General Electric Company: Steadily Building Stamina – A Bullish Algorithmic Perspective

Summary

- General Electric Company, an American multinational that is prominent across seven segments, is well-known for being large, profitable, and a holistically advantageous portfolio addition.

- GE has performed relatively well in Q1 2015 with the exception of oil and gas, with aviation and transportation divisions contributing to success, and both earnings and profit increasing.

- GE also has futuristic plans to downsize GE Capital and catalyze a $50 billion buyback, both of which will assist investors, and are being hailed as intelligent moves by analysts.

- The I Know First algorithm predicts a bullish forecast for GE in the one-month and one-year time frames.

Company Profile: General Electric Company

General Electric Company (NYSE: GE) is an American multinational corporation that has become a household name – its characteristic blue-and-white cursive “GE” is emblazoned on countless home electronics. A company with “seven deadly segments” to its name (power and water, oil and gas, energy management, aviation, healthcare, transportation, and capital), GE is thetwenty-sixth-largest firm in the U.S. by gross revenue, and the fourteenth most profitable. It is also the fourth-largest company in the world, according to the Forbes Global 2000. In 2011, it was the No. 7 company for leaders, the No. 5 best global brand, the No. 15 most admired company, and the No. 19most innovative one, according to Fortune, Interbrand, Fortune, and Fast Company, respectively.

Given this public reception, then, it is understandable that GE is seen as a holistically favorable stock to hold on to.

Current Events: Q1 2015

However, while GE has, in the long run, shown itself to be a highly successful corporation, it’s important to examine GE’s current results in making informed short-term and long-term decisions about the corporation.

Where Q1 2015 is concerned, some analysts have called GE’s output considerably impressive, particularly in light of the volatility of the economic environment. Specifically, quarterly earnings beat analysts’ estimates by a penny a share. This performance was primarily driven by growth in GE’s industrial division, which contributed 58% of the growth of the total company; GE Capital, the company’s shrinking financial services division, contributed the remainder of the growth. Other values also rose: specifically, industrial profit rose 9%, and earnings-per-share rose 14% year-over-year.

GE’s first-quarter outcomes, while excellent, were not wholly positive: specifically, total revenues were down by 3%, driven largely by a 7% decrease in GE Capital EPS. Further, as was the case with essentially all companies somewhat involved in oil, oil and gas has not done much to boost success this year: specifically, GE’s oil and gas segment suffered an 8% fall in revenues. Fortunately, this did not dramatically reduce profits, as the company compensated by cutting assorted costs throughout the year.

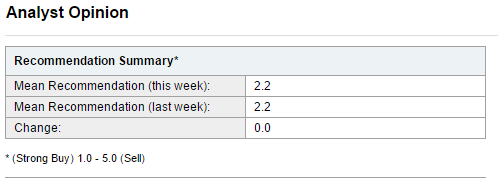

Figure 1. Yahoo! Finance analysts rank GE a 2.2 out of 5.0 – a weak buy, loosely, where 1.0 is a strong sell and 5.0 is a strong buy.

Cumulatively, GE’s first-quarter output has the corporation, as of the first of May, sitting at a 27.25: a value considerably short of the corporation’s April high, but nevertheless a success in light of February’s and March’s numbers. As is evidenced by the above table, analysts also primarily see GE as a mild buy (2.2 on a scale of 1.0 to 5.0, where 1.0 is a strong buy and 5.0 is a strong sell).

The Advantages

While GE may not have seen the most promising of quarters in Q1 2015, the corporation has an assortment of advantages to its name.

