Electric Buses Vs. Fuel Cell Buses: Plug Power Has A Stake In The Winner

Summary

- Public transportation systems are slowly integrating hybrid diesel-electric, full electric and fuel cell buses.

- Both technologies hold promise with advantages and disadvantages.

- Plug Power should be able to benefit from buses as the largest transportation fuel cell player in the US.

- Algorithmic analysis is bullish on Plug Power in the 1-month, 3-month and 1-year time horizons.

The demand for public transportation is increasing each year. This is driven largely by global urbanization and population growth. At the same time, the growing need for renewable energy and zero emission transportation is creating a new way of meeting the demand needs. The trend for hybrid diesel-electric buses has grown for several years with examples such as the New Routemaster hybrid bus in London – released on the road in 2012. Theaverage cost of a diesel bus is around $300,000-$400,000. However, hybrid buses average around $600,000, making their initial purchase price much higher (50%-100% more). The New Energy World Industry Group (NEW-IG) “Urban Buses: Alternative Powertrains For Europe” report found that two solutions are functional and operational in the public transport sector. The first is opportunity e-buses and the second is the fuel-cell bus.

Image 1: A fast recharging bus docked in a bus station in China.

Opportunity e-buses rely on small battery packs and superchargers that are briefly charged at each station and generally have a very small range. These buses are already heavily integrated in China and are more cost effective than overnight charge buses inside urban areas. They do, however, have a large drawback, which is the set-up infrastructure costs and low flexibility. As can be seen in the image above, the bus must be able to charge in each station, requiring the development of an entirely new network of charging stations throughout the public transport grid. Secondly, the system is extremely inflexible with a simple roadblock creating a serious problem (as the bus cannot charge on an alternative route), or of course a power outage that would instantly shut down the entire transport system.

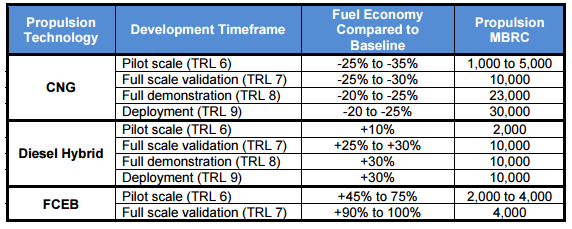

Image 2: BYD Auto hybrid bus stats.

Hydrogen fuel buses are the most comparable in operation to conventional buses, with high driving performance and route flexibility. Although the initial costs are higher, the maintenance and fueling costs are lower before adding any of the environmental benefits. Chinese BYD Auto Co., Ltd is already expanding into the US with the first five buses being delivered (out of 25). Similarly, electric battery-based buses also are beginning to spread with examples such as the EcoRide BE35 – the first 30-foot or larger all electric to complete federal Altoona testing – which operates 600% more efficiently than a diesel operated bus. The department of energy (DOE) report “Fuel Cell Buses in U.S. Transit Fleets: Current Status 2012” uses gasoline as a baseline to compare compressed natural gas (CNH), diesel hybrid, and fuel cell electric buses (FCEB).

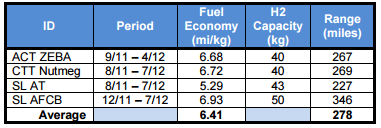

Image 3: Comparison of CNG, Diesel Hybrid and FCEB with a diesel benchmark.

With natural gas being less efficient than gasoline due to the ignition cycle, it certainly does not qualify as a long-term solution. Diesel-hybrid is well tested and already deployed. Furthermore, it has shown to be a reliable technology. With diesel combustion occurring only when the battery needs recharging, the technology is able to increase fuel efficiency by an average of 30%. Fuel cell technology is in much earlier stages of testing but demonstrates large promise as the preliminary full scale validation already signals an average 95% increase in efficiency (and zero emission). Moreover, the report demonstrated that these buses truly have an incredible range, averaging 278 miles.

Image 3: Average distance for a fuel cell bus.

It is a truly perfect synergy of technology and transportation. Bill Van Amburg, senior vice president of CALSTART – a green energy transport nonprofit – believes “we’re starting to see a breakout point.” He expects the number ofzero-emission fuel cell buses to double in the next year and account for 20 percent of the transit bus market by 2030. To put things in perspective, BYD Auto has already delivered 5,200 buses worldwide.

Summary of the Technology

In conclusion, there are two available future solutions. The first is the full electric bus, which will likely be an evolved form of the current diesel-hybrid solution. There are two types of these buses; the opportunity based short range (charge a bit at every station) and overnight charge solution. The major disadvantage of the short range solution is infrastructure cost (setting up the stations to charge buses) and lack of flexibility – with long range travel being completely out of the question. Furthermore, bad weather would create a major issue of reliability. Overnight charge buses have much longer range but lack flexibility in operation time. However, they are much cheaper. A combination of inner city opportunity charging and outer city overnight charging could eventually be the most desirable solution.

