Ford Stock Forecast For 2015 Based On A Predictive Algorithm

Confira nosso artigo (25/1/2015) no Seeking Alpha: Ford Stock Forecast For 2015 Based On A Predictive Algorithm

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Ford Motor Company, an American multinational automaker that is America’s second-largest in terms of size, and the world’s fifth-largest in terms of sales, is well-known around the world.

- While Ford is generally well-regarded, recent events in Russia and Venezuela have resulted in Ford’s Q4 profitability dropping, and have prevented Ford’s European operations from breaking even in 2015.

- Though this may be interpreted as problematic, analysts still recommend holding on to Ford; Ford’s fundamentals remain strong.

- I Know First algorithm predicts a strongly bullish forecast for Ford in the one-month and three-month time frames.

Company Profile

The Ford Motor Company (NYSE: F) is an American multinational automaker that’s become a household name, and for due cause. Incorporated in 1903, the company has been selling commercial and luxury cars for quite some time, and has also, on occasion, produced tractors and automotive components. While it has been involved in several industries, then, Ford is most renowned for being an automaker – in the U.S., it is second to only General Motors in terms of size, and is the fifth-largest in the world based on 2010 vehicle sales. That aside, the company was also ranked eighth overall in the 2010 Fortune 500 based on global revenue: fitting, given that its operations span North America, Europe, Oceania, East and Southeast Asia, South and West Asia, South America, and Africa. All this has meant that Ford is often granted positive reception in analyst and investor circles. I Know First is bullish on ford, here is why:

Recent News: Reduced Q4 2014 Profitability, January 29th Earnings Call, and 2015 Outlook

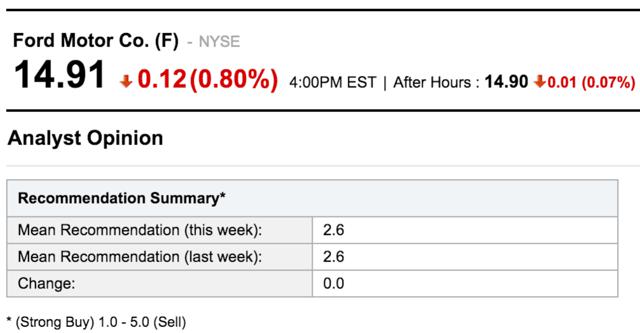

While Ford, then, is holistically well-regarded, some recent events have given rise to a little negativity regarding the company (Figure 1), and understandably so.

To begin, while Ford’s operations in Europe were expected to break even in 2015, but they may well not do so, given Russia’s economic sinking. Russia is, presumably, a “bloodbath for everybody” at the moment, according to Renault-Nissan CEO Carlos Ghosn – initially expected to become Europe’s largest automotive market, Russia may slip to third place when December sales are counted up, and that has meant bad news for Renault-Nissan, General Motors, and, of course, Ford. Our company of interest, specifically, fell40% in terms of sales in November alone, and it subsequently announced that it would be unable to break even this year. This, of course, could be understandably disappointing for those investors who’ve seen Ford’s EPS be sub-optimal for quite some time.

Further, Europe aside, the company has announced reduced profitability (specifically, $700 million) in Q4 2014 as a result of its Venezuelan operations. To elaborate, the company’s Venezuelan subsidiary faced difficulties paying dividends as a result of the low exchange rate between the Venezuelan bolivar and the U.S. dollar, and Ford chose to, as a result, record an $800-million pre-tax charge. As Ford’s Q3 2014 quarterly report indicates, Ford, at least to an extent, saw this coming: the company labeled the operating environment in Venezuela “challenging”, and noted that “a further devaluation from an exchange rate of 12.0 bolivars to the U.S. dollar would result in a balance sheet remeasurement loss”. While this was somewhat expected, then, this charge could result in Ford’s first net loss since the recession; as such, understandably, this doesn’t signal anything overwhelmingly positive for investors.

Figure 1. A chart following Ford’s stock in the one-year period, showcasing a $13.26 to $18.12 52-week range. Note that October onwards saw Ford drop prominently several times in succession.

Cumulatively, these events, among others, have Ford sitting at approximately $14.91. Now, only the company’s Q4 earnings call – scheduled for January 29th – remains to determine Ford’s reception in the short term, and its 2015 outlook; while we wait for that to take place, let’s review some fundamentals.

The Positive Attributes

While things may not look spectacular for Ford at the moment, then, it is important to consider that the company still has massive strengths.

To begin, let’s bring out the more generic truths: Ford is a large company with an international scope that’s remained a consumer favorite for quite some time. Its accolades in customer loyalty and automotive safety are further testaments to its success.

