Can Mayer Successfully Transition Yahoo: An Analysis Of Her Mobile-Centric Strategy And An Algorithmic Forecast

Confira nosso último artigo (25/11/2014 )no Seeking Alpha: Can Mayer Successfully Transition Yahoo: An Analysis Of Her Mobile-Centric Strategy And An Algorithmic Forecast

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Yahoo stock has more than tripled due to the company’s investment in Chinese e-commerce giant Alibaba.

- Yahoo has acquired new startups to enter new growth markets in online advertising.

- Yahoo is trying to find a tax-free way to return remaining investment in Alibaba to shareholders.

- I Know First algorithm correctly predicted stock price increase in June 30th article and forecasts a future bullish signal for Yahoo stock.

When Marissa Mayer was named CEO of Yahoo (NASDAQ:YHOO), the company had fallen on hard times. Started by two graduate students at Stanford in their early 20s who were playing around with the relatively new phenomenon of the World Wide Web, Yahoo was founded in 1995 and quickly became the undisputed industry leader of Internet portals. Yahoo’s dominance continued throughout the rest of the decade until Google (NASDAQ:GOOG) (NASDAQ:GOOGL) entered the market. Equipped with a better search engine that was based more on relevance, Google was able to quickly overtake Yahoo and establish dominance as the main search engine on the web. Younger upstarts such as Facebook (NASDAQ:FB) and Twitter (NYSE:TWTR) have also overtaken Yahoo in popularity. For years, Yahoo toiled without a coherent business strategy, as a string of unsuccessful CEOs have been unable to transition the company, allowing it to experience a years-long slide from its former glory. Never focusing on one thing, Yahoo dabbled in social networking, auctions, photo sharing and videos without much conviction or focus.

On July 16th, 2012, Marissa Mayer was named CEO of Yahoo. The 20th employee at Google, she had risen up the ranks all the way from programmer to Vice President of location services, the company’s next key growth driver. At an informal dinner with Yahoo’s board, Mayer shocked everyone with a detailed plan for the company going forward, causing one member of the board to claim, “That’s the next CEO of Yahoo,” after she left. Mayer has listedfour new fields as Yahoo’s growth businesses to help offset declining display ads, stating, “Video, along with mobile, social, and native, represents a new format of online advertising that has the potential to help us transform and modernize Yahoo’s display business and return it to growth”. Since becoming CEO of Yahoo, Mayer has acted quickly to transition the company, immediately acquiring assets to do so and using them to acquire startups that can make her vision a reality.

Yahoo Core Business

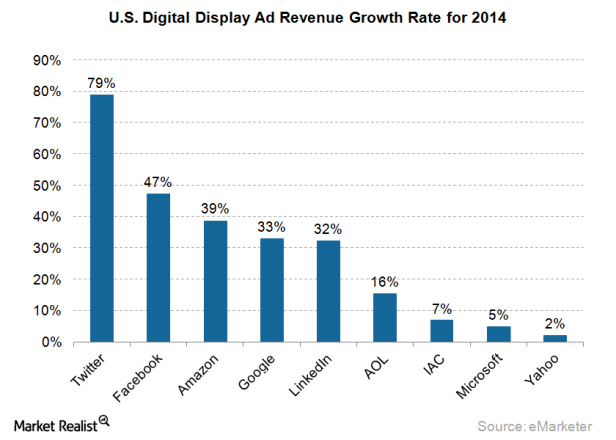

Yahoo’s core advertising business has been in a prolonged decline, losing business to popular websites such as Facebook and Google. Its online display ad business, once the largest in the world, has been in decline for years now and continued to spiral. During the company’s third quarter results conference, it was disclosed that Yahoo’s display ad business generated 5% less revenuethan in the same quarter the previous year. This is particularly worrying since the company had an increase in number of advertisements sold, but saw this mitigated by a 24% drop in price of ads. Critics of Mayer have correctly pointed out her inability to correct this problem, as Yahoo’s display ad growth rate has drastically lagged behind that of their competitors.

