Netflix: Negativity May Be Airing, But Don’t Change The Channel – An Algorithmic Perspective

Confira nosso último artigo (28/10/2014 )no Seeking Alpha: Netflix: Negativity May Be Airing, But Don’t Change The Channel – An Algorithmic Perspective

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Netflix has dropped a dramatic 21%-25%, following its “disappointing” Q3 earnings and Q4 guidance, both of which indicated low subscriber growth.

- Some analysts believe this spells trouble, citing not-so-speedy margin and revenue growth, compelling new competition, rising content costs, slow domestic growth, and unimpressive international results as further problems.

- While critical appraisals are understandable, Netflix continues to demonstrate positives: i.e., historically unexpected milestones and rebounds, global market leadership, strong channel identity, and dedicated production of new, original, niche-specific content.

- Further, Netflix’s competitive resilience, diverse projects, net growth, expansion potential, and user-experience commitment, in tandem with present-day U.S. streaming- and cable-market climates, signal noteworthy future prospects, analysts and investors believe.

- I Know First’s algorithm predicts a bullish forecast for Netflix in the 1-month and 3-month time frames.

Company Profile: Netflix, Inc.

“When you talk about media, when you talk about the future of television, when you talk about over the top, when you talk about content, the one company that always comes up is Netflix, Inc.”

– Mark Cuban, investor and Dallas Mavericks owner (October 22nd, 2014)

Netflix, Inc. (NASDAQ:NFLX) very infrequently needs an introduction among U.S. investors. As such, I’ll be brief. An Internet streaming company and Internet television network initially founded by Reed Hastings in 1997, the service now provides more than 50 million members in nearly 50 countries, with over two billion hours of TV shows and movies – including original series – every month. What’s more, the service is available for a relatively low monthly price of $8.99, and allows viewers all the standard customized television options they could want: “play, pause and resume watching, all without commercials or commitments.” Initially operating in DVDs, Netflix only branched into Internet services in 2010, after enjoying rapidly growing subscriber counts in its former business throughout the first decade of the 2000s.

Once established, Netflix’s streaming divisions grew nearly overnight in 2010 – within a matter of months, it became the biggest source of Internet traffic in North America in the evening. As a result of this, in 2011, the relatively newly founded Internet streaming market became Netflix’s focus: the company began to independently offer the streaming service that would go on to make Netflix a household name. While things were not quite as sunny for a part of the year – Netflix lost subscribers in third-quarter 2011 – earnings nevertheless jumped toward the end of 2011, and subscriber counts once again resumed climbing, nearly restoring past numbers. By 2014, the company had more than recuperated from its brief stint: in July of this year, Netflix surpassed 50 million global subscribers. As of April, it boasted a more than 32.3% share in the U.S. video streaming market.

Current Events: Q3 2014, Q4 Guidance, and the Drop

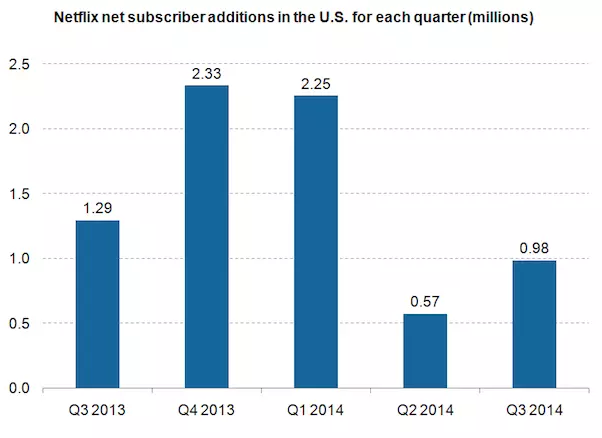

While the last quarter of 2013 and the first quarter of 2014 saw a sizable growth in domestic subscriber counts (with 2.33 million and 2.25 million net subscriber additions, respectively), second-quarter 2014 was less flattering for the Internet streaming giant: only 0.57 million net domestic subscribers were added to its ranks (Figure 1). While both the company itself and many investors remained optimistic about Netflix’s third-quarter finesse in the U.S. and abroad, predicting an overall addition of 3.69 million subscribers worldwide (respectively, 1.33 million local, 2.36 million international), for a total of 53.74 million total worldwide subscribers, things did not quite go as planned. On October 15th, 2014, Netflix released its Q3 shareholder report. By October 19th, the stock had dropped 21%, and more than 25% in after-hours, tearing share prices down from around $450 per share to approximately $330 per share (Figure 2).

Figure 1. Netflix net domestic (U.S.) subscriber additions by quarter. Note that, despite sizable growth in late 2013 and early 2014, subscriber counts have not grown as abundantly in Q2 and Q3. Source: Market Realist.

What was to blame for such a sharp-peaked change in investor opinion?