That aside, Ford is also dedicating itself to business developments that could, potentially, speak of good things to come. Firstly, On January 22nd, Ford announced that, this year, it will be opening the Ford Research and Innovation Center (a research and development lab – the company’s largest thus far) inSilicon Valley; this note could have played a role in pulling stocks up 0.4% from the day before. Soon to be located within a few miles of Tesla Motors’s (NASDAQ: TSLA) headquarters and Stanford University, and sharing the region with such automakers as Volkswagen AG (ADR) (OTCMKTS: VLKAY), Nissan Renault, General Motors Company (NYSE: GM), and BMW (OTCMKTS: BAMXY), Ford’s facility is dividing headfirst into a densely populated pool of innovators, and intends to make its mark: the research center will, according to Ford, explore the latest technologies (e.g., smart and driverless cars), will have Apple’s (NASDAQ: AAPL) Dragos Maciuca as its head, and will – if Ford CEO Mark Fields is correct – be decidedly “cool enough” to both “change the way the world moves”, and snag some of the best programmers, researchers, and engineers the Valley has to offer, even if that means tearing them away from the likes of Google (NASDAQ: GOOG) and Facebook. (NASDAQ: FB) While the facility and its operations are still evidently in the works, an initiative like this could, if successful, grant Ford the kind of technological prominence integral to competing with innovative automakers like Tesla; given that future cars are presently a large focus for most players in the automotive industry, Ford’s entering in on this market showcases that the company is, at least to a degree, concerned with making progress.

The company isn’t just dealing in futuristic technologies, however – it’s also making the best of current trends, like the growing demand for “muscle cars” –i.e., two-door sports cars that have powerful engines and are designed for high-performance driving, but are not as expensive as the kinds of two-seat sports cars and 2+2 GTs intended for professional racers – and extreme-performance “supercars”. Muscle cars, used predominantly for everyday driving and low-key drag racing, are understandably popular with the public, and even more-pricey supercars have their fair share of enthusiasts: global sales of high-performance cars appear to be up 70% since 2009. Further, performance vehicles – because they tend to draw a younger crowd – typically, and require customers willing to make a significant monetary commitment – tend to help automakers build up a future base for sales. With this in mind, Ford announced that it will be rolling out twelve performance cars from now through 2020, merging its Team RS, Ford SVT, and Ford Racing units to createFord Performance: a novel unit geared at crafting precisely the aforementioned kinds of sports cars. It has also announced the release of several new models, among them a 2016 model of the Focus RS (the specifications of which will be unveiled on February 3rd), boasting an improved power output, higher peak torque, a superior suspension system, more fuel efficiency, and better on-road performance. Another car on the line-up is Ford’s new GT: a V6 supercar that, potentially out-pricing the above-mentioned Focus by quite a bit, appears to be worth its relatively high weight in gold: it raced vehicles to three wins in the IMSA TUDOR United SportsCar Championship last year, and won another seven distinctions. These and other new models, given current trends in high-performance vehicle purchasing, have the potential to help Ford boost domestic and international sales in the short term; further, the innovations developed as a result of their production can be expected to enhance Ford’s more mainstream vehicles in the long-run, eventually bringing new technologies and engines to even those consumers who can’t afford cars in this price range.

“In with the new” appears to be the phrase of the year in yet another sense – Ford’s senior leadership, much like its auto models, is on track to be seriously revitalized in 2015, with new additions including CEO Mark Fields (ex-CEO of Mazda, and former COO of Ford), and Vice President of U.S. Marketing, Sales, and Service Mark LaNeve. Succeeding Alan Mulally and John Felice respectively, Fields and LaNeve could dramatically alter Ford’s market-share-securing strategies. In particular, LaNeve – who has held senior positions at both General Motors and Volvo Cars – is well-known for being competitive, aggressive, and interested in boosting numbers, which many people involved are lauding. As one Ford dealership owner puts it, “We’ve got great product, but sometimes you’ve got to get market share – you’ve got to go after it,” and LaNeve, if his reputation is any indication, will most definitely be seeking to step up Ford’s numbers. CEO Fields appears to be introducing innovation in another regard: in a recent interview with the Huffington Post‘s Larry Magid, he noted that Ford would be experimenting with mobility technologies – with, in other words, all kinds of solutions that make “customer’s lives easier getting from Point A to Point B”. Under Fields’s leadership, the company is partnering with the likes of M.I.T. and Stanford in experimenting with ride-sharing services, a car swapping app., modified bicycles, improved voice-recognition systems, off-road services, and cars with sensors that detect open parking spaces – all of which could contribute to increasing market share, and could culminate in, according to Fields, “a good business opportunity”.

Even Ford’s negatives aren’t that dismal – as much as the company no longer expects to break even in Europe in 2015, and has lost about $4 billion in the region since the beginning of 2012, Ford still increased sales and gained market share in 2014, boosting sales by 7.3% over 2013, and coming in as Europe’s number-two best-selling brand. The company is also progressing where its sales strategy is concerned: it emphasizes selling to retail buyers and fleet customers: generally more profitable audiences than daily rental and dealer registration customers. As such, its operations are moving along the right track. Pair these facts with Ford’s plans for 2015 (several new and refreshed vehicles will make their debut this year), and things do not look that horrid in Europe.