Figure 1 Source: Market Realist

Mayer has had some success, though. When she became CEO of Yahoo, the company’s stock price had fallen by nearly 50% over the previous five years to a value of $15.69. Mayer has since been able to more than triple the stock price, which is now valued above $50. Mayer inherited an ownership stake in Chinese e-commerce giant Alibaba (NYSE:BABA), which released its IPO in September. During the IPO release, Yahoo sold 140 million shares, bringing in $9.4 billion dollars. Yahoo retained a 16.3% stake in Alibaba worth $44 billion even after selling those shares, along with a 35% stake in Yahoo Japan, worth $8.2 billion. These investments have driven up Yahoo’s stock price, and have given Mayer some assets with which she can shift the company and implement her vision.

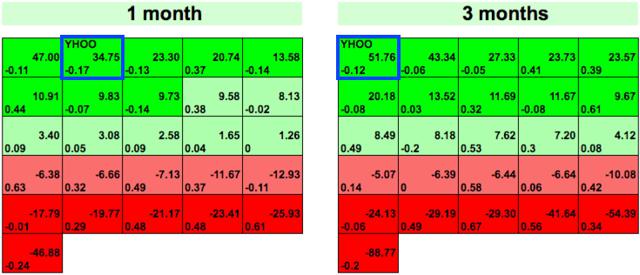

In an article published on Seeking Alpha on June 30th titled “Bullish Algorithmic Forecast For Yahoo Around The Alibaba IPO“, I Know Firstrecommended a bullish forecast using the algorithm for Yahoo stock in the 1-month and 3-month time horizons. The author correctly pointed to increased revenue from native ads on Tumblr and the Alibaba IPO as possible ways that Yahoo stock would increase, which were confirmed during Yahoo’s third quarter earnings report.

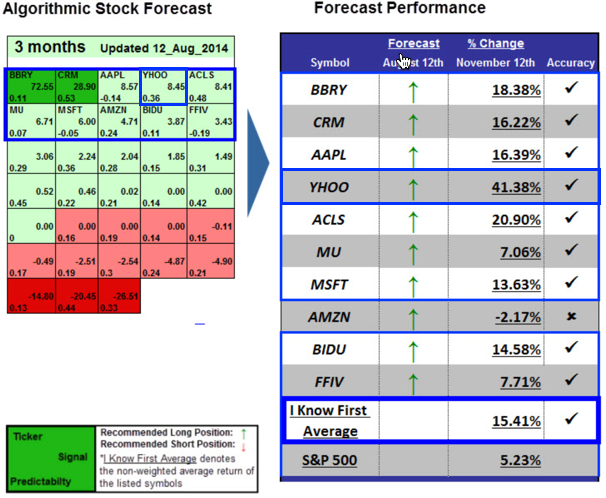

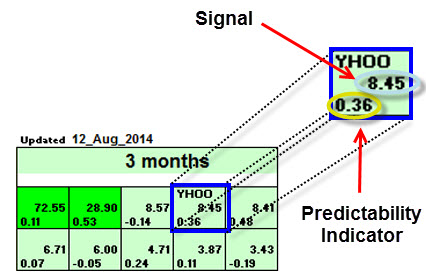

An example of when I Know First’s algorithm was correctly able to predict that the value of Yahoo’s stock would increase was on August 12th. The algorithm provides a signal strength and predictability indicator. The signal strength indicates how much the current price of a stock deviates from what the algorithm considers an equilibrium price. The signal strength can be positive (predicted increase) or negative (predicted decrease). The predictability indicator measures the importance of the signal. Ranging from negative one to one, the predictability indicator is updated daily using a historical correlation between the prediction and the actual market movement. As you can see below, Yahoo had a signal strength of 8.45 and a predictability indicator of 0.36 on August 12th, 2014. Since that time, Yahoo stock’s value has increased over 40%, due to many of the factors discussed earlier.