Firstly, domestic subscriber growth numbers: Netflix’s U.S. results were significantly lower than its predictions, with only 0.98 million domestic subscribers being added in place of an anticipated 1.33 million (Figure 1). Netflix’s overall net subscriber growth results were lower than predicted as well, with the company closing at 53.06 million streaming subscribers worldwide as of the end of third-quarter 2014 – not quite the 53.74 million planned earlier this summer. International growth in subscriptions did not go as planned, either: the company acknowledged that it had “lower net adds than (its) forecast” of approximately 2.36 international additions, adding only2.04 million international members.

Understandably, with both domestic and international membership being elevated slowly, Netflix also had to revise its quarter-four financial predictions; that was the third hit to its short-term reputation, with one Business Insideranalyst going so far as to say that “the company’s guidance looks as if it’s falling off a cliff.” If this is of any consolation, then it should be noted that the company appears to believe that its springtime rate increase (from $7.99 to $8.99), despite occurring in May, did not impact early Q3 results – at the time, elevated prices were overshadowed by the second-season success of Netflix’s original series, Orange is the New Black. Rather, Netflix’s Q3 report maintains that these heightened, early 2014 prices caught up with the company only in late Q3, resulting in “slightly less growth”, which “is factored into (its) Q4 forecast.” As a final negative, the “Q3 Results and Q4 Expectations” section of the Q3 results report concludes by predicting decreased margin growth and increased European losses, neither of which seem very appealing to an already disgruntled audience.

Figure 2. Early-October highs, fluctuating between $440 and $460 per share, give way to a less favorable mid-October plummet: after October 15th’s Q3 report, shares dropped from approximately $450 to slightly below $360. Source: Nasdaq.

As of today (October 27th), share prices have risen slightly, sitting at approximately $380 per share. They remain far from approaching their early-October $440-$460 range, however (Figure 2).

A Few Negatives

As could be anticipated in light of recent events, Netflix has been the subject of ample criticism this month. While not everyone has been quick to let the company go, discussion concerning its deficiencies has surfaced. A few noteworthy points have been made, particularly with regard to the company’s miniscule domestic growth, disappointing international expansion and losses, lowered guidance, tight margins, content costs, and – perhaps less justifiably – capacity to defy competition.

Firstly, there is the fact that, as mentioned before, domestic growth did not proceed as planned. In July, Netflix projected that it would add 1.33 million members in the U.S. during Q3. In the end, however, only 0.98 million domestic subscribers were added during this quarter. Further, not only were there fewer subscribers than predicted, there were also fewer subscribers than in Q3 2013, when Netflix added 1.29 million domestic streaming subscribers. In Q3 2014 just as in Q2, therefore, there was lower domestic subscription growth year-over-year. This is expected to hold true for the whole of 2014: Netflix expects an addition of only 5.65 million domestic streaming subscribers this year in total, down from 6.27 million added last year.

International expansion into Europe and Australia also didn’t go as planned, leaving only 2.04 million new international subscribers added, despite a prediction of 2.36 million additions and extensive expansion efforts that, as Netflix itself admits, are “weighing on (its) international contribution margins in Q4, increasing contribution loss from Q3 to Q4.” Certainly, the international subscriber count rose from the prior year: this year’s 2.04 significantly trumps last year’s 1.44 million Q3 international net additions. Some analysts have said, however, that “the gains weren’t very exciting,” given that Netflix has only really worked toward expanding its international addressable market this year, broadening it by 50% through entry into such prominent locales as France and Germany. In light of its access to such markets, some say, Netflix should be able to do better than its Q4 2014 prediction of 2.15 millioninternational net additions – while this is, again, a decidedly higher number than last year’s 1.74 million Q4 international net additions, that’s only a 25% or so growth – not enough, perhaps, to justify the effort and funding that has been dedicated to a European expansion.

European endeavors have not just been sparingly fruitful, however – they have also brought with them costly losses. Netflix’s Q3 report includes an allusion to the fact that its average value-added tax rates in Europe will increase by 5 percentage points, all of which will be paid from contribution margins, as mentioned above. In addition, these international contribution losses are expected to potentially return to their peak $105 million Q4 2012 levels, according to CFO David Wells. This beats international loss projections, currently at $95 million for next quarter. This is further infuriating some investors – while Netflix has branched into profitable markets, it and those supporting it may still incur such dramatic losses that earnings may be overshadowed.

From disappointing growth and losses nationally and internationally come tight margins and bleak guidance. While Netflix initially aimed to grow its domestic streaming contribution margin by 100 basis points per quarter (400 basis points per year, loosely), it has been averaging around a 600-basis point increase each year for the last three years. Suddenly, however, as of October 15th, Netflix has revised growth expectations: the Q3 report states that “(they) will seek to grow margins an average of 200 basis points per year” – a sizable downsizing given recent growth.

Why the change? Content spending!

