Negative Expectations On Iron Ore And Coal Caused ArcelorMittal To Become Oversold

Confira nosso artigo (15/5/2015) no Seeking Alpha: Negative Expectations On Iron Ore And Coal Caused ArcelorMittal To Become Oversold

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Weak first quarter with further staggering losses.

- Iron ore and coal are not stabilizing as advertised.

- Algorithmic evaluation of ArcelorMittal is bearish despite everything.

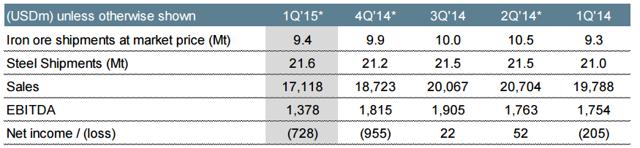

ArcelorMittal (NYSE: MT) produced double the amount of steel its nearest competitor Nippon Steel & Sumitomo Metal (NISTUF) did in 2014. While most recent financial bookings compare 1Q2015 to 1Q2014, a deeper look reveals that quarter to quarter data is not as glamorous. Iron ore shipments are down to their lowest point in the last 4 quarters. Steel shipments are up shedding some light of hope. Sales are at a 5Q low and EBITDA naturally is down as well. The company suffered heavy losses of $728 million in Q1, slightly down in comparison to 4Q2014.

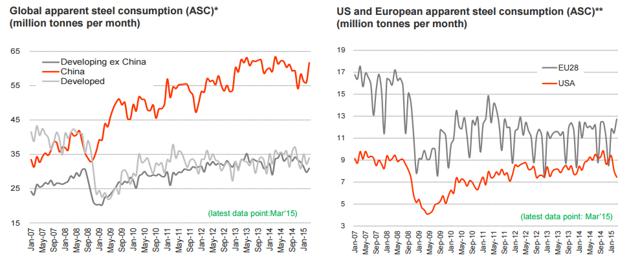

Furthermore, steel consumption is not picking up at the rate most expected.

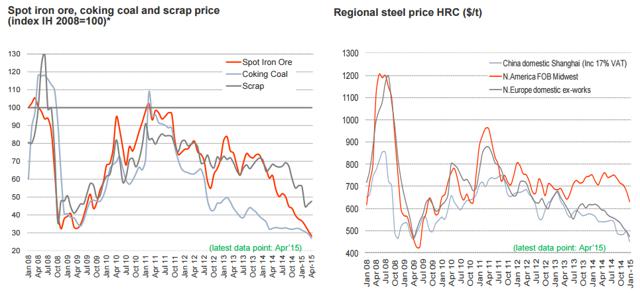

Most investors are expecting commodity prices to recover, but this does not seem to be the trend. For the time being prices or iron ore and steel continue declining and there is no end in sight. I would not agree with ArcelorMittal’s statement that prices have “stabilized at a low level”. Prices seem to be free falling and there is no end in sight; however, as fast as steel and iron ore prices go down they could go up once the outlook flips.

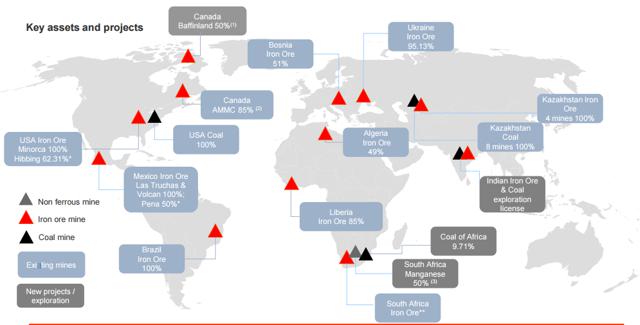

As the largest steel mining company in the world they are not shy of expanding globally. Through acquisitions and mergers the company built up an impressive portfolio with new mines still to be opened. The positioning of the mines is also good as iron ore and coal mines are positioned closely which is indicated by the red and black triangles in the portfolio image below.

The company is largely exposed in terms of sales to Europe and North America. NAFTA is responsible for 26% of revenues and Europe for 39%, largely due to car production demand. South America is responsible for 13% of sales and Africa to 7%. Thus over 2/3 of the company’s exposure is in developed countries – especially in Europe. With most of the region’s economies in a constant struggle it is unlikely a spike in demand will occur anytime soon.

Algorithmic Analysis

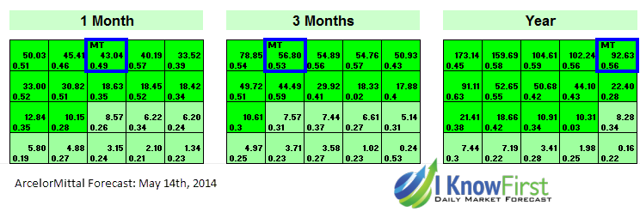

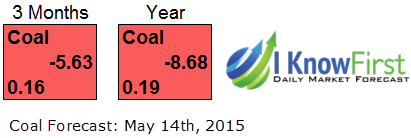

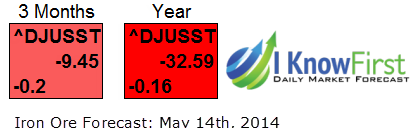

I Know First uses a market screening algorithm to forecast financial assets ranging from stocks to ETF indexes and commodities. ArcelorMittal is a particularly interesting asset to forecast as its prediction is based on thousands of relationships in the market. From the obvious things such as the spot price for coal and iron ore to the more complex relationships with the overall industry, market risk sentiment, interest rate expectation, global economic outlook, competition and millions of other factors. Overall for an analyst this is a very hard investment to asses. We use the coal forecast, Dow Jones Iron & Steel forecast, and finally ArcelorMittal’s forecast to try and draw a possible investment profile.

Coal is currently bearish in the 3 months and 1 year horizons. This is indicated by the middle number, the signal. The predictability score (bottom number) is in the lower percentile indicating this is a particularly hard commodity to forecast; however, it is still above 0 which means there is a historical correlation between the algorithm and market.

Iron ore is even more bearish than coal in the 3 months and 1 year horizons. The dark red box in the 1 year forecast indicates a very high significance signal, and it is very bearish. In order to get an accurate forecast of where iron ore prices might go we track the Dow Jones U.S. Iron & Steel Index. The predictability of iron ore is negative, which would suggest its behavior to be erratic and unpredictable as of late. For the algorithm to know that it is unpredictable and still release a strong bearish signal means that there are a lot of factors pointing the price will go further increase.

With this is mind it would seem obvious that ArcelorMittal’s forecast should be bearish as well. Surprisingly the algorithms identified it as the 2nd strongest signal from our aggressive stock universe. The only way that the algorithm would produce a strong bullish signal on a stock which has a bearish signal most of its core dependencies is when it identifies it as being oversold and undervalued.

Unlike the commodities themselves, ArcelorMittal is very predictable with a 1 year score of 0.56. The high positioning on the aggressive table hints to a potential upside of over 20%. However, if this materializes it could quickly flip and go back down if coal and iron ore spot prices continue to decline.