Uncertainty Aversion: Why Cliffs Natural Resources Is A Good Buy In An Environment With Uncertain Iron Ore Prices

Confira nosso último artigo (22/05/2014 )no Seeking Alpha: Uncertainty Aversion: Why Cliffs Natural Resources Is A Good Buy In An Environment With Uncertain Iron Ore Prices

Clique aqui para ler o artigo diretamente no Seeking Alpha.

Summary

- Iron ore spot prices have just dipped below the $100 threshold leaving many investors worried that smaller iron miners will no longer be profitable.

- Cliffs Natural Resources’ stock has been especially hard hit as Cliffs also has many other company specific problems.

- These two factors have caused Cliffs’ stock to fall below its intrinsic value and to deviate from its historic ratio to the iron ore spot price.

- I Know First predicts that Cliffs Natural Resources has a lot of growth potential in the medium and long-term time horizons.

Iron ore prices have fallen more than 25% so far this year and seem bound to fall further according to major financial institutions. Larger mining conglomerates, which own more diverse portfolios of mineral resources as well as have better quality and more efficient iron mines, will be better able to weather the decline in iron prices than smaller producers, such as Cliffs Natural Resources (CLF) that rely overwhelmingly on iron ore. Additionally, since most iron ore producers have stopped negotiating long-term contracts with their largest consumer, the steel industry, they are much more susceptible to iron ore price fluctuations. This means that many smaller companies will likely struggle to repay the debts they’ve incurred from expanding operations and acquiring new mines. Cliffs Natural Resources has the additional misfortunes of being saddled with years of poor management, an inefficient coal division, increased costs of producing iron ore, increased operating expenses, mounting debt, activist investors, lawsuits, and a particularly harsh U.S. winter.

While the entire mining industry is suffering from lower iron ore prices, Cliffs Natural Resources, because of all its travails, has been underperforming its industry peers. Cliffs’ stock price has fallen far below its historical range relative to the global spot price of iron ore despite Cliffs’ meaningful steps to prepare for lower iron ore prices by signing long-term contracts and idling high cost Canadian mines. I believe investors have been overly wary of Cliffs because of its precarious position in a world of uncertain iron prices and steel demand and have thus driven down its stock price below its fundamental value.

I Know First’s proprietary algorithm indicates that Cliffs has much room to rebound, and it ranks Cliffs as one of its top investments for both the medium and long-term time horizons. Investors are often too averse to uncertainty and thereby neglect the underlying value of investments. I believe such is the case with Cliffs Natural Resources.

Anticipated Iron Ore Slump

Goldman Sachs and Citigroup both predict that the price of iron ore will fall to $80 per metric ton in the next few years, as the future of China’s economy has become more uncertain. As China imports more than 60% of the global iron ore supply, its demand for iron ore can completely sway the market price. When China reported disappointing trade data in March – a trade deficit of $23 billion, an 18.1% decrease in exports, and a 7.8% drop in property values – many analysts began to doubt China’s ability to maintain its current growth trajectory, real estate bonanza, and steel demand.

Goldman Sachs analyst, Christian Lelong predicted “the sunset of the Iron Age starts in 2014” as “steel capacity in China is about to peak” after a decade when China’s steel production growth exceeded its GDP growth. China has also taken many steps to cut credit to underperforming and polluting steel mills, thus limiting their ability to purchase iron and leaving an oversupply of iron ore at the ports. Additionally, firms that had been using iron ore as collateral are beginning to dump inventory on the open market to repay creditors, further driving down prices.

However, the mining industry expects that Chinese demand for iron and steel will continue to increase in the next decade and seems to be unfazed by the short-term decrease in iron prices. In fact iron ore producers in Australia are ramping up production to record levels to meet the sustained Chinese demand. In its April 2014 report, the World Bank indicated that it expected iron ore prices to fall 9.1% in 2014, but predicted that the inflation adjusted price of iron ore would hover around $117 per metric ton in the upcoming decade, well above the break even point for most iron miners.

Even though there is much uncertainty and plenty of speculation as to whether China can maintain its strong demand for steel, IG marketstrategist Stan Shamu pointed out that despite the fact that “panic certainly seems to have set in for all things iron ore at the moment,” “it is important to note that Chinese steel production is running at record rates with most steel production actually being exported.” He concluded, “as a result these fears are likely to be more shadow-banking related. In fact, the current price for the futures translates to a price of around US$114.08/t for iron ore.” According to Shamu, iron should continue to have a strong fundamental value in the near future. Although it may be worrisome for iron producers that the price of iron ore has fallen below $100 per metric ton this past Tuesday, the last time such an event occurred was in September 2012 when it stayed below $100 for only two weeks and then quickly recovered.

