Health And Innovation: The New CVS Brand

Summary

- CVS’s CEO Larry Merlo just spoke at the UBS Global Healthcare Conference and brought up some interesting points.

- The company will seek to increase market share in the specialty medication as the main source of investor value.

- Algorithmic analysis identifies CVS as the top mega cap choice to invest in.

Larry J. Merlo CEO of CVS Health (NYSE: CVS) previously known as CVS Pharmacy, spoke at the UBS Global Healthcare Conference today. The main thesis of his speech was the rebranding from a pharmacy brand into a health brand. This seems fairly in line following the controversial decision to discontinue cigarette sales at CVS Pharmacies under the belief that “We came to the decision that cigarettes and providing health care just don’t go together in the same setting.”

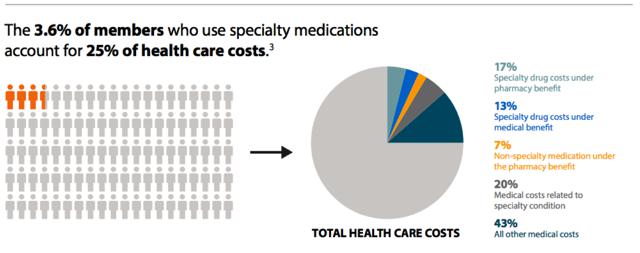

The speech was based around where the brand plans to achieve most its added value, which was mainly pointing at care and medication. In the past this market was less attractive due to the unstable costs, special storage and handling requirements, and very strict rules. However, due to improvement in service infrastructure and management patients can now receive specialty care for various problems including but not limited to Cancer, Crohn’s Disease & Ulcerative Colitis, Cystic Fibrosis, Hepatitis C, HIV/AIDS, Infertility, Multiple Sclerosis (MS), Psoriasis & Psoriatic Arthritis, Rheumatoid Arthritis (RA), and Transplant Medication. Becoming a dominant factor in this market will be a big step, although the amount of people who require these scripts and care is small (low economies of scale for sure), the profits from providing these cares are immense.

According to Mr. Merllo, CVS Health currently manages 25% of specialty scripts. Though its 7800 retail stores across 48 states the chain served 5 million customers a day. According to his statement, by 2016 specialty scripts could be responsible for over $37 billion dollars in revenue which would be about 17% of the overall expected revenue.

He also mentioned the target of 1500 Minute Clinics by 2016, which would be an aggressive expansion (over 50%), which again seems a little high reach.

However, it is very constant with the overall innovative model of becoming a health provider. Finally he expressed that the companies scheduled $1.40 annual dividend is on track as well as the scheduled $6 billion of stock repurchases.

Algorithmic Analysis

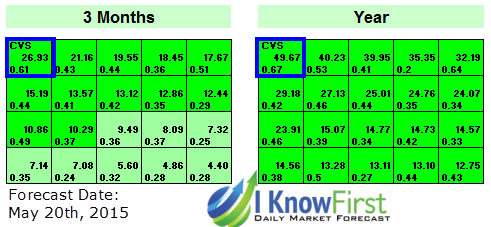

The I Know First market screening algorithm indicates CVS Health is currently undervalued. According to the most recent forecast based on the algorithm’s fair valuation and price equilibrium, and recent market money flow analysis the stock is oversold. The annual predictability score of 0.67 (bottom number) is at the top 5 percentile and indicates the algorithm has an over 80% accuracy score in predicting the stock historically. Although the stock’s Beta is 1 we believe it is going to significantly outperform the market in upcoming months. This is concluded by comparing the 1 year signal (bottom number) of 49.67 to all similar companies on the table. As one can see it is currently ranked as the top opportunity of all companies exceeding a market cap of $100 Billion in the 3 months and 1 year horizons.

Based on the fact that we really like the company’s choice of switching into a health and innovation brand, solid fundamental growth, positive analyst estimates, and very bullish algorithmic forecast we will suggest this mega cap as an attractive addition to any risk conscious portfolio.