Declining Oil Prices Convey A Bearish Outlook For Guggenheim Solar ETF

Confira nosso último artigo (5/12/2014 )no Seeking Alpha: Declining Oil Prices Convey A Bearish Outlook For Guggenheim Solar ETF

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Most recent articles suggest there is no relationship between oil and renewable energy anymore.

- My analysis suggests most points are largely irrelevant or wrong, and are mostly affected by wishful thinking.

- Guggenheim Solar ETF and Crude Oil’s Correlation suggests the two have a moderate to strong relationship.

Most recent articles foolishly claim renewable energy is no longer correlated to oil prices, and a rather weak correlation remains. The various arguments are:

- Oil now serves primarily as a transportation fuel for planes, trains, boats and automobiles.

- Natural Gas (Large competitor of renewable energy) used to be strongly correlated with oil; however, fracking has drastically reduced U.S. natural-gas prices over the past few years while oil prices remained sky-high, thus natural gas prices will not go down now that oil is declining.

- Grid parity (Different sources of energy being able to deliver electricity at the same cost) is shrinking as renewable energy costs are declining due to innovation.

As a renewable energy advocate I would not want to see this big of a hurdle stagnate the growth of the industry. I am sorry to burst some fan boys’ bubbles, but if oil prices decline, renewable energy will as well, it’s simple economics. In reference to the arguments above here are the three revisions.

- Oil now serves primarily for transportation in developed countries.

- Fracking is environmentally harmful; if we replace our energy generation with natural-gas through fracking, we have only decreased our reliability on oil.

- Grid Parity is only viable with government subsidies which are now expiring and being repealed. Renewable energy is almost there – but needs a bit more time.

I Know First recently investigated First Solar (NASDAQ: FSLR) in an article “Solar Energy’s Future Is Shining, But Is First Solar Still Competitive? The Algorithmic Perspective” and suggested to short the stock according to the recommendation of our state of the art predictive algorithm (prediction was for the 1 year time horizon). Oil prices declining will crush the price of Guggenheim Solar ETF (NYSEARCA: TAN) – according to a moderately strong correlation between the two of 0.6.

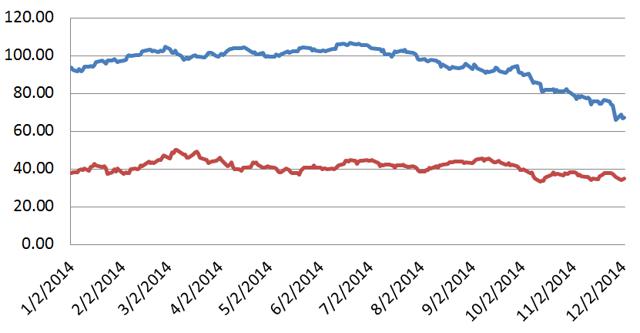

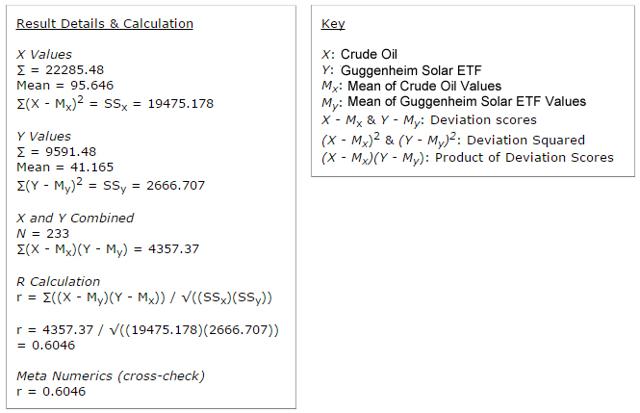

Guggenheim Solar ETF and Crude Oil’s Correlation

For the calculation I used two sets of data. Variable x is the daily closing price of 1 barrel of crude oil. Figure Y uses Guggenheim Solar ETF, which assets currently divide as follows.