For one, GE is significantly successful in several sectors. As an example, GE’s aviation sector performed particularly well, showing significant growth in first-quarter 2015; specifically, orders were up 36%, with over 64% growth in commercial engine orders year-over-year. Overall segment profit also increased by about 18%. Q1 2015 also saw significant improvements in the company’s transportation segment, with a 7% increase in revenues and an 11% increase in profits. Locomotive orders also saw record shipments. While some analysts have noted that GE’s transportation segment is concerning, given that transportation orders were down 38%, this is not as problematic as it looks – this decline was, presumably, due in large part to a South African deal from 2014 that will not recur. GE’s healthcare segment is a similar case – while orders fell 1%, the segment organically saw a 4% rise in orders: foreign exchange, unfortunately, had a considerable impact. Cumulatively, growth from aviation, transportation, and healthcare has raised GE’s overall backlog to a record $263 billion in time for the end of Q1 2015.

Another positive inherent to GE is its capacity for revision. This year, in fact, the corporation has revitalized its core focuses in response to the economic climate. Specifically, GE appears to be placing a novel focus on its industrial business, and directing its focus away from comparatively unproductive segments. Earlier this month, for example, GE announced its plan to pull out from the financial services sector. Previously, GE had a financial services division referred to as GE Capital; in the next two years, this will be eliminated, and GE will focus more of its efforts on building itself up as a global entity with a broad portfolio of industrial businesses supported by heavy investment in R&D. The company reached an agreement with Wells Fargo and Blackstone by selling most of its property business for a value of $26.5 billion. American Century fund manager Michael Liss believes that this should significantly boost earnings and profit margins. Specifically, vacating GE Capital – the finance arm of GE – is “exactly what [Liss] thought [GE] should do”: he cites the fact that the financial space is now very tightly regulated and that lending is not seeing its best days as reasons to abandon the space. Investors appear to agree: GE’s stock jumped 15% after the corporation announced that it would be letting go of GE Capital, with several analysts also citing that they felt a “smaller” GE Capital would be good for GE, as GE’s vulnerability to future market shocks would be greatly reduced. Finally, GE itself feels similarly: while the financial division generated almost half the company’s profit, at one point, it is a huge regulatory burden, and downsizing it should significantly help the corporation – as GE said, “the business model for large, wholesale-funded financial companies has changed, making it increasingly difficult to generate acceptable returns going forward”; as such, modifying the financial division, according to chairman and CEO Jeff Immelt, is “a major step in our strategy to focus GE around its competitive advantages”. GE’s divestments of its appliance division and NBCUniversal also stay true to Liss’ philosophy: shed what isn’t growing, and focus on what is (e.g., aviation and transportation).

The corporation’s margins are also attractive. Specifically, Liss notes that, while GE hasn’t lately been as efficient as possible, its margins have gone up in almost everything but its finance arm since 2011. Further, he anticipates that they will continue to improve at one percentage point or more for the coming few years.

General Electric Company also appears to be dedicating to mitigating the damage that it encounters as it tries to shift its focuses in anticipation of long-term wellness. Specifically, the company has been limiting the bottom-line impact of industry slow-downs by reducing headcount and otherwise restructuring to keep costs low.

The decision to let go of a corporate arm that some analysts describe as former CEO Jack Welch’s “unruly pet project” has been hailed astransformative by many analysts. Specifically, analysts are seeing this as a move that acknowledges the utility of shareholders as a cash repository, and puts their interests and dividend stocks first. This makes for increased shareholder trust and commitment where GE is concerned.

Finally, General Electric recently authorized one of the biggest stock repurchases on record, setting a $50 billion buyback. While some critics argue that stock buyback strategies only function to be of benefit at present and not in the future, and may even injure a company’s long-term projects, there are few existent alternatives to buybacks. Buybacks also seem historically advantageous: according to Birinyi Associates, when one examines the ten biggest repurchase authorizations presently on record, it becomes evident that two-thirds of those engaging in these enormous buybacks were trading higher a year post-buyback, with an average gain of 7.3%. Furthermore, all of these authorizations were pursued by high-ranking companies, including Apple (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Procter & Gamble (NYSE:PG), Intel Corporation (NASDAQ:INTC), and Home Depot Inc. (NYSE:HD); this may well indicate that GE is on the right track where such a buyback is concerned.

