Is Intel Corporation An Investing Opportunity?

Confira nosso artigo (19/3/2015) no Seeking Alpha: Is Intel Corporation An Investing Opportunity?

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Intel is often oversold and undervalued, even in times of good performance and steady dividend growth.

- Cash flow analysis estimates a fair value of $35.

- Opinion analysis estimates an average price target of $36.11.

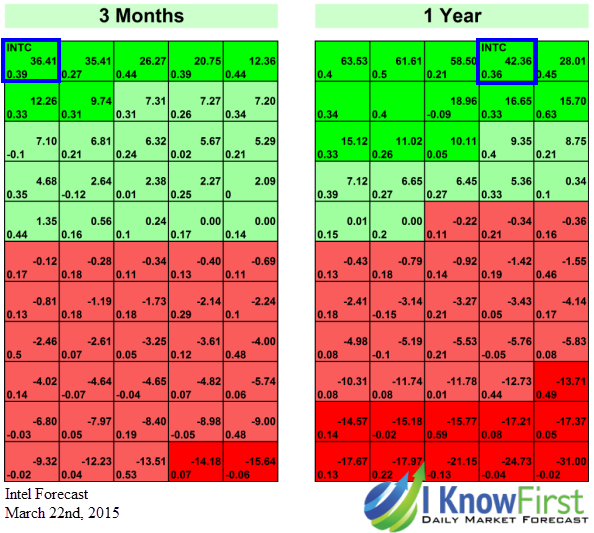

- I Know First Algorithm is bullish on the company in the three-month and one-year time horizons.

- Probability and target price projections agree on a present value of 7.83% return in 2015 (excluding dividend payouts).

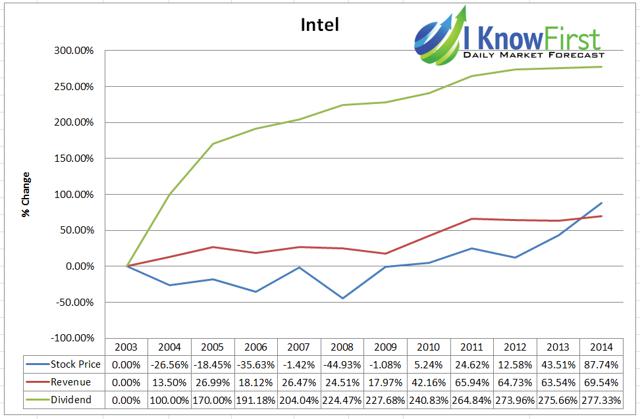

Intel (NASDAQ: INTC) is without any doubt one of the world’s leaders in computing innovation since its inception in 1968. The company has verified time and again that it has capable management complemented by a continued drive to innovate and preserve its position as a major market player; however, often the market differs with this judgment. The company endured the financial crisis with hardly a scratch, with revenue down only 2% in 2008. Investors chastised the firm and the stock lost nearly 43.5%. Since 2003 the corporation had an accumulated stock price appreciation of 87.74%, a very stumpy total bearing in mind that revenues increased nearly 70%, and dividends increased by nearly 280%.

Figure 1: Stock price, revenue and dividend accumulated change since 2003.

After the latest quarterly revenue/profit warning the stock lost further value, and is now down almost 16% in the 3 months horizon. There is merit behind this. First of all the Skylake processor – the successor to the Broadwell – is likely behind schedule. According to commentary from Cowen’s Timothy Adams the “Skylake timing remains at risk”, which Arcuri claims is backed by his company’s work in Asia. If the processor fails to launch in time, vendors will be forced to sell last year’s computer designs and the few 2015 models which use the Broadwell processor. This ultimately reduces the attractiveness of upgrading, a situation in which both Intel and the PC vendors loose.

Figure 1: A slide originally posted by Intel indicating that 10nm process technology will release in 2015.

The next generation 10-nanometer technology which was expected to launch 2015 is also brought into question. In an interview from December 17th 2014 with EE Times, Intel Senior Fellow Mark Bohr alleged the company does not expect to run into the issues that plagued 14-nanometer (a launch delay) at 10-nanometer; however, the company has been extremely quiet concerning the launch timeline.

