Procter & Gamble Co: Despite Negativity, We’d Go All In – An Algorithmic Perspective

Confira nosso artigo (1/3/2015) no Seeking Alpha: Procter & Gamble Co: Despite Negativity, We’d Go All In – An Algorithmic Perspective

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Procter & Gamble Co., an American consumer goods multinational with brands like Tide, Pantene, Gilette, Old Spice, and Oral B to its name, is the world’s largest consumer products maker.

- Despite its reputation, P&G suffered at the hands of dollar exchange rates in Q2 fiscal 2015, falling 31% and 4% compared to the prior-year period in earnings and revenue respectively.

- This situation, paired with P&G’s dramatic plans for strategic reform, has installed doubt within some analysts; consequently, the company’s share prices took a hit as the new year dawned.

- P&G is, however, still strong: its business development moves (geared at building public and media presence, and ameliorating sales), experienced leadership, and the aforementioned controversial portfolio slim-down may reap benefits.

- I Know First predicts a bullish forecast for P&G in the three-month time frame.

Company Profile: Procter & Gamble Co.

Procter & Gamble (NYSE: PG) is an American multinational dedicated to consumer goods, and a brand whose name has permeated everyday conversation, as well: say you work for P&G at a dinner party, and you’ll likely get relatively positive reception. Considering that the company brought in approximately $83.1 billion in sales in 2014, and is considered the world’s largest consumer products maker, its general reputation is not that surprising, either: though it is famed for its historically broad range of products and large brands, selling everything from pet foods to personal care products, P&G is considerably more selective where its employees are concerned, hiring only 1% of all applicants each year (most of whom, presumably, receive some pretty handsome perks).

Job-and-internship gossip aside, it remains clear that P&G is a robust operation: it’s the maker of such well-known brands as Tide, Bounty, Charmin, Crest, Oral B, Olay, Always, Pantene, Gilette, Old Spice, and Pampers. It sells products in 180 countries, has fifty-eight years of consecutive dividend increases to its name, as $23B-dollar brands, and $83B in sales.

Current Events: Unfavorable Exchange Rates & the Q2 Drop

While P&G is usually one to watch, then, as could be inferred from the above introduction, current events indicate that the company is not necessarily performing at its peak, at the moment.

To begin, Procter & Gamble’s Q2 fiscal 2015 performance was not at stellar as it could have been, sinking by 4% compared to the prior-year period, and missing analysts’ estimates. The company earned $2.37 billion this Q2 (down from $3.43 billion in the previous year – a 31% hit); revenue also fell by more than four percent to $20.16 billion. Analysts, it seems, expected more, looking for an earnings-per-share of approximately $1.14, and anticipating about $20.7 billion in revenue. Holistically, core EPS fell 8% compared to the previous year, as well. As could be expected, shares dropped when this was publicly declared.

To exacerbate things, the company mentioned on January 27th that dollar exchange rates will continue to pose a problem in fiscal 2015. While this is mostly due to the strong U.S. dollar, and while one cannot fault P&G for the situation, this is problematic for investors: considering that P&G does a large component of its business overseas (approximately two-thirds, in fact), a sizeable proportion of the company’s annual sales – derived from other countries – could translate into fewer dollars than usual. P&G has indicated similarly, noting that foreign earnings may drop by up to 12%; further, the company’s topline is also expected to take a 5% hit.

The company’s recent attempt at reform – which, as will be discussed further in “The Positives”, involves shedding those brands that don’t align well with P&G’s central focus – and its lack of success in China have also been criticized by several analysts. Barclays Capital’s Lauren Lieberman, for example, says she still is not “sure what P&G’s corporate strategy is”, and describes the company as “far off course”; Deutsche Bank analyst Bill Schmitz concurs, adding that P&G really should not be losing out in China.

Cumulatively, these concerns presently have Procter & Gamble sitting at $85.17 – a relatively safe figure, situated almost right between the 52-week low and high.

The Positives

Though the company may look to be in a somewhat disadvantaged state at the moment, then, I’m inclined to state that this is one “Gamble” you should still bet on. Specifically, the company’s dedication to bettering the profits of its core focuses, its possession of immensely large brands, its involvement in the media, its dedication to cultural and environmental events, and its move to ameliorate the sales process on the East Coast via a manufacturing plant capable of fueling the area should all be seen as positives.

Firstly, in the long term, it appears that P&G is adaptable, and looking to work towards smoother operations and management. Specifically, on August 1st, 2014, the company announced that it would be streamlining, dropping 100brands that it does not as frequently engage with, and retaining the 80 brands responsible for approximately ninety-five percent of its profits. Besides dropping comparatively less successful brands, P&G has noted that it is focusing on fueling its core categories: even large brands may be let go, it appears, if they do not align with the company’s central focuses (e.g., beauty, fabric care). CEO Lafley, who has had some prior experience managing P&G’s operations, sees this as a step towards a company “of leading brands that’s easier to manage and operate”, and William A. Ackman – a hedge fund manager who is one of the company’s main investors – may well be inclined to agree: two years ago, in fact, he pushed for a similar focus. Assuming that the objectives really are growth, product innovation, and reliable profit- and cash-generation, this trim-down could be a “less-is-more” move for P&G. And if it is not, we’ll know soon: P&G executives have said they hope to sell most of the 100 brands targeted for divestiture by this summer; at that point, we may be better able to evaluate the success of Procter & Gamble’s strategic changes.

