Sina Is Not Just Another Chinese Stock: Fundamental And Algorithmic Analysis

Confira nosso artigo (27/1/2015) no Seeking Alpha: Sina Is Not Just Another Chinese Stock: Fundamental And Algorithmic Analysis

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- What makes SINA’s services the equivalent to what we know as Twitter and Yahoo.

- Cash flow projection points to 30% upside potential in the upcoming months.

- Algorithmic analysis points to a positive outlook in the short and mid-term after which the stock’s price will bounce back down.

- The risks involved, and the general gloomy outlook for Chinese stocks in general.

About SINA

SINA Corp (NASDAQ: SINA) would be in the spotlight if it was a western company, and not Chinese. Investors are simply more attracted to companies with which they can more highly relate, which is the reason this stock stands out for me as an interesting opportunity to capitalize on.

SINA Corp’s Weibo (NASDAQ:WB), is a Chinese microblogging social network equivalent to what we know as Twitter (NYSE: TWTR). The site currently holds 56.5% of the Chinese microblogging market based on active users. Tencent(OTCPK:TCEHY) and Baidu (NASDAQ:BIDU), the two major competitors, pale in comparison with only 13.5% of the market share when you measure browsing time on the three sites. To put things in perspective, SINA’s Weibo currently has more users than Twitter, which makes it the largest microblogging site online. Weibu is currently the 5th most popular Chinese website, and 15th in the world rankings.

SINA Online, found under SINA.com, is an online portal, similar to Yahoo (NASDAQ: YHOO). The site covers a wide range of content such as: SINA News, SINA Finance, SINA Auto, SINA Sports, SINA Fashion, SINA Entertainment, and SINA Video. In terms of web traffic the site is ranked 4th in China and 13th in the world. 93% of site visits originate in China and 3.2% of visits originate in the US. 13.5% of visitors are linked through Baidu, the most popular Chinese website, which serves as an alternative to Google (NASDAQ: GOOG) (NASDAQ:GOOGL) in China. The rest of the visitors come from Google and Weibu with a share of 7% and 6.5% respectively.

The company is fast expanding into the service sector with a similar expansion model to Google’s. Some examples are SinaMail, a free E-mail service, Sina Instant Messenger, which can easily replace applications such as WhatsApp in SINA’s mobile environment, and Sina Dating which is a matchmaking and personal ads website. The company even offers internet access services currently available in Dial-up for Chinese, US, and Taiwanese residents. American Chinese users can browse content specific to them, allowing the company to market advertising to western brands with an impressive client portfolio: AT&T (NYSE:T), Caesar Entertainment (NASDAQ:CZR), Chase, Coca-Cola (NYSE:KO), Comcast (NASDAQ:CMCSA), Delta Airline (NYSE:DAL), Ford Motor (NYSE:F), General Motors (NYSE:GM), Godiva, Hyundai (OTC:HYMLF), Infiniti, Lancome, McDonald’s (NYSE:MCD), Nissan (OTCPK:NSANY), State Farm Insurance, Toyota (NYSE:TM), Wal-Mart (NYSE:WMT), Wells Fargo (NYSE:WFC), Verizon (NYSE:VZ) and more.

Cash & Growth

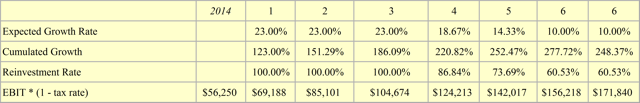

Revenues in 2014 were $665 million following a steady growth of 22%/year. Using 1Q2014 earning reports of $171.5m, 2Q2014 earning reports of $187m, and 3Q2014 earning reports of $198.6m will place the company’s total earning in 2014 at around $270m, with a standard deviation of 5m. This estimate uses the company’s 4th quarter revenue expectations of between “$204 million and $210 million”. As the company still has much room to grow in China, especially through new services, I estimate that this growth rate should not drop in the next three years, after which it will likely decline to around 10% over a 3-4 year period. It is also unlikely investors will see any dividend in the next 6 years as the company is in high growth and not close to meeting its investment needs. 2014’s net income was 45m, and my estimate for 2015 is at around 56m.

