Cash Flow Is Better Than Cash – Why McDermott International Is A Losing Play

Confira nosso artigo (22/5/2015) no Seeking Alpha: Cash Flow Is Better Than Cash – Why McDermott International Is A Losing Play

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- First-quarter report blames third parties for losses.

- Assets are slowly decreasing with no reason for the trend to actually change.

- Algorithmic money flow analysis predicts McDermott will experience a sharp decline.

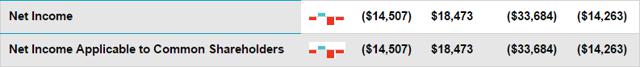

McDermott International (NYSE:MDR) is an international engineering, procurement, construction and installation company in the oil and gas sector. The company has recently released their first-quarter report, which seems particularly worrisome. McDermott reported a net loss of $14.5 million. On the one hand, this looks like a vast improvement in comparison to Q1 2014 when the company lost $46.5 million; however, a deeper look finds some serious inconsistencies and problems.

The report attributed the losses to third-party performance delays on the company’s INPEX project. Considering this contract is the largest subsea contract McDermott has been awarded to date, it seems that a simple third-party delay causing a $50 million personal reduction in revenues is outrageous. The second factor reducing profits is “customer initiated changes on Middle East brownfield projects that impacted the timing of vessel mobilization.” It would be nice to hear more about this too, and not such as broad shift of blame.

The main concern here is not just the $50 million reduction in revenue, but also that operating costs are down $115 million in comparison to Q1 2014. If no other factors came into play it would mean the company should have converted that reduction in costs into revenue, or else the company is contracting operations. If this is the case, then the headline for the quarterly report “Successful Quarter of New Order Intake in the Middle East and Americas” is simply not true. It should be more like we reduced our costs and still made losses — is there anything else left to improve?

When we look at the quarterly data we can perhaps explain why the stock exploded over 100% after Q4 2014.

But when we look at the annual table, the red candles and numbers look pretty bad.

Investors should be careful. Q1 starts on a bad footing with cash down $52 million in comparison to Q4. While assets are up $16 million, total liabilities are up $45 million. The company’s huge bankroll of $800 in cash and cash equivalents does not justify the current losses, and the current stock price certainly does not reflect it. This really does not seem like a business that can actually generate positive cash flow consistently over a long period to its investors.

Algorithmic Analysis

Analysts at Marketwatch and Yahoo Finance say hold, which doesn’t really say much to those holding the stock. Our market screening algorithm indicates McDermott International is currently dangerous to hold and risky to buy. According to the most recent forecast based on the I Know First Algorithm’sfair valuation and price equilibrium, and recent market money flow analysis, the stock is going to go down in price over the next month. The monthly predictability score of -0.01 (bottom number) indicates that historically the price movement of McDermott was completely unpredictable. The stock is a part of our aggressive universe, which means it standard deviation classifies it as extremely volatile, and the signal (middle number) of -35.99 indicates a strong bearish outlook and net outflow of capital.

Based on this, we would highly recommend selling the stock if it is a part of your existing portfolio. It has very little upside potential, yet massive downside risk. Furthermore, if you are looking for a one-month play, taking a short position and capitalizing on the company’s weak performance is not out of the question. However, this stock is volatile and that could quickly backfire, so proceed with caution.