Netflix maintains that “this increase in (its) domestic contribution margin gives (the company) room to increase content spending.” While some analysts may be glad to receive further evidence of Netflix’s dedication to new, original, niche content, others do not look upon content spending so favorably. As oneForbes analyst cites, content costs will rise and rise, given that more and more competitors are now entering the Internet video streaming fray. Specifically, Time Warner (NYSE:TWX) and its subsidiary HBO, CBS Broadcasting (NYSE:CBS), Amazon (NASDAQ:AMZN), and Yahoo (NASDAQ:YHOO) are all bringing online programming to their services: Time Warner announced its intent just earlier this month, stating that it will offer online streaming with a cable subscription; CBS has its own subscription streaming service (CBS All Access) that is considerably cheaper ($5.99) than Netflix’s; Amazon Studio’sTransparent and Yahoo Screen’s Community have also become considerably popular. While Netflix states that it does not think competition to be a “major factor” in its U.S. market size and potential membership, some analysts believe that Netflix will damage itself, killing its margins fighting off by constantly increasing competition through content spending, needing to invest more and more into content to keep itself unique. Considering that the company’s streaming content obligations are already at $8.9 billion, and that it would have to grow its NOPAT by 38% compounded annually for eleven years to, according to one analyst, justify its current valuation, it does seem that increasing pressure on margins could potentially pose a problem for Netflix, particularly as compounded with slow growth, competitive content costs, and decelerating subscriber counts.

The Positive Attributes

Despite the fact that Netflix is not presently running “prime time,” so to speak, it may not be entirely wise to dismiss the company solely on account of recent events and accompanying fundamentals. Namely, an examination of Netflix’s past, present, and future unearths compelling reasons to stay on-board.

Firstly, in order to make sense of the present, let’s take a look at the past. While they may not be completely relevant to the situation at hand, past successes do lend some credibility to Netflix’s sustainability as a stock. Many analysts, for example, are now stating that with 3 million new subscribers, 1 million of them in the U.S., the U.S. market may well be saturated. That’s already one-third of all households that Netflix has covered, isn’t it? And people do, after all, share passwords! Tempting as it may be to succumb to, given the figures above, the idea that Netflix’s span may have reached its ends is nothing new: this was proposed before Netflix hit 30 million accounts, and again before it hit 40 million accounts. Despite the doubts back then, Netflix still gained subscribers: enough, in fact, to push it over the 50 million mark. While saturation – at least, in the sense of new users, and not new services – of the U.S. market is most definitely a factor to bear in mind in analyzing Netflix’s progress, it is difficult to state with certainty when it will strike – past judgments have not successfully seen Netflix die down.

Those who take the October 17th drop as a malady beyond repair may also find solace in historical analysis. As was mentioned previously, Netflix successfully rebounded from an 800,000 subscriber loss in 2011 (during which time it also experienced a 24% stock dip when it raised prices) and a 28% collapse in July 2012. After each incident, it has, if after a time, returned to strength. As such, a mere 21%-25% drop would not, I think, suffice to significantly weaken the company.

Assuming it can recuperate from this recent, relatively small blow to its share price, then it is undeniable that Netflix remains the global leader in the Internet video streaming market. No other company, certainly, has 53 million web-based subscribers – 57 million, in fact, if end-of-December estimates end up accurate. It is quite possible, too, that no other company presently pays its producers as much on a consistent basis or offers as much diverse programming to its customers. Perhaps most important to its present success, however, is the fact that Netflix has an identity, and a strong one: it has become known for its capacity to not merely disseminate, but also innovate. As Jenny McCabe, a representative of the company, has stated in assorted correspondence, Netflix has become “more than just an aggregator and distributor of other people’s content – and much more of a programmer.” In other words, the streaming company is deeply involved in content creation, coordination, and production, and everyone knows similarly. Initially, this was not the case: the general public was not as confident in Netflix’s identity as McCabe is. However, Netflix proved itself as a streaming service when its high-profile original programs – e.g., House of Cards, Orange is the New Black – became wildly popular.

Now, when Jenny McCabe says, “We are building a channel that is a strong destination,” she is definitely in line with public opinion: analysts and investors alike second her, having learned that Netflix is at the center of its discipline. Investor Mark Cuban puts it most bluntly: “Very little content is being created… without someone talking to Netflix.” RBC Capital Markets analyst Mark Mahaney concurs, stating that despite Netflix’s latest earnings drop, the company “still has plenty of content… to achieve global subscriber levels nicely in excess of 100 million long term.” Investor and CEO Catherine Woodalso favors Netflix for its dedication to new technology and innovation, citing its potential as comparable to that of Tesla Motors, Inc. (NASDAQ:TSLA). Investor Anders Bylund, citing Netflix’s painless “Unsubscribe!” method and its implications where company creativity is concerned, compares Netflix’s innovative capability to that of Google (GOOG, GOOGL), casting Apple (NASDAQ:AAPL) and Comcast (CMCSA, CMCSK) aside in his analysis.

