A Fundamental And Algorithmic Analysis Of Why Ford Is Bullish In The Long Term

Confira nosso último artigo 11/12/2014 )no Seeking Alpha: A Fundamental And Algorithmic Analysis Of Why Ford Is Bullish In The Long Term

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

A Fundamental And Algorithmic Analysis Of Why Ford Is Bullish In The Long Term

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…)

Summary

- Ford has had a rough year because of setbacks that were largely out of their control.

- Market factors are aligning to help the auto industry have its best year in a decade.

- Ford has effectively cut costs and improved their product to thrive in the future.

- I Know First’s algorithm is very bullish for the company in the long term.

Investors in Ford Motor Co. (NYSE: F) have had a bumpy year, with many stock price fluctuations including a couple of significant drops. The stock price hit a low point on October 13th, having lost 12.25% of its value since the beginning of the year. Setbacks this year have caused the company to lessen its pretax guidance for 2014 to $6 billion, from $8.6 billion last year, and the company has lost market share in the U.S. However, many of the problems that Ford have faced are not as drastic as they appear, as this was always supposed to be a transition year for the automaker company. Their patient approach to building up the company with a solid foundation appears to be prudent, as the company is set up for substantial gains in 2015 and beyond.

Struggles in 2014

Ford has had some major setbacks that have harmed the performance of the company in 2014. One such setback was warranty expenses, which will cost over $1 billion this year. About half of this amount is tied to faulty airbag mechanism supplied by Takata Corp. The most recent recall for the faulty airbags includes about 38,500 vehicles in the United States, bringing the total number of vehicles recalled to 98,000. The recall is for 2004-2005 Ford Rangers and 2005-2006 Ford GTs in areas with high humidity.

Besides the increased warranty costs, Ford operations are also losing more money than expected in Europe and South America. Ford had planned to be profitable in Europe by 2015, but they have recently changed course and said that another loss is likely next year. The auto making company expects to post a $1.2 billion loss this year and a $250 million loss next year. The two key factors to Ford’s disappointing results in Europe are because of Russia and pension expenses. Ford was counting on Russia for significant expansion, but economic-deterioration in Europe’s third-largest market has clobbered new vehicle sales. Meanwhile, Ford will have to contribute more money to pension plans in Europe next year than they expected. Interest rates in Europe still have not recovered after the big recession late last decade, and the fixed-income investments in Ford’s European pension funds are not performing as well as previously hoped.

Source: Wall Street Journal

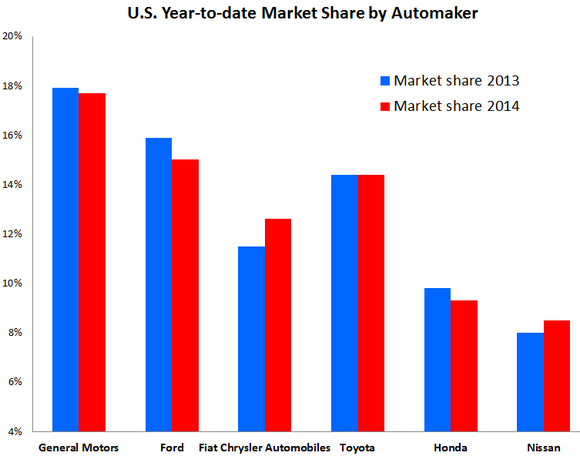

Besides the market factors that were out of Ford’s control, 2014 was expected to be a transition year for the company. Ford has lost considerable market share in the U.S., partly because the automaker has backed off their focus on rental fleet sales, typically accompanied by thin margins. Their rental business is down 16%, or about 40,000 units through November, which is equivalent to 1.8% of Ford’s sales this year. The company also lost market share and has warned that they will continue to for at least a few more months as it ramps up production of their redesigned F-150 pickup. As Ford retools their production plants producing the F-series truck for their new aluminum-bodied model, they lost production and potential sales of roughly 90,000 units. While sales in November fell 2% from November 2013, they were actually up 2% when excluding the F-series. All of these issues harming Ford stock can be viewed as only temporary and fixable moving forward.