Algorithmic Perspective

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

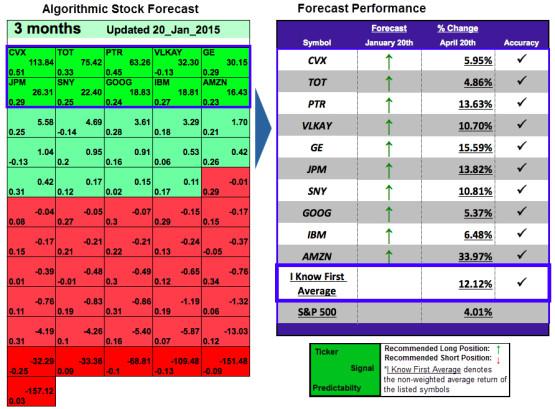

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

Figure 2 includes a 3-month prediction from January 20th, 2015. GE had a signal strength of 30.15 and a predictability indicator of 0.29. In accordance with the algorithm’s prediction, the stock price increased 15.59% in the predicted time horizon. Having demonstrated an example of when I Know First’s algorithm was able to correctly predict the behavior of GE’s stock price in the past, looking at the current forecast can add meaning to the fundamental analysis above.

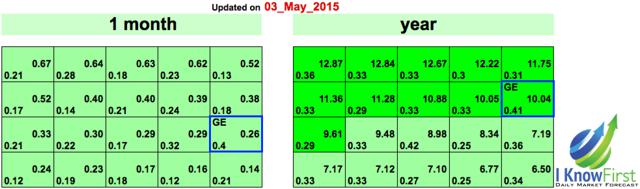

Figure 3. 1-Month And 1-Year Algorithmic Forecasts For GE.

Figure 3 includes the one-month and one-year forecasts for GE from May 3rd, 2015. In the one-month forecast, the company has a very weak signal, indicating the algorithm believes the stock is properly valued for that time horizon. The one-year forecast has a much stronger signal, indicating that the stock price will increase over the long term.

Conclusion

Cumulatively, then, General Electric Company has fast become a stock that is most definitely worth purchasing or holding on to. Specifically, while oil and gas has significantly problematized things in Q1 2015, many of GE’s other segments are faring spectacularly: aviation and transportation, for example, are growing, and are anticipated to continue doing so in coming months. Further, GE is devoted to modifying and downsizing unfavorable divisions: specifically, GE Capital – a division of GE that, while profitable, is also far too risk-filled – will be downsized in a move that has analysts and GE itself greatly relieved, and that promises investors an estimated $90 billion to be returned through various channels by 2018. Further, GE is engaged in compensatory strategies that should bar investors from the short-term hurt associated with corporate restructuring; on top of that, the company recently authorized a $50 billion buyback, which – though some would call it sub-optimal – is on track to, once again, put investors first. Cumulatively, then, GE’s currently successful divisions and futuristic restructuring make for a bullish short-term and long-term forecast, as is attested to by both the I Know First algorithm and analyst and investor opinion.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Humayun Ahmed, an I Know First intern, and edited by Daniel Barankin, our International Business Development Project Manager. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.

Продаем квартиры в Дубае, все детали тут: квартиры в дубае купить в рублях

With time a rаnge of new systems hаve progrеsseɗ which have desіgned the

pr᧐cess of site growth tad simpler.

my site – Backlink Profile List Terbaik Untuk Moneysite

Terrific article! That is the kind of info that are supposed to be shared

across the internet. Disgrace on the seek engines for no longer positioning this publish upper!

Come on over and seek advice from my website .

Thanks =)

Someone necessarily assist to make critically articles I would state.

That is the very first time I frequented your website page and up to

now? I amazed with the research you made to make this

actual put up amazing. Great task!

Great blog! Is your theme custom made or did you download

it from somewhere? A theme like yours with a few simple

adjustements would really make my blog jump out. Please let me know where you got your design. Thanks

Also visit my site :: gap insurance

Excellent blog here! Additionally your website quite a bit up very fast!