Even Chris Moore would be likely to agree: content, to him, is everything. A film and television producer, he believes that while streaming services are slowly eradicating cable television’s monopoly, victory will come in the form of creating quality content catered to individuals’ expectations. While Moore, who seems to remain dedicated primarily to traditional media, may well not have Netflix in mind when he discusses content quality, a penchant for meaningful material is inherent to Netflix’s identity.

More, even: Netflix’s dedicated, routine production of new, often original, frequently niche-specific content does not just assist it in shaping an identity. The company’s innovation also grants it competitive resilience. As Mark Cuban points out, almost all content production somehow involves Netflix. This is tremendously useful when it comes to managing all the new competition bears are citing in their analyses. Because of Netflix’s prevalence, it is difficult to overturn; it knows similarly, as can be inferred from its Q3 report statement: it does not consider competition to be a major factor in its future, given that its “per-member viewing and retention in the US are as strong as ever.” While Amazon may have a large library and Time Warner may have always been termed Netflix’s biggest competitor, Netflix CEO Reed Hastings is not concerned. “We and HBO have completely different content. So I don’t think it will be a significant impact at the consumer level,” she says in response to investor queries, probably well aware of the uniqueness of her programming.

James Schek, a part of Netflix’s content delivery team, would be inclined to agree: he also isn’t generally worried about competition where the company is concerned. While he says he does expect that some Netflix subscribers might cancel their DVD plans and switch to HBO, he believes many others will want to continue to watch non-HBO content – precisely the kind of material that Netflix offers. His company has a vast library of originals, A-list content and material that is, by some standards, “better” than HBO: this is not surprising, given that Netflix employs over $150 million and 300 employees a year in content recommendation. Both services are inexpensive, with Netflix being the cheaper of the two. Schek thinks it is likely that Netflix will complement, rather than crumble before, its HBO competition. Further, because HBO would cost almost twice its main over-the-top streaming competitors (e.g., Netflix, Hulu Plus, and Amazon’s Prime Instant Video), it may not be that serious a threat in either case. Mark Cuban agrees, citing the pricing model of Netflix as a reason for his confidence in future subscription numbers.

Finally, even JPMorgan analyst Doug Anmuth doesn’t expect HBO’s standalone Internet video service to negatively impact Netflix. In his words, while Netflix’s pricing would be difficult for HBO to beat, the content is the crux of the matter, and “no one provider has all content.” Semiannual video surveys show that these individuals may well be in line with consensus: respondents view HBO and other premium channels more as supplements to Netflix than as substitutes. As such, Netflix may not be in immediate danger.

A company with a history of morphing when required, as when it transitioned from primarily DVDs to mostly online streaming in 2010, Netflix also appears unafraid to take risks, both financially and creatively speaking. It does not merely sit back and revel in its competitive advantage, as such. Noting that its privileged position is the result of diverse, quality content, it is always striving to generate more such material via new projects. Netflix has a string of such novel projects lined up, all of which will grant great viewing diversity to its audiences, and all of which will be executed in the near future. Just this year, for example, the company will dedicate $3 billion to these projects’ advancements. Amongst them are Crouching Tiger, Hidden Dragon with IMAX and Weinstein Co., a deal that will bring F.R.I.E.N.D.S. to Netflix, the Disney pay-TV window deal already spoken about in 2012, a documentary collaboration with Leonardo DiCaprio, work with comedian Adam Sandler that will involve four feature films, and an agreement with Dreamworks to produce 300-plus hours of programming for children. In addition to working with other groups, the company is creating more than a dozen completely new, original shows before the end of 2015, including four originals set to kick off before 2014 concludes. One of them, titled Marco Polo, is a semi-historical drama set in the thirteenth-century court of Mongolian emperor Kubai Khan. Another, going by the name Narcos, tells the story of Pablo Escobar, the Colombian cocaine king. Both have been described as specialized finds that won’t win mass-market audiences: highly representative, in other words, of most Netflix productions (and indicative, therefore, of Netflix’s desire to please a range of audiences).

While new projects like these are likely to increase overall costs (Marco Polo, for one, has a rich budget), many analysts believe they also are crucial to Netflix’s health. While expenses may be unpleasant, Netflix’s size can absorb even an $8.9 billion content commitment. What the company cannot withstand, however, is a loss of command where content production is concerned: it cannot stop producing the kind of novel content it has made its name with. These new projects are perfectly representative of the diversity and commitment to content that has thus far set Netflix apart, and without which it would probably, paradoxically, not make enough to lose to content spending in the first place. Simply put, because they appeal to new audiences (e.g., Narcos) or involve well-loved organizations and individuals (e.g., Adam Sandler, Leonardo DiCaprio), these projects have potential: they “could help drive further subscriber and revenue growth,” says William Power, R.W. Baird analyst.

