First Solar Is An Attractive Value At Current Prices

Confira nosso artigo (8/6/2015) no Seeking Alpha: First Solar Is An Attractive Value At Current Prices

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

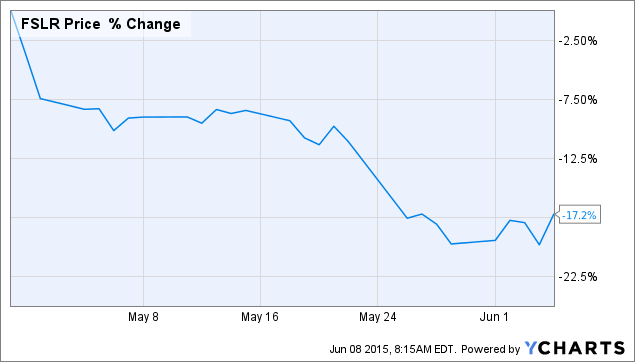

- First Solar’s stock price has fallen over 17% since the last earnings report, the latest rapid movement of the traditionally volatile stock.

- The sell-off is overdone, however, as the underwhelming results can easily be explained away.

- The company is set up well to take advantage of increased demand over the next couple of years and to grow internationally.

- I Know First Algorithm is bullish on First Solar, believing the company is a viable future player in a rapidly growing market.

First Solar, Inc. (NASDAQ: FSLR) is a solar energy company that produces Cadmium Telluride (Cd-Te) panels. The leading global provider of photovoltaic (PV) solar systems, the company’s stock price has proven to be extremely volatile in the past, with a 52-week price range of $39.18 to $73.78.

The latest bit of volatility has seen the stock price fall over 7.43% on June 1st, the day after the company reported its first quarter earnings. Since the earnings report, the stock price has continued to fall, now down 17.18% since the earnings report, as some sell-side analysts have lowered their estimates for the company.

Figure 1. Source: YCharts

This sell-off of the stock has been overdone, though, and the current stock price of around $50.00 is an attractive entry point for investors. For one, the company’s earnings report results from the first quarter are easily explainable and will recover during the rest of the year, while First Solar’s long-term outlook is very bright due to strong executive leadership.

Poor Q1 Earnings Report

First Solar’s first quarter earnings report was underwhelming, as revenues plunged. The company had projected a loss of 25 to 35 cents per share. But losses came in at 62 cents a share, compared to profits of $1.10 per share a year earlier. The results were clearly disappointing to investors, causing the stock price to fall.

Things were only made worse when the stock was downgraded at RBC Capital on May 26th. The analyst firm reduced its target price for the company from $54 to $34 because it believed revenue growth would be flat over the next couple of years. The projection is wrong, however, as revenue growth will be solid in coming years, and the stock price should jump during the next earnings report.

The falling revenue and overall poor earnings report was caused by a variety of factors, including the West Coast port strike and delaying the sale of part of its Los Hills-Blackwell Project to Southern Company (NYSE: SO), which will now be completed during the second quarter. However, the main cause of falling revenues was the creation of its yieldco, which will be completed by the end of the year.

The joint venture with SunPower Corporation (NASDAQ: SPWR) will allow the First Solar to fund projects more cheaply and will generate long-term value to its shareholders. But First Solar did not sell many of its existing projects like it would have in the past, instead funneling them into the yieldco to give it the assets it needs to launch by the end of the year.

Meanwhile, the company expects earnings to be positive once again in the current quarter, projecting earnings per share of 45 to 55 cents. The company has been one of the few solar energy companies to remain profitable, with the loss last quarter being its first since 2012.

Figure 2. Source: YCharts

Figure 2 shows the company’s profits in comparison to competitors SunPower and SolarCity Corp. (NASDAQ: SCTY) over the last two-plus years. Until last quarter, First Solar consistently was the most profitable of these companies, and that trend should resume next quarter.

Strong Management Sets Company Up For Future

Besides the return to profitability during the next earnings report that should act as an immediate stimulus to send the stock price higher, strong management also makes the company bullish in the long-term. I already mentioned the yieldco earlier, which will reduced First Solar’s funding costs while returning value to the company in the form of dividends, since the company will have a large stake in the joint venture.

The company’s revenues should also continue to grow over the next few years, despite projections from RBC Capital. Demand domestically should ramp up during that time, as companies will buy solar solutions for their energy needs before a tax credit in the US for such installations drops from 30% to 10% starting in 2017.

First Solar will be one of the few solar energy companies capable of meeting the increased demand during that time, as it is currently expanding its capacity. CEO James A. Hughes said that the company is basically sold out for 2015 and is increasing its contracted volumes for 2016. To meet the increased demand, the company is increasing factory production while adding production lines in a plant in Ohio.

During the first quarter, the company shipped 690 megawatts, its highest volume in a single quarter ever, while increasing production in the first quarter 6% over the previous quarter and 22% over the previous year. Figures like these show the company’s overall health is solid, and that it will be able to grow revenues until 2017.

The company is also set up for when the tax credit is reduced, focusing on increasing its international presence by working on projects in India and Japan, markets that have a growing demand for solar energy projects. First Solar also announced a deal with Caterpillar Inc. (NYSE: CAT) that will increase its production in international markets.

First Solar will produce PV solutions for microgrid applications, which Caterpillar will exclusively sell and support (FirstSolar.com). The partnership will provide microgrid solutions for small communities and mine sites in the Asia Pacific, Africa, and Latin America regions through Caterpillar’s global distribution network.

Analyst Opinion

The fall of First Solar’s stock price since the last earnings report has made the stock an attractive investment, as shown by the relatively cheap forward P/E ratio of 20.04. This is a low value for a company in a growth sector like solar energy, implying that the stock price is currently undervalued.

Figure 3. Source: YCharts.

Analyst opinion tends to agree with the bullish fundamental analysis of the company, with a number of research firms commenting on the stock besides RBC Capital, which I mentioned earlier. Analysts at Deutsche Bank upgraded the stock to a buy rating on May 7th, setting a target stock price of $68.00 for the stock. On May 8th, analysts at Cowen and Company increased their target price from $60.00 to $62.00.

Figure 4. Source: Yahoo! Finance

This target price is in line with the consensus target price of $62.77. The mean target price is in agreement with the bullish fundamental analysis of the company, as it represents a 22.36% premium on the current stock price.

Conclusion

The recent sell-off of First Solar is just the latest trading of this traditionally volatile stock. The stock price should recover in the coming months, with the next earnings report a likely stimulus to send the stock price higher. Strong leadership from the management team, solid profitability historically, and a relatively cheap current valuation make this company an attractive target for investors. The stock offers up to 20% upside potential in the short-term, and the company’s long-term viability in a growing market makes it a stock worth buying and holding on to. I Know First has a bullish algorithmic forecast for First Solar, believing that it will increase during the second half of the year and beyond.