Gilead Sciences, Inc.: Still In The Lead Or Lagging Behind? An Algorithmic Perspective

Confira nosso artigo (10/3/2015) no Seeking Alpha: Gilead Sciences, Inc.: Still In The Lead Or Lagging Behind? An Algorithmic Perspective

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Gilead Sciences, Inc., an American biotechnology company with international operations and twenty-plus innovative products, centers on discovering, developing, and commercializing treatments for a range of conditions (e.g., hep C, HIV).

- After a year of increased revenue and product sales, Gilead is well off; its assorted innovative, novel products, abundance of research activity, and international accessibility initiatives all strengthen the company.

- Harvoni and Sovaldi are particularly responsible for these positive trends; Gilead predicts that they will continue facilitating sales growth.

- The I Know First algorithm contradicts analysts and the fundamental outlook. Gilead poses a risk in the next month of a downswing; however, it holds strong long-term value investing.

Company Profile: Gilead Sciences, Inc.

Gilead Sciences (NASDAQ:GILD) is an American biotechnology company that is involved in drug discovery, development, and commercialization, centering on treatments for HIV, hepatitis B, influenza, an assortment of pulmonary, liver, and cardiovascular diseases, cancer, and – most recently – hepatitis C. Initially founded in California, the company now has operations across North America, Europe, and Australia, and boasts an impressively diverse product line (to be specific, the company produces approximately twenty therapies, some of them wildly successful (e.g., Sovaldi), and each with a slightly different focus).

Current Events: Simply Put, All’s Well!

Though there’s usually some form of turbulence to be had in the biotechnology market, there’s relatively little to be said in terms of weaknesses where Gilead Sciences is concerned. The company, for one, appears solid in terms of its figures.

During 2014, total revenues increased to $24.9 billion (from $11.2 billion in 2013), and total product sales also went up, from $10.8 billion in 2013 to $24.5 billion in 2014. Where product sales are concerned, further, the company’s specialty – antivirals – were at $22.8 billion in 2014, up (dramatically) from $9.3 billion in 2013 (other product sales, of course, also increased ($1.7 billion, up from $1.5 billion in 2013). It also seems worth noting that product sales increased both domestically and abroad (in the U.S., sales went up to $18.1 billion, compared to $6.6 billion in 2013; in Europe, they increased 54% to $5.1 billion, compared to $3.3 billion in 2013). All this was primarily attributable, says Gilead, to Harvoni and Sovaldi: two HCV products that, combined, sold $10.5 billion in the U.S. and $1.6 billion in Europe in 2014.

Net income also increased, now at $12.1 billion, or $7.35 billion per diluted share (up from $3.1 billion, or $1.81 per diluted share, in 2013).

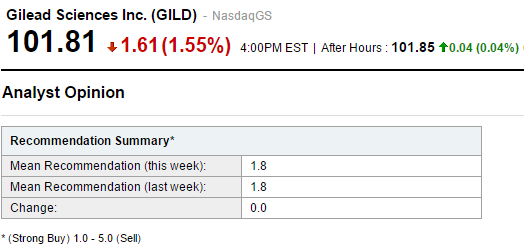

Gilead’s 2014 outcomes presently mean that positive analyst sentiment is in the air. Among others, Nomura recently gave the company a “buy” rating. Vetr actually upgraded Gilead, taking it from a “buy” to a “strong buy”; finally, Citigroup Inc. reiterated its prior “buy” rating. Yahoo Finance analysts’ sentiment is also overwhelmingly positive: at present, the company is rated 1.8 out of 5.0, where 1.0 is a strong “buy” and 5.0 is a strong “sell” (Figure 1).

Figure 1. Yahoo Finance analysts rate Gilead Sciences a 1.8 out of 5.0: a relatively strong “buy”, in other words.

The Positives: Innovative, High Cure-Rate Drugs, Significant Research, Soaring Sales, Outrunning AbbVie, and International Accessibility

To begin with, 2014 saw Gilead Sciences realize several highly effective treatment options, and in a diversity of focus areas. For one, the company received FDA and EC approval for Harvoni: the first ever once-a-day, single-tablet regimen for hepatitis C genotype 1 treatment. We can safely say, I think, that this treatment option revolutionized hep. C treatment: while patients receiving medical care prior to the dawn of Harvoni had to subject themselves to pegylated interferon injections and ribavirin, those using Harvoni must not; further, Harvoni’s cure rates range from 94% to 99% in the eight-to-twelve week time frame. Gilead’s HIV division – which Barclays and ex-J.P. Morgan biotechnology analyst Geoff Meacham calls best-in-class – submitted a new drug application for another innovative treatment, and received US FDA approval for Tybost and Vitekta. Finally, the company received approval for Zydelig (a lymphoma and leukemia treatment). In sum, then, Gilead Sciences has managed to churn out several innovative, successful treatments for high-concern conditions, some of which have sold extraordinarily well. The company isn’t stopping at just the aforementioned products, however: Gilead’s research activity is also substantial, with the company citing more than 225 clinical studies as “active” at the end of 2014.