Industry Giants vs. Small Players

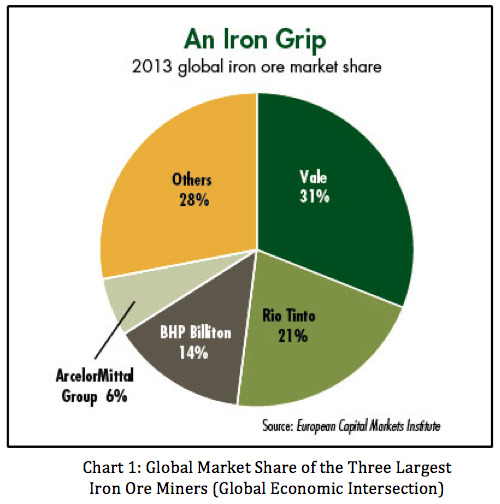

Three mining conglomerates, Vale (VALE), Rio Tinto (RIO), and BHP Billiton (BHP), control nearly two thirds of the global iron ore market share. These major miners have the highest quality mineral deposits and take advantage of economies of scale, which allows them to

extract iron ore for less than $50 per metric ton. Although iron is the fourth most abundant element in the Earth’s crust, comprising nearly 5% of the total soil, it is much easier to extract it in certain forms such as iron oxides. The major miners control most of the best iron mines in the world and therefore have lower costs of extraction. Smaller miners generally have worse mines in more inhospitable areas, which leads to higher costs of extraction and lower margins of profit. There are also many small Chinese iron ore producers whose costs of extraction make operating their mines unprofitable when iron ore prices fall below $90-$100 per metric ton. Cliffs’ Eastern Canada iron ore operations experienced a cost per ton rate of $105.66 in 2013, making it unprofitable to mine iron at the current price levels. However, Cliffs is wisely idling its most expensive mines, such as Wabush, and will only operate its mines in Eastern Canada that are expected to cost at most $85-$90 per ton.

Historical Iron Ore Prices and Changing Market Conditions

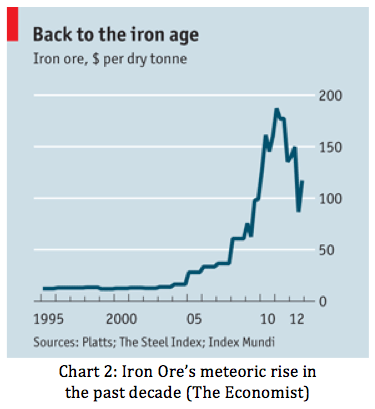

Up until 2003, the major miners and Japanese steelmakers would negotiate a benchmark iron ore price usually ranging from $10 to $15 per metric ton. However, once

China began to ramp up its steel production, buying its iron ore from independent Indian suppliers, the global spot price of iron ore began to increase steadily. By 2005, China supplanted Japan and South Korea as the world’s largest steel producer, leading Chinese steel manufacturers to be the main negotiators for the benchmark iron ore prices. BHP Billiton realized that by signing yearly contracts with steel producers, it was missing out on most of the capital gains from the appreciation of iron ore and ceased to negotiate long-term contracts, selling its ore on the spot market instead. After all three major iron producers abandoned the contract system, the spot price of iron ore began to skyrocket.

In response to these record high iron ore prices, many smaller miners began to mine the metal, but at a much higher cost per ton than the larger conglomerates. Though the largest miners experienced huge margins between their revenues and costs of production, the smaller miners had much smaller margins and thus lower profits. When iron ore peaked in February 2011 at $191.90 per metric ton, even the most inefficient miners were wildly profitable. Now however, that iron ore prices have been falling, the future of these smaller miners is uncertain.

No one believes that the price of iron will fall to pre-21st century lows of $15 per ton, however some analysts are pessimistically predicting the price to fall to as low as $50. This seems unreasonable considering that the cost of extracting iron ore has been rising due to the depletion of the richest reserves and political regulations in Africa and India. Still, even an $80 floor would force many smaller miners out of business. In the short term, ANZ’s head of commodities, Mark Pervan, asserted that “Chinese steel mills remain largely sidelined, awaiting a market test at $US100 per tonne,” indicating that there has been much anticipation for a lower mean price of iron ore. Even though many analysts are anticipating a slowdown in the Chinese economy, China’s expected steel consumption isn’t expected to peak until 2026. Sustained demand coupled with increased costs of iron ore extraction will most likely sustain a price of iron above $100 in the long term.

