AT&T: A Bullish Algorithmic Perspective

Confira nosso último artigo (14/09/2014 )no Seeking Alpha: AT&T: A Bullish Algorithmic Perspective

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- AT&T, despite being the second-largest wireless telecommunications provider in the U.S., has recently been regarded as a problematic stock, because of high competition in telecommunications and T’s lower-than-estimated revenues.

- Recent developments – including new mobile plans and phones, network expansion, novel technologies, and increased subscriber counts – make success foreseeable for T, especially when coupled with its steady dividend.

- While lower revenues, a competitive market, and questionable investments are not going away, T is not the disaster some analysts paint it to be.

- I Know First algorithm predicts a bullish forecast for T in the 1-month and 3-month time frames.

Company Profile

AT&T Inc. (NYSE:T) is the second-largest wireless telecommunications provider in the United States, with nearly 190 million subscribers nationwide (including landline), and more than 116.6 million mobile customers. As of May 2014, according to Forbes, T is also the twenty-third largest company in the world, and the sixteenth-largest, if we exclude oil. While the company experienced a very problematic phase when it implemented its 3G network, and while investors seem to see it as a problematic stock, given its competition with Verizon (NYSE:VZ) and its failure to meet Wall Street expectations, T may not be as poor an investment as it is painted to be, given recent developments and its steady dividend.

A Few New, Potentially Positive Developments

While T was not especially successful in meeting revenue estimates this yearand last, it has seen several noteworthy improvements this year where retaining old users, attracting new customers, implementing novel technology, and ameliorating plans are concerned; it has also managed to concurrently maintain its dividend.

Firstly, AT&T has worked to implement several new features in the hopes of pleasing its current mobile customer base. Overall, AT&T has gone to work expanding its 4G LTE service. One locality that has benefited is Attica, Indiana: T has implemented new cell sites in Attica and Pine Village to boost 4G LTE coverage for residents and businesses, providing faster mobile internet speeds, higher reliability, and, hopefully, better performance. Other areas – most of the eastern half of the United States, in fact – are expected to receive connectivity by the end of 2014.

T has also implemented new plans – including a contract-free plan called “Next,” and a plan that will allow internet data to be shared across multiple devices; these plans seem to have attracted new subscribers. The company said it has activated 1,000,000+ new postpaid customers (those who pay at the end of the month) – more than its anticipated 800,000 – since the plans’ introduction, and that over half of them came from subscriptions to Next. Further, AT&T reduced the price of its one-line, 2GB, unlimited international messaging, no annual service contract plan from $80 to $65 per month, and announced that it would lower prices on Mobile Share plans using 10GB+ from $40 to as low as $15.

These plans have, according to T executives and Jackdaw Research, also helped current customers stay loyal to T. By the end of second quarter 2014, AT&T reported its churn rate (customer leaving rate) to be its lowest ever: 0.86%, which is considerably lower than Verizon’s. Evidently, customers did not mind the changes: in fact, AT&T saw the most subscriber growth it has seen in five years.

In 2014, AT&T is also zooming in on specific customer groups to better serve their needs. As an example, T is catering to its large number of Apple (NASDAQ:AAPL) customers this fall by offering them iPhone 6 trade-in options. From September 12th to 30th, AT&T subscribers will receive up to $300 in credit towards the iPhone 6 if they trade in a past iPhone device (e.g., iPhone 4, 4S, 5, 5C, and 5S). Other Apple-relevant discounts will include $100 credit towards an iPhone if customers add a new line to their AT&T Next plan, and $200 towards an iPad if they purchase an iPhone on an AT&T Next plan. T-Mobile US (NYSE:TMUS), Sprint Corporation (NYSE:S), and Verizon hadalready launched their own iPhone trade-in programs by the time AT&T grew interested in offering these benefits, but now that plans are underway, AT&T Mobility President and CEO Glenn Lurie seems particularly excited about T’s iPhone 6-related deals.

In an interview with CNBC, he was quick to point out the merit behind devising benefits catering to Apple’s innovations, stating,

Obviously, we have the longest relationship with Apple. We have the most iPhone customers, so every time [Apple] innovate[s], it’s just terrific for AT&T.

Beyond pleasing current T customers, iPhone 6 deals could also bring more iPhone-centric customers to the service provider, especially in light of the fact that T recently reduced its wireless pricing.

AT&T will also appeal to Android and Windows phone users this year. A company that hasn’t always been the first to release new flagship phones, AT&T has stepped up its game this season, announcing that it will be offering the Galaxy Note Edge and Galaxy Note 4 to Android customers as of October. T will also sell the Nokia Lumia 830 in the United States: a welcome update for those interested in Windows Phones, given that the company’s previous flagship release was the Nokia Lumia 1520 last November.