This led to a sharp decline, which triggered our algorithm designed to identify anomalies in markets. When prices fall below the algorithms fair value it alerts the investor of upward pressure on the stock. Intel reached number one among its parallel mega cap stocks. This indicates that its present-day price is currently the furthest away from its fair valuation, comparative to all other mega cap stocks in our predictive universe. We made an independent fundamental analysis to control whether the financial balances and projected gains come to an agreement with the algorithm, and our results found Intel somewhat undervalued. Intel is worth no less than $35 a share according to our analysis – bellow is our support for that statement.

Fundamental Analysis

In order to understand the future cash flows we divide the analysis into various value adding segments. The more established processors and chipsets are divided into servers, desktops, and notebooks. We then analyze the small segments with large growth potential such as mobile and the internet of things which can become a major revenue source in the future. Finally based on all estimations we establish a fair price valuation of $35 a share – based on diluted EPS of $2.75 and PE ratio of 13.

Server Processors: 2015 Net Income Projection – $7.5 Billion.

Server Processors are currently Intel’s flagship market. With an overwhelming 95% dominance in 2014 the company has certainly done a good job, in comparison to the 2007 level of 84%. We expect server prices to gradually increase towards the $600 mark by 2020. In 2015 we estimate prices will reach an average of $585 which will account for $7.5b in net income – up from 2014th $11.83b. This is with the underlying assumption that global server shipments continue to grow at an annual rate of 6.5% as they did in 2013 and 2014. Finally it also assumes that Intel will lose no more than 1% of their market share in 2015, but will ultimately reach equilibrium at 85% by 2020. We furthermore take into account that the EBITDA margin will drop by about 1.6% this year as competition increases (to a level of 60%).

Notebook Processors: 2015 Net Income Projection – $6.93 Billion.

While notebook processors have larger revenues, their profit margin is slightly lower than servers. The average price in 2014 was $81; however, this figure is estimated to progressively decrease with the lower projected demand in upcoming years. We estimate that global shipments will see little to no growth and remain around 2014th level of 193m. If Intel is able to sustain their market share in 2015 it will render into $13.84b in notebook microprocessor revenues. Because notebook demand is expected to grow slower than smartphone tablets in western economies, but at the same time experience growth in emerging markets, the two will likely cancel each other out in terms of value. To remain conservative we reduce the margin from 53% to 50% and remain at that level for the next several years. This will put the operating expenses at $6.91b for 2015 resulting in a net income of $6.93b.

Desktop Processors: 2015 Net Income Projection – $5.68 Billion.

Global desktop shipments are down 21% in 2014 from 136m in 2013 to 112m just one year later. We expect a further 10% drop this year, and estimate that shipments will decline to around 102m. If Intel is able to maintain the average price level at around $133 and market share at 83% then revenues from desktops will be $11.24b. This is supported by the natural transition of consumer preference for notebook computers over desktops. The more the performance and pricing gap narrows, the more attractive notebooks become over desktops. Notebook and desktop margins are nearly identical, if we retain our assumption that EBITDA will reach 50% it sums to a total operating expenses for desktop processors of $5.56b for a net income of $5.68b in 2015.

PC and Server Chipsets: 2015 Net Income Projection – $6.25 Billion.

For those who don’t know the chipset is a set of electronic components which manage the processor, memory and peripherals. As a rule, a motherboard which has an Intel processor will use an Intel chipset as well. The market is expected to have steady stable growth in the next several years. We expect revenues to grow by about 1% from 2014 and reach revenues of $8.5b and a net profit of $4.35b assuming a net margin of 51.2%. Chipset demand growth is strong and expected to be a major revenue driver in the next few years. We believe this year could see growth as high as 10% resulting in an estimated $3.16b in revenues from server chipsets. The margin for server chipsets is expected to follow closely with that of processors, and thus we estimate EBITDA margin to be 60% as well in 2015. The result will be a net income of $1.9B in server chipsets and a total of $6.25B for both PC and server combined

The Internet of Things, Mobile and all Other Operating Profits Investments: 2015 Net Income Projection – $2.88 Billion.

One of the most exciting and modern ideas of our decade is the internet of things (NYSEMKT:IOT). It refers to a network of physical objects that have electronic software and sensors embedded in them to enable them to connect with other devices or the manufacturer. This connectivity can drastically increase the capabilities of these physical objects, and represents the merger of the physical world and the internet – a market with nearly endless potential. This will have huge implication in boundless fields such as manufacturing, energy management, healthcare, transportations, and much more. The internet of things is, without a doubt, the largest growth sector Intel could tap into, and we expect revenues to grow by 50% in 2014 and 400% by 2022. As a relatively new market, the operating margin should also increase as the company becomes more efficient; however, assuming a margin of 40% in 2015 this sector alone will account for $1.28b in net revenue. The mobile market offers potential as well, but will unlikely be a very profitable in 2015. While the company tries to establish its foothold it will likely break even in 2015. In the long term mobile market offers much potential and should definitely be a major target of Intel. The net income from all other operations should account for another $1.34B. Finally Intel will increase net income by an estimated $261 million from equity gains and interest income generated in 2015.