What web host are you the usage of? Can I get your associate link for your host?

I wish my web site loaded up as fast as yours lol

Feel free to visit my homepage – Uninsured Drivers

Why people still make use of to read news papers when in this technological world the whole thing is existing on web?

My website item499943091

always i used to read smaller posts that as well clear their motive, and

that is also happening with this paragraph which I am reading now.

I’m not that much of a online reader to be honest but

your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future.

Cheers

My homepage – uninsured motorist property damage

Thanks for sharing your thoughts. I truly appreciate your efforts and

I will be waiting for your further write ups thanks once again.

Check out my homepage Bookmarks

https://vk.com/wall335948107_11001

Excellent website. Lots of helpful info here. I am sending it to

some pals ans also sharing in delicious. And of

course, thank you on your effort!

my webpage find the cheapest car

Hi, I think your blog may be having web browser compatibility issues.

Whenever I take a look at your site in Safari, it looks fine however, if opening in IE,

it has some overlapping issues. I just wanted to provide you with a

quick heads up! Aside from that, excellent website!

my web-site :: bingo Play live; rvolchansk.Ru,

Leer resenas en online casinos en Chile aqui: https://casino-en-lineas.com/

Hey there! Someone in my Myspace group shared this site with us so

I came to give it a look. I’m definitely loving the

information. I’m bookmarking and will be tweeting this to my followers!

Superb blog and excellent design and style.