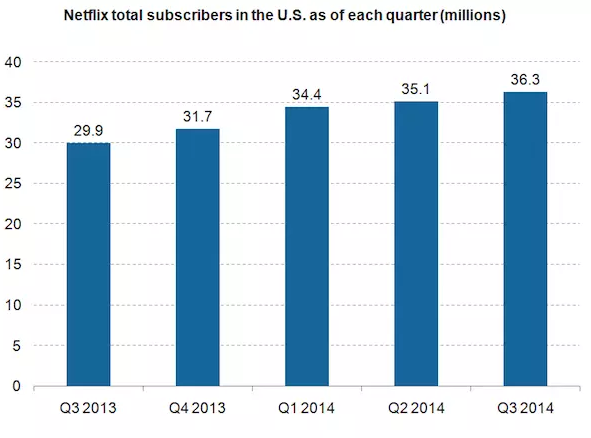

And yes. Indeed. Netflix is growing. Slowly, perhaps. But growing. Both domestic subscriptions and revenues, in fact, are increasing over time. Domestic subscriptions are climbing less-than-speedily (Figure 3), but revenues are a little sharper: even given the unfortunate quarter that the company experienced this Q3, revenues still increased by 27%; operating profit and net income did as well, increasing by 93% and 86% respectively.

Figure 3. While they are rising slowly, Netflix total subscriber counts are increasing in the U.S. with each quarter. Source: Market Realist.

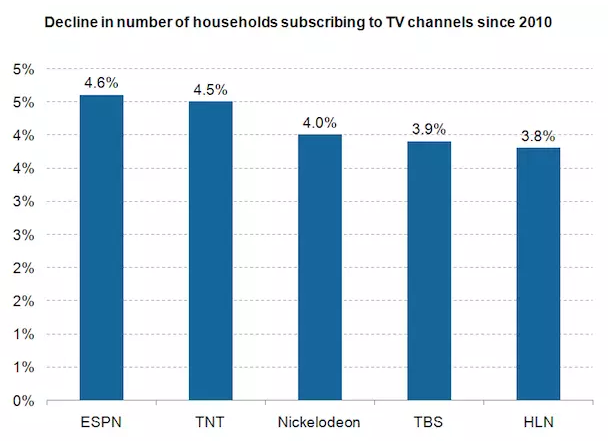

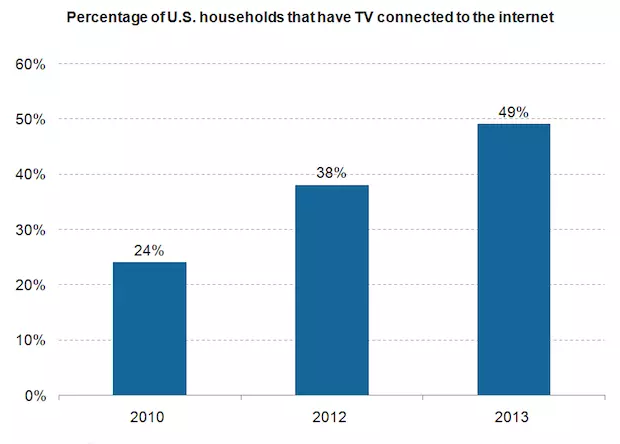

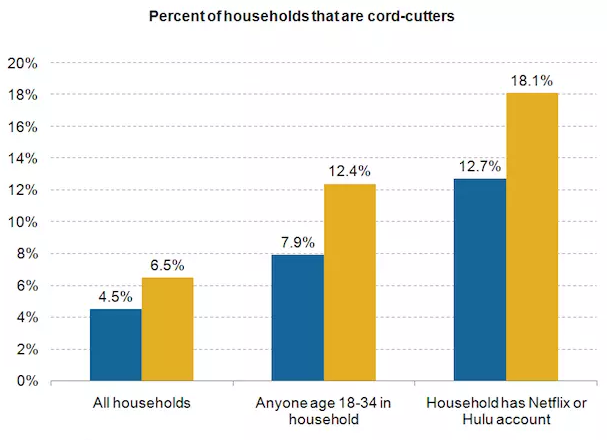

Netflix’s growth is not solely its own doing, however. The company’s own content delivery and marketing successes aside, the climate of the U.S. Internet streaming and cable markets appears to be playing a role in Netflix’s upwards push. Firstly, as Bloomberg’s Olivia Sterns points out, the number of people paying for television and cable is steadily decreasing (Figure 4). People are “watching more and more TV than ever,” to be sure, but “the trick is” that this is online television (Figure 5). As such, cable doesn’t just falter, streaming prospers! Finally, households are “cutting the cord” on expensive cable deals more now than ever before (Figure 6). Sterns estimates that 12.5% of those between 18 and 34 have already disposed of these bundles in favor of online television.