Market Info

While Ford experienced a 2% decline in sales from last year, car companies in general had an exceptional month. The industry is currently on pace for its best annual performance since 2007, as low gas prices, interest rates, and an improving job market have consumers buying larger cars with higher price tags. Analysts believe that November was the best for automakers in more than a decade, as total car sales for the month are believed to be 1.3 million, an increase of 4.1% from the same month last year. Paramount to manufacturers is that the transaction prices are also increasing, which reflects the increasing popularity of large trucks and SUVs.

Low gas prices have made these vehicles more agreeable. Oil prices have almost halved since hitting a June high above $115, as prices are now approaching $60. Rising U.S. output has coincided with waning demand growth, generating a global supply surplus. Saudi Arabia, the largest exporter of oil and main member of the Organization of Petroleum Exporting Countries, has refused to cut output, producing between 9.6 and 9.7 million barrels per day in November. While other OPEC members are divided on how to respond to the global surplus and falling prices, Saudi Arabia is unlikely to adjust their output, as they want to let the market correct itself. This will drive fringe oil companies out of business, eventually decreasing supply. Saudi Arabia is also frightened of losing market share to Iran, whom they rival for regional influence in the Middle East.

Interest rates have remained low since the great recession late last decade. The American economy has recovered lately, demonstrated by a strong jobs report from November that included 321,000 additional jobs, beating estimates of 230,000 new jobs. The recovery of the economy has led to the expectation that the Federal Reserve will raise interest rates sometime in the middle of 2015 to stave off inflation. In anticipation of this, demand for housesand cars could increase before the money to buy them gets more difficult to come by. Consumers are using the low financing rates to buy more expensive cars, with an average transaction price for a new vehicle sold in the United States this year of $32,415, up $325 from last year.

Also helping Ford will be the decision by General Motors (NYSE: GM) to reenter the midsize pickup market with the Chevrolet Colorado and GMC Canyon. GM will not be able to lower prices too far on their full size pickups because it would cut into their sales of midsized trucks. F-series trucks bring in the bulk of Ford’s automotive profit, and they do not sell a midsized truck. Ford will be able to keep their prices high and won’t have to worry about competition from their closest competitor.

Ford Outlook For 2015

As mentioned earlier, Ford planned for 2014 to be a transition year. The good news is that most of Ford’s decisions look as if they will pay off in the future. Ford will launch 23 new models this year, the most ever, setting the company up to gain market share. However, while there are a variety of new models, the number of vehicle platforms, which are the basic structures on which various models are built, will actually decrease to 15 this year from 27 seven years ago. Further, Ford says it can get to nine by 2016. Having fewer platforms will cut down the costs for their vehicles improving profit margins.

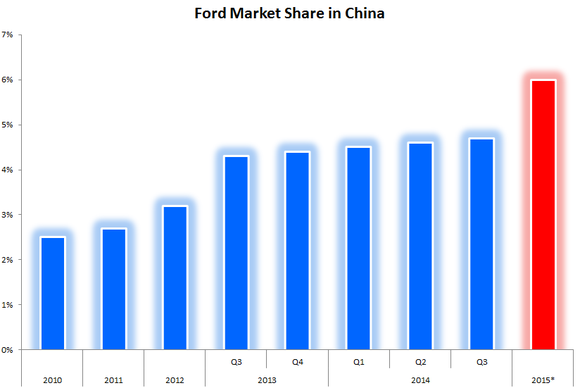

Ford also looks set to turn a corner internationally. The automaker’s business in Europe was discussed earlier, and while the company has faced setbacks in 2014, their plan is still on track to significantly shrink losses next year and turn operations in Europe to profitability in 2016. Europe has overcapacity in the auto industry, with far more factories than its levels of sales can support. Ford has shut down two factories in the U.K. and is currently closing one in Belgium. These closings will save Ford Europe at least $400 million a year going forward. Ford is also expanding its European offerings, and will have brought 25 new or significantly refreshed products to Europe since 2012 after having offered a relatively small product line for years. Ford is also making progress in China since investing $5 billion in 2012 to expand its production capacity and sales, as their market share has more than doubled since that time. By all accounts, Ford should continue to make gains in China and will need to do so in order to reach their target of a 6% market share by the end of 2015. Ford is also on pace to pass Nissan as the third-best-selling foreign automaker in China next year. The growth in China and decreased losses in Europe should return international operations to profits next year.

