Algorithmic Prediction Is Bullish On Tesla

Confira nosso último artigo (14/10/2014 )no Seeking Alpha: Algorithmic Prediction Is Bullish On Tesla

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Tesla Motors, an American manufacturer of high-end electric cars, has long been a very popular, reliable stock.

- Despite the fact that it is almost always a worthy stock to invest in, certain current business developments make Tesla even more of a bull at present.

- Specifically, TSLA’s branching into self-driving cars, varyingly priced models, international markets, deals with Toyota, and gigafactory construction could increase the stock’s success in the short and long terms.

- I Know First predicts a bullish forecast for TSLA in the 1-month and 3-month time frames.

Company Profile

Tesla Motors, Inc. (NASDAQ: TSLA) is an American manufacturer of electric cars and other electric vehicle components widely known amongst investors, as is evident from the quantity of articles on Seeking Alpha that center on this company. Operating stores or galleries in 22 U.S. states, Tesla is already established in the United States as a favorite for stockholders, given its secure returns and potential for long-term growth. However, it is always innovating in the short-term, as well; specifically, this year, a few novel developments could be contributing to Tesla’s share rises, as I Know First algorithmic predictions suggest.

A Few New, Potentially Positive Developments

Firstly, Tesla announced that it plans to further investigate self-driving cars and other electric car automation. Specifically, one system developed by Tesla, according to Barclays analyst Brian Johnson, may keep cars in a set lane, and may involve all-wheel drive. These kinds of features could be beneficial to TSLA: as a company that sells less than 50 000 cars per year, most of them to high-paying customers, Tesla must keep abreast of elite customerexpectations if it is to continue growing. As such, implementing the kinds of high-tech features that Johnson says are often found on other, competing models will help Tesla remain current, increasing sales amongst high-paying customers.

Secondly, Tesla also appears to be trying to diversify its clientele: it has started offering some more low-budget products to, perhaps, offset its singular focus on high-paying customers. Elon Musk, Tesla’s owner, has a habit of announcing new Tesla products using letters and images; via Twitter, he recently noted that Tesla would unveil a “Model D” vehicle on October 9th. While some assumed that the upcoming Model D would be a Gen III product – a comparatively low-budget model expected to be a small, mass-market vehicle – it ended up being a new dual motor called the P85D. Its new features? It has all-wheel drive, is capable of going 275 miles on a single charge, and has an impressive start-up: it can go from zero to sixty miles per hour in 3.2 seconds. Its price? A solid $120 000.

This has disappointed some analysts. While Musk previously suggested that some of Tesla’s new Gen III products will be comparatively low-budget (theModel 3 has already been introduced), that hasn’t as yet happened. Further, some analysts and investors hoped for a self-driving car, given Musk’s recent emphasis on automation: big things were expected, including a system that could keep drivers in their lane automatically. One analyst is going so far as to call Elon Musk “the boy who cried wolf”, suggesting that what Tesla has devised with the P85D is nothing more than a “logical next step” – one that “every competitor [will] offer”. And that’s a problem, given that Tesla caters largely to elite customers already capable of obtaining these features elsewhere.

However, the P85D still signals that Tesla is interested in varying its offerings to suit a range of clientele, and does hint more at automated features in the future. For one, Musk has announced that there will be some level of auto-pilotsoftware in the model. Specifically, it can read and respond to speed-limit signs, and can turn itself when the turn signal is enabled. If it isn’t entirely the cutting-edge new product investors, customers, and analysts were waiting for, it is, at least, a decent upgrade to the Model S. Further, as Elon Musk has pointed out, this investment into diversifying Tesla’s product line showcases that the company’s capital expenditure and R&D numbers are “better than they appear because there are things you don’t know about,” as Musk puts it. While progress in new models may not be as apparent as hoped, this may well be part of the reason why Tesla’s stock, trading at $40 last year, is now near$260.

Tesla also appears to be interested in boosting production and benefits via increased domestic and international sales. As has previously been pointed out, Tesla – despite its fame – does not sell many cars per year. In certain countries, it does not have very wide reception, either. As such, increasing sales proves an intelligent objective. Earlier this year, Tesla committed to further expansion in Europe, stating that it will open more than 30 service centers across the continent, and will continue expanding its Supercharger network – a collection of charging stations, essentially. This could be immensely helpful to Tesla, for whom Europe is presently a priority market. More recently, too, Tesla has worked towards increasing its success in China; specifically, the company has orchestrated a deal with China Unicom(NYSE:CHU), which will install hundreds of charging stations across China. Endeavors like these, in boosting Tesla vehicles’ accessibility in the country, may well also draw new drivers to the American manufacturer. Further, China has announced a mandate starting in 2016 that will require 30% of all cars used by the Chinese government to be electric-powered, in order to limit pollution. Further, officials have stated that they want 5 million electric vehicles on the road by 2020. While this won’t be uniquely advantageous for Tesla, given that other companies could contribute electric vehicles, it is noteworthy that shares went to an all-time high in August of this year when the CHU deal was finalized.