Further, Gilead Sciences’s launch of Harvoni was not just initially successful: it appears to be progressing smoothly to this day, outpacing competitor AbbVie (NYSE:ABBV) to a significant degree. Specifically, as Barclays analysts Geoff Meacham and Marck Purcell noted just prior to March 4th, the U.S. hepatitis C market, when tasked with deciding between Gilead’s and AbbVie’s treatments, appears to favor the Gilead-affiliated Harvoni. This news, in fact, succeeded in elevating shares of Gilead Sciences by approximately 0.2% and dropping AbbVie shares a corresponding 0.2%, and is complemented by similar information from other sources – the latest Bloomberg Intelligence analysis, for example, discussed in a March 4th article by Hannah Ishmael, indicates that 95% of U.S. hepatitis C patients are treated with either Harvoni or Sovaldi (both Gilead products), while the AbbVie equivalent – Viekira Pak – covers only approximately 4% of that market. While some analysts have pointed out that Viekira is newer and may thus take time to gain popularity, I think it’s relatively easy to agree that AbbVie isn’t anywhere close to trumping Gilead’s hep. C sales at present (and won’t, perhaps, be doing so for quite some time). Further, while it may well be true that Viekira just entered the market recently, there is yet more data to indicate that Harvoni may, in fact, continue to triumph over time: one analysis found that its two-weeks’ prescription count since its launch back in October is much higher than the number of total Viekira prescriptions that AbbVie has received over the course of the ten weeks since the product’s launch, indicating that Harvoni has relatively consistently – and dramatically – outpaced AbbVie’s product. Harvoni did not just have a strong start, then – it’s still very much alive and well, propelling Gilead forward.

The aforementioned BI analysis also suggests that of the projected 250 000 people who will undergo hep. C treatment in the U.S. in 2015, more than 79% will use Gilead’s drugs. If this does indeed turn out to be accurate, then Gilead will have, by the end of this year, established itself as more than just a one- or two-hit wonder where hep. C is concerned. Harvoni and Sovaldi will, if they truly do attract nearly 80% of those being newly treated for hep. C, be more and more readily thought of as the industry standard.

Speaking of its hep. C products, in fact, I should note that Gilead is also making some cutting-edge moves where international accessibility is concerned. In 2014, the company worked with seven India-based drug companies to manufacture Sovaldi and Harvoni for distribution in 91 developing countries, for one thing. For another, Gilead Sciences USA has recently approved a significantly subsidized rate for consumers in Pakistan, cutting Sovaldi’s tablet price by 40%. Gilead has expressly noted that it is doing this to ensure that the maximum number of eligible patients can benefit from the drug, but this should, of course, significantly benefit the company as well, given the volume of hep. C-affected people in Pakistan: the country has over 10 million hepatitis C patients at present, and has the second-highest prevalence rate of hepatitis C in the world (approximately 4.5-8% of the population). And because this measure was made effective last month (February 5th), it should begin elevating profits (at least to a minute degree) within a short time frame. Gilead explicitly notes that it expects similarly, stating in its 2014 Annual Report (released on February 25th) that while the company does not expect the level of growth it experienced in 2014 to be replicated this year, it does anticipate overall net product sales growth by dint of Sovaldi and Harvoni’s expansion to other markets.

Algorithmic Perspective

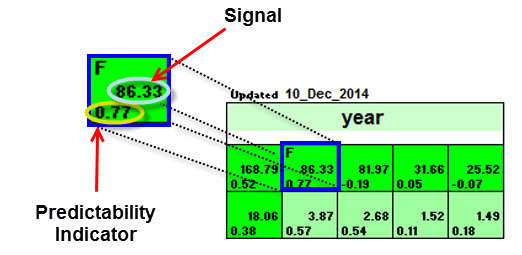

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

The signal represents the predicted movement direction or trend, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength, with the strongest up signals at the top, while the down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal, and red indicates a negative signal. A deeper color means a stronger signal, and a lighter color equals a weaker signal.

The predictability indicator measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically, the predictability ranges from minus one to plus one. The higher this number is, the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

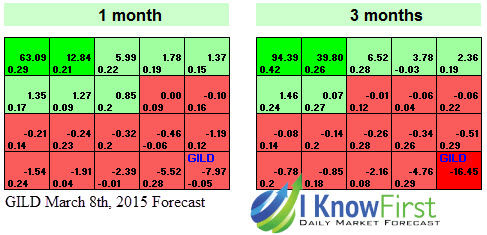

Figure 2. Newly updated one- and three-month forecast for Gilead, last predicted March 8th, 2015; GILD, in blue for emphasis, has been deemed bearish for the months to come; which contradicts the fundamental analysis.

Gilead’s position on the algorithmic chart, then, indicates a bearish signal for the company in the three months to come. The algorithm contradicts analysts’ opinions and believes the money flow, and the stock’s algorithmic analysis indicates the price will go down.

Conclusion

Cumulatively, then, Gilead Sciences may still be considered an industry leader. The company, first of all, has seen approval of numerous, diverse products in 2014; it targets everything from HIV to HCV, and many of them promise to be highly successful therapies. It has also seen a large increase in product sales with the dawn of Harvoni and Sovaldi – two innovative hepatitis C drugs that, with high cure rates, have been responsible for a very large component of the company’s 2014 sales. These two drugs have thus far dominated the market for hepatitis C therapies, stealing most of the show from AbbVie; what’s more, these products are expected to continue furthering Gilead’s sales growth for the rest of the new year. Gilead’s prolific research output is yet another positive, with more than 225 clinical studies actively being pursued as of late 2014. Finally, the fact that Gilead is expanding into international markets (some of which are drastically in need of hep. C therapies) and lowering treatment prices for those in need will not just assist everyday people; this business development will also help the company dominate more of its target markets in developing countries. From the algorithmic perspective, the outlook is bearish and signals that the price should go down in the upcoming months. Because both are contradicting, we would not advice to take any position in Gilead just yet; however, if the price goes down, as is anticipated by the algorithm, the stock will make a very solid long-term investment.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Humayun Ahmed, an I Know First intern, and edited by Daniel Barankin, our International Business Development Project Manager and Daniel Hai, our algorithmic systems analyst. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.