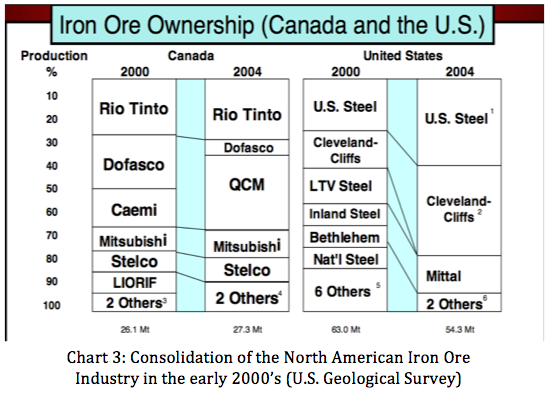

Historical North American Consolidation Trends and Steel Acquisitions

In the wake of the 2001 recession, the steel market began to struggle and the higher cost producers began to consolidate or shut down. Cliffs (Cleveland-Cliffs at the time) bought out and consolidated many of the Michigan iron mines, vastly increasing its market share in the region. Although most of the large steelmakers divested from their iron ore mines in 1982 to focus on their core businesses, by the early 2000’s the two largest regional steelmakers, US Steel (X) and ArcelorMittal (MT), rapidly began increasing their holdings in iron mines. In 2006, ArcelorMittal bought the largest Canadian iron producer, Dofasco, for $5.6 billion. Steel Dynamics has also been aggressively buying up iron ore mines and processing factories to further integrate its steelmaking operations.

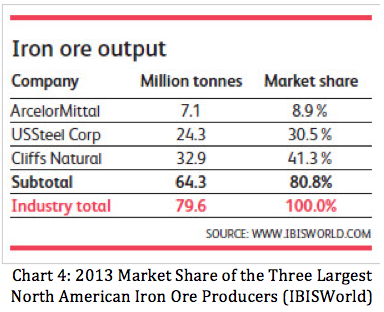

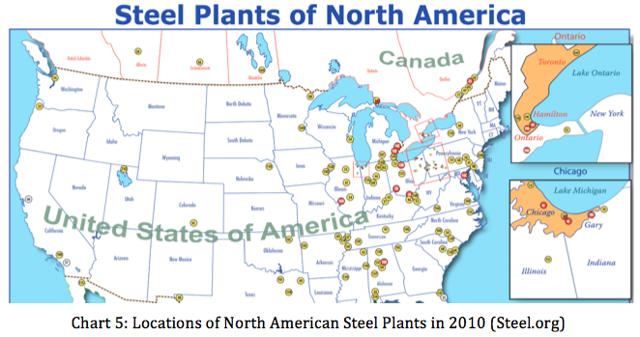

As a Chinese economic slowdown is becoming more likely, the American economy is expected to grow at a healthy rate in the near future. American steelmakers are ready to meet the growing infrastructure and automotive demands and are ramping up domestic production. Since the majority of American steel production facilities are in the Midwest and generally east of the Mississippi River, as shown in Chart 5, it is much easier for American foundries to buy their iron from domestic sources. Cliffs is in a great position to meet American iron ore demand as its mines are predominantly located in Michigan, Minnesota, and Eastern Canada and are connected to the major American steel foundries via the Great Lakes and railroad networks. It is currently the largest North American iron ore producer, as shown in Chart 4, and has more than 40% of the American market share. Independent American iron miners, like Cliffs, are in a great position to establish long-term contracts at favorable rates with steelmakers and are attractive acquisition targets to steelmakers operating in the Eastern United States as they aim to become more integrated.