Tesla’s plan to increase domestic and international sales also appear to include Toyota Motor Corporation (NYSE: TM), the large Japanese automotive manufacturer whose models appear so frequently in the United States. Consisting of 333 498 employees worldwide and ranked as the fourteenth-largest company in the world by revenue, Toyota was once the largest automobile manufacturer by production; it is the world’s first manufacturer to produce more than 10 million vehicles per year, and the largest listed company in Japan by market capitalization and revenue. As such, TM seems a valiant company with which to partner, as Tesla has already seemingly acknowledged: the two worked together on a deal in which Teslaprovided Toyota with motors and batteries. While this deal is expected to end this year, there are hints that Tesla will be making another deal with TM. If this is indeed true, then Tesla could stand to benefit significantly, given that Toyota is doing so well overall. Further, given its catering towards lower-budget customers, TM has succeeded in tapping into revenue streams that Tesla could not otherwise access.

In the long term, there is also talk of Tesla’s planning to create a gigafactoryin collaboration with Panasonic Corporation, one of Japan’s large electronics producers alongside Sony, Hitachi, Toshiba, and Canon. The Japanese and American giants will construct a large-scale battery manufacturing plant in the United States, for which Tesla will provide land, buildings, and utilities. Cumulatively, it is hoped that this gigafactory will reduce the costs of long-range battery packs for electric vehicles. If Tesla manages to make this a reality, electric vehicles may well open up to the mass market, generating more profit for the company. Further, Musk has made another move to make electric vehicles more accessible at large: this June, he opened up Tesla’s patents to “anyone who, in good faith, wants to use our technology”, stating that “laying intellectual property landmines” would constitute “acting in a manner contrary to [the goal of accelerating the advent of sustainable transport”. Opening up the electric vehicle market, while it may seem to further competitors’ success as well, also has the potential to greatly further Tesla.

Finally, Tesla’s technical considerations are also solid. The stock has continually been hailed as a secure investment with potential for growth. Just this year, it has produced a 60%+ year-to-date return, and has an unusually high PE. Tesla is expected to do so well this year, in fact, that analysts’ projected earnings estimates have risen dramatically, going from nine cents in profit this year to over two dollars per share in 2015.

These expectations represent consistently rising confidence in Tesla, as analysts’ estimates confirm. Analysts consistently call Tesla a buy, as evidenced by NASDAQ’s online ratings summations (Figure 1).

Figure 1. Analysts from J.P. Morgan, Barclays, Jefferies & Co., Wedbush Securities, and other firms primarily deem Tesla a strong buy. Note that no analysts rate it a “sell”.

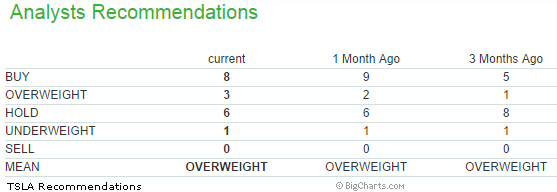

Recommendations are also overly positive at MarketWatch.com, where the mean recommendation for Tesla for the last three months has been an “overweight” (Figure 2).

Figure 2. MarketWatch analysts rank Tesla: at present, 8 call it a “buy”, 3 call it an “overweight”, 6 call it a “hold”, and one calls it an “underweight”. Note that none recommend selling the stock.

Algorithmic Perspective

Several years ago, fundamental analysis was the only way to go. However, at present, we can gain an algorithmic perspective on investment, as well. While algorithmic analysis should not be regarded as conclusive, it is a decidedly useful tool for most investors.

I Know First recognizes this, and has thus devoted time to developing an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks: one capable of predicting the flow of money in almost 2000 markets from 3-days to a year. This algorithm provides traders with a trend they can use to identify when to enter and exit the market; though it may be used for intra-day trading, the predictability of this trend becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – effectively be used to analyze the value of such stocks as Tesla. While I Know First’s algorithm should not be regarded as a stand-alone testament to Tesla’s value, the algorithm has seen an unusually high degree of accuracy, and as such is, at least, a useful complement to independent analysis.

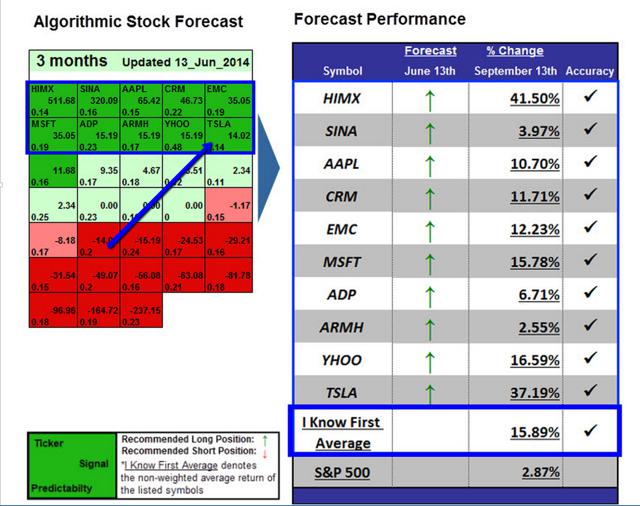

While many investors may question the validity of such an algorithm, particularly as compared to analyst recommendations, I Know First has successfully predicted the performance of many stocks – Tesla included. On June 13th, 2014, for example, I Know First recommended a strong bullish position for Tesla for a period of three months, from June 13th to September 13th, 2014. Comparing this forecast to Tesla’s actual progress (Figure 3), we see that the two aligned: the stock return was +37.19%. Specifically, since our updated May 9th prediction, featured here, Tesla has gone up by 42%; since our updated strongly bullish June 9th prediction, Tesla has gone up by 27%.

