Estudo da Performance do Algoritmo (Parte 2)

Análise de Performance do Algoritmo I Know First (Parte 2)

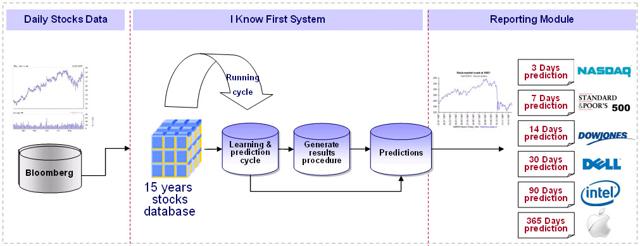

Cofundador & CTO da I Know First Ltd com mais de 35 anos de pesquisa em Inteligência Artificial e Machine Learning. Dr. Roitman obteve um Ph.D pelo Weizmann Institute of Science.

Cofundador & CTO da I Know First Ltd com mais de 35 anos de pesquisa em Inteligência Artificial e Machine Learning. Dr. Roitman obteve um Ph.D pelo Weizmann Institute of Science.

Uranium Energy Corp. Could Very Well Have Nuclear Growth In 2015: Fundamental And Algorithmic Analysis

Summary

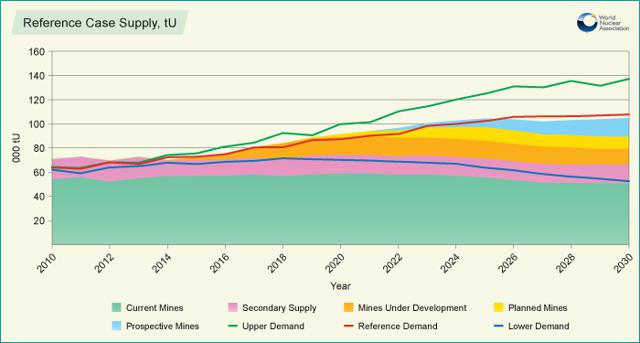

- The most current exploration projects and reduced operations in the United States, awaiting the inevitable uranium price recovery.

- The supply and demand paradox in which expected demand is high, expected supply is low, and prices are dropping.

- Company finances, historical analysis, demand expectations, external analysts' opinions, and investment potential summaries.

- State-of-the-art algorithmic analysis of the stock, supported by a further study of the World Uranium Total Return Index and Market Vectors Uranium+Nuclear Energy ETF.

- Investment projections and risks.

Don’t Fall Off The Long Cliff: Algorithmic And Summative Analysis Is Bearish On Cliffs Natural Resources Inc.

Summary

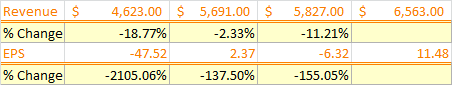

- The company recently announced a lawsuit against them for $52.6 million which was followed by a $500 million senior secured note due 2020 sell announcement.

- EPS down over 2000% from 2013, investors are weary of waiting for the rebound.

- Analysts agree the stock is unlikely to recover, which is supported by a strong Goldman Sachs iron ore price target for 2015.

- Algorithmic analysis and decision alternatives.

Gilead Sciences, Inc.: Still In The Lead Or Lagging Behind? An Algorithmic Perspective

Summary

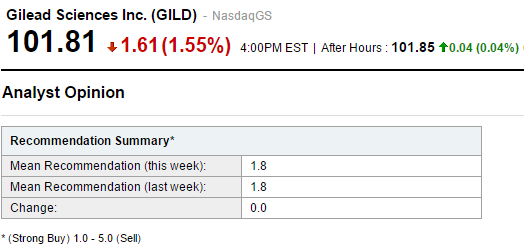

- Gilead Sciences, Inc., an American biotechnology company with international operations and twenty-plus innovative products, centers on discovering, developing, and commercializing treatments for a range of conditions (e.g., hep C, HIV).

- After a year of increased revenue and product sales, Gilead is well off; its assorted innovative, novel products, abundance of research activity, and international accessibility initiatives all strengthen the company.

- Harvoni and Sovaldi are particularly responsible for these positive trends; Gilead predicts that they will continue facilitating sales growth.

