Buy GlaxoSmithKline At The Current Price For Amazing Dividend Yield

Confira nosso artigo (15/6/2015) no Seeking Alpha: Buy GlaxoSmithKline At The Current Price For Amazing Dividend Yield

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- GlaxoSmithKline’s stock price has fallen over the past year as its core performance struggles.

- The price is now near its 52-week low, and is unlikely to fall much further limiting the risk involved with the stock.

- Sales will improve next year, offering upside potential, and investors can enjoy the dividend yield until then.

- I Know First Algorithm is bullish on this stock for the long-term, believing it is perfect for patient, income-seeking investors.

GlaxoSmithKline (NYSE: GSK) is a pharmaceutical company incorporated in the United Kingdom. The company researches and develops pharmaceutical drugs, vaccines, and consumer healthcare products, and it is well known in the biotech sector for its large dividend yield. A premier pharmaceutical company, its stock price has come under pressure over the last year, falling almost 23%.

The stock price is currently trading near its 52-week low, which is $41.25. The stock price has been hit by a fine in China stemming from a bribery case, as well as declining earnings from one of its benchmark drugs Advair. Sales of this drug have fallen over the past few quarters as cheaper, generic versions are introduced to the market. However, GSK is working to replace this drug and grow its pipeline in 2016, which will lead the stock price to rebound. With an impressive dividend yield, this is an attractive stock for patient income investors.

Figure 1. Source: YCharts.com

Revamping Pipeline

The company recently revamped its business, going through a major reshaping as it works to improve its long-term performance. One such case is a deal it made with Novartis AG (NYSE: NVS), an asset swap that was implemented to help grow each company’s strengths. While deals such as this one will help GSK in the long term, it resulted in the current year acting as a rebasing for the company, pushing down the stock price.

The company’s performance will turn around in 2016, though, leading to an increased stock price. Before then, there is enough reason to buy the stock now. The asset swaps have helped GSK’s business in the consumer health care and vaccines sections of the company, which make up 25% and 16% of the company’s total revenues. These sections of the company are also growing rapidly.

Consumer health care grew 24% year-over-year last quarter, up 8% pro forma. Roughly half of this growth came from the launch of the Flonase brand in the first quarter in the US. Meanwhile, the vaccine business grew 10%, or 3% pro forma. These results actually caused the company’s total sales during the last quarter to increase 1%, even as pharmaceutical sales fell 7%.

However, there is currently reason to believe that the pharmaceutical sales will turn around as well. As I mentioned, sales of GSK’s asthma and COPD drug Advair continued to fall during the previous quarter, as generic alternatives are introduced to the market. This trend will most likely continue for the rest of the year, but management expects other drugs in this market to drive growth from respiratory drugs next year.

At the same time, GSK is working to further broaden its pharmaceutical portfolio. While the company plans to start growing sales from its respiratory business in 2016, it will also work to reduce its dependence on any one drugs, with aims of getting 90% of pharmaceutical sales from nine drugs in 2020, compared to only four drugs as of now.

And it appears as if this is a realistic goal for the company going forward, as it currently has 40 products in either phase 2 or phase 3 development. More information about these drugs will be made available this year, but current news being released surrounding its drugs have been positive.

Two lucrative fields of the pharmaceutical market that the company will continue to focus are the HIV and respiratory inhaler markets. I’ve already discussed how the company hopes to return the respiratory business to sales growth next year, and it recently received a positive review from the FDA’s Pulmonary-Allergy Drugs Advisory Committee for its drug mepolizumab, which is for the treatment asthma in adults. This is a strong sign that it will receive approval from the FDA later this year. Another asthma drug, Arnuity Ellipta, received approval last quarter.

It also has made promising progress in the HIV market, and it recently announced that it would keep retain control of ViiV Healthcare instead of moving towards an IPO. Sales for this business grew 42% last quarter, as sales of recently released drugs Tivicay and Triumeq continue to grow. GSK believes that this market could be worth up to $15.3 billion in the future, and recently announced that it would partner with North Carolina-Chapel Hill for HIV research, committing $20 million to the cause in the next five years. Along with its 78% stake in ViiV Healthcare, this will help GSK improve its sales performance in the long-term.

Impressive Dividend Yield

The company’s health for 2016 and beyond looks healthy, but the company is expected to experience further declines in its respiratory business this year. Now is still a good time to invest in this company, as the stock price is trading at a low valuation. Its current P/E ratio is currently below 6.60, which is incredible considering it is part of the biotech sector. Granted, the company is not experiencing much growth as of now and it will only be in the high single-digits next year, but this is still an attractive evaluation.

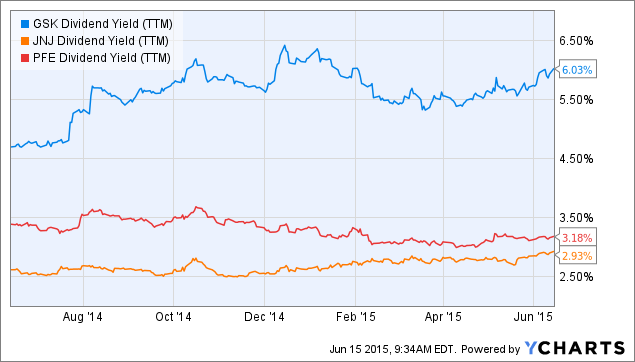

Figure 2. Source: YCharts.com

More importantly, the company places an emphasis on returning value to shareholders, as it currently has a dividend yield of over 6%. This is an especially strong yield for investors who want exposure to the biotech sector, as it is much greater than that of its main competitors.

Conclusion

This pharmaceutical company has had a rough past year, as the stock price has been hit by poor performance of the record company. Current prices are an extremely attractive value for potential investors, as prices have likely bottomed out before increasing next year when its new pipeline and restructuring improve its core performance. With such a strong dividend yield at a more than reasonable price, now is a great time to purchase this stock and be one of the investors that the company places an emphasis on returning value to going forward. I Know First has a bullish

Algorithmic forecast for this stock along with the bullish fundamental analysis.