Continue Buying Gilead Sciences At Current Prices

Summary

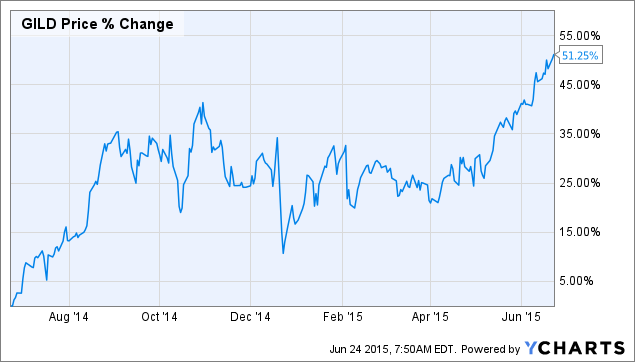

- Gilead Sciences’ stock price has increased over 50% in the last year, in most part because of the rapid growth of its HCV drugs.

- Sales of these drugs will not fall off, with plenty of additional growth still to be had.

- Along with the success in the HIV market and potential in the oncology field, the company’s pipeline is currently robust.

- With a cheap valuation and a large cash pile with which to return value to shareholders, this stock is still attractive to long-term investors.

- I Know First algorithm is bullish on Gilead Sciences over the next year, believing the stock price will climb to new highs.

Gilead Sciences, Inc. (NASDAQ: GILD) is a pharmaceutical company that originally made a name for itself with its HIV treatment options. Last year, its Hepatitis C drugs Sovaldi and Harvoni helped the company more than double its revenues. The success of these drugs caused the stock price to increase over 50% in the last year. Even recent news that a patent for Sovaldi was rejected in China has been unable to harm the stock, as it quickly recovered the slight losses incurred after the announcement.

I Know First published a bullish article for this stock on May 28th, and the stock price has increased 8.77% since that time. The stock price will now only continue to climb higher, as the addressable market for HCV patients remains vast. With sales continuing at such a rapid pace, the company’s current valuation is extraordinarily cheap for a biopharmaceutical company, and it is currently the strongest play in the industry. Investors should add this stock, as the stock price will continue to climb and dividend growth is likely in the future.

Figure 1. Source: YCharts

Revenue From HCV Drugs Will Continue To Grow

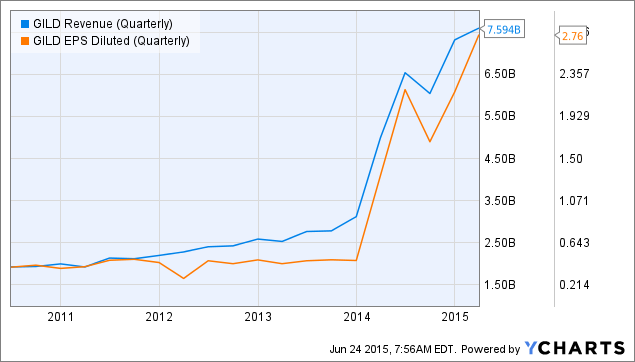

The past fiscal year was a wildly successful one for Gilead sciences, as revenues more than doubled in just the last year. Sovaldi brought in revenues of over $10 billion last year after being introduced in December of 2013. Sales fell to $972 million in the first quarter from $2.3 billion a year earlier, but these sales have been made up by the newer wonder drug, Harvoni, which brought in $3.6 billion in sales in the first quarter.

This staggering performance, in the drug’s first full quarter on the market, will improve the company’s full-year performance once again. After posting revenues last year of $24.89 billion, the company is offering guidance between $28-29 billion for the current year. If revenues do come in at this level for the current fiscal year, it would represent an increase of 12.5% to 16.5% for the year.

While this growth is not nearly as great as the 122.2% growth in sales it recorded last year, it is still a very healthy figure. Further, these estimates could be on the low end, as the company recorded revenue of nearly $7.6 billion during the first quarter, meaning the company is well ahead of schedule to meet its guidance. Further, the increase in sales is seen in the company’s profits, with earnings per share increasing to $2.76 in the first quarter, 107.5% higher than they were in the first quarter.

Figure 2. Source: YCharts

This growth will obviously slow down as sales growth will not be able to match that of the initial release of the drug, but plenty of growth is still available. Analysts expect that the company’s profits will continue to grow over 13% annually during the next five years.

Gilead Sciences should be able to meet this mark because of its patent schedule, with the HCV drugs just having been released. Even as other pharmaceutical companies work to release their own drugs in this market, Gilead Sciences has its own next-generation therapies going through clinical trials, and it should not have any issue holding off the competition.

And even with increased competition in the future, there is plenty of room for growth in the HCV market because of the large number of untreated patients. According to the American Liver Foundation, 3.2 million people in the US and 150 million people worldwide have the virus. Only 1.5 million of these potential patients have been diagnosed, and only 250,000 to 300,000 of the diagnosed patients will be treated this year.

