Don’t Fall Off The Long Cliff: Algorithmic And Summative Analysis Is Bearish On Cliffs Natural Resources Inc.

Summary

- The company recently announced a lawsuit against them for $52.6 million which was followed by a $500 million senior secured note due 2020 sell announcement.

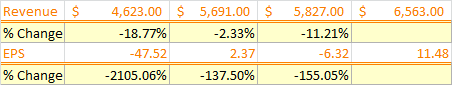

- EPS down over 2000% from 2013, investors are weary of waiting for the rebound.

- Analysts agree the stock is unlikely to recover, which is supported by a strong Goldman Sachs iron ore price target for 2015.

- Algorithmic analysis and decision alternatives.

About

Cliffs Natural Resources Inc. (NYSE: CLF) is a leading mining and natural resources based in the United States. The company supplied iron ore pellets to the North American steel industry from its mines and pellet plants located in Michigan and Minnesota. The company also operated mining facilities in Western Australia. Cliffs also produces low-volatile metallurgical coal in the U.S. from mines located in Alabama and West Virginia. Since 2011 Cliff’s saw shares decline, and the trend does not seem to be changing.

Recent News

On April 19th Cliffs Natural announced it was sued by Canada’s Bank of Nova Scotia (NYSE: BNS) for 52.6 million plus unpaid accrued interest and expenses for breaching debt terms regarding the Quebec Bloom Lake mine. The lawsuit follows a cease in production at the mine back in November 2014 after the company failed to sell a 30% stake in the mine.

This was followed by an announcement for the sale of $500 million aggregate principal amount of Senior Secured Notes due 2020 to be sold to select creditors. The notes will be first lien notes which means that these creditors will be first to collect in case of a default. This is possible because to entire raised budget will go towards repaying the current creditors and restructuring their debt.

This does not signal towards any future plans, and the money will likely have zero to no added value to the company as the new debt terms are unlikely to be better than before, and in fact could even be worse. To make matters even bleaker the company’s current market cap is just $679 million. Yet, in 2014 they still chose to pay a quarterly dividend of 15 cents.

2014 Was Perhaps the Beginning of the End?

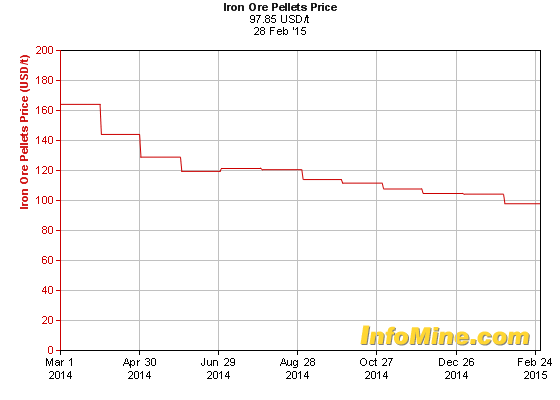

In 2014 the company hired Jefferies Group LLC to advise on assets sales in Australia and Deutsche Bank (NYSE: DB) for the US following the appointment of the new CEO Lourenco Goncalves. The company significantly lags behind competitors such as Vale (NYSE: VALE) BHP Billiton (NYSE: BHP) and Rio Tinto (NYSE: RIO) in the Asian markets; furthermore, Mr. Goncalves himself noted that they “have the vast majority of the merchant market, and God bless them, but I don’t want to be a part of that.” While Cliff has prided itself on shifting away from the seaborne iron ore market, this raises some concerns; however, his non expansionary policy certainly makes sense in the current Iron Ore markets. To make it clear the oversupply in the markets brought the price of iron ore pellets from $165 to slightly under $100 in just 1 year.

However, what is much more concerning is the rate of contraction. Fixed assets declined from $11.2 billion in 2013 to $1.4 billion in 2014, a reduction of over 87 percent in fixed assets. 2014 saw a further decrease of almost 19% and revenues, leading to a net loss of $47.52/share, a value 8 times larger than one shares value at the end of the year.

Commodities are taking a hit, a serious hit. Uranium, Oil, and Iron Ore are experiencing the exact same phenomenon. The natural fact of supply and demand is simple, in times of high supply and low demand someone has to go. To be fair the fundamentals of Cliffs Natural Resources although bad, are not much worse than competitors, however this does still not make it a good stock, it simply makes it less terrible than the other ones.

Analysts Opinions

Yahoo Finance currently grades Cliff as a sell, with one analyst recommending to buy, 10 to hold, 5 underperform and 3 sell. A similar statistic onMarketWatch.com has 1 analyst recommending to buy, 9 to hold, 2 underweight and 7 sells. Furthermore, their core business commodity iron ore is projected to have another severe decline in 2015, after already plummeting 47% in 2014, Goldman Sachs still projects that the steel-making ingredient may average $66 a metric ton this year, down from their earlier estimate of $80.

Algorithmic Analysis

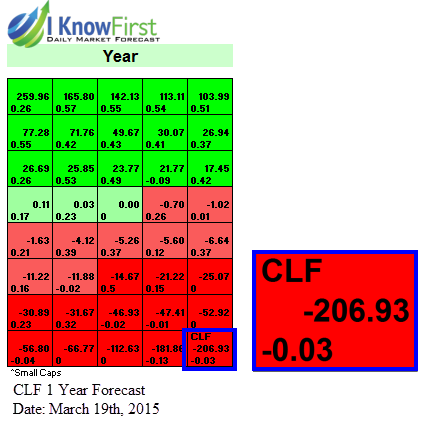

I Know First algorithm is a genetic self-learning supercomputer based onartificial neural networks created to imitate the same activity neurons exhibit in the human brain. The algorithm is taught how to study financial assets with no preset parameters, meaning that it is able to study markets and correlations in ways analysts have never anticipated or even though of. We used the algorithm in order to study Cliff Natural Resources to find if there are any unexpected market events which could push its value up or down. All of the stocks historical data enters into a universe of over 2000 stocks, commodities, indices, ETFs and currencies being tracked and is then algorithmically projected forward based on a macro and micro view of the algorithm.

We use a historical indicator known as predictability (bottom number) in order to measure the confidence level. The current average predictability level for CLF in the short and long horizon is very low (slightly negative), which means that in historical market condition, the algorithm was unable to predict the assets’ direction with a high accuracy rate. This is useful when the signal strength – our strength and direction indicator – is relatively low and in the range of 5-10. The current signal, however, is very strong bearish, and as of the 19th of March, 2015 is -206.93 in the 1-year horizon. This represents the strongest bearish signal in our entire small cap universe, and increases the confidence level by a roughly estimated 20-30%.

This represents an overall relatively low confidence level of 60-70% that CLF will indeed go down in value; however, if it does the very strong algorithmic signal suggests the return would be well in the two digits. This really leaves only three alternative paths of action.

Decision Alternatives

- If you currently own shares you should consider selling, the company has shown no signs of recovery or potential turnaround and is overshadowed by the ever decreasing iron ore prices.

- If you do not currently own shares you can find better opportunities, or wait for a while before making any long decisions regarding this investment.

- If the risk does not scare you, fundamentals, momentum, and our algorithmic analysis all suggest the stock will continue its decline throughout 2015, going short is on the chapter here.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.