Uranium Energy Corp. Could Very Well Have Nuclear Growth In 2015: Fundamental And Algorithmic Analysis

Confira nosso artigo (19/3/2015) no Seeking Alpha: Uranium Energy Corp. Could Very Well Have Nuclear Growth In 2015: Fundamental And Algorithmic Analysis

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- The most current exploration projects and reduced operations in the United States, awaiting the inevitable uranium price recovery.

- The supply and demand paradox in which expected demand is high, expected supply is low, and prices are dropping.

- Company finances, historical analysis, demand expectations, external analysts’ opinions, and investment potential summaries.

- State-of-the-art algorithmic analysis of the stock, supported by a further study of the World Uranium Total Return Index and Market Vectors Uranium+Nuclear Energy ETF.

- Investment projections and risks.

Introduction

Presently engaged primarily in the exploration, pre-extraction, extraction and processing of uranium projects in both the United States and Paraguay, Uranium Energy Corp. (NYSEMKT:UEC) is a concealed gem among its competing associates. The company utilizes in-situ recovery (ISR) techniques which have lower operating costs and shorter lead times than conventional open pit or underground mining approaches.

The company extracts uranium concentrates (U3O8) since November 2014 from the Palagana Mine in Texas. The uranium is then transferred to the Hobsun Processing Facility, in which it converts the material into drums of U3O8. Each drum contains 850 lb (385.5 kilo) of U3O8. The company has strategically reduced operation since July 2014 in the Palagana mine, in order to adjust for the extremely low uranium spot prices, at the time hovering around $28 a pound. Other projects include the Bruke Hollow Mine in Texas, for which, thus far, 526 exploration holes averaging 468 feet a depth have been dug; and the Anderson Project in Arizona, which is currently awaiting approval following the NI 43-101 filing in September 2014. Considering that around $70 a pound is the economic incentive threshold, and furthermore that pre-crisis prices were above $100, makes a paradox which is hard to understand. How can demand be high, and expected to grow higher, while the price is so low?

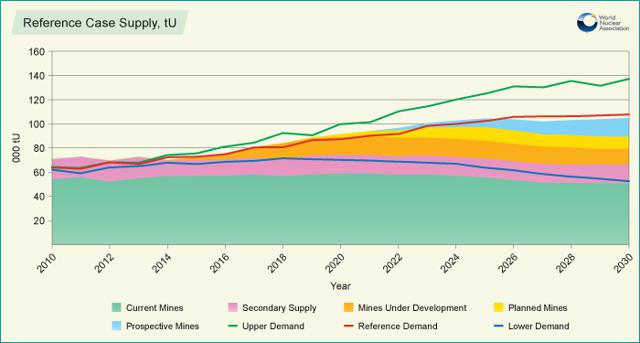

Figure 1: Uranium supply and demand line graph (Source: World Nuclear Association)

While the stock market and financial markets have seen at a full recovery since the financial crisis, uranium has not. What is even more interesting is the expanding gap between supply and demand. As you can see in the image above, the reference demand is above the orange line which represents mines under construction – by 2022, even the mines under construction won’t be able to meet the demand. There are currently 434 reactors operating in 30 different countries, with 70 new ones under construction. By 2022, 90 new reactors are expected to be constructed, which will likely be responsible for at least a 20% increase in demand. There are also 173 reactors currently planned to be built and 310 which are proposed, which combined make for more reactors then all the currently existing ones. China’s accelerated plan is to approve six to eight plants a year through 2020; part of its war on pollution, which is expected to be one of the largest catalysts in terms of this demand growth.

The Supply and Demand Paradox

Incredibly low prices and ever-growing expected demand are two things that generally do not go together. CEO and president Amir Adnani claims in a Bloomberg interview that Japan’s Fukushima Daiichi nuclear disaster is still heavily inscribed in people’s minds and is keeping uranium prices low for a lot longer than expected. After 3 of the 6 reactors at the Fukushima I Nuclear Power Plant had a nuclear meltdown followed by massive radiation spill as a result of a magnitude 9 earthquake and an ensuing tsunami, nuclear energy took a serious hit.

