Netflix Stock Forecast For 2015 Based On A Predictive Algorithm

Confira nosso artigo (9/1/2015) no Seeking Alpha: Netflix Stock Forecast For 2015 Based On A Predictive Algorithm

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Netflix stock fell over 20% immediately after its earnings report on October 15th, 2014, because of consumer growth not reaching expectations.

- Investors have expressed concerns over international expansion and content costs, but these are necessary for the company’s future.

- Expansion in European markets and new, attractive original content means Netflix stock is poised to make a strong recovery by the end of the year.

- The I Know First algorithm is bullish for Netflix in the three-month and one-year time horizon.

Company Profile

Netflix (NASDAQ: NFLX) was founded in 1997 by Reed Hastings and Marc Randolph. The company mailed individual movies online to customers and did not have late-fees, unlike other movie rental companies of the time. In September of 1999, Netflix introduced a monthly subscription rate, allowing customers to pay a monthly fee for discs. They could keep the movies or television shows for as long or short as they wanted, and a new one would be mailed within a few days when a disc was returned. The single-rental model was dropped in early 2000. Netflix then introduced video on demand in February of 2007, realizing the potential this market had with increased broadband capability and the growth of streaming-capable devices. By 2010, the company had gone from being the fastest-growing customer of the United States Postal Service’s first class mail to the biggest source of Internet traffic in the evening. Netflix’s stock price has been unusually volatile, experiencing massive growth and losses in cycles since then.

Brief Recent History

Netflix experienced immense growth in 2009 and 2010. The stock price increased from around $35 in March 2009 to $304.79 in July of 2011. Hastings, now the company’s CEO, became enamored with streaming, believing that this was the future of home entertainment. In 2011, he announced that customers would no longer be able to bundle the streaming service and DVDs in the mail together, and would have to pay for them separately. This basically amounted to a price increase of 60% for customers that still wanted both services. Further enraging customers was the announcement that Netflix would be spinning the DVD service into a separate company called Qwikster, a decision that was reversed after three weeksbecause of the enraged reaction of consumers. Hastings underestimated how upset customers would be, and announced during the 3Q11 earnings report that the company had lost 800,000 subscribers. This caused the stock price to drop from a high of $298.73 on July 13, 2011 all the way to about $75 on October 25, 2011.

Netflix was able to revive consumer growth in 2012. It had 26.1 million subscribers as of March 31st, more than the 24.6 million the company had just before the price-hike was announced. However, the stock price remained under $100, and fell as low as $53.80 on September 25th. The stock price remained low because of investors’ concerns over international losses. Netflix started expanding into new markets in 2010 when they launched the product in Canada. By 2012, the company was in 45 countries. This expansion was estimated to result in losses of $60-$70 million for Netflix, and it halted any more expansion until the company returned to profitability. Investors were also concerned about the profitability of the streaming model, as the company had to pay licensing agreements to media companies and use some of its cash for original content to keep consumers happy.

The stock price finally took off in the beginning of 2013, as investors concerns about spending were eased. Netflix had a strong holiday quarter and was able to win back Wall Street. The stock jumped from $97.81 to $169.56 shortly after, and continued to improve on solid subscriber growth. Netflix added 11 million new subscribers globally during the year, bringing its total subscribers to 44 million. Its original content also began paying off, as House of Cards and Orange is the New Black became critically acclaimed shows that garnered media attention. International also started gaining momentum, as the company had more new international subscribers than domestic for the first time in 3Q13.

History Repeats Itself

This recent history is very important, as it can help investors understand the behavior of Netflix’s stock at this point in time. In fact, the factors behind the rapid rise of the stock before 2011, the fall of the stock price in 2011, the stagnant behavior in 2012, and the rise in 2013 are all playing a part in the current behavior of the stock. The company’s stock price continued to improve in 2014, as Netflix saw further consumer growth and better monetization drive their performance. The company even passed 50 million subscribers in 2Q14, and it increased 20% from the beginning of the year. This period of growth is much like the growth the company experienced before 2011.

What caused the stock price to precipitously fall then was a price increase followed by an earnings report that did not live up to analysts’ expectations. In May of 2014, Netflix once again raised the price of their service, which caused its 3Q14 results to come in below expectations. The company added 980,000 domestic subscribers, less than the 1.37 million that analysts expected. Investors were concerned, and in a repeat of 2011, the stock fell abruptly, losing close to 20% of its value. Investors’ concerns over the company’s spending also returned shortly after the less than expected consumer growth. While Netflix was able to triple the amount of international streaming members from 4.3 million in 2012 to 15.88 million through the first nine months of 2014, the company has not yet been able to translate this into profits.

