Micron Stock Forecast: Why The Algorithm Still Forecasts A Bullish Signal For Micron Stock.

Confira nosso último artigo (23/10/2014 )no Seeking Alpha: Micron Stock Forecast: Why The Algorithm Still Forecasts A Bullish Signal For Micron Stock.

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Micron Displays Recent Positive Trends with the acquisition of Elpida paying off.

- The company sits firmly as a top three DRAM and DRAM mobile industry player.

- Turbulent movement for Micron stock in recent weeks was successfully predicted.

- I Know First algorithm future forecasts bullish signal For Micron stock.

Current Market Position of Micron

To get familiar, Micron Technologies (NASDAQ:MU) is an American corporation known for manufacturing semiconductors. Their major products are DRAM, SDRAM, flash memory, SSDs, and NAND. Micron owns its own consumer brands Crucial Technology and Lexar, and is a supplier of parts for known companies such as Apple. In 2012 and 2013 Micron was named one of Thomson Reuters “Top 100 Innovators of the Year“. Over the last 5 years Micron’s staggering growth of 1,100% left its closest US competitors Rambus Inc. (NASDAQ: RMBS) and Spansion Inc. (NYSE: CODE) far behind with 27% and -10% growth respectively. However the international market has proved rather difficult with major players such as Samsung Electronics Co. Ltd. (OTC:OTC:SSNLF) dominating the DRAM (39%) and mobile DRAM (45%) market share.

Micron Displays Recent Positive Trends

The first reason for the recent positive trends is the increase in expectation for Micron to do well in the upcoming months following their acquisition of Elpida in July last year for $2.5 billion. Elpida focused on creating mobile based DRAM products (Dynamic random-access memory) used in many Apple devices such as the iPad Air, IPhone 5s and MacBook Air. The acquisition boosted Micron revenues from $2.32 billion in fiscal Q3 2013 to $3.98 in fiscal Q3 2014, an increase of 72%. Moreover, Q4 2014 showed no slowing down as the 2014 report states “Revenues for the fourth quarter of fiscal 2014 were $4.23 billion and were 6 percent higher compared to the third quarter of fiscal 2014 and 49 percent higher compared to the fourth quarter of fiscal 2013”. Earnings per share have gone up from $1.16 in 2013 to $2.87 in 2014, an increase of 147%. However, it is important to note that DRAM technologies falls under the Compute and Networking Business Unit (“CNBU”) at Micron, which according to the 2014 report (see figure 1) Q4 2014 had a significantly lower operating income than Q3 2014.

Figure 1. Operating Income by business unit. Source: Micron Q4 2014 Reports

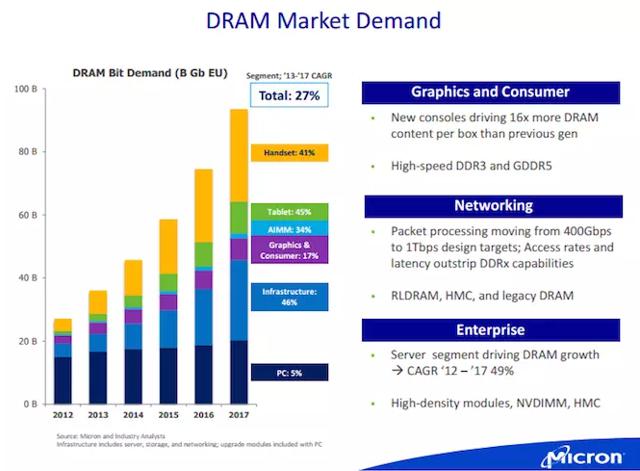

The recent release of the IPhone 6 (which is using Micron memory technology) is expected to increase revenues even farther; Moreover, this shows that Apple chose to remain with the old hardware supplier (Elpida) after the acquisition. While the PC market is relatively static, the mobile market is growing quickly. The Mobile Economy 2013 Report estimates a CAGR (Compound Annual Growth Rate) in the mobile industry of 4.2%. More generous analysts estimate that the market will have a growth rate of 10% a year until 2020. The increase in demand is demonstrated in figure 2.

Figure 2. DRAM Market Demand demonstrating the rapid growth of mobile industry and slow growth of PC industry. Source: Micron and Industry Analysts

Analysts currently expect a balanced supply and demand for both DRAM and NAND in 2015, which benefits Micron. For this reason Pacific Crest upgraded Micron’s rating to “Outperform”. Nonetheless, although Micron stock has been undervalued in the recent weeks, it is fair to say the stock’s equilibrium price fixed itself. The nature of the DRAM industry makes it extremely hard to gain market share, making the major source of revenue the reduction of cost and improvement of processes within Micron.

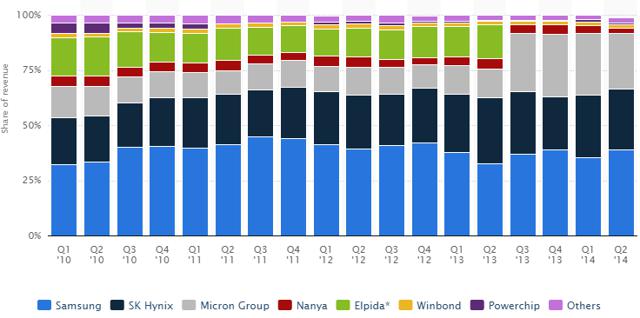

Figure 3. Market share distribution of DRAM Source: Statistica.com

Recent trends lean towards a three player market with Samsung Electronics Co. Ltd, SK Hynix, Inc. (OTC: HXSCL); and Micron Technologies owning 91.7% of the total market (see figure 3). The Mobile DRAM market is more extreme with the three above mentioned companies owning 98% of the market share. Before acquiring Elpida, Micron’s mobile DRAM market share was only 3.4% (in comparison to the current 22.6%). With the market stabilizing between the three competitors and mobile DRAM demand going up analysts are extremely bullish about Micron stock.

