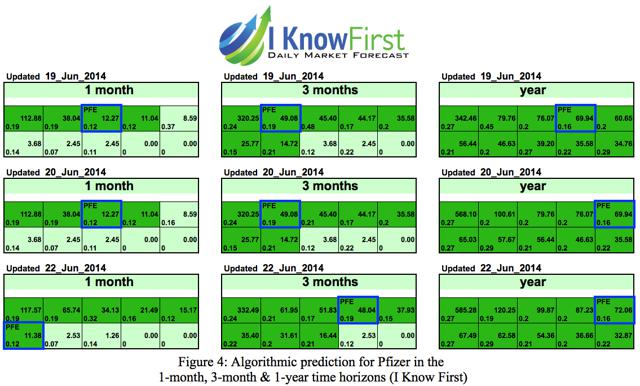

In accordance with the algorithmic forecast PFE fell 6.68% over the stated time horizon. Figure 4 shows the algorithmic prediction for Amazon in the 1-month, 3-month & 1-year time horizon. Comparing the algorithmic performance from the forecast above to the most contemporary forecast is an excellent strategy for rationalizing your expectations utilizing algorithmic trading as one tool in your analysis toolbox.

We recommend watching for any trends in the movement of an asset within the forecast over a few days. In this forecast for Pfizer, the stock remains within the deeper green forecast, demonstrating the bullishness of the market prediction system. The signal and the predictability for Pfizer remain the same on June 19th and June 20th, however the hierarchy order of our performing investment recommendations changes slightly in the 1-year time horizon. Since we release the forecast for Monday, June 23rd on Sunday, June 22nd, it represents tomorrow’s forecast. Overall the prediction for PFE remains fairly stagnant slightly weakening in the 1 & 3-month time horizons but strengthens in the 1-year time horizon. This demonstrates consistency in the forecast and should provide an additional level of confidence in the forecast.

The predictability or designated confidence of this forecast (from each day shown) increases steadily over each time horizon from 0.12 to 0.16. Predictability ranges from positive 1 to negative 1. This metric is an adaptation of the Pearson correlation coefficient. A higher predictability is better but generally a predictability of 0.2 is preferable. Consider both indicators in your own analysis, as both indicators are independent. Algorithmic traders utilize these daily forecasts as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. We never recommend blindly purchasing assets that are endorsed by the algorithm without your own additional analysis.

Conclusion

While Pfizer is not a perfect investment, consider this biopharmaceutical company at the price it is currently trading. The I Know First self-learning algorithm has a strong bullish signal for this asset and we are not alone in our assessment. Aside from the Goldman Sachs price target of $35, the consensus opinion on Yahoo! (YHOO) Finance is 2.3, where 1.0 is a strong buy and 5.0 indicates a sell. PFE has a mean price target of $34.40 out of 16 brokers, indicating that shares can potentially rise a fair amount from current trading levels. The approach to the new facility in Cambridge, Massachusetts is entirely distinctive from the traditional pharmaceutical industry of in-house drug development that will embolden fresh ideas and originate innovation that will benefit shareholders over the long term. The company is developing experimental drugs in the pipeline including medications for immunology, pain control and rare diseases. The most promising prospect, Palbociclib fulfills an unmet need and could eventually generate annual sales of $5 billion. The stock also pays an enticing 3.5% yield. Where shares are currently trading the downside is limited versus to the projected potential, making Pfizer an attractive investment currently.

Business disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. Joshua Martin, an I Know First Research analyst wrote this article. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.