Figure 4. I Know First successfully predicted TSLA’s strong bullish trend for three months in June 2014. I Know First’s June 13th forecast is shown on the left, with Tesla boxed in blue for clarity; Tesla’s actual performance is shown on the right.

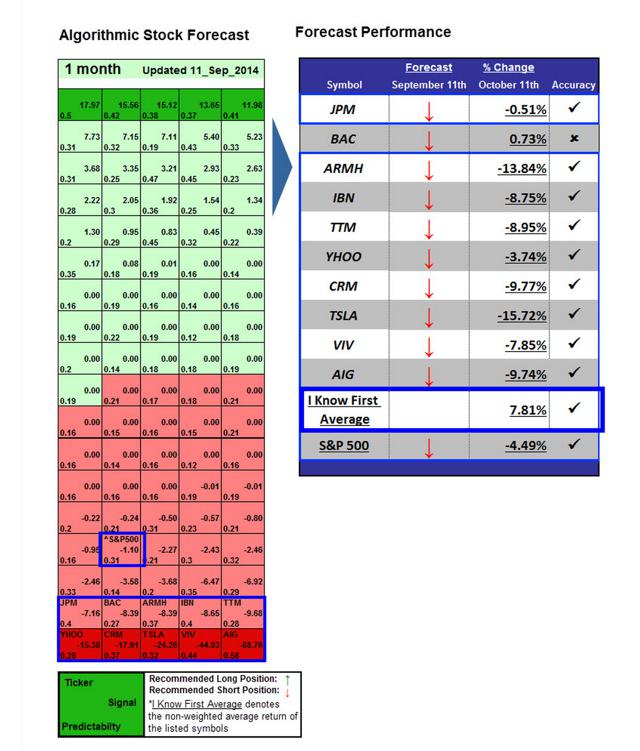

Last month, the one month forecast for Tesla was negative:

Figure 5. I Know First’s September 11th forecast is shown on the left, with Tesla boxed in blue for clarity; Tesla’s actual performance is shown on the right.

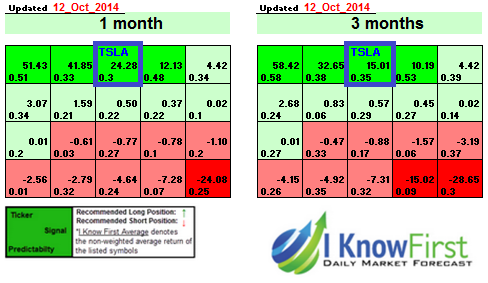

The most updated forecast generated by the I Know First algorithm, updated on October 12th, is shown below (Figures 6). Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and itspredictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast). Taking all this into consideration, the ticker symbol for Tesla Motors – “TSLA” – may be seen as bullish in the 1-month and 3-month time frames.

Figure 6. I Know First’s most recent 1-month and 3-month forecasts for Tesla Motors. Tesla is boxed in blue, and shown to be bullish.

This bullish forecast for the short term coincides well with recent developments in Tesla’s automated driving plans, lower-budget models, and international outreach. Given analysts’ mean positive recommendations and Tesla’s plans, it may be wise to consider keeping Tesla in one’s portfolio until further change.

Conclusion

Tesla has long been hailed as a stock to celebrate. While it has sparked analyst attention for some time, the present is as good a time as any – and, perhaps, an even better time than most – to get involved with Tesla. In pursuing all-wheel drive, automated lane-keeping, and other high-tech automated functions, Tesla is looking to remain abreast in the high-budget market. Simultaneously, however, Tesla- previously geared only at producing vehicles for high-paying customers – is now attempting to diversify its range of products, creating low-budget models for the mass market. The company is also confident in its R&D, capital expenditure, and ability to grow, having produced a 60% year-to-date return and a high PE. Tesla’s potential renewed deal with Toyota Motors will also be of immense help to the company, if it is in fact going to be finalized: via TM, Tesla could access revenue streams of which it couldn’t otherwise avail itself. Finally, further expansion into the Chinese and European markets as well as plans for a gigafactory may well contribute to Tesla’s successful in the long term. As a result of all this, analyst recommendations have grown more positive in recent months. Finally, I Know First predicts that Tesla will be bullish in the 1-month and 3-month time frames. With stock trading at about $220 more than it did last year, now is an excellent time to consider investing in Tesla.