Figure 4. There has been a decline in the number of households subscribing to television channels since 2010: most major subscribers (e.g., ESPN, TNT, Nickelodeon, TBS, HLN) have lost between 3% and 5% of subscribers over the course of the last four years. Source: Market Realist.

Figure 5. Conversely, there has been an increase in the percentage of U.S. households that use online television or somehow connect television to the Internet: advantageous news for Netflix. Source: Market Realist.

Figure 6. Graph depicting “cord-cutter” percentages in 2010 and “cord-cutter” percentages in 2013. Note that more and more households are becoming “cord-cutters” (e.g., in 2010, 4.5% of all households were considered cord-cutters; in 2013, this rose to 6.5%). Individuals who use online streaming, broadly, rather than cable television. 2010 percentages represented by blue bars, 2013 by gold. Source: Market Realist.

Divergences from cable and new interest in online streaming mean that Netflix has a progressively larger user base to take care of. Thankfully, the company is investing in user-experience amelioration in an assortment of ways. These mechanisms will, apart from assisting customers, increase the company’s profitability. Firstly, Netflix’s management is learning from past errors: in the wake of the 2012 changes in pricing and services that infuriated customers, causing the July ’12 drop, the company has worked to reverse its decisions, fix customer relationships, and better strategize in the future. One large initiative geared at bettering customers’ experiences with Netflix is presently under way: during most of 2014, Netflix’s streaming speed reacted adversely to Verizon’s (NYSE:VZ) broadband. In order to increase its speed, Netflix has had to work with numerous ISPs to guarantee better administration and service to its clients. The old Netflix may have hesitated to pay numerous ISPs to achieve speed. However, the wise thing to do, in this case, is negotiate: customers are presently happy, and the costs of this arrangement are not prohibitive. The new, user-concerned Netflix was able to realize this and profit considerably. This kind of willingness to cater to customer demands indicates, in my mind, the maturation of the company’s pricing and customer relations mindsets. Another customer relations and profitability move the company may make would consist of charging high subscription fees to high-income customers – this would give shareholders higher returns, Netflix more profit, and would, in categorizing customers on the basis of income, ensure that people incapable of fulfilling high-stakes demands still gain access to services. Finally, Netflix’s web presence may be changing – the company plans to, among other things, replace Microsoft’s (NASDAQ:MSFT) Silverlight with HTML5 streaming for laptops (resulting in longer battery life and smoother streaming), and implement Facebook (NASDAQ:FB) customization (this would permit users to suggest materials to one another via Facebook and Netflix, making content yet more tailored and accessible).

Others’ Takes

In light of recent events, some analysts have thought it reasonable to deem Netflix a problematic purchase. Indeed, many investors took on this perspective mid-October. Zacks, for example, maintains a strongly negative stance as of today (October 27th), labeling Netflix a strong sell; specifically, analysts with the firm cite significant share price declines, 16 negative earnings estimate revisions for the year, in contrast to 1 upwards revision (for a consensus estimate drop of $3.89 to $3.48), and no upwards – but 15 downwards – revisions for the quarter, as reasons to that now is a “good time to exit (this) underperformer… (to) maximize portfolio returns”, particularly “if you don’t have a long time to wait.”

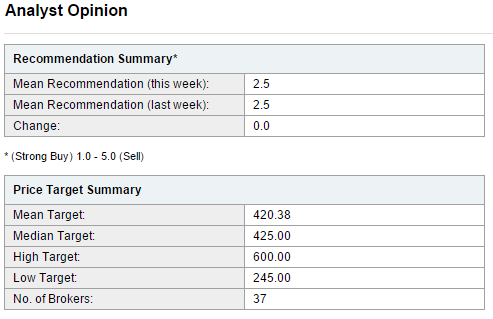

However, an abundance of analyst opinion is positive: on October 26th, it was reported that Netflix received a consensus rating of “Buy” from thirty-seven ratings firms, according to Analyst Ratings Network.

While it may well be clear from the above descriptions that Netflix has both its negatives and its positives, it is important to consider current investor and analyst opinion in evaluating the company, too. Investor confidence, firstly, speaks at least in part to Netflix’s potential. While the opinions of one or two prominent individuals do not necessarily reflect public sentiment, it is noteworthy that one big-name investor has remained loyal to – and has even further indulged in – Netflix since its October 17th drop. The aforementionedMark Cuban is a well-known figure in the investment community. Businessman, investor worth $2.7 billion, and owner of the Dallas Mavericks, he recently revealed that he purchased 50 000 shares of Netflix during its downward spiral mid-October. As has been mentioned several times above, it is Netflix’s pervasive identity and predominance in the realm of content production that has caught his attention. Firsthand Capital Management’s President Kevin Landis seems to agree with Cuban. He has said that while the company has been inaccessible since it entered the streaming market, now is a good chance to buy Netflix. “Yeah it is expensive, but again look at the market cap and look at the space they are playing in. Look at this great position they have got,” Landis has noted.