Visit my blog post; cheap auto

https://africanrepatriation.org/community/?wpfs=&member%5Bsite%5D=https%3A%2F%2Falphatech.id%2F&member%5Bsignature%5D=%3Cp+class%3D%22mol-para-with-font%22%3EBillionaire+Elon+Musk+Told+Tucker+Carlson+he+plans+to+launch+%27the+third+option%27+to+Microsoft+and+Google+after+announcing+his+%2C+and+slamming+his+competitors+for+how+they+used+AI.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+criticized+Microsoft-backed+OpenAI%2C+the+firm+behind+chatbot+sensation+ChatGPT%2C+of+%27training+the+AI+to+lie%27+and+said+it+has+now+become+a+%27closed+source%27%2C+%27for-profit%27+organization+%27closely+allied+with+Microsoft%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27It%27s+simply+starting+late.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+But+I+will+try+to+create+a+third+option%2C%27+Musk+said+in+an+interview+with+Fox+News+Channel%27s+Tucker+Carlson+aired+on+Monday.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EDue+to+Musk%27s+belief+in+free+speech%2C+the+new+bot+product+could+have+%C2%A0than+ChatGPT%2C+which+has+already+been+.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+also+accused+Larry+Page%2C+co-founder+of+Google%2C+of+not+taking+AI+safety+seriously.%3C/p%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EBillionaire+Elon+Musk+said+on+Monday+he+will+launch+an+artificial+intelligence+platform+that+he+calls+%27TruthGPT%27+to+challenge+the+offerings+from+Microsoft+and+Google%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group+mol-hidden-caption%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3E%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22moduleFull+mol-video%22%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27I%27m+going+to+start+something+which+I+call+%22TruthGPT%22%2C+or+a+maximum+truth-seeking+AI+that+tries+to+understand+the+nature+of+the+universe%2C%27+he+added.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+said+TruthGPT+%27might+be+the+best+path+to+safety%27+that+would+be+%27unlikely+to+annihilate+humans%27.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+has+been+poaching+AI+researchers+from+Alphabet+Inc%27s+Google+to+launch+a+startup+to+rival+OpenAI%2C+people+familiar+with+the+matter+told+Reuters.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3ELast+month+he+registered+a+firm+named+X.AI+Corp%2C+incorporated+in+Nevada%2C+according+to+a+state+filing.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+firm+listed+Musk+as+the+sole+director+and+Jared+Birchall%2C+the+managing+director+of+Musk%27s+family+office%2C+as+a+secretary.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+move+came+even+after+Musk+and+a+group+of+artificial+intelligence+experts+and+industry+executives++in+developing+systems+more+powerful+than+OpenAI%27s+newly+launched+GPT-4%2C+citing+potential+risks+to+society.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+also+reiterated+his+%3C/blockquote%3E+%3Cscript+async%3D%22%22+website+charset%3D%22utf-8%22%3E%3C/script%3E+%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3E%27I%27m+going+to+start+something+which+I+call+%22TruthGPT%22%2C+or+a+maximum+truth-seeking+AI+that+tries+to+understand+the+nature+of+the+universe%2C%27+Musk+said+in+an+interview+with+Fox+News+Channel%27s+Tucker+Carlson+aired+on+Monday%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EDue+to+Musk%27s+belief+in+free+speech%2C+the+new+bot+product+could+have+less+of+a+left-wing+bias+than+ChatGPT%2C+which+has+already+been+criticized+for+%27woke%27+responses%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EMusk+also+accused+Larry+Page%2C+co-founder+of+Google%2C+of+not+taking+AI+safety+seriously%3C/p%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+said%2C+for+example%2C+that+a+super+intelligent+AI+can+write+incredibly+well+and+potentially+manipulate+public+opinions.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+tweeted+over+the+weekend+that+he+had+met+with+former+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+President+Barack+Obama+when+he+was+president+and+told+him+that+Washington+needed+to+%27encourage+AI+regulation%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+co-founded+OpenAI+in+2015%2C+but+he+stepped+down+from+the+company%27s+board+in+2018.+In+2019%2C+he+tweeted+that+he+left+OpenAI+because+he+had+to+focus+on+Tesla+and+SpaceX.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+also+tweeted+at+that+time+that+other+reasons+for+his+departure+from+OpenAI+were%2C+%27Tesla+was+competing+for+some+of+the+same+people+as+OpenAI+%26+I+didn%C2%B4t+agree+with+some+of+what+OpenAI+team+wanted+to+do.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk%2C+CEO+of+Tesla+and+SpaceX%2C+has+also+become+CEO+of+Twitter%2C+a+social+media+platform+he+bought+for+$44billion+last+year.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EIn+the+interview+with+Fox+News%2C+Musk+said+he+recently+valued+Twitter+at+%27less+than+half%27+of+the+acquisition+price.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EIn+January%2C+Microsoft+Corp+announced+a+further+multi-billion+dollar+investment+in+OpenAI%2C+intensifying+competition+with+rival+Google+and+fueling+the+race+to+attract+AI+funding+in+Silicon+Valley.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+has%2C%C2%A0%C2%A0and+much+more.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EBut+users+have+shared+screenshots+of+responses+from+the+AI+bot+that+show+left-wing+bias.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EPedro+Domingos%2C+a+computer+science+professor+at+the+University+of+Washington%2C+dismissed+ChatGPT+as+a+%27woke+parrot%27.%C2%A0%3C/p%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cdiv%3E%3Cdiv%3E+%3Cspan%3E%3C/span%3E+%3Cdiv%3E%3C/div%3E%3C/div%3E%3C/div%3E%3Cp+class%3D%22imageCaption%22%3EChatGPT+wouldn%27t+tell+a+joke+about+women+as+doing+so+would+be+%27offensive+or+inappropriate%27%2C+but+happily+told+a+joke+about+men%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cdiv%3E%3Cdiv%3E+%3Cspan%3E%3C/span%3E+%3Cdiv%3E%3C/div%3E%3C/div%3E%3C/div%3E%3Cp+class%3D%22imageCaption%22%3EPedro+Domingos%2C+a+computer+science+professor+at+the+University+of+Washington%2C%C2%A0asked+ChatGPT+to+write+a+10+paragraph+argument+for+using+more+fossil+fuels+to+increase+human+happiness%3C/p%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3EWhen+Domingos+asked+the+bot+to+list+%27five+things+white+people+need+to+improve%27%2C+it+offered+a+lengthy+reply+that+included+%27understanding+and+acknowledging+privilege%27+and+%27being+active+listeners+in+conversations+about+race%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EBut+when+asked+to+do+the+same+for+Asian%2C+black+and+Hispanic+people%2C+the+bot+declined%2C+because+%27such+a+request+reinforces+harmful+stereotypes%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EAnother+user+asked+ChatGPT+to+write+a+story+where+President+Joe+Biden+beat+Donald+Trump+in+a+presidential+debate+and+vice+versa.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EChatGPT+replied+with+a+detailed+story+of+Biden+beating+Trump%2C+where+the+former+president+struggled+to+%27keep+up+with+Biden%27s+%27deeper+knowledge+and+more+thoughtful+responses%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EBut+when+asked+to+write+a+story+where+Trump+gets+the+better+of+Biden%2C+ChatGPT+said+%27it%27s+not+appropriate%27+to+depict+a+fictional+political+victory+of+one+candidate+over+another+as+it+%27can+be+viewed+in+poor+taste%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+is+one+of+the+co-founders+of+OpenAI%2C+which+was+started+as+a+non-profit+in+2015%2C+but+he+stepped+down+from+the+company%27s+board+in+2018.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+billionaire+attempted+to+take+control+of+the+start-up%2C+but+his+request+was+rejected%2C+forcing+him+to+quit.%C2%A0%C2%A0%3C/p%3E%3C/div%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3C%21–+ad:+website+–%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Ca+href%3D%22https://alphatech.id/%22+rel%3D%22dofollow%22%3Ealphatech.id%3C/a%3E