Total Revenue: $57b

Earnings before interest, taxes, depreciation, and amortization: $29b

Free Cash Flow: $12.5b

Diluted EPS: $2.75

Estimated Fair Value (Based on an estimated PE ratio of 13): $35

External Analysts’ Opinions

Intel Corporation currently holds 21 buy, 1 overweight, 16 holds, 2 underweight, and 6 sells for an overall bullish projection marketwatch.com.Yahoo Finance, currently has no opinions; however, last month was mainly bullish.. Nasdaq.com marks the stock as a buy with 17 strong buy opinions, 8 holds, 1 underperform and 4 sell recommendations. In contradiction, Goldman Sachs’ analyst James Covello has Intel’s target price at $23, and believes the stock is “lagging fundamentals and expensive valuation”.

Furthermore many analysts have recently updated their opinions, below is a summary:

Figure 3: Opinions of analysts. Source

Algorithmic Analysis

The market forecast self-learning algorithm at I Know First affirms the bullish outlook for Intel. I Know First says Intel has one of the strongest Buy signals for the 90-days and 365-days horizon. The positive +36.41 and +42.36 algorithmic signal say Intel is currently undervalued

Figure 4: Algorithmic analysis for Intel Corporation for the 3 months and 1 year horizons from March 22nd, 2014.

Conclusion

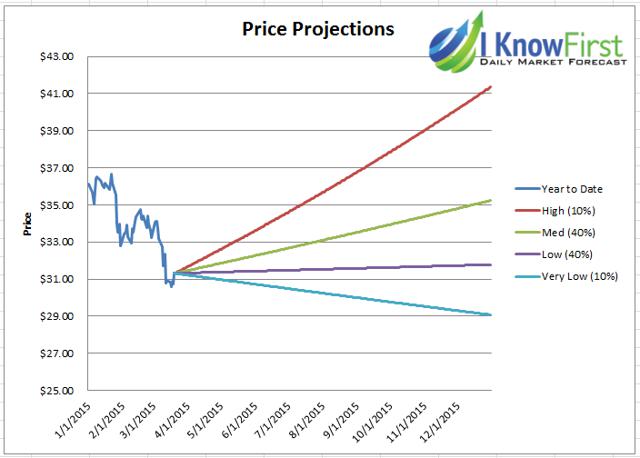

By combining the price targets of analysts alongside the fundamental analysis, we are able to plot rough estimated for 2015.

Figure 5: Projected scenarios using algorithmic, fundamental and opinion analysis.

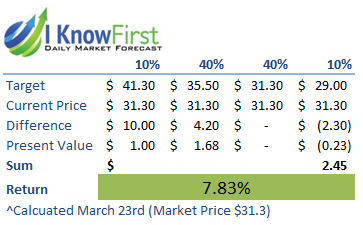

Our analysis indicated Intel has a 10% probability of crossing the $40 mark, which represents a 30% appreciation. Our most likely bullish scenario is a price target in the range of $35, with a low end scenario breaking even at current price levels. Finally our bearish low scenario indicates a maximum downside of 7%, which has a 10% probability. Using these values we can generate a present value estimation of the investment. Our calculation estimated Intel will yield a return of 7.83% in 9 months, before dividend payments.

Figure 6: Calculation for estimated return based on the scenario analysis in figure 5.

Intel certainly qualifies as an attractive long term investment if you are searching for the right dividend stock. It has a very high market share and EBITDA margin in the server processors and chipset segment. Intel furthermore is well aware of the shifting trend from desktop to notebook, it is well positioned to capitalize on this trend (or at least if anything make up the losses from desktops in notebooks). Intel will also gradually get more exposure into mobile markets as they have begun doing this year by integrating the 64-bit Atom Z3580 in ASUSTek (OTC:ASUUY) ZenFone 2. Finally the huge growth potential of the internet of things could be a major revenue growth segment in the future.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.