Source: Wall Street Journal

The most obvious factor that will turn around Ford’s fortunes is the F-150, by far the top selling truck in the United States. As mentioned earlier, production this year has been down as the company transitions to their 2015 aluminized model. Ford is replacing the steel in the body with an aluminum alloy that will reduce the weight of the vehicle by 700 pounds. Ford says this will bring up to 20% better fuel economy, and will also make for better handling, faster acceleration, and more hauling and towing power. The proportion of new-vehicle sales attributed to trucks and SUVs has jumped to 49.1% from 43.4% since 2009, and the newly improve F-150 model should be in a great position to take advantage of this starting next year.

Algorithm Analysis

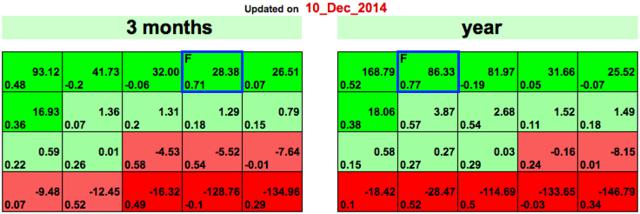

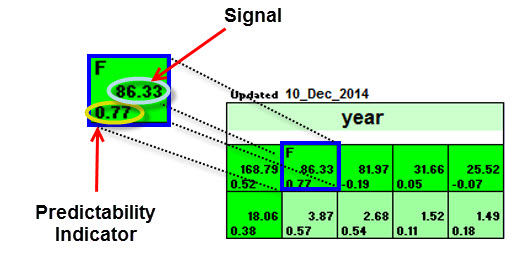

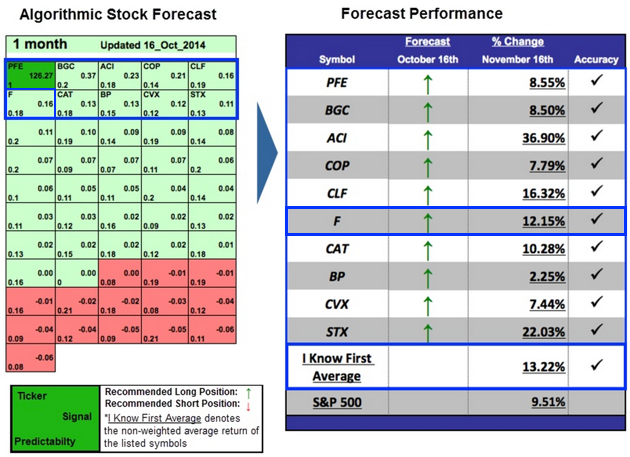

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

The signal represents the predicted movement direction or trend, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength with strongest up signals at the top, while down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal and red indicates a negative signal. A deeper color means a stronger signal and a lighter color equals a weaker signal.

The predictability indicator measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically the predictability ranges from minus one to plus one. The higher this number is the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

While Ford stock struggled in 2014 and reached a low point in mid-October, the stock has since had a small rally, largely off of positive reviews of the new F-150 and a positive future outlook. The I Know First algorithm was able to predict this in the “Best Dividend Paying Stocks Based On Algorithm” article on November 23rd. Ford had a signal strength of 0.16 and a predictability indicator of 0.18 over the one-month time horizon. In accordance with the algorithm, Ford’s stock price increased 12.15% over that time.

While Ford stock struggled in 2014 and reached a low point in mid-October, the stock has since had a small rally, largely off of positive reviews of the new F-150 and a positive future outlook. The I Know First algorithm was able to predict this in the “Best Dividend Paying Stocks Based On Algorithm” article on November 23rd. Ford had a signal strength of 0.16 and a predictability indicator of 0.18 over the one-month time horizon. In accordance with the algorithm, Ford’s stock price increased 12.15% over that time.

The algorithm is also very bullish for Ford in the long term, supporting the fundamental analysis of the company. The three-month and one-year predictions are provided below. In the one-year time horizon, Ford has a strong signal strength of 86.33 and a predictability indicator of 0.71. These predictions match what the strong fundamental analysis for Ford suggest, indicating that it would be wise to invest in Ford now for the long term.

I Know First Research is the analytic branch of I Know First, a financial start up company that specializes in quantitatively predicting the stock market. This article was written by Aaron Tallan, one of our interns. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.