Figure 2 Source: I Know First

Worth watching will be how Mayer handles the shares Yahoo still possesses in Alibaba. Any capital gains Yahoo makes would be subject to tax deductions of 35%, or about $15 billion. Mayer has insisted that Yahoo will do what is best for the company’s shareholders. An alternative approach favored by some shareholders, including activist investment group Starboard Value, Inc., would be to spin off the Alibaba shares into a separate company in a tax-free transaction. This leaves Mayer in a difficult position, as it might satisfy shareholders, but would leave Mayer in charge of a company roughly one-fourth the size. This would make her vision of transforming the company into a mobile advertising leader even more challenging. Mayer has hired some of the best tax experts in the country to find a tax-free arrangement to sell the remaining shares in Alibaba, and the shares can’t be sold until September 15th, 2015, as part of an agreement of Alibaba’s IPO. Mayer plans to give an update no later than during the next earnings call, early next year.

Mayer’s Plans for the Future

While Mayer has been unsuccessful in turning around display advertising revenues, she has started to make progress in new areas, including video, mobile, and native, in large part due to her acquisitions of startups. The most notable startups are the blogging service Tumblr, which Yahoo purchased for $1.1 billion, along with Brightroll for $640 million and Flurry, reportedly purchased for more than $300 million.

The purchase of Tumblr, a social media platform, gave Yahoo access to a younger generation of users, immediately growing the amount of users and traffic on their site. However, many analysts believed that Yahoo was overpaying for the company, as it had never posted a profit, made a fraction of Yahoo’s sales, and was not certain to contribute to revenues for years. Mayer seems to have been able to silence the critics recently, though. Unlike most of Yahoo’s consumer web products, Tumblr is culturally relevant with young people and growing, with a 40% increase of users since last year. While Tumblr only had $13 million in revenue in 2012, Mayer said the blogging site is on track earn $100 million in ad revenue next year, and Tumblr founder Dave Karp has said he hopes to blow past that mark. More interesting than the growing number of users or unexpected earnings that Tumblr will make so soon, though, is Mayer’s vision for the site: she hopes to make it into a YouTube competitor.

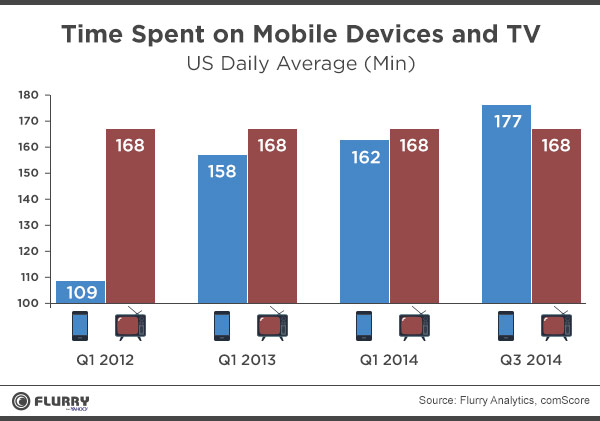

Mayer has been trying to acquire a video service since she got the job, as it will allow Yahoo to enter the video market using native and mobile advertising. People now spend more time on their mobile devices than watching television, but advertising money for mobile videos still lags far behind that of its more traditional competitor. This provides a huge opportunity for growth that Yahoo hopes to exploit. Yahoo had tried to acquire Dailymotion, Hulu, and Twitch, all video networks, but was unsuccessful in each attempt. Now, Mayer has decided to look within the company at one of her earlier acquisitions, as video posts are now growing twice as fast as photo posts on Tumblr. This is possible due to a new video player, including the ability for users to pop out a video and watch it while continuing to scroll through their feeds. Tumblr will be able to use native ads, allowing advertisers to post videos and pay to promote them in regular content streams. This is appealing to advertisers, as videos are much more likely to get the attention of consumers than still banner ads, which are almost always clicked on by accident.

Figure 3 Source: Flurry.com

Brightroll is also expected to contribute to the growth of Yahoo’s new marketing strategy. A leading programmatic video advertising platform, Brightroll served more ads and reached more consumers in the United States in 2014 than any other platform, making Yahoo’s video advertising platform the largest in the U.S. Because online advertising is fragmented across thousands of sites and apps throughout the web, advertisers need simpler ways to purchase ads across many sites in fewer transactions. Brightroll has relationships with many of the largest advertisers in the country, including all of the top 15 advertising agencies, using programmatic advertising to match advertisers with video content on mobile devices and desktops in real time. Unlike Tumblr, Brightroll was already posting profits before the acquisition, and is expected to earn $100 million in revenue this year. Mayer has claimed that the acquisition can help both companies, allowing Brightroll to scale to even more consumers globally and bringing their platform to Yahoo’s advertisers.

