Follow The Leader: Insider Buying At Abercrombie & Fitch Is A Good Sign

Confira nosso artigo (9/7/2015) no Seeking Alpha: Follow The Leader: Insider Buying At Abercrombie & Fitch Is A Good Sign

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Follow The Leader: Insider Buying At Abercrombie & Fitch Is A Good Sign

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…)

Summary

- The latest source of optimism comes from Form 4 insider trading reports recently released from the SEC.

- A change in leadership following CEO Mike Jeffries’ resignation heralds new hope for the struggling brand.

- Implementation of new business strategies aiming to change the face of Abercrombie & Fitch.

- I Know First’s algorithm is bullish on Abercrombie & Fitch.

Investors have anxiously watched Abercrombie & Fitch’s (NYSE: ANF) stock fluctuate since CEO Mike Jeffries stepped down in December 2014. Twenty years ago, Jeffries turned the brand around into the Abercrombie & Fitch we all know today. Unfortunately for the company, changing consumer trends have left ANF in dire need of a makeover. Analysts are certainly aware that sales are down, and investors want to know what the company has in store, but optimism still shines on the future of the brand.

Form 4 Filings Foster Optimism

On June 29, 2015, ANF disclosed a Form 4 to the SEC, revealing director Craig R Stapleton’s insider buying transaction of 10,000 shares of ANF stock at $22.42 per share. This purchase comes on the heels of Christos Angelides’ purchase of 45,200 shares for about $22.16 per share and Fran Horowitz-Bonadies purchase of 10,000 shares for about $22.55 per share earlier in June. News of these purchases correlates to a rise in stock price.

(click to enlarge) Source: Yahoo Finance.

Source: Yahoo Finance.

Nejat Seyhun, professor, researcher, and author of “Investment Intelligence from Insider Trading” found a positive correlation between insider stock purchases and stock price, in that stock generally outperformed the market by 8.9% in the year following an insider purchase.

These major purchases in a time of such great uncertainty regarding the future of the brand signal an extremely positive outlook on the company’s future.

New Leadership Brings New Hope

In the continued wait for ANF to appoint an outright replacement for Jeffries, they have united 2 experienced executives to take his place. They have moved Fran Horowitz-Bonadies from her position as Hollister brand president and Christos Angelides from his position as president of Abercrombie & Fitch (as well as abercrombie kids) in the hopes that their joint expertise will do for the company today what Jeffries did 20 years ago.

Both Horowitz-Bonadies and Angelides started at ANF in 2014. Fran Horowitz-Bonadies has a strong retail background with successful companies such as Ann Taylor Loft, Express Inc., and Bloomingdales. Christos Angelides boasts an equally strong retail background coming from the extremely successful Next PLC based in the United Kingdom. These backgrounds stand in stark contrast to that Mike Jeffries, who has a history of bankrupted businesses under his belt.

New Strategies to Attract the New Generation

With new leadership poised to change the image of what Abercrombie & Fitch used to stand for, coupled with the upcoming back-to-school shopping spree, Abercrombie has a chance to regain its position in the retail sector.

Former CEO Mike Jeffries concentrated too much on showmanship, excluding possible customers and ignoring the changing tastes of consumers. The brand has already begun changing their image by making over their stores through quieter music, spraying less perfume, and letting more light in. They no longer refuse to sell black clothing, their models now have more clothes on, their logo does not appear on all of their clothing, and they sell clothes above a size 10.

Already having closed 275 stores, ANF plans to close others by letting their leases expire in the coming 3 years. This will provide cost savings and a hint rarity to a brand that once flooded pop culture.

They do, however, plan to open additional outlet stores as these stores saw a 20% increase in sales when compared to standard retail stores.

Abercrombie & Fitch executives know that these changes will not have an immediate turnaround effect on the company’s books, as they expect to feel the residual negative effects of the company’s prior marketing campaign through the current year.

ANF has also implemented an incentive based compensation package together for managers and district managers in an effort to get management at all levels of the organization working together. The all-encompassing revamp of the Abercrombie & Fitch brand by new leaders at the helm gives reason to view this stock as a bullish one.

Analyst Opinion

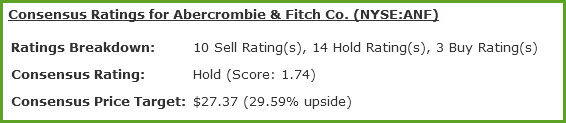

The second quarter of 2015 shows a relatively steady stock price that hovers around $21 – $22 per share amidst the company’s search for a new CEO. Furthermore, it shows a positive trend despite the first quarter’s actual reported loss of $0.53 per share. Marketbeat.com reports the following analyst opinions regarding Abercrombie & Fitch stock: 10 sell ratings, 14 hold ratings, and 3 buy ratings. This translates to a consensus rating of hold with a price target of $27.37 per share.

Source:marketbeat.com.

Source:marketbeat.com.

Despite revenue for the year showing a 9.06% decrease from the prior year, hesitate to dismiss the stock because they see the potential lying within the new face of the company.

Conclusion

Abercrombie & Fitch executives have implemented a myriad of strategies to revive their brand. While awaiting the results of these changes, other positive signals have popped up including the various insider transactions occurring as of late which shows great confidence coming from the new board members. Furthermore, the expertise of both Fran Horowitz-Bonadies and Christos Angelides in the retail sector has great potential to boost ANF stock back to highly profitable levels. The sweeping changes made both inside and outside the company points ANF stock in a positive direction which mirrors I Know First’s most bullish algorithmic forecast.