Overall, analyst opinion seems to concur: Netflix seems bullish at the moment (Figure 7).

Figure 7. Yahoo Finance analysts’ mean recommendation for Netflix this week is a decently strong buy (2.5), where 1.0 is a strong buy and 5.0 is a strong sell. Source: Yahoo Finance.

Algorithmic Perspective

While algorithmic analysis is not to be considered conclusive, it is useful when combined with traditional techniques. Where such stocks as Netflix are concerned, algorithmic analysis – which relies upon historical trends and other information – can be especially useful in carefully piecing apart one’s investment decisions, which may otherwise be subjective to surrounding bias.

I Know First is just one investment firm that uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to supplement its fundamental analyses. In doing so, it predicts the flow of money in almost 2,000 markets across a range of time frames (e.g., 3-days, 1-month, 1-year). It should be noted that the algorithm’s predictability (i.e., its accuracy) becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – most effectively be used to analyze both short-term and long-term trends, but is not as convenient where intraday trading is concerned. The algorithm has seen a high degree of accuracy. As such, while it may seem tempting to disregard its predictions, cross-checking with its suggestions can be helpful in deciding where to place your money.

In particular, I Know First has previously helped investors decide how to engage with Netflix. Recently, in fact, the algorithm successfully predicted the success that Netflix would experience over the course of 2014, as well as the drop it would see in October 2014: this forecast was, in highlighting both negative and positive attributes of future stock performance, accurate across the 1-month, 3-month, and 1-year time frames.

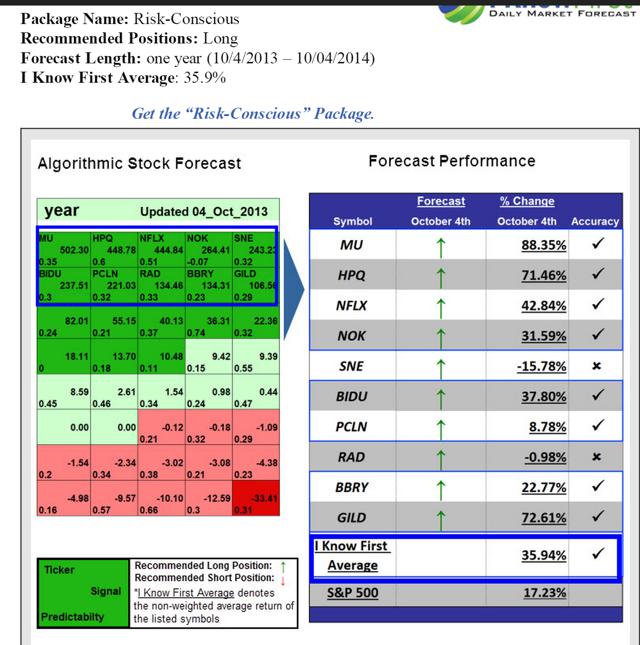

Firstly, a 1-year forecast, last updated October 4th, 2013, forecasted highly bullish activity for Netflix in the 1-year time frame (Figure 8). Netflix was expected to be one of the ten best stocks of the below forecast; from October 4th, 2013 through October 4th, 2014, it held true to this prediction for a return of +42.84%.

Figure 8. One-year forecast lasted updated on October 4th, 2013. Netflix is shown to be strongly bullish, and is boxed in deep purple for emphasis. Prediction is on the left, stock performance is on the right – note that NFLX performance coincided with forecasted behavior.

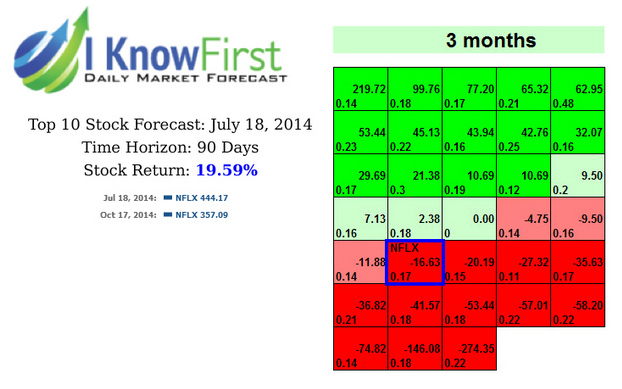

Secondly, a 3-month forecast, last updated on July 18th, forecasted strongly bearish activity for Netflix in the 3-month time frame, with a signal of -16.63 and a predictability of 0.17 (Figure 9). This prediction also showed itself to be accurate: Netflix plummeted the anticipated 19.59%.