In the interests of ameliorating general customer experience, T is not just reducing prices, creating plans, and selling new phones. It is also looking at new technologies that make everyday mobile use more effective. Amongst them are mobile payment options: in other words, inbuilt services that will allow customers to perform a range of transactions using their mobile phones. T sees these payments as an opportunity to give customers a choice as to how they pay, given that so many people carry phones. The service provider will be using Softcard (formerly Isis) – a mobile payment space jointly produced by AT&T, Verizon, and T-Mobile – to implement mobile payments for AT&T customers. While the transition to mobile options won’t be immediate (minimally a year will be needed for this function to be introduced), it is a potentially attractive aspect of T’s future business.

The technological advances get bigger, too. T is concurrently focusing on even more futuristic technology that it feels will bring it further attention. As a player in the overly saturated, excessively competitive telecommunications market, T has not always come out on top. If, however, it succeeds in branching into new, not-as-yet dominated markets, it may do well for itself. The company appears to recognize this, and is looking into experimenting withwearables, connected cars, and connected homes. Where wearables are concerned, CEO Lurie has stated that “AT&T believes the future is a standalone wearable device with full functionality,” though creating such a piece will take time.

T’s plans for connected cars and homes are more concrete, however. According to AT&T’s Mobile and Business Solutions CEO Ralph de la Vega:

The connected car is the new wave of wireless technology that will make cars safer and more intuitive. Meanwhile, the ride will be more entertaining for the passenger.

T has already begun planning to implement this technology; an entire division of the company – AT&T Drive Studio – has been created to carry out the in-car connectivity vision, and the service provider has allegedly already secured partners like General Motors (NYSE:GM), Audi AG, and BMW AG to assist with its plans. Recently, T even partnered with Ericsson (NASDAQ:ERIC) on a studyconcerning connected car popularity; the companies’ research found that half of all drivers worldwide would switch brands to a comparable brand to get connected car services, that 72% would wait one year to buy a connected car, that almost 67% consider connectivity an important feature, and that 67% would probably or definitely buy WiFi connectivity were it available. Users are especially interested in WiFi-dependent features like roadside assistance, traffic tracking, music streaming, and general connectivity. Given the popularity of in-car connectivity as suggested by this data, it seems that connected cars could generate a lot of success for T in the long run, if satisfactorily implemented.

Where connected homes are concerned, AT&T is going to partner with Telefónica SA (NYSE:TEF) to launch Digital Life, an “IP-based, home security and automation system that allows users to keep tabs on their homes through their smartphones,” and Digital Life Care (a similar system geared at monitoring senior citizens). For now, this technology is just licensed to Telefónica SA, but in time, CEO Lurie has said that he “expects to do more deals around the globe.” Connected homes could, in other words, bring T more international attention than it has previously received; that could, in the distant future, significantly boost cash flow.

On another positive note, if investment in capital and the United States is any indicator of success, then T is also to be looked upon favorably. It has been hailed as the largest capital spending corporation in the United States for the third consecutive time by the Progressive Policy Institute, trumping Verizon, Exxon Mobil Corporation (NYSE:XOM), and even Walmart (NYSE:WMT). Just recently, it spent more than $20.6 billion on a new plant. From 2008 to 2013, T has invested more than $140 billion in terms of acquisitions and operations, and another $21 billion in capital is planned for 2014. CFO John Stephens says that domestic investment is “critical to continuing the economic gains” of the U.S., and that the telecommunications industry is paving the way for economic growth and increased jobs. Recent T investment initiatives include Project Velocity IP (geared at granting high speed Internet to more of America), and a DirecTV (NASDAQ:DTV) joint initiative geared at providing wireline and fixed wireless broadband network connectivity to 15 million customer locations, which will help service underserved rural areas. Both initiatives could create benefits for T. Project VIP is already bringing increased customers to the service provider: T has said that its U-verse service (phone, Internet, and TV connectivity), which already grew 30% year-over-year in 2013, has now seen the addition of a cumulative 670,000 subscribers with the help of Project VIP. As a pleasant, community-centric after note, T also appears to care about the nation, if slightly. It has made news for supporting political advancement, and for, alongside Udacity (a major educational organization involved in MOOCs), offering scholarships to underserved students to prepare them for careers in the tech industry. While this does not constitute a worthy reason to rationally invest in the company, and while investing in unprofitable projects is always a risk, investor interest means an increase in the success of the market and the nation, so T’s contributions are not to be overlooked.

