This Might Not Be The Bottom, But The Time To Buy Chesapeake Is Now

Confira nosso artigo (25/6/2015) no Seeking Alpha: This Might Not Be The Bottom, But The Time To Buy Chesapeake Is Now

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

This Might Not Be The Bottom, But The Time To Buy Chesapeake Is Now

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…)

Summary

- CHK’s stock price has fallen 60% in the last year, and it still might not be the very bottom.

- Investors should start considering this stock anyways, as the company’s management has set the company up to succeed when oil prices recover.

- Cost cutting technology and improved efficiency will lead to robust cash flow within a year from now, and the company has assets to hold off until then.

- I Know First algorithm is bullish on CHK in the long-term, believing the stock has huge upside potential with low risk.

Chesapeake Energy Corporation (NYSE: CHK) is an energy company that explores, develops, and acquires properties to produce natural gas and crude oil. The stock price has fallen precipitously over the last year, and analysts have been predicting that the bottom has come for some time. However, the stock price has continued to fall, dropping another 24.5% in the past month.

Whether or not the current 52-week low that the company is now trading at is the bottom or not is unclear. However, it is clear that the recent fall is presenting investors a good opportunity to buy a stock with lots of upside potential. The stock price will eventually climb well above present levels, as the management team has set the company up for future success. Cost-saving technologies, increased production, and the value of the company’s land holdings make it a strong investment opportunity for investors with a long-term outlook.

Figure 1. Source: YCharts

Improved Long-Term Outlook

The current CEO Doug Lawler took over the company a couple of years ago after the former CEO spent recklessly to expand the company’s foothold. Since then, the new management team has done a great job of cleaning up the balance sheet and improving the company’s outlook. One step Lawler took as CEO was reducing the company’s costs so that profits would improve once the oil market recovers.

This work can be seen in the Eagle Ford developments, where costs have decreased 33% per completed foot. This comes at the same time as per-well estimated ultimate recoveries have increased 76% per well. These wells will be completed during the second quarter, according to Lawler during the most recent earnings report, and show how the company’s general health is improving.

All this does not matter as long as oil prices remain as low as they are currently are. Crude oil is currently trading just above $60, as investors reading are sure to know that OPEC has allowed oil supply to build up to pressure US fracking companies out of business. This technique has been unsuccessful so far, and the work done to lower profitability break evens by companies such as Chesapeake Energy shows the ingenuity in this field.

Figure 2. Source: PetroGlobalNews.com. CEO Doug Lawler has set the company up for future success.

With oil prices falling so far, Chesapeake Energy has cut back operations, shutting down many of its wells until prices recover. However, the company continues to explore and find new potential wells for when prices recover. The company is adding 600 to 700 new locations in the Eagle Ford basin, illustrating that the company will be ready to increase operations and generate robust cash flow when the opportunity presents itself.

But that time is not right now. This being the case, the company has shut down many of its rigs, decreasing its rig count from 20 in January of this year to just three rigs by July, according to Executive Vice President of Operations Mikell Pigott. The ramping down of activity during the current fallen stock price is the right decision, but it continues to obscure predictions for when the stock price will recover.

Oil prices could jump back to previous levels quickly, but this is unlikely. There is a good chance that prices will continue to recover slowly, although they will probably not return to previous levels. A slow, constant recovery will be good for Chesapeake Energy, as the company will be prepared to ramp up production when the opportunity presents itself. Lawler bragged during the most recent earnings report about the company’s ability to ramp up operations is one of its key attributes with its base optimization program.

With oil prices likely to slowly recover during the rest of the year, prices could reach as high as $70 in the next year. At this price, the company will be able to return to profitability and continue its historic success. At that point, the current stock price will look ludicrously low, and the current dip in oil prices could be a blessing to investors in a better-modeled, higher efficiency company.

Cash Flow And Dividend

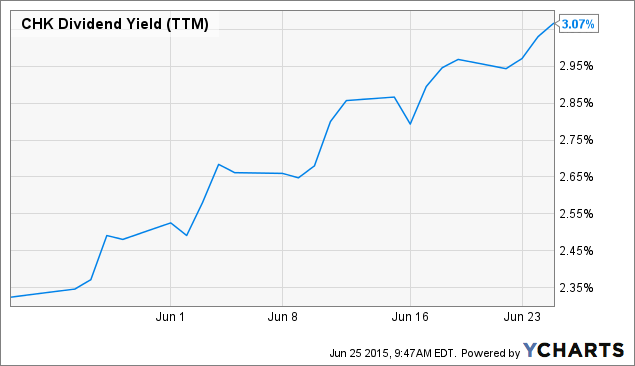

Chesapeake Energy ended the most recent quarter with $2.9 billion in cash, but it also has an undrawn credit facility with capacity of $4 billion. This provides the company a safety net until it is able to make cash flow positive again, which I project will happen by the middle of 2016. With this conservative forecast, the company will have no problem continuing to pay out its dividend, which at this point offers a yield of 3.07%.

Figure 3. Source: YCharts

This is good value for investors while they wait for oil prices to recover, when the company’s stock price will rise along with it. The company also has a very low price to book ratio of 0.76, which is well below that of the industry average. It seems that this company is getting singled out more than most others in the industry for its struggles as a result of falling prices, with the new management not being given credit for cleaning up the balance sheet and improving the operational efficiency during that time.

Even if prices take longer to recover than expected, the company still holds prime acreage in some of the best shale oil plays in the country. Management has shown the ability to get great value for its assets, as seen by the $5.38 billion sale of 413,000 acres with 1,500 wells completed last year. A shrewd deal by management, this gave the company the cash it needed to pay down its debts while positioning itself as a more responsible company.

Conclusion

The falling price of crude oil has been a bearish factor for many energy companies, but Chesapeake Energy has been hit harder than most. With the company managing to cut costs per foot while improving efficiency, the company is set up to skyrocket when the company returns to profitability, which is not that far off. Within the next year, the current stock price will be laughable, and investors should take advantage of the huge upside potential. Even in a worst case scenario, the company’s attractive land holdings and its unused line of credit give the company time to wait for oil prices to increase, as they cannot stay this low forever. I Know First is bullish on this stock in the long-term, with a strong algorithmic analysis in support of the fundamental analysis.