Income Investors Should Consider Boeing Because Of Free Cash Flow

Confira nosso artigo (23/6/2015) no Seeking Alpha: Income Investors Should Consider Boeing Because Of Free Cash Flow

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Boeing is the largest aerospace company in the world, with commercial aircrafts making up 66% of its revenues.

- The company received more firm orders than its rival, Airbus, at the recent Paris Air Show.

- It also has more deliveries per year, meaning a higher free cash flow that translates into a higher dividend yield for investors.

- I Know First is bullish on Boeing over the next year, believing the stock price will climb to new highs.

The Boeing Company (NYSE: BA) is currently the largest aerospace companyin the world in terms of revenue, and it is the largest commercial jet manufacturer in the US. The company’s commercial segment drives revenue growth, making up roughly 66% of its total revenues in 2014. It offers a range of narrow-body offerings, and along with rival Airbus Group SE (OTCPK:OTCPK:EADSY) is a leading player in the wide-body market.

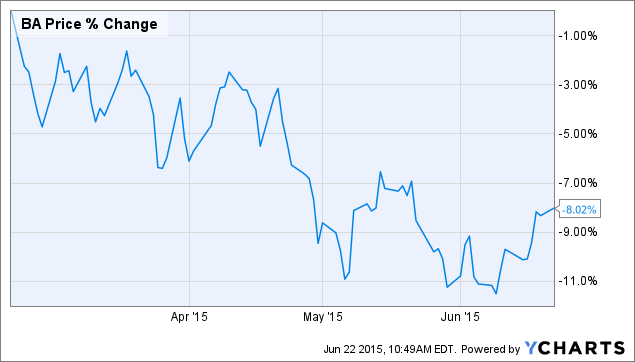

The stock price has increased over 12% so far this year, but has fallen roughly 8% from the high it reached in February. With the conclusion of the Paris Air Show, there is much speculation about who was the biggest winner of the event. Boeing is set up well after the show, and its stock price is set to climb during the rest of the year. A strong backlog of orders, an impressive cash flow and its emphasis on returning value to shareholders means investors should buy this stock during the current dip.

Figure 1. Source: YCharts

Outlook After Paris Air Show

During the Paris Air Show, which was from June 15-21, Boeing received ordersfor 331 aircraft for $50.2 billion. This was lower than Airbus’s orders for 421 planes worth $57 billion, but it can still be argued that Boeing was the real winner of the event. Two reasons are it had more firm orders, with 154 compared to the 124 for Airbus, and it will have more deliveries meaning it will have higher sales.

The total orders were less than from the same event in 2014, but it was still more than analysts had been expecting going into the event. The falling amount of orders should not be taken too seriously, though, for a couple of reasons. For one, the company already has a backlog that will take it through 2016 and beyond for some models. Boeing is currently working to sell some of its older models to bridge the gap to updated models that won’t be ready until 2020 or beyond.

The fact that orders were better than expected shows just how good the current market is for jetliner demand. Boeing and Airbus both made statements about increasing production to increase deliveries as their backlogs of orders continue to build. Randy Tinseth, the vice president of Marketing for Boeing, claimed that the event showed the resilience of the market.

With such a strong demand and solid backlog of orders, Boeing now needs to increase its production. The market for low-cost, narrow-body airplanes is growing, and the company wants to increase its production to meet this demand. Tinseth said during the air show that the company is on pace to have a book-to-bill ratio of over one in 2015 as a result of the increase in production.

Figure 2. Source: flyawaysimulation.com

Boeing currently predicts it will have deliveries of 750-755 aircraft deliveries during the current year. This is greater than the 723 commercial aircrafts delivered in 2014, which was a record amount. In order to continue to increase deliveries, the company will need to work with suppliers, especially with narrow-body planes, where a large percentage of deliveries come from.

Boeing collects roughly 60% of the jet’s price upon delivery, so increasing production would mean better revenues. The company is currently exploring an increase of production of the 737 models to 60 per month, a 43% increase over current levels. A smaller increase as an intermediary step is likely, probably to 52 aircrafts per month by 2018. The company is most likely close to an agreement with suppliers already as it continues to publicly speak about such a program.

Besides increasing production of the 737 models to increase sales, Boeing also claims that 787 models will break ever during the current fiscal year. The new model was introduced in 2011 and has eaten up profits in recent years. The company outsourced 70% of the production for the plane to decrease production time and cut costs, but the program was very rocky and hit many snags due to quality issues.

Quality Cash Flow And Dividend

If Boeing is in fact able to make the 787 break even this year, which there is no reason to suspect it can’t, it can then become profitable next year. At that point, the company will make a profit on every plane it offers. While adding the planes to the backlog is nice, increasing deliveries this year and into the future will improve the company’s revenues.

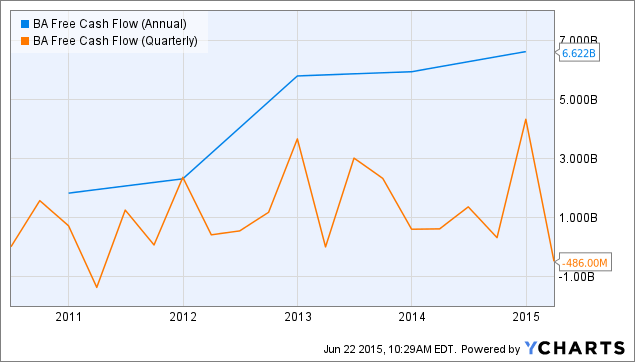

Going back to the record amount of deliveries the company expects this year, it is also safe to assume that the company will also have record sales. Free cash flow increased last year to $6.62 billion, up from $6.08 billion a year earlier. This year, the company has guided for at least $6.2 billion in free cash flow, even as the company had an outflow of $486 million in the first quarter.

The outflow of money was mostly due to the company accelerating advanced cash payments into the fourth quarter of last year, and the first quarter is seasonally weak anyways. Boeing expects that cash will come primarily during the second half of the year, as it has in the past.

Figure 3. Source: YCharts

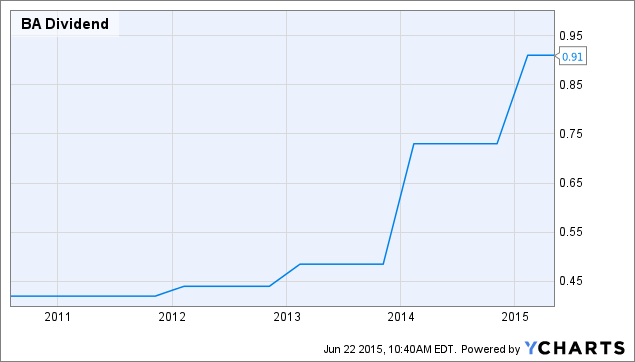

Figure 4. Source: YCharts

This strong cash flow makes the stock very attractive, as the company offers an impressive dividend yield to investors. Boeing has done a tremendous job returning value to shareholders in recent years, consistently increasing its dividend. Its dividend yield is currently 2.26%, which is high for its industry. Further, the company also repurchased 17 million shares, worth $2.5 billion, during the first quarter.

Conclusion

Patient, long-term investors should seriously consider buying Boeing stock at the current prices. With a strong backlog for its products and better deliveries than its rival Airbus, it is the strongest play in the aerospace industry currently for income investors. The management team has shown a strong emphasis on returning value to shareholders, and the company is entering into a harvest phase when it reaps the benefits, in the form of revenues, from the large backlog of orders that the company has built up. I Know First currently is bullish on Boeing, with a strong algorithmic analysis to support the fundamental analysis.