| Ticker | Name | Shares / Par Value | Market Value | Weighting |

| SUNE | SUNEDISON INC | 1,719,485 | $36,539,056 | 12.13 % |

| 566 | HANERGY THIN FILM POWER GROU | 134,427,069 | $35,022,400 | 11.62 % |

| FSLR | FIRST SOLAR, INC. | 513,548 | $24,198,382 | 8.03 % |

| 3800 | GCL-POLY ENERGY HOLDINGS LTD | 80,636,348 | $21,528,264 | 7.15 % |

| SCTY | SOLARCITY CORP | 401,204 | $20,758,295 | 6.89 % |

| SPWR | SUNPOWER CORP | 539,629 | $14,235,413 | 4.72 % |

| 968 | XINYI SOLAR HOLDINGS LTD | 43,554,000 | $13,032,383 | 4.33 % |

| TERP | TERRAFORM POWER INC – A | 340,225 | $10,645,640 | 3.53 % |

| RECSOL | REC SOLAR ASA | 692,345 | $10,038,835 | 3.33 % |

| TSL | TRINA SOLAR LTD-SPON ADR | 1,015,157 | $10,009,448 | 3.32 % |

| CSIQ | CANADIAN SOLAR INC | 399,015 | $9,257,148 | 3.07 % |

| MBTN | MEYER BURGER TECHNOLOGY AG | 1,283,781 | $9,136,530 | 3.03 % |

| 1165 | SHUNFENG INTERNATIONAL CLEAN | 11,990,000 | $9,123,868 | 3.03 % |

| AEIS | ADVANCED ENERGY INDUSTRIES | 402,211 | $8,848,642 | 2.94 % |

| REC | REC SILICON ASA | 26,349,088 | $8,472,641 | 2.81 % |

| JKS | JINKOSOLAR HOLDING CO-ADR | 330,965 | $7,506,286 | 2.49 % |

| 750 | CHINA SINGYES SOLAR TECH | 4,484,245 | $6,894,034 | 2.29 % |

| JASO | JA SOLAR HOLDINGS CO LTD-ADR | 776,949 | $6,837,151 | 2.27 % |

| ABY | ABENGOA YIELD PLC | 243,918 | $6,749,211 | 2.24 % |

| YGE | YINGLI GREEN ENERGY HOLD-ADR | 2,435,691 | $6,211,012 | 2.06 % |

| ENPH | ENPHASE ENERGY INC | 485,410 | $5,922,002 | 1.97 % |

| S92 | SMA SOLAR TECHNOLOGY AG | 216,624 | $4,050,411 | 1.34 % |

| DQ | DAQO NEW ENERGY CORP-ADR | 140,969 | $4,021,846 | 1.33 % |

| 712 | COMTEC SOLAR SYSTEMS GROUP | 25,904,000 | $3,608,265 | 1.20 % |

| SOL | RENESOLA LTD-ADR | 1,958,167 | $3,172,231 | 1.05 % |

| HSOL | HANWHA SOLARONE CO -SPON ADR | 1,812,360 | $2,863,529 | 0.95 % |

| VNP | 5N PLUS INC | 1,385,782 | $2,598,227 | 0.86 % |

Source: guggenheiminvestments.com

The correlation is based on the last 233 closing day figures, thus is relevant to today. Below are the key figures for the correlation calculation, the full list of input data and calculations can be found here.

The moderate to strong r value of 0.6 suggests a positive correlation between the declining price of crude oil and Guggenheim Solar ETF share price. Grid parity can only be reached through innovation, which is primarily based on incentive. Without increasing oil prices, a large chunk of that incentive goes away, and all the growth stocks in Guggenheim Solar ETF’s portfolio lose much of their implied value. Needless to say, if oil prices rise again the solar industry will see its average share prices go back up.

I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai, one of our interns. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.