In the most recent earnings report, Netflix predicted 44 cents per share in earnings for the current fourth-quarter, well below the average analysts’ prediction of 85 cents per share. The reasons for the lower than expected earnings prediction, which further worried investors, are very similar to what worried investors about the stock in 2012. While transforming into an online television market, Netflix is facing high costs for original content and international expansion. In mid-September, Netflix continued its international expansion, launching in Germany, France, Austria, Switzerland, Belgium and Luxembourg. The company also had to pay for new original content, such as the $90 million it paid for Marco Polo. It hopes this new show will attract international viewers.

The stock is now trading at about $327, which is 27% lower than it was when the last earnings report was announced. History is likely to repeat itself, so the stock should return to the levels it was trading at before and even higher. However, the stock could fall even further before then, or it could remain stagnant for a few quarters. Evaluating current events surrounding the stock can help investors understand when the stock will begin to rise again, giving investors an opportunity to profit.

Current Events

The main burdens for Netflix’s stock, which were explained above, are the lower than expected consumer growth caused by the price increase, lagging profitability in international markets, and the high costs of original content. Netflix has learned from many of their past mistakes, and the stock price should not take as long to recover as it did after falling in 2011.

For one, the price hike is not as severe as it was then. The first price hike amounted to an extra six dollars for consumers that wanted both DVDs and the streaming service. That price hike was done hastily, and assumed that customers would not mind. The more recent price hike was only one dollar, and Netflix only implemented the price change this time after proper research and conducting tests on different samples across various markets. The streaming service also has more brand recognition and consumer loyalty than it did in 2011 due to consistently good service and innovative content. Also, the current price for the streaming service is still low when compared to competitors, and customers that already had the service were grandfathered in this time, meaning they will pay the same price as before for at least two years. This will help ward off customers from dropping the service.

Domestic consumer growth can be expected to continue to grow, as consumers’ TV viewing habits have shifted towards online devices, especially among millenials, or consumers between the ages of 18 and 34. More than half of online TV viewers mentioned schedule flexibility and convenience as the main reasons for watching TV online. The rising popularity of watching programming on computers, tablets, and smartphones, as well as the ability to watch television on devices like AppleTV, Chromecast, video game systems, and smart TVs, means this trend will continue. Netflix continues to project to eventually have between 60 and 90 million domestic subscribers. Mark Mahaney of RBC Capital Markets recently explained that Netflix is the definitive number one destination for consumers who want to watch TV shows and movies online. He says consumer satisfaction is on the rise and they have declining interest in turning off the service.

While the company will still experience more growth domestically in the coming quarters, Netflix’s push into Europe late last quarter will be key to Netflix’s future growth. The combined markets nearly rival the US in potential subscribers, and they are more abundant with high-speed broadband users than any of the other markets it has previously expanded into. While the move into Europe will provide abundant growth opportunities for the company in the future, it comes with set up costs that will eat into Netflix’s profits for the next few quarters. Excluding the latest European launches, the company’s international profits are on track to be profitable in the fourth quarter. This has taken a couple of years, and the same will be true for the European launches. But the international losses will decline over the next few years, with MoffetNathanson analyst Michael Nathanson predicting declining losses in 2015 and being around break-even in 2016 and 2017, followed by a $215 million international profit in 2018. While earnings per share will suffer because of the expansions in the short term, the future revenue growth possibilities mean investing its domestic profits on international expansion is a wise move.

While the international expansion has startup costs that will lead to future growth, content costs have also continued to grow. Netflix’s content obligations have grown from $7.2 billion at the end of 2013 to more than $8.8 billion as of September 30th, an increase of $1.6 billion in the first nine-months of 2014. These costs are for both original content, such as Marco Polo, and the acquisition of other streaming content, such as the TV show Friends. These costs account for more than 70% of the company’s total expenses, and will result in lower margins for the company. But these content costs are necessary in order keep consumers satisfied with the product and to fend off competitors like Hulu and Amazon (NASDAQ: AMZN). Having its own content like House of Cards and Orange is the New Black, which have both been extremely successful critically, gives the streaming service an air of exclusivity.