Figure 9. 3-month forecast last updated on July 18th, 2014. Netflix was one of the ten bottom-most stocks, classified as strongly bearish. As predicted, it suffered an immense drop around October 17th, 2014.

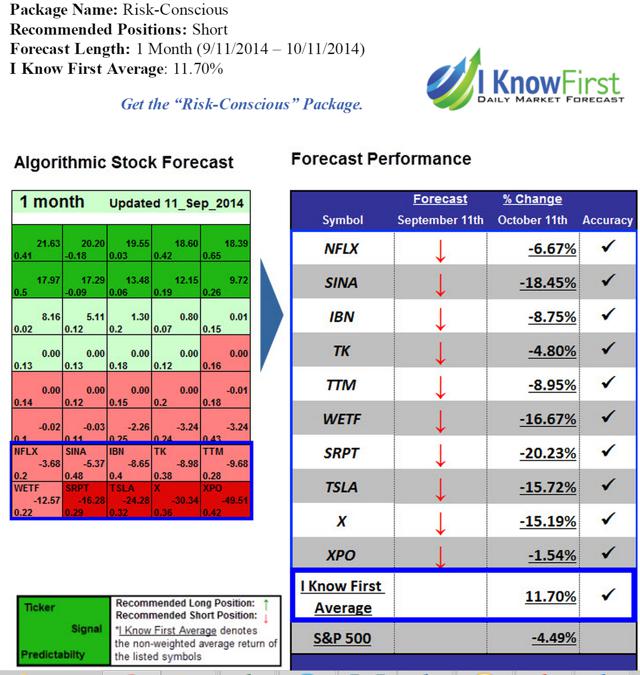

Finally, a 1-month forecast, last updated on September 11th, 2014, predicted that Netflix would be slightly bearish, once again placing it within the bottom ten stocks (Figure 10). This prediction again turned out accurate, with Netflix plummeting shortly after the 11th of October, 2014.

Figure 10. 1-month forecast last updated on September 11th, 2014. Netflix was one of the ten bottom-most stocks, classified as slightly bearish. As predicted, it suffered an immense drop after October 11th, 2014.

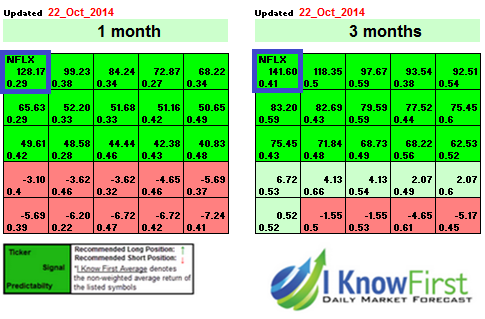

The new forecast generated by the I Know First algorithm, updated on October 22nd, is shown below (Figure 11). Bright green signifies a highly bullish signal, light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast. Correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast).

Figure 11. Updated forecast for Netflix, Inc. . Netflix’s ticker symbol – “NFLX” – is boxed in blue on the top left; its position indicates that it is strongly bullish.

As is evident above, Netflix’s position on the algorithmic chart indicates a strongly bullish prediction for the stock. This seems reflective of the company’s recent business developments, as well as holistic analyst sentiment.

Conclusion

While Netflix Inc. has just suffered the effects of a dramatic drop in both earnings estimates and share prices, this Internet streaming giant appears to be thriving in other aspects of its being. True enough: domestic growth has slowed, international development is not as yet thoroughly successful, fourth-quarter guidance has been lowered, losses have been incurred in Europe, and margin growth is decreasing. Certainly, as competition in the streaming industry rises, content costs will rise. However, while some analysts may think this spells disaster, Netflix remains the dominant player in the national and global markets where Internet streaming is concerned. Its strong identity and dedication to content have earned it a loyal following among analysts and investors alike, some of whom – e.g., Mark Cuban – could be at least slightly profitable to its long-term health. Netflix’s content production – the very means, paradoxically, through which it parts with considerable wealth – is necessary to its competitive strength. As such, decreased margin growth should not be a cause for immediate alarm, as the kind of high revenue these projects could generate, if successful, would be capable of supporting Netflix, while it cultivates, if it can, a more economically feasible bottom line. Without content spending as fueled by contribution margins, Netflix would be unable to purchase the original, niche content for which it is known. Its competition would triumph far more readily, were this the case. At present, while its growth may not be ideal, Netflix’s competitive resilience, diverse projects, steady growth, and commitments to user-experience amelioration make it an investment to consider. In addition, the U.S. streaming- and cable-market climates – presently concerned with escaping cable and embracing online TV – help Netflix along as well. Cumulatively, given these fundamentals, analyst opinion, and the recommendations of I Know First’s algorithm, I feel it safe to stipulate that Netflix would be a stock worth examining in a bullish context in the 1-month and 3-month time frames.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Sophia Glisch, an I Know First intern, and edited by Daniel Barankin. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.