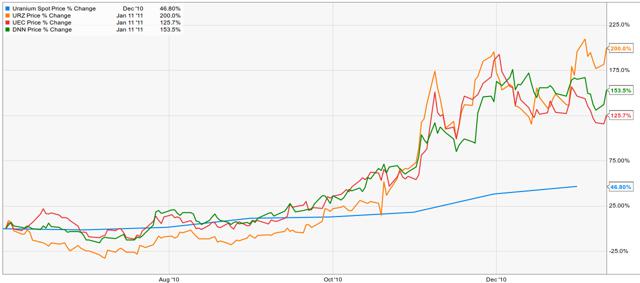

Figure 2: Full Ux U3O8 Price history (Source: UXC.com)

As can be seen in the table above, it took prices four years to begin recovering following the financial crisis, and just as the levels were exceeding $60, the Fukushima spill and closing down of all Japanese nuclear power plants kicked the prices to an all-time low. We are now again approaching the 4-year recovery time, and with all conditions aligned, it seems natural for prices to go up over the next several years. Following the accident, 48 nuclear plants in Japan were shut down; however, the Japanese government is now pressing towards reopening these plants, insisting the economic benefits outweigh the risks – four plants have already been approved to re-open. Many hoped a natural disaster of this magnitude would lead towards large reform and emphasize the need for safer renewable energy; however, recent years prove the process is slow and will require many years. There is no doubt that nuclear energy demand will increase, as it is the only environmentally conscious approach to filling the energy gap left by slow renewable energy supply growth and the ever-less popular coal approach.

Finances

Uranium Energy Corp. recorded a net loss of $5,875,540 ($0.06 per share) for the 6 months ending January 31, 2015, in comparison to a net loss of $7,178,894 ($0.08 per share) in 2014 for the same period. This reduction in costs is significant, and demonstrates management’s ability to scale back in order to avoid unnecessary expenses.

During the six months ending January 31, 2015, the Palangana Mine and Hobson Mine both extracted 11,000 pounds of U3O8. In comparison, in 2014, both mined 27,000 and 28,000 pounds respectively – indicating a scale-back of over 50%. No revenues of sales were generated during the period, which largely leads to the heavy net loss, and might largely be deceiving to investors. Since November 2010, the company extracted 571,000 pounds of U3O8, of which 490,000 pounds were sold. The inventory is currently 81,000 pounds as of January 31, 2015 which currently holds a market value of $3,199,500.

Historical Analysis

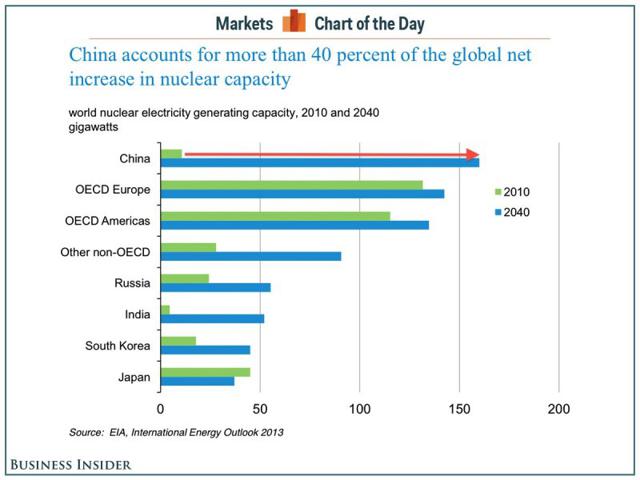

What makes the investment so attractive is the 3-1 and better relationships most uranium stocks are poised to gain when price go up. The most prominent example can be seen between August to December 2010. Uranium prices at that period increased (and very expectedly) by 46.8%. At the same time, Uranium Energy Corp. alongside Uranerz Energy Corporation (NYSEMKT:URZ) and Denison Mines Corp. (NYSEMKT:DNN) increased by 125%, 200% and 153.5% respectively, at growth ratios of 2.7, 4.3 and 3.3 respectively. This is a very clear indication of what massive upside potential such an investment holds; moreover, future demand seems to fit well into this historical picture.