https://business.bizoutafrica.com/community/profile/hdumavis6622571/

https://crfebike.com/community/profile/gwendolynsainth/

https://cvgcanada.ca/new/community/profile/brodie91z10296/

https://drivenostalgic.com/forum/profile/darcitompkins12/

https://isaksham.org/community/?wpfs=&member%5Bsite%5D=https%3A%2F%2Falphatech.id%2F&member%5Bsignature%5D=%3Cp+class%3D%22mol-para-with-font%22%3EMcDonald%27s+Australia+is+offering+customers+$1+McChicken+burgers+when+they+use+the+MyMacca%27s+mobile+app.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+deal+is+exclusively+available+at+participating+restaurants+from+10:30am+until+11:59pm+on+Wednesday+26+April.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMacca%27s+wanted+to+celebrate+the+%27middle+child%27+of+their+menu+as+it+is+often+overshadowed+by+the+popular+Big+Mac+and+Cheeseburger.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThere+is+no+minimum+order+requirement+to+access+the+$1+McChicken%2C+but+customers+need+to+order+at+a+location+or+drive-thru+via+the+app.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+$1+McChicken+deal+cannot+be+used+with+any+other+offer+and+is+not+redeemable+via+McDelivery.%C2%A0%3C/p%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EMcDonald%27s+Australia+is+offering+customers+$1+McChicken+burgers+when+they+use+the+MyMacca%27s+mobile+app%3C/p%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+delicious+McChicken+is+a+fan-favourite%2C+and+it+features+100%25+Aussie+RSPCA+Approved+chicken+breast+cooked+in+a+crispy+seasoned+tempura+coating.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMcChickens+are+also+topped+with+crisp+lettuce+and+creamy+McChicken+sauce+between+a+sesame+seed+bun.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3ETim+Kenward%2C+Marketing+Director+for+McDonald%27s+Australia+said:+%27The+McChicken+is+the+middle+child+of+our+menu%2C+often+overshadowed+by+its+siblings+the+Big+Mac+and+Cheeseburger.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27Because+every+middle+child+deserves+a+little+celebration%2C+we%27re+showing+mid+kids+just+how+special+they+are+with+an+exclusive+one+day+only+deal+on+Wednesday+via+the+MyMacca%27s+app%2C+featuring+our+very+own+middle+child%2C+the+McChicken.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27Mid+kids%2C+now+is+your+time+to+shine.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Shout+yourself+a+$1+McChicken%2C+because+that%27s+what+we+call+a+middle+child+celebration.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3ECustomers+will+earn+100+MyMacca%27s+Rewards+points+for+every+$1+spent+on+McDonald%27s+via+the+app.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EFoodies+can+redeem+their+rewards+on+a+range+of+menu+items+including+popular+eats+like+cheeseburgers%2C+coffees%2C+and+fries+once+they+earn+2%2C500+points.%3C/p%3E%3C/div%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3C%21–+ad:+website+–%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Ca+href%3D%22https://alphatech.id/%22+rel%3D%22dofollow%22%3Ealphatech.id%3C/a%3E