Netflix will be releasing a plethora of shows in 2015, including new seasons of both House of Cards and Orange is the New Black, the Tina Fey series Unbreakable Kimmy Schmidt, the sci-fi series Sense8 from the Wachowski brothers, and Daredevil, the first of four planned Marvel series focusing on different Marvel characters that will all eventually merge. The company will also be releasing a sequel to Crouching Tiger, Hidden Dragon this year, as well as an original Adam Sandler comedy. These offerings will help keep customers entertained and fend off new completion from Time Warner, which will be offering HBO as a streaming only service for the first time, and CBS, doing the same with Showtime. Netflix does not view them necessarily as competition, believing that they will complement each other as consumers move away from traditional television to streaming options. Having exclusive content that appeals to its subscriber base will keep the company strong and attract more customers to drive consumer growth.

Algorithmic Analysis

While algorithmic analysis is not to be considered conclusive, it is useful when combined with traditional techniques. Where such stocks as Netflix are concerned, algorithmic analysis – which relies upon historical trends and other information – can be especially useful in carefully piecing apart one’s investment decisions, which may otherwise be subjective to surrounding bias.

I Know First is an investment firm that uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to supplement its fundamental analyses. In doing so, it predicts the flow of money in almost 2,000 markets across a range of time frames (e.g., 3-days, 1-month, 1-year). It should be noted that the algorithm’s predictability (i.e., its accuracy) becomes stronger in 1-month, 3-month, and 1-yearforecasts; as such, it can – when coupled with traditional analysis and careful reasoning – most effectively be used to analyze both short-term and long-term trends, but is not as convenient where intraday trading is concerned. The algorithm has seen a high degree of accuracy. As such, while it may seem tempting to disregard its predictions, cross-checking with its suggestions can be helpful in deciding where to place your money.

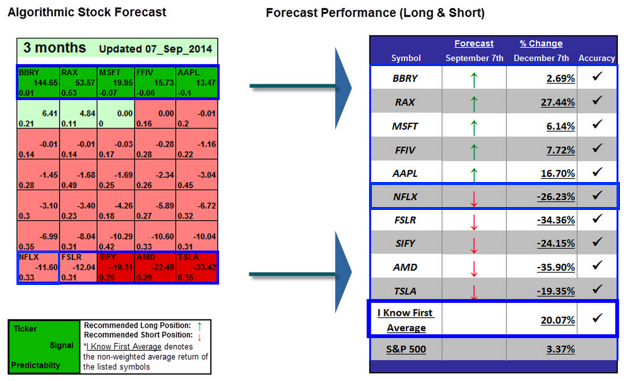

I Know First has previously helped investors decide how to engage with Netflix. In fact, the algorithm was able to successfully predict that Netflix would be bearish in the three-month time horizon between September 7th, 2014 and December 7th, 2014. During this time period, the stock price tumbled after the earnings report on October 15th, which was explained earlier. This forecast was accurate, as can be seen below, yielding returns of -26.23%.

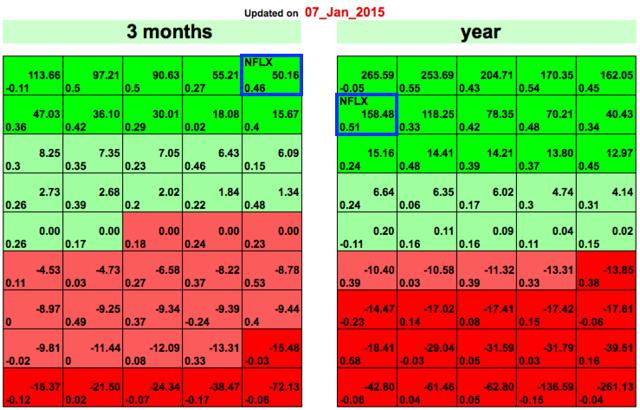

Given that the algorithm appears relatively accurate, its most recent Netflix-related forecast, updated on January 7th, is shown below. Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast).

Netflix’s position on the algorithmic charts indicates a strongly bullish signal for the company in the three-month and one-year time horizons; in the short term, of course, this signal may not be as accurate, but this appears to coincide well with the long-term outlook for the company. A positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Netflix. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

Conclusion

The precipitous drop of Netflix’s stock price has striking similarities to the one it experienced in 2011. Just like it did then, the stock will recover and can earn investors a healthy profit. This time, it will not take the stock as long to recover, because the price increase is not as drastic and Netflix has solidified itself as the number one streaming website for television shows, movies, and original content. High costs of international expansion and original content are necessary, and will help the company continue to grow its consumer base and revenues, making the company financially healthy. Netflix will release its next earnings report on January 20th for the quarter ending in December, and the results should be watched closely. While Netflix might slightly fall further, the stock will increase by the end of the year, most likely to new all time highs as international expansion and new original content create consumer growth.