Figure 3: Uranium Energy Corp. and competition prices following price spikes in 2010.

Demand Expectations

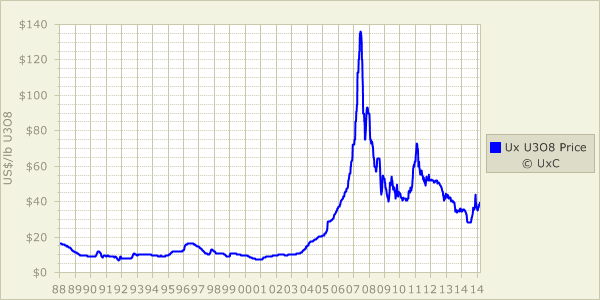

Toro Energy Ltd.’s (OTC:TOEYF) managing director, Dr. Vanessa Guthrie, spoke at the 2015 PDAC convention in Toronto and expressed strong belief that uranium prices are set to increase in 2015, or so the small Australian uranium explorer hopes. While no definitive trend is clear, uranium spot price is up 14% over last year. China alone would represent enough growth, without the accommodated global support to kick demand up. Business Insider projects China’s nuclear power demand to grow from 15 gigawatts to 160 gigawatts by 2040, a 967% growth. This is strongly supported by all the Chinese construction and planned projects currently in the pipeline. While developed countries are projected to maintain demand levels, developing nations are set to more than quadruple demand – with China and India expected to have off-the-chart growth.

Figure 4: Projected future demand for uranium (Source: Business Insider)

With the possible legalization of Iran’s nuclear program and removal of sanctions, which becomes a serious possibility following recent talks, it could well be that the demand will further increase at unprecedented rates. Iran is currently believed to only have two uranium mines, which could very likely fall short of the aggressive nuclear expansion they would undertake once their program gets approved.

With Japanese demand gone and temporary supply from decommissioned nuclear warheads, the market is simply ripe for investment. Exelon (NYSE:EXC), a nuclear utility company and operator of 23 plants, has recently recognized this inevitable ending and began buying up large quantities of uranium, which has pushed prices up from the sharply undervalued $28 they were at. Other demand-side operators, such as Duke Energy (NYSE:DUK) and FirstEnergy Corp. (NYSE:FE), will likely all stock up when prices start going up, resulting in very quick exponential growth for a short period.

External Analysts’ Opinions

Uranium Energy Corp. currently holds two buy and one hold recommendation on marketwatch.com. Similarly, on Yahoo Finance, the stock currently has a strong buy and one regular buy, plus one hold recommendation. Nasdaq.comcurrently marks the stock a strong buy for five analysts, and one hold. The Motley Fool has the same core as Nasdaq, with five strong buys and one hold.

Investment Potential

Uranium prices will go up, that is certain. The question is only when. I estimate that Uranium Energy Corp. can reach 200,000 pounds of uranium extraction annually in a very short execution time. The previously discussed Hobson facility has the physical capacity to process an estimated 2 million pounds of uranium a year. A key price level of $80/pound which we could see by 2016, and a ¼ capacity production of 500,000 pounds, would make the company worth $40 million in revenue annually, which is a third of its current market cap. Considering the fact that the stock’s value will increase much more than uranium prices, a 25% increase in uranium prices will already lead to at least 70% of growth. The critical point is $70, when production becomes profitable and all scalable projects are at max capacity – at this point, sky is the limit, with 4-digit growth not being out of the question.