The fuel cell solution ranks ahead in range, long-term cost and similarity to the current system. It would be easier to transition into familiar territory (fueling at a station) than to venture into entirely new electrical grid-based systems. However, a very heavy price tag on each bus, lingering at an average of one million dollars for a larger order, and lack of fueling stations makes market penetration extremely difficult.

Plug Yourself in for This Opportunity

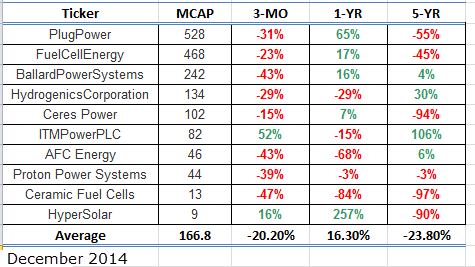

Looking back at the US, there are two major companies which have true long-term investment value in the fuel cell market. One of these is Plug Power (NASDAQ: PLUG) and the other is Fuel Cell Energy (NASDAQ: FCEL). The rest of the companies have very low market caps (<250m) and are too small or risky for more discussion here. However, for those who are interested in a more risky investment, below is a list of some major fuel cell companies based in the US and Canada you might want to consider.

Figure 3

Unfortunately, Fuel Cell Energy is focused on utility power, which is having a hard time taking off. The difficulty here is the competition with solar, nuclear, gas and wind, which are all fighting for the top position. The relatively low margins have shown that it is a weak business model and offers little applicability but perhaps back up power (which is rare, thus doesn’t require refueling). Because of the focus on utility, it has little to benefit from the advancement of fuel cells in the transportation sector. Plug Power took the vehicle approach, but focuses on warehouse forklifts. These machines need to be operated around the clock and must have very little refueling time, or even none (with a constant hydrogen fuel source through a tube). Major companies such as Wal-Mart have already decided that PlugPower’s KeyGen solution is the real deal and utilize their forklifts. The needs of a warehouse from forklifts are very similar to the needs of an inner city transport system from buses. They both require constant use, resulting in high energy costs and the lack of time to refuel.

Plug Power is one of the few fuel cell companies that are well positioned to take advantage of this new category. Even if they don’t supply the buses directly, they could benefit from the fuel station demand growth or even the support vehicles such as in the case of airports, ports, etc. If fuel cell technology wins the race, which is largely dependent on reduced costs, increased efficiency and a little luck, Plug Power is positioned as the front runner in the US to take advantage of it.

Algorithmic Analysis

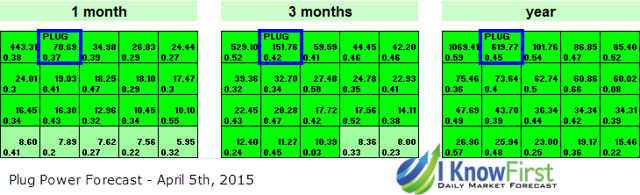

The I Know First algorithmic forecast engine uses the power of advanced self-learning algorithms combined with genetic models and artificial neural networks in order to detect opportunities in various markets. The forecast is denoted as a signal, which is a number from 0 to infinity, and measures strength and direction. The positive 619.77 signal from April 5th, 2015, marks Plug Power as the second strongest opportunity in the 1-year time horizon out of the entire technology stock universe. This forecast is furthermore supported in the 1-month and 3-month time horizons with signals of 70.69 and 151.76, respectively. The 1-year predictability of 0.45 is indicative of a 72.5% historical accuracy (hit ratio) of the algorithm for Plug forecasts – measured as the last 90 days Pearson Correlation of the prediction and actual market behavior.

The stock is now down 65% in 1-year and 15% in the last 3 months. We believe that this 15% represents the downside risk over the next year, and has a fairly high chance of materializing. However in the long term the stock’s upside potential is huge. Fuel cell technology had a hard time being noticed as much of the earlier development was focused on competing with batteries and solar alternatives. Now that the equipment is being utilized where battery and solar have much less applicability, it offers an attractive steady growth model over time. This long-term value growth supported by our algorithmic analysis makes our stance bullish on Plug Power for the 1 month, 3 month and 1 year horizon.

I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.

Beachy waves are perfect for summer – try one of these stunning hairstyles.

Check out our website for expert tips and creative ideas on tiny house living.

The Byzantine legacy in Turkey is fascinating. Our website delves into this historical aspect.