Cliffs Natural Resources – A Beaten Down Miner

Cliffs Natural Resources is a relatively small American mining company with approximately 48% of its assets in US iron ore, 14% in Canadian iron ore, 22% Asia-Pacific iron ore, and 16% in North American coal. Unlike the larger diversified mining conglomerates, Cliffs sells almost exclusively to the North American steel industry and thus is much more responsive to changes in steel demand and changes in coal and iron prices. Cliffs also operates the vast majority of its mines in North America where the extraction costs per ton are significantly higher than those in Australia and Brazil. It is

(click to enlarge) also vulnerable to the occasional super harsh winter that slows down iron ore extraction and transportation through the Great Lakes. Further contributing to its woes, after years of poor management and bad acquisitions, the activist hedge fund, Casablanca Capital is trying to force its way onto the Cliffs board and plans to cut costs drastically and spin offCliffs’ foreign assets.

also vulnerable to the occasional super harsh winter that slows down iron ore extraction and transportation through the Great Lakes. Further contributing to its woes, after years of poor management and bad acquisitions, the activist hedge fund, Casablanca Capital is trying to force its way onto the Cliffs board and plans to cut costs drastically and spin offCliffs’ foreign assets.

The price of coal has fallen significantly since Cliffs acquired its coal holdings in 2007 and these coal assets have since been a drag on Cliffs’ profits. Though Cliffs will suffer from decreasing coal and iron prices, it has taken some positive steps in cutting capital expenditures on its highest cost mines. It has expressed plans to idle its Wabush mine in Eastern Canada as well as suspend the expansion of the Québécois Bloom Lake iron ore mine that it obtained in 2011 when it acquired Consolidated Thompson, which produces iron ore for approximately $110 per ton. Its production costs of its other Eastern Canadian operations are expected to be $85-$90 per ton – a reasonable cost relative to the worst expectations of $108 per ton for this year. Cliffs U.S. and Asia-Pacific costs per ton are expected to be $65-$70 and $60-$65 respectively – plenty of room for significant profits.

Cliffs other main weakness is its large debt burden of $3.29 billion largely associated with its untimely acquisition of Consolidated Thomson in 2011. However, Cliffs has taken many actions to get its financial situation in order. It implemented a CEO succession plan, replaced its president and COO, suspended its costly Canadian chromite project, and idled its highest cost mines. Casablanca Capital has helped Cliffs refocus its energy away from expanding capacity by advising it to cut its capital expenditures and spin off its underperforming Canadian assets. Cliffs has also been making manyefforts to cut the production costs of its more efficient mines.

Cliffs Natural Resources – Current Valuations

There has recently been a spate of negative forecasts for Cliffs; however, the majority of the valuation targets are still above Cliffs’ current share price. Nomura revised its price target down from $26 to $23, Citigroup maintained its $19 price target, and the consensus target price is $20.24. Cowen revised its price target from $23 to $16 – essentially Cliffs’ current stock price. Even pessimists at Forbes say that Cliffs is fairly valued at $24 despite a pessimistic outlook for iron ore prices and Cliffs’ Canadian baggage.

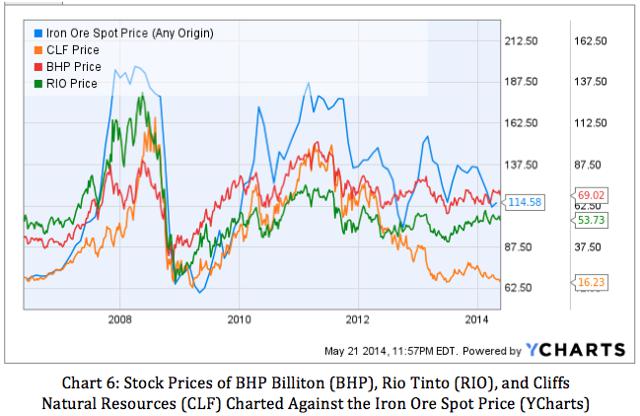

Despite all these valuations that indicate that Cliffs is currently undervalued, the stock has a short float of about 37%. Presumably investors are pessimistic about the company because they expect smaller iron ore producers to struggle because of lower iron ore prices, and they conclude that Cliffs is a particularly easy target because of its other operational problems. This exuberant negativity toward the stock has caused the stock to fall below its fair market value and its historical price relative to the spot price of iron ore. Chart 6 shows the spot price of iron ore relative to Cliffs and two of the largest mining conglomerates, BHP Billiton and Rio Tinto. Although all three companies’ stock

(click to enlarge) prices tend to track the spot price of iron ore, only Cliffs’ stock seems to be greatly deviating from the trend and “underperforming” iron ore. It’s possible this deviation is due to Cliffs’ other problems; it has always been known thatCliffs’ mines are more costly to operate than those of its competitors and that its transportation routes are more vulnerable to the weather than theirs. But it is more likely that it is the negative exuberance that causedCliffs’ stock to overshoot its lower fair valuation threshold. Since Cliffs has such a large short float, any good news about Chinese growth or more optimistic iron ore prices can lead to a short squeeze and cause Cliffs’ stock to spiral upwards.