The company has also been involved in public relations work that may well drive more profit and consumer trust towards it, in innovation that has been significantly recognized, and in seemingly smart business development moves. On a relatively small scale, for example, P&G’s recent #LikeAGirl campaign – which, appearing both as an online video and on television via a sixty-second Super Bowl ad, showcased women performing at their prime, thus subverting the negativity behind the phrase “You [do action X] like a girl” – met considerable success: it left the company with nearly 4.5 billion free impressions, was seen by 50% of the brand’s target audience between the ages of 12 and 24, and aided P&G in receiving the most Twitter and Facebook attention of anyone involved in the Super Bowl. The company will also be sponsoring the Cincinnati Music Festival, which brings tens of thousands of fans to Ohio; the second-largest festival of its genre in the nation, the festival will be renamed to “Cincinnati Music Festival Presented by P&G” – a move that draws attention to P&G’s involvement. Where innovation is concerned, P&G recently won four product innovation awards at the Product of the Year Gulf 2015 awards, and is being promoted by Walmart (NASDAQ: WMT) as aSustainability Leader – which, again, can be expected to channel consumers in P&G’s general direction. Finally, a recent business development move – namely, a plan to build a $500-million manufacturing plant in West Virginia – is attracting public attention; it may also, perhaps, be advantageous to investors in the long run, especially in view of the fact that the facility, set to open in 2017, will be able to send products to 80 percent of the East Coast within one day; this could considerably ameliorate the sales process, leading to more profit and more consumer and retailer involvement.

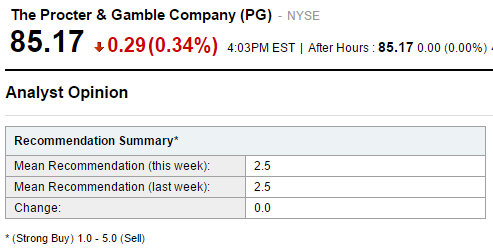

Analysts appear to also be leaning towards optimistic perspectives: while the company may well be sitting a bit low in terms of share prices at the moment, Yahoo! Finance analysts still rate P&G a 2.5 out of 5.0, where 1.0 is a strong buy and 5.0 is a strong sell (Figure 1). Most, in other words, recommend holding on to Procter & Gamble despite its recent less-than-optimal performance.

Figure 1. Yahoo! Finance analysts rate P&G a 2.5 out of 5.0, where 1.0 is a strong buy and 5.0 is a strong sell.

Algorithmic Perspective

While algorithmic analysis is not to be considered conclusive, it is useful when combined with traditional techniques. Where such stocks as P&G are concerned, algorithmic analysis – which relies upon historical trends and other information – can be especially useful in carefully piecing apart one’s investment decisions, which may otherwise be subjective to surrounding (in this case, overwhelmingly positive) bias.

I Know First is just one investment firm that uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to supplement its fundamental analyses. In doing so, it predicts the flow of money in almost 2,000 markets across a range of time frames (e.g., 3-days, 1-month, 1-year). It should be noted that the algorithm’s predictability (i.e., its accuracy) becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – most effectively be used to analyze both short-term and long-term trends, but is not as convenient where intraday trading is concerned. The algorithm has seen a high degree of accuracy. As such, while it may seem tempting to disregard its predictions, cross-checking with its suggestions can be helpful in deciding where to place your money.

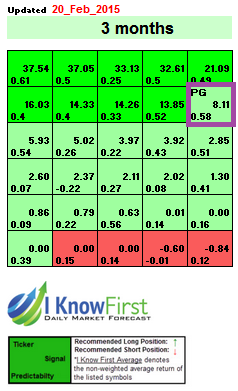

To further analyze Procter & Gamble’s outlook, I Know First’s algorithm was used to generate a new, three-month forecast for the corporation on January 6th. Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast).

Figure 2. Newly updated three-month forecast for Procter & Gamble, last predicted February 20th, 2015; P&G, boxed in purple for emphasis, has been deemed bullish in the months to come; this coincides with fundamentals.

P&G’s position on the algorithmic chart, then, indicates a bullish signal for the company in the three months to come; in the short term, of course, this signal may not be as accurate (in the short term, for example, Procter & Gamble has been down), but this appears to coincide well with the hold recommendations discussed above.

Conclusion

Cumulatively, then, Procter & Gamble, though it has experienced a rough period in Q2 by dint of dollar exchange rates, may still be a worthy investment. While exchange rates may continue to scar fiscal 2015, P&G as a company is reinventing its strategic framework, trimming its portfolio to focus on its biggest achievers, engaging in innovative media work that is bringing it to the forefront of consumer attention, dedicating attention to cultural and environmental events, and still has some of the biggest brands in consumer products to its name; all this can assist in increasing revenue and earnings. Further, this summer will grant us more information about P&G’s divestiture moves, and how deep they will really run. As such, although P&G may not grant immediately satisfying returns, it – as analysts’ predictions suggest, and as I Know First’s forecast also seems to indicate – is a company to hold on to, for the moment.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Sophia Glisch, an I Know First intern, and edited by Daniel Barankin. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.