Algorithmic Analysis

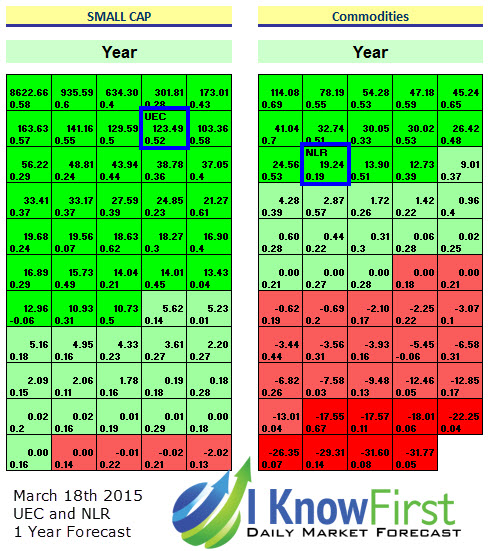

I Know First algorithm is a genetic self-learning supercomputer based onartificial neural networks created to imitate the same activity neurons exhibit in the human brain. The algorithm is taught how to study financial assets with no preset parameters, meaning that it is able to study markets and correlations in ways analysts have never anticipated or even though of. We used the algorithm in order to study Uranium Energy Corp. to find if there are any unexpected market events which could push its value up or down. At the same time, we set the algorithm to study the World Uranium Total Return Index (URAXD) and the Market Vectors Uranium+Nuclear Energy ETF (NYSEARCA:NLR), and watched how they interact with our universe of over 2000 stocks, commodities, indices, ETFs and currencies being tracked.

We use a historical indicator known as predictability in order to measure the confidence level. The current average predictability level in the short and long horizon is 0.45, which means that in any market condition, the algorithm is able to predict the assets’ direction with a 72.5% accuracy rate. This is useful when the signal strength – our strength and direction indicator – is relatively low and in the range of 5-10. The current signal, however, is very strong, and as of the 18th of March, 2015, is 123 in the 3- and 1-year horizons. This is at the top 10 percentile of the entire small cap universe, and increases the confidence level by a roughly estimated 8-15%. The algorithm is not taught which assets are correlated, and is expected to study all relationships in the market autonomously; thus, we can confidently use our NLR forecast as a secondary independent indicator. Although with a lower confidence level of 60%, NLR has a strong bullish signal in the 1-year horizon of 19.

Figure 5: I Know First algorithmic projections for UEC and NLR (Source: I Know First Databases)

Investment Projections

In the same way that a cash flow analysis is near-meaningless for estimating this stocks value, it seems also incorrect to estimate a potential price target. The current market positioning and price, supported by the strong algorithmic signals, gives us an estimated confidence level of above 80% that the trend will be bullish in the next 3-12 months. In terms of return, we can only use the historical information available to us. Reaching $2.80, which is a 100% return, seems to be the bottom-end of our expectations, considering the high risk involved in the investment. The expected value is certainly positive, as our upside is 80% for a 20-100% gain and 20% for a 20-50% loss; however, if the stock were to respond as aggressively as it did to uranium price increases in 2010, the upside could be well over 2000%. Any portfolio which allocates a section to high-risk investments and is willing to undertake the downside risk is positioning itself well for a high return through 2015 with Uranium Energy Corp.

Investment Risks

Apart from the obvious current decline trend in the stock’s value, there are several other risks. If uranium prices remain this low, it will keep the stock from growing and the company will continue scaling back extraction and exploration – possibly to a complete stop. Secondly, renewable energy is gaining momentum, and most developed countries have come to a decreased dependence on nuclear energy, with some nations scaling down already. The strong demand for renewable energies and global warming could eventually materialize into a disruptive technology which could consume the energy market share; however, with most technologies which could do this being at no more than rumor stages, this seems unlikely to happen anytime soon. Finally, although it is the equivalent of a meteor disaster, the use of any nuclear weaponry could see governments delegitimize the use of any nuclear technology, including for utility purposes.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.