prices tend to track the spot price of iron ore, only Cliffs’ stock seems to be greatly deviating from the trend and “underperforming” iron ore. It’s possible this deviation is due to Cliffs’ other problems; it has always been known thatCliffs’ mines are more costly to operate than those of its competitors and that its transportation routes are more vulnerable to the weather than theirs. But it is more likely that it is the negative exuberance that causedCliffs’ stock to overshoot its lower fair valuation threshold. Since Cliffs has such a large short float, any good news about Chinese growth or more optimistic iron ore prices can lead to a short squeeze and cause Cliffs’ stock to spiral upwards.

Cliffs Natural Resources – Not as Bad as It Seems

Cliffs does face many real problems, but nearly all of these problems have already been factored into its stock price. In March, Citigroup’s analyst Clarke Wilkins said that “$US80 a tonne iron ore has already been priced in.” Cliffs has already reported how it expects its struggling Canadian mines to perform and the incredibly cold winter was an abnormality as it was the coldest winter in more than 30 years. Additionally, while many analysts were initially concerned by Casablanca Capital’s activist role in the company, it now seems that Casablanca is proposing positive changes that will give shareholders more value for their equity.

There are also many factors that have put Cliffs in a good position for the upcoming years. Cliffs has established long-term contracts with large steelmakers such as ArcelorMittal to ensure a steady stream of income in the near future to hedge against the expected volatile iron prices on the spot market. The American economy is also expected to grow at a faster relative pace than the Chinese economy; thus American steel foundries are likely to have a greater relative demand for iron ore and Cliffs’ North American iron ore operations are perfectly situated to serve them. On top of all this, iron ore tends to be a seller’s market as there are very few miners who can fill large contracts, while steelmaking is a buyer’s market as there has been very little consolidation in the industry and no single steelmaker controls more than 6% of the global market.

Algorithmic Outlook for Cliffs Natural Resources

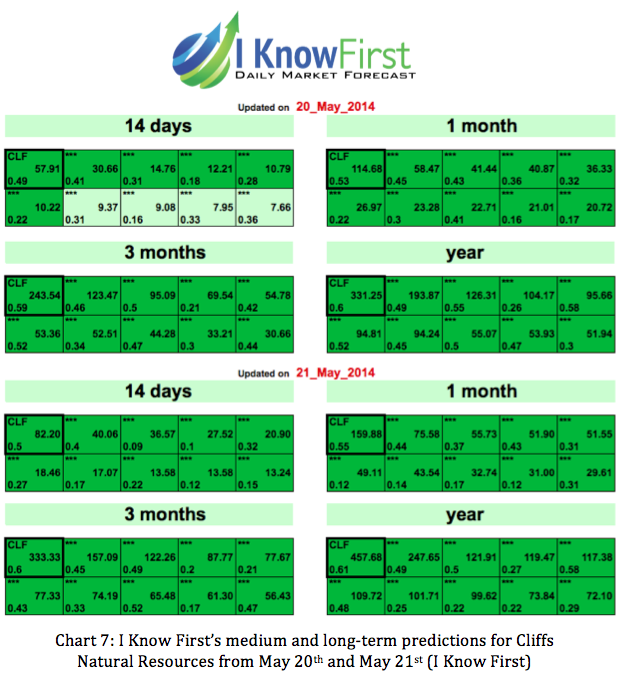

I Know First is a financial services firm whose research branch utilizes a self-learning algorithm to identify stocks that are most likely to outperform the general stock market. The self-learning algorithm uses chaos theory to separate the signal from the noise and can track patterns in stock movements. Although there is plenty of noise in the stock market, there are also identifiable feedback loops, which dictate the medium and long-term trends in the market. Feedback loops are very similar in concept to momentum: a positive feedback occurs when optimistic/pessimistic investors buy/sell stock and then the stock price increases/decreases as demand increases/decreases. A negative feedback occurs when investors sell stock when prices are relatively high and buy stock when prices are relatively low thus causing the stock to appear to be stagnant. The algorithm analyzes the dynamic relationship between positive and negative feedback loops and identifies the transitional periods between them. The algorithm currently predicts that Cliffs Natural Resources is due for a period of an upward positive feedback loop in the medium and long-term horizons.