T’s acquisitions in recent years are questionable. Alongside its potential $48.5 billion acquisition of DirecTV, the likes of which would further its capital investment, T was rumored to have been interested in Vodafone Plc (NASDAQ:VOD). The latter deal, however, if it was ever conceived, saw no realization. T also acquired Leap Wireless (LEAP) this year; this acquisition alone, given that LEAP is the sixth-largest carrier in the U.S., brought T an additional 4.5 million customers. While many onlookers are worried about how profitable the DirecTV acquisition will be, given that it will divert funds and may not be as successful as intended, there may be upsides to the deal; some analysts are saying that while DirecTV may be a bad buy, it won’t hurt AT&T’s dividend. Others even feel it could enhance cash flow.

T’s utility to the individual investor should also be considered. While many investors seem disappointed in T’s progress, the stock’s dividends grew every year since 2008, and while they did decline this year, the stock’s dividend yield is still currently at 5.12%: the highest in the industry (whose average is4.91%), topping Verizon’s 4.18% and outyielding both the 30-year and 10-year Treasuries. Some analysts would argue that this is not a dreadful number, as, according to Barron’s, “steady dividend-payers like AT&T help portfolios achieve more consistent returns.” T also has the lowest debt-to-equity and total debt-to-enterprise ratio of all major US telecommunications companies; that furthers its long-term stability as a stock, as well.

To sum up, a few other factors make T worth at least thinking about. Firstly,smartphone penetration has increased in the United States, up from 42% to 62% in 2014. While this does not specifically cater to T, it certainly does not harm the service provider. T’s GigaPower, an ultrafast fiber network that is drawing attention to U-verse, is also something to consider: the web service has potential to attract new customers, and sales of the ultrafast broadband service, have, presumably, already “exceeded expectations“. In fact, presumably, it’s “…reliable, crazy fast, and priced to attract more and more people to give us a try.” Finally, it seems that AT&T is reasonably confident in its own success: in response to customer growth via its Next plan, AT&T raised its guidance (i.e., its full-year revenue forecast) to five-percent growth, up from a prior estimate of four-percent growth.

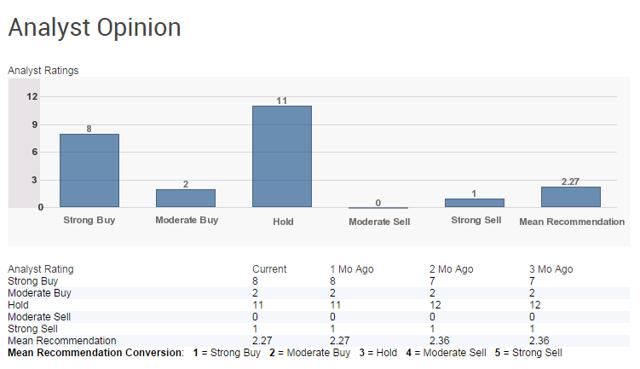

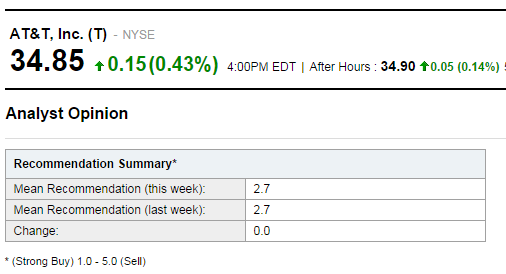

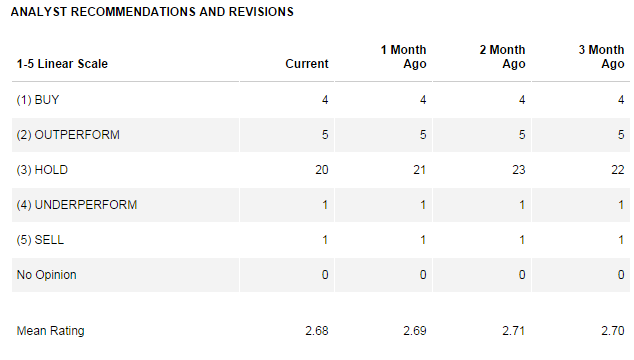

Analyst opinion and public reception reveal that AT&T’s progress has not gone unnoticed. T recently won two innovation awards at the Mobile World Congress, one of them for Digital Life. Analysts are also not overly critical –Yahoo! Finance calls T a solid hold, as does Reuters; the Motley Fool goes so far as to label T a moderate buy (Figures 1, 2, 3).

Figure 1. Yahoo! Finance analysts rate T a 2.7, Hold, where 1.0 is a Strong Buy and 5.0 is a Strong Sell.

