Buy Gilead Ahead Of The Upcoming Earnings

Confira nosso artigo (14/7/2015) no Seeking Alpha: Buy Gilead Ahead Of The Upcoming Earnings

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Buy Gilead Ahead Of The Upcoming Earnings

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…)

Summary

- Gilead Sciences has fallen over 6% since reaching an all-time high on June 23rd.

- The recent pullback is a great investing opportunity for long-term investors as concerns over HCV competition are overblown.

- The valuation is very cheap, and the company is reducing its reliance on the HCV market.

- I Know First Algorithm is bullish on Gilead Sciences in the long-term and believe it will reach new record highs.

Gilead Sciences, Inc. (NASDAQ:GILD) has fallen over 6% since it reached an all-time high on June 23rd, but the stock price is still up over 20% since the beginning of the year. With its next earnings report coming up in a couple of weeks, the current pullback represents a strong opportunity for long-term investors to add to their positions in this stock, if they haven’t initiated one already. History shows that the concerns over competition in the HCV market, both currently and in the future, are overblown. Further, the company is moving towards having less reliance on this one market and the current valuation is far too low.

Figure 1. Source: YCharts

HCV Competition

The fall of Gilead Sciences’ stock price can partially be attributed to an announcement from its current chief rival in the market, AbbVie Inc. (NYSE:ABBV). AbbVie revealed that its HCV drug Viekira Pak demonstrated 100% cure rates for HCV genotype 1b patients, leading to further speculation that increased competition will harm Gilead Sciences’ performance in this market moving forward.

This is unlikely to be the case, though. For one, Harvoni has already proven to be 100% effective at curing HCV genotype 1, not just 1b. Genotype 1a makes up a majority of the genotype 1 cases in the US, and Harvoni is still the better drug as it has less side effects.

Further, its drug Harvoni was approved for treatment of patients with HCV genotype 1 in Japan last week, a big step for the company. Somewhere between 70-80% of the over one million HCV patients in Japan have the genotype 1 strain, presenting huge growth opportunities for the company. Along with Sovaldi, which has already been approved in Japan, Gilead Sciences should be able to gain a majority of the market share in Japan, providing huge upside revenue potential.

The company and its management have also shown the ability to stay ahead of competitors in the past with its HIV drugs, which continue to lead the market. There is no reason to think they won’t be able to do so again in this market. The main competition expected to enter into the market looking ahead is Merck & Co., Inc. (NYSE: MRK), which submitted a New Drug Application to the FDA for its single tablet combination therapy during the end of May.

But testing for this new drug has so far not proven to be superior to Harvoni in any way and is unlikely to do so. The next step in HVC medications will be shortening the treatment time needed to cure the disease, and Merck’s drug will not do so. The current and future competition has already been weighed into the valuation of the company, as the stock price would be much higher without this threat.

Most importantly, the company is on track to its sales estimates for Harvoni and Sovaldi this quarter, and I believe the company will beat the expectations for sales of $3.1 billion from these two drugs. With the current and future competitors unlikely to supplant Gilead Sciences’ offerings as the best on the market, concerns over competition are overblown and the stock price should be much higher.

Markets Other Than HCV

While the breakthrough HCV drugs have been a huge part of the company’s success and increased stock price, its HIV drugs have also held up well, and it continues to be the biggest player in this market. The company has now submitted a New Drug Application for a once-daily single tablet regimen for the treatment of patients that are 12 years or older with HIV-1 infection.

This is the third TAF-related filing in the past 12 months, and this should take over as the primary drug combination for the treatment of HIV when its Viread patent expires in 2017. The current trials show that the company is preparing to replace this drug with new offerings that provide a favorable safety profile to other treatments currently on the market.

Besides the current trials for TAF related drugs, the company also has plenty of free cash flow to use for acquisitions. As of the most recent quarter, Gilead Sciences had roughly $14.5 billion in cash and equivalents and it will most likely look to use some of that money to fund a transformative acquisition, most likely in oncology.

Gilead Sciences has had plenty of success in acquisitions in the past, as management has shown a keen eye for profitable opportunities. This is not limited to the acquisition of Pharmasset in 2012, which led to the breakthrough in the HCV market. With such a strong track record, an announcement of an acquisition should send the stock price higher as it could signal a future breakthrough.

Management, including CEO John Martin, has mentioned that the company is looking for a cornerstone molecule for its oncology portfolio, such as Sovaldi for HCV or Viread for HIV. If the company is unable to produce such a cornerstone molecule from its pipeline, which is certainly possible, it can use the large amount of cash and equivalents to acquire one. This will be key to the company reducing its reliance on the HCV market, and the fact that management realizes this need and is looking to address it is positive for the long-term outlook.

Valuation

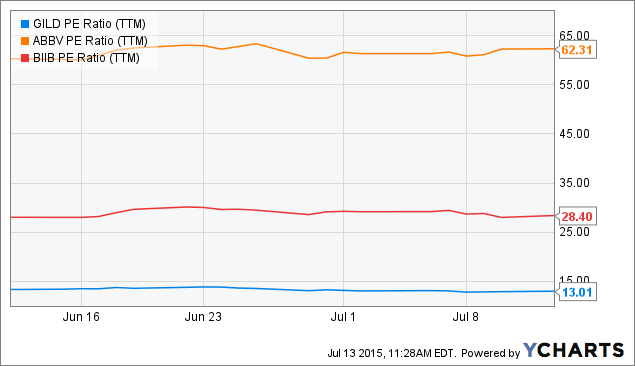

While the HCV and other markets point to a strong future for this company, especially considering the track record of the company’s management, the current valuation is the main reason investors should be jumping at the chance to buy this stock at current prices. Simply, this stock is the best investment opportunity in the Biotech sector. Its PE ratio of roughly 13 is significantly lower than its competitors.

Figure 2. Source: YCharts

Wall Street analysts also tend to believe that the current valuation is too low, as they offer a consensus rating of buy for this stock according to Yahoo Finance. The mean target price among these analysts is $123.32, offering over a 7.5% upside to the current stock price. I Know First has a bullish algorithmic forecast as well, further supporting the idea that the stock is currently undervalued.

Figure 3. Source: Yahoo Finance

Besides the fact that the stock is trading at a price that is too low, the company also offers a great capital allocation program. The company’s board announced a $15 billion repurchase program in February on top of its current $5 billion repurchase program. On top of this, it also announced its first quarterly cash dividend of $0.43 per common share of stock, which has since been paid out. Management has emphasized the desire to return value to shareholders, and the dividend should only increase going forward.

Conclusion

Long-term investors should continue adding this stock at current prices. The recent pullback is a prime investing opportunity, as this stock is the most attractive option in not only the biotech sector, but quite possible of any stock on the market. The recent news that Harvoni was approved in Japan offers plenty of extra room for revenue growth, and the market in the US is far from drying out. Along with the new TFA drug trials for HIV patients and the potential for an acquisition to bolster its oncology offerings, there is plenty to be excited about moving forward. With such a cheap valuation, buying this stock ahead of the upcoming earnings report is a good move, as full year guidance could be increased as revenue from Sovaldi and Harvoni beat market expectations. Based on the last closing price. I Know First algorithm is bullish on this stock in the long term, with a bullish algorithmic forecast to support the fundamental analysis.