This leaves plenty of growth over the next couple of years, and there is plenty of room for growth in Europe and in developing countries, where the company has come to an agreement to offer the drug for cheaper prices. The newest HCV drug the company is developing, named 5816, is currently in the clinical trial period, and is supposed to be a sequel to Harvoni. This drug aims to work across all genotypes and will be targeted to developing countries, another reason investors should be confident that HCV sales will continue to grow.

Not Just An HCV Specialist Company

With the wild success of its HCV drugs during the last year, it is hard to take notice of the company’s other drug solutions. Gilead Sciences originally made a name for itself with its HIV solutions, and the company currently has eight drugs that are on the market for the treatment of the virus.

Gilead Sciences has a focus on single tablet regimens for HIV, distinguishing it from other drug makers in the field. A single tablet regimen is safer and simpler for patients, improving adherence and preventing drug resistance. The company currently has about an 80% to 90% market share for newly diagnosed patients, with Viread-based combination pills, including Truvada, Atripla, Stribild, and Complera, driving revenues in the past before the introduction of the HCV drugs.

Figure 3. Source: Bloomberg.com

Among the drugs that the company currently has in clinical trials are a couple of new combinations of drugs to treat HIV. One such drug is known as TAF, which is expected to launch later this year. A follow-up to the Viread drug, it aims to have fewer side effects to benefit patients. HIV is not currently curable, so patients typically stay on the drugs unlike HCV patients who are cured after those drug regimens.

Introducing new drugs is key to future revenue growth, as the company will lose its patent for Viread in 2017. By introducing new combinations, Gilead Sciences can shore up its patent protection, possibly until 2020. The successful HIV drugs produced more than $10 billion in revenue last year, and continuing to grow these sales will further boost the company’s balance sheet in the future.

Besides the current drugs on the HIV market, the company also has 37 compounds that are currently in clinical trial, including eight that are in Phase 3 and two that are pending regulatory approval. The entrance into the oncology market should be watched closely as the drug Zydelig got FDA approval last summer.

This drug is currently aimed at only the sickest patients, but new drugs currently in ongoing Phase 3 trials will be aimed at patients that are not as sick. These drugs will allow the company’s cancer drugs to meet areas of unmet demand, improving the company’s financials.

These drugs will not bring in the same amount of revenue as the HVC drugs, but could still be worth between $1 billion and $2 billion in peak sales annually. Such sales could increase EPS by $0.50 annually, which is still significant. With new drugs currently in the pipeline, there is also reason to believe that Gilead Sciences will be able to increase sales with oncology drugs beyond these figures.

Increased Cash And Cheap Valuation

The wild success of the company has drastically improved its financial standing, giving it the flexibility for acquisitions and mergers to drive future revenue growth and return value to shareholders. Last year, Gilead Sciences’ cash and equivalents jumped from $2.6 billion in 2013 to $11.7 billion in 2014. This number grew to $14.5 billion after the most recent quarter.

These cash holdings will allow the company to act if a good merger or acquisition presents itself. Gilead Sciences has shown the capability to identify good acquisition targets in the past, with its purchase of Pharmasset in 2011 giving it the exclusive rights to produce drugs using the compound sofosbuvir. This compound led to the company’s massive sales in the HCV market.

A similar acquisition could act as a further catalyst to the stock price moving forward, especially if it is in the HBV, HIV, or oncology fields. With operating cash flow of $5.7 billion in the first quarter, it can be aggressive with acquisitions or the purchase of new compounds, but the company will be selective and only act if it finds a good fit that can provide high profit margins.

Besides the strategic flexibility the excessive cash holdings gives the company, it also allows Gilead Sciences to return value to shareholders. The company announced a quarterly program of $0.43 per share in February, when it also authorized the repurchase of $15 billion of the company’s shares over five years. This is on top of the currently authorized $5 billion repurchase program over three years announced in May 2014.

Figure 4. Source: YCharts

Most importantly, with revenues and earnings growing rapidly, the stock price has been unable to keep up. Even with the stock price increasing over 50% in the past year, the P/E ratio has still fallen over 50%, now at 13.88. The forward P/E ratio is only at 11.07, well below the industry average. This shows how the stock is still undervalued even with the massive gains of the stock price, showing just how attractive an investing opportunity this is.

Conclusion

Even with the huge increase of the stock price over the last year, investors should still continue to add Gilead Sciences to their investment portfolio at current prices. HCV sales are going to continue growing, and the company’s pipeline is currently very healthy. With the rapid revenue and earnings growth, the company has plenty of cash to invest in acquisitions and new drug compounds. Most importantly, the company’s valuation is extremely cheap even with conservative projections, and investors should continue to add this stock to their current positions. I Know First is bullish on this stock in the long term, with a bullish algorithmic analysis to support the fundamental analysis.