The third major acquisition Yahoo has made, Flurry, is the industry leader in mobile analytics. The combined offerings of Flurry and Yahoo will enable more effective advertising solutions for brands, creating app experiences that are more personalized for mobile and desktop advertising. Brightroll and Yahoo will be able to use Flurry’s network of 170,000 apps, including Snapchat and Pinterest, to reach more customers. Flurry allows retail brands to buy 15, 30, or 60-second mobile ads and can then track performance down to the store level. These new acquisitions have opened up growth markets that Mayer is trying to take advantage of, revolutionizing the company and adapting it to the modern market.

Mayer was able to calm critics during Yahoo’s third quarter earnings call.Revenue was $1.09 billion, a 1.5% rise from a year prior, and beat analyst’s expectations of $1.05 billion. Profit per share also beat expectations easily, at 52 cents per share compared to the expected 30 cents per share. Mayer noted the one time cash windfall from the sale of Alibaba stock during the company’s IPO, but also noted the repurchase of 23.5 million shares from a financial institution for $933 million. Yahoo ended the quarter with $12 billion in cash, compared to $5 billion as of the end of last year. More important for Mayer was the impressive growth in mobile advertising, with $200 million in reported revenue during the third quarter. Mayer said gross revenue in mobile is estimated to exceed $1.2 billion this year, showing that the company’s investments in mobile are starting to pay off.

Algorithmic Analysis: Explanation

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box, and the predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

Example of an I Know First Algorithmic Heat Map.

In this particular Top 10 Stocks Forecast from August 12th, 2014, YHOO had a strong 1-month signal and predictability. If the asset is in a deeper green color box, it indicates that the algorithm is very bullish.

The signal indicator represents the predicted movement direction, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium, or “fair”, price. The signal strength is the absolute value of the current prediction of the system. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength with strongest up signals at the top, while down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal and red indicates a negative signal. A deeper color means a stronger signal and a lighter color equals a weaker signal.

The predictability measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically the predictability ranges from minus one to plus one. The higher this number is the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

The algorithmic forecast (above) is from November 25 2014. The algorithm currently has a bullish outlook for Yahoo for the one-month and three-month time horizons. Yahoo’s remaining stock in Alibaba could increase the value of its own stock, especially if Mayer and the team of tax experts she hired can come up with a tax-free way to return money to shareholders. Whether Mayer will be able to successfully transition the company into mobile, video, native, and social will be key to the core of the business. With Tumblr, Brightroll, and Flurry, Yahoo has begun to successfully transition into these new growth fields. By recognizing that these are the online growth markets of the future, Mayer might be able to bring an iconic company back to greatness.

Conclusion

Whether Mayer will be able to successfully implement her vision of growth in new fields remains to be seen. The fact that the investment in mobile is already paying off is a positive sign, and the company’s acquisitions do make sense when looking at Mayer’s mobile centric plan for the company. While Mayer has been able to increase the value of Yahoo’s stock, much of this has been due to the company’s investment in Alibaba. Until the most recent earnings report, Yahoo’s revenue had remained flat. With the company’s recent acquisitions now being implemented to take advantage of the growth areas of the company, Yahoo is in position to increase revenues for the first time since Mayer became CEO, even though display ads continue to struggle. If Mayer can gain market share from Google and Facebook, the current two largest players in mobile advertising, remains to be seen. Yahoo stock could have its price continue to increase because of the remaining shares in Alibaba. As mentioned earlier, Mayer has been working to find a way to return the remaining assets in the Chinese company to investors tax-free, and doing so would considerably drive up the value of Yahoo stock. Her announcement on how the remaining shares will be handled during the next earnings report will provide further clarity on Yahoo’s future.

I Know First Research is the analytic branch of I Know First, a financial start up company that specializes in quantitatively predicting the stock market. This article was written by Aaron Tallan one of our interns. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.