- The I Know First algorithm contradicts analysts and the fundamental outlook. Gilead poses a risk in the next month of a downswing; however, it holds strong long-term value investing.

Even With Poor February Results, Ford Is Still Bullish

Summary

- Ford’s sales in February unexpectedly fell, causing the stock price to fall, but I Know First remains bullish for the long term.

- The company’s efforts in Europe are taking shape, as sales rose in January and it opened a new plant in Valencia that will improve capacity.

- Increased capacity will have a similar effect in China for Ford, where sales growth will be massive.

- The company is clearly undervalued using basic figures, and algorithmic analysis agrees that the company is bullish for long-term investors.

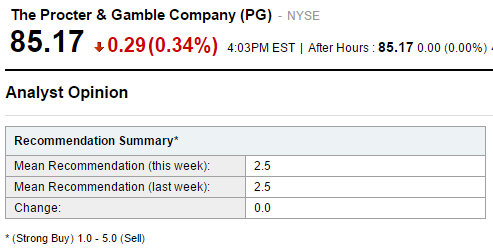

Procter & Gamble Co: Despite Negativity, We’d Go All In – An Algorithmic Perspective

Summary

- Procter & Gamble Co., an American consumer goods multinational with brands like Tide, Pantene, Gilette, Old Spice, and Oral B to its name, is the world’s largest consumer products maker.

- Despite its reputation, P&G suffered at the hands of dollar exchange rates in Q2 fiscal 2015, falling 31% and 4% compared to the prior-year period in earnings and revenue respectively.

- This situation, paired with P&G’s dramatic plans for strategic reform, has installed doubt within some analysts; consequently, the company’s share prices took a hit as the new year dawned.

- P&G is, however, still strong: its business development moves (geared at building public and media presence, and ameliorating sales), experienced leadership, and the aforementioned controversial portfolio slim-down may reap benefits.

- I Know First predicts a bullish forecast for P&G in the three-month time frame.

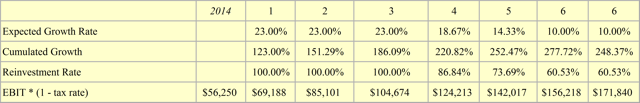

Sina Is Not Just Another Chinese Stock: Fundamental And Algorithmic Analysis

Summary

- What makes SINA’s services the equivalent to what we know as Twitter and Yahoo.

- Cash flow projection points to 30% upside potential in the upcoming months.

- Algorithmic analysis points to a positive outlook in the short and mid-term after which the stock’s price will bounce back down.

- The risks involved, and the general gloomy outlook for Chinese stocks in general.

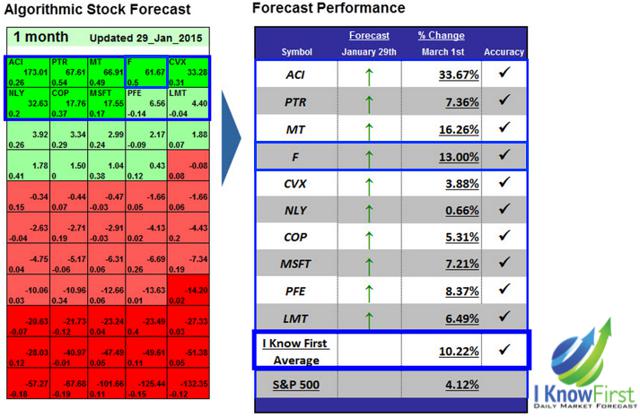

Ford Stock Forecast For 2015 Based On A Predictive Algorithm

Summary

- Ford Motor Company, an American multinational automaker that is America’s second-largest in terms of size, and the world’s fifth-largest in terms of sales, is well-known around the world.

- While Ford is generally well-regarded, recent events in Russia and Venezuela have resulted in Ford’s Q4 profitability dropping, and have prevented Ford’s European operations from breaking even in 2015.

- Though this may be interpreted as problematic, analysts still recommend holding on to Ford; Ford’s fundamentals remain strong.

- I Know First algorithm predicts a strongly bullish forecast for Ford in the one-month and three-month time frames.