What the Analysts forecast

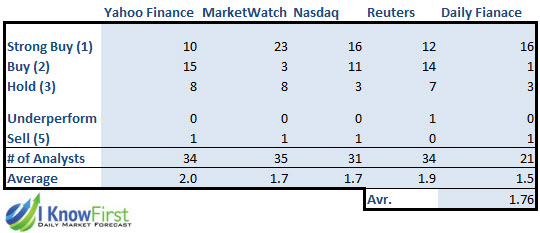

Below is the table representing five sites which provide analyst recommendations: Yahoo Finance, Market Watch, NASDAQ, Reuters, and theDaily Finance. In order to maximize the accuracy of the results we calculate an average estimation for all 5 sources using a 1-5 scale, with 1 being a strong buy and 5 a strong sell.

Figure 4. Sources: Reuters, Daily Finance (Brokerage firms), NASDAQ (Brokerage firms/ Research groups), Yahoo Finance, Yahoo Finance (Uses Data from Reuters), Market Watch. Please note that two website can use the same analyst or source.

The average analyst recommendation is a strong buy (1.76). Only 5/155 analysts recommended to sell. 44 recommended to buy and 77 recommend a strong buy. This means 78% of analysts currently recommend buying the Micron stock, 18.7% recommend to hold and only 3% recommend to sell.

Algorithmic Analysis

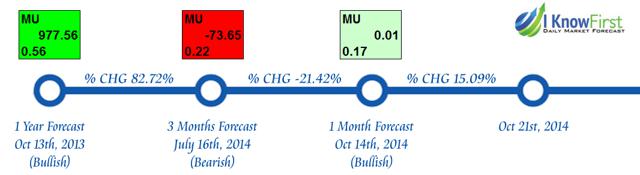

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. 1 year ago the algorithm forecast a strong bullish signal for Mircon stock (first box). On August 4th we published the surprising bearish forecast for Micron from July 16th (second box), at a time when most analysts insisted on strong bullish signals. The article named “Moving Forward with Micron Technology: Algorithmic Analysis” focused on the unexpected short term (1 month and 3 months)price depreciation forecasts. The forecast was correct, and the stock was down to $27.03 on Oct 13th, a -21.42% since the bearish forecast. The Algorithm changed from a bearish to bullish signal on the 13th of October 2014, which has turned out to produce a15% price increase in just 7 days (10/14/2014 – 10/21/2014).

Figure 5. Timeline for Micron Stock forecasts and returns.

Figure 6. The 1 Year Micron stock chart with I Know First Buy and Sell recommendations taken from figure 5. Source: Google Finance

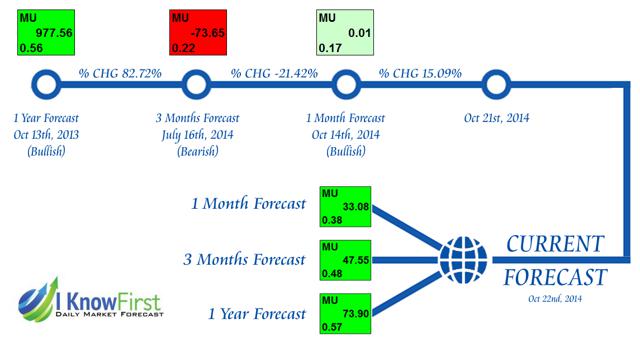

The Micron Technology stock price is forecasted to increase in the 1-month, 3-months and 1-year horizons, according to the algorithm. Our recent forecast agrees with the current analyst predictions for Micron stock. In the chart below, Micron’s future forecast has a green background. Green indicates a forecast of appreciating stock price prediction (While red indicates a depreciating forecast). The positive number in the middle of the above mentioned boxes represents the direction and magnitude by which the algorithm predicts the stock will move. I Know First algorithm also includes a predictability quotient, indicating the algorithm’s level of confidence in the forecast; this is represented by the decimal number at the bottom of the stock. Investors can further increase the accuracy of I Know First forecasts by comparing the stock’s present signal and predictability to I Know First historical forecasts of the same stock. Further explanations are available here.

Figure 6. Algorithmic forecast for Micron (NASDAQ:MU) on October 22nd, 2014: bullish across the 1-month, 3-month, and 1-year time horizons. Source: I Know First Research

Conclusion

As can be seen in the algorithmic forecast for Micron, the 1 month, 3 months and 1 year forecast is still bullish. I Know First algorithmic forecasts are released on a daily basis for the 3, 7 and 14 day horizon and the 1, 3 and 12 month horizons. Some stocks are easier to predict than others; among those is the Micron stock. This can be seen through the relatively high predictability indicator (bottom number). The I Know First Algorithm is 100% independent of any analyst recommendation; thus an algorithmic prediction supported by similar analyst predictions has a significantly increased probability of being accurate. While I Know First has a positive outlook on Micron, it is important to understand that trading technology stocks involves a higher risk because of the innovative nature of the industry. Micron revenues depend on their sales of semiconductors technologies, which could quickly become obsolete when a disruptive technology reshapes the market.

I Know First Research is the analytic branch of I Know First, a financial start up company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai one of our interns. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.