Using this data I can project earnings for the next 6 years. This data is largely estimated and only serves as a general perspective.

After refinancing in 2013 with an $800m loan the company is expected to be able to finance itself for at least 2.5 years, by which point it should be operating in the green in terms of cash flows. By 2020 I estimate SINA’s cash flow to be at the very least $100m.

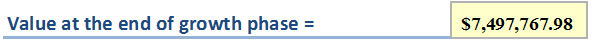

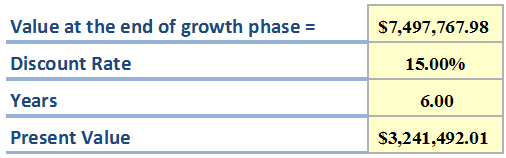

Following these assumptions by 2021 the market capitalization of SINA should be around 7.5b representing a potential upside of three times the firms value today. Rather than investing in the long term this investment offers an interesting opportunity today.

Considering the high risks involved with this investment which I will mention later, I believe the appropriate return should be around 15% annually. Using that as my discount rate yields me a net present value of $3.24B, which is about $800m higher than the company’s value today. Using this estimate I find that the present value of this investment is about 32% higher than the current value. This means my price target for 2015 would be around $49, with an adjustment in the next month to around $42.

Algorithmic Analysis

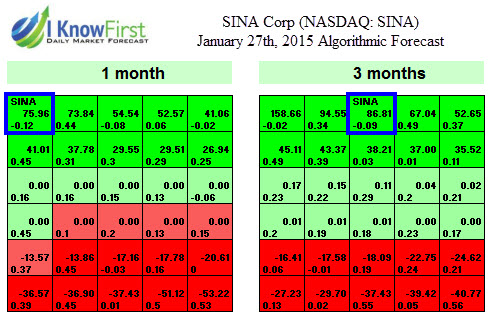

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box, which is representative of price and direction. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

The system is able to follow the movement of capital across markets and through an aggregation of fundamental, technical, and algorithmic indicators asses the upward or downward pressure on a stock.

In the short-term to medium-term from an algorithmic perspective the stock is an attractive investment. In the long-term it seems like the momentum will drop until significant changes take place.

In our tech forecast we have identified SINA as the most appealing 1-month investment, which can be observed through its signal of 75. In the 3-month horizon SINA still holds a strong signal (86); however, the increase does not really justify holding the investment that long, it has also gone down in its relative position to other stocks, and is only 3rd on the lest. Our forecast believes SINA will increase in the near future, before losing its value again the months that follow.

Risks

The reason SINA is so cheap, and perhaps the reason it should be is that the company is simply not transparent. While it raises capital in the US, the financial reports include very little data. Quarterly data is coming in the form of press releases to English speaking investors which can be found here. The company is also struggling to create positive earnings for investors in part due to its heavy expansions each year, which in 3Q2014 made a loss from operations of $11m, in comparison to the same time last year where it made $23.2m in earnings. Because all the data is not calculated through generally accepted accounting principles (GAAP) it is also not as reliable as it should be.

Furthermore, China’s financial markets are in bad shape coming into 2015. The government’s China Securities Regulatory Commission (CSRC) banned the country’s three biggest security brokerages – Citic Securities, Haitong Securities and Guotai Junan Securities – from opening new margin trading accounts for the next three months. However, it might be too late as the markets are overflowing with funds which truly should not be there. From a different perspective in our article “Global Market Forecast For 2015 Based On A Predictive Algorithm” we algorithmically forecast Shanghai’s stock exchange as one of the most dangerous investment’s globally for the year.

Strategy

The stock’s upward momentum looks like it will carry it up to the $44-$46 range in the next 3 months. In about a month the annual report will release which presents two strategies. The first is rather safe, buy now and hold until before the release for which I estimate the stock will appreciate to around 40-41$. The second would be to hold it through until mid-March, as I believe the report will be positive and raise the stock to around $46 by then. My suggested exit indicator would be if the stock falls below the 10 day SMA for more than 5 trading days.

I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.