The market prediction system has two independent indicators for each asset that are utilized by traders to identify when to enter and exit the market. The first indicator is the signal. This is the number in the middle of the box (flush right). It gives the predicted direction (not a specific number or target price) for that asset. The second is the predictability indicator is the historical correlation between the prediction and the actual market movements. This indicator is located at the bottom of the box. In other words, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence.

This easy to read algorithmic forecast is color-coded, where green indicates a bullish signal and red indicates a bearish signal. Deeper greens signify that the algorithm is very bullish, as it does in these forecasts. While the algorithm can be used for intra-day trading, the predictability tends to become stronger over longer time-horizons such as the 1-month, 3-month and 1-year forecasts. Further explanations are available here. Chart 7 shows the algorithm’s 14-day, 1-month, 3-month, and 1-year predictions for Cliffs.

Signals of 57.91 and 82.20 from each forecast respectively, are extremely strong signals for the 14-day time horizon. Predictabilities as high as 0.4 and 0.5 are also indicate tremendous confidence in this 14-day forecast. In each time frame, the signal becomes significantly stronger indicating the bullishness of the algorithm. The high predictability of this forecast indicates strong conviction as well. The strongest predictability possible is 1.0, however predictability this extreme indicates that there is perfect correlation between the actual historical market movement and its predicted movement for an asset. For the majority stocks monitored, they tend to fall between 0.2 and 0.7. In the 1-year time horizon CLF’s predictability is 0.6 and 0.61 respectively. However please be advised that algorithmic forecasts are intended to be utilized in conjunction with your analysis in order to reduce risk and optimize returns.

Conclusion

It’s clear that Cliffs doesn’t warrant the high valuations it had three years ago when iron was valued above $180 and seemed to be going higher; however, it’s currently undervalued even if iron prices were to fall to the most pessimistic prediction of $80. Of course we shouldn’t take the price/book ratio that seriously considering Cliffs’ recent untimely, overvalued acquisitions, but it is important to note that Cliffs’ book value is more than double its current share price. Its profit margin of 4.3% is not much worse than the more diversified Rio Tinto’s 7.2% and it is much better than the largest iron producer Vale’s -0.2%. Even though Cliffs tends to have higher cost mines, Cliffs’ revenues will still decrease by the same magnitude as the larger miners’. The only difference is that if the price of iron falls below the critical level of $100, many of Cliffs’ Canadian mines will no longer be profitable; however, by idling these mines Cliffs could avoid such losses.

Iron miners’ stock prices have generally been beaten down too far in response to the lower iron prices even though Wall Street has anticipated such decreases for months. It seems that in reality the iron miners are a proxy for investors’ speculations about the Chinese economy and that the uncertainty about China has driven investors to look negatively on the iron miners. Perhaps this uncertainty about China and the direction of the price of iron ore has led investors to overvalue the risk of ambiguity and fall prey touncertainty aversion. Cliffs has received particularly bad press because it operates mines with high extraction costs and because of its operational problems, however in all fairness, it isn’t in a much worse position than its competitors and in many ways it is better situated to take advantage of growing American steel demand.

I believe that Cliffs has become a particularly good investment as it has become undervalued after falling more than 40% in the last six months. Its stock has been pushed down considerably by its strong short interest of nearly 40%. However, this negative interest can actually work to the advantage of long investors if a short squeeze were to occur. Additionally, now that iron ore spot prices have fallen below the symbolic $100 mark, investors have become even warier of mining stocks despite the fact that the vast majority of analysts expect the price of iron to be higher for the remainder of 2014. I Know First’s algorithm also predicts that Cliffs is currently situated for very strong growth in both the medium and long-term time horizons, perhaps because of its divergence from its historic relationship with the spot price of iron. Cliffs may have had some difficulties in the past few years, but it has taken many significant steps to get its finances in order. Although I believe now is a great time to buy Cliffs Natural Resources, I suggest executing a 5% stop loss in case this negative trend continues, then reopening this position if the stock were to rise again to its current price. It takes a lot of courage to invest in a stock when it’s at its lowest point, but often doing so allows you to profit from the best opportunities.

so happy to find good place to many here in the post, the writing is just great, thanks for the post.

Great post I would like to thank you for the efforts you have made in writing this interesting and knowledgeable article.

Here at this site really the fastidious material collection so that everybody can enjoy a lot.

Hi, I log on to your new stuff like every week. Your humoristic style is witty, keep it up