Figure 2. Reuters analysts concur: on a scale of 1 through 5, where 1 is a buy and 5 is a sell, T ranks 2.68. Notice that, several months ago, T was a more solid hold. Now, the stock is moving more towards an outperform.

Figure 3. The Motley Fool seems a bit more optimistic than both Yahoo! Finance and Reuters, ranking T a moderate buy.

Algorithmic Perspective: After a Bearish Start, Bullish in the long Term

While algorithmic analysis is not to be considered conclusive, it can prove a useful tool when combined with traditional techniques.

I Know First uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to predict the flow of money in almost 2000 markets from 3-days to a year. This algorithm provides traders with a trend they can use to identify when to enter and exit the market; though it may be used for intra-day trading, the predictability of this trend becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – effectively be used to analyze the value of such stocks as T. While I Know First’s algorithm should not be regarded as a stand-alone testament to T’s value, the algorithm has seen an high degree of accuracy, and as such is, at least, a useful complement to independent analysis.

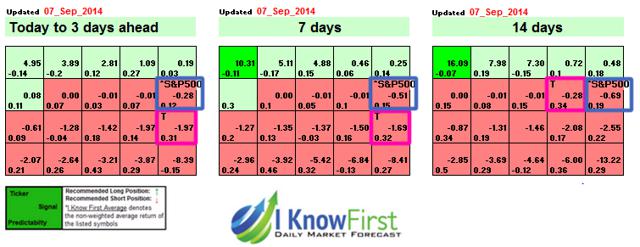

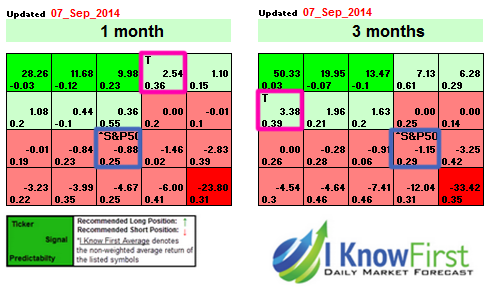

The new forecast generated by the I Know First algorithm, updated on September 7th, is shown below (Figures 4 and 5). Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and its predictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast). Taking all this into consideration, the ticker symbol for AT&T – “T” – may be seen as bearish in the three to fourteen-day horizons (Figure 4). Later, as the algorithm gains reliability, it becomes bullish in the 1-month and 3-month time frames (Figure 5).

Figure 4. I Know First’s most recent 14-day forecast for AT&T. T is boxed in magenta, and shown to be bearish. For comparison, the S&P 500 is boxed in blue. Please note that a negative predictability indicates high risk, and that the algorithm is significantly more reliable in the 1-month and 3-month time frames than it is on a day-to-day basis.

Figure 5. I Know First’s most recent 1-month and 3-month forecasts for AT&T. T is boxed in magenta, and shown to be bullish. For comparison, the S&P 500 is boxed in blue. Please note that a negative predictability indicates high risk, and that these forecasts are significantly more reliable than that shown in Figure 4. The latter is provided merely to give readers a more complete picture of the present situation.

This bullish forecast for the long term coincides well with recent developments in T’s plans, network expansions, technologies, and subscriber count. Given analysts’ mean “Hold” recommendation and T’s activities in the last year, it may be wise to consider keeping T in one’s portfolio until further change makes it either a buy or a sell.

Conclusion

While T’s recent DirecTV acquisition is not without potential flaws, and while it has not as yet met Wall Street’s expectations in terms of revenue, the stock is not one to steer entirely clear of. T’s new postpaid plans (specifically, Next), expanded networks, reduced pricing, and Android, Windows Phone, and Apple-specific offers have captured the interest of customers old and new, lowering its churn and boosting its subscriber count. This could, in time, increase revenue. In addition, T has plans for cutting-edge technologies, namely, connected cars, homes, wearables, and mobile payments, that are of interest to customers, and has the partners to actualize these ideas. If these schemas are successful, T could see success in new markets and new localities (e.g., Europe). While investing in certain projects could prove unprofitable, T’s acquisitions and capital spending (including investment initiatives like Project VIP) bring it public support and increased subscriptions. Concurrently, an increased U.S. smartphone penetration rate and T’s steady dividend further nurture T’s potential to succeed. Analysts and the industry are taking note of this; specifically, analysts’ recommendations have grown more positive in recent months, with mean recommendations going from strong holds to weak ones, and in some cases, even to moderate buys. In addition, I Know First predicts that T will be bullish in the 1-month and 3-month time frames. While none of these facts independently point to T’s becoming an irresistible buy, it would be wise to avoid completely disregarding the stock. It is decidedly not the entirely irredeemable investment it is often broadcasted as.