All of the aforementioned developments appear to be favorable ones where long-term progress is concerned; at present, analyst sentiment appears to indicate that we’re not the only ones to think similarly. Most firms remain decently hopeful where Ford is concerned – this week’s mean recommendation is, approximately, a hold (Figure 2).

Figure 2. Yahoo! Finance analysts’ mean recommendation for Ford this week is a 2.6 out of 5.0 (a hold), where 1.0 is a strong buy, and 5.0 is a strong sell.

Algorithmic Analysis

While fundamentals are very important, it can be quite advantageous to also consider stocks like Ford from an algorithmic perspective. Though algorithms, like any other methods of analysis, are not definitive, they often contribute important information about a company, especially when viewed in combination with historical trends and fundamentals.

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm predicts the flow of money in almost 2000 markets across a range of time frames (e.g., 3-day, 1-month, 1-year). The algorithm’s predictability becomes stronger in the 1-month, 3-month, and 1-year horizons, so it is particularly useful as a long investment tool, albeit that it can also be used for intraday trading.

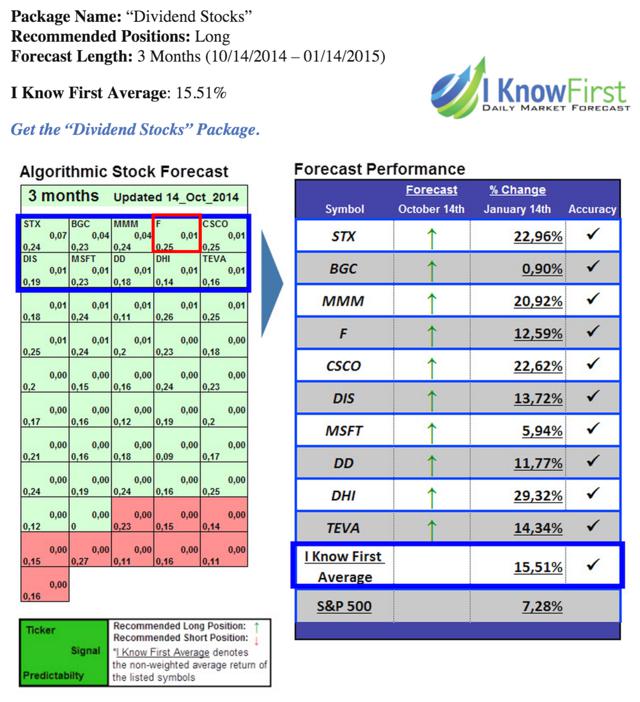

I Know First has successfully predicted Ford’s outcomes in the past (Figure 3). For example, in a three-month forecast running from October 14th, 2014 to January 14th, 2015, I Know First predicted that Ford would be one of the tenbest stocks of the forecast; the stock held true to this prediction for a return of +12.59%.

Figure 3. Three-month forecast last updated on October 14th, 2014. Ford is shown to be strongly bullish, and is boxed in red for emphasis. Prediction is on the left, stock performance is on the right – note that Ford performance coincided with forecasted behaviour.

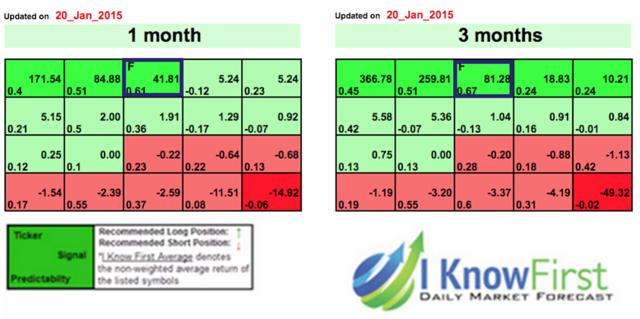

The new 1-month and 3-month forecasts for Ford, generated by the I Know First algorithm and updated on January 20th, are shown below (Figure 4). Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, though not as negative. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence our service has in the forecast).

Figure 4. Updated forecast for Ford Motors. Ford’s ticker symbol – “F” – is boxed in blue; its position indicates that it is strongly bullish.

This algorithmic assessment coincides well with the previously described developments, and parallels analyst sentiment, to a degree.

Positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as CAT. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

Conclusion

While Ford may well have had some rough patches in 2014, most especially due to its operations in Venezuela and Europe, the company should still be positively considered: Ford’s novel market-share- and innovation-oriented leadership, the company’s reputation, its focus on muscle car and supercar innovation, its new models in the coming years, and its customer loyalty and safety ratings make Ford fundamentally strong. Combined with neutral analyst recommendations and a bullish forecast from I Know First, these developments make Ford a company worth holding on to, both in the long and in the short run.