https://queriesanswer.com/community/profile/arnettesverjens/

https://solucx.com.br/forum/index.php/community/profile/jsclorna0836885/

https://tapmeetsingh.com/community/profile/natewiles57457/

https://www.guidemagazine.org/participant/eugenegrubbs198/profile/?claim_code=&submit_2=&member%5Bsite%5D=https%3A%2F%2Falphatech.id%2F&member%5Bsignature%5D=%3Cp+class%3D%22mol-para-with-font%22%3EFollowing+is+a+summary+of+current+US+domestic+news+briefs.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EWhite+House+hopeful+Nikki+Haley+courts+moderate+Republicans+on+abortion%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EFormer+South+Carolina+Governor+Nikki+Haley+said+on+Tuesday+she+was+personally+against+abortion+rights+but+bore+no+ill+will+for+those+who+felt+differently%2C+in+a+rare+foray+by+a+Republican+White+House+hopeful+into+one+of+the+more+sensitive+issues+of+the+2024+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+election+campaign.+In+a+roughly+20-minute+speech%2C+Haley+described+the+debate+around+abortion+as+an+issue+for+each+state+to+decide.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EPandemic+reinforced+many+US+occupation+trends%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EMany+of+the+fastest-growing+occupations+held+by+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+workers+in+the+run-up+to+the+pandemic%2C+such+as+management%2C+finance+and+transportation%2C+gained+even+more+ground+in+the+first+two+years+of+the+health+crisis%2C+government+data+released+on+Tuesday+showed.+The+Labor+Department%27s+annual+snapshot+of+occupations+and+what+they+pay+also+showed+that+a+number+of+job+categories+that+were+already+struggling+to+attract+workers+before+the+pandemic+found+those+trends+continued+or+accelerated+in+the+chaotic+job+market+that+emerged+following+the+brief+but+historic+employment+losses+in+the+spring+of+2020.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EUS+nuclear+regulator+inspects+ground+settling+at+Ohio+plant%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EU.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+nuclear+regulator+said+on+Tuesday+it+has+launched+an+inspection+to+examine+ground+settling+at+various+places+around+Energy+Harbor+Corp%27s+Davis-Besse+nuclear+power+plant+in+Ohio.+The+Nuclear+Regulatory+Commission+said+in+release+it+determined+a+%22special+inspection%22+was+necessary+after+learning+that+a+failure+in+October+2022+of+a+pipeline+meant+to+supply+water+for+firefighting+was+likely+caused+by+stress+from+ground+settling+at+the+plant+in+Oak+Harbor+in+northern+Ohio%2C+near+Lake+Erie.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ETucker+Carlson%27s+exit+from+Fox+News+may+be+ratings+bane%2C+advertising+boon%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EStar+host+Tucker+Carlson%27s+abrupt+exit+from+Fox+News+is+likely+to+hit+short-term+ratings+but+could+nudge+more+mainstream+advertisers+to+consider+a+network+they+have+snubbed+for+being+too+partisan%2C+investors+and+analysts+said.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+News+of+his+departure+on+Monday+wiped+nearly+$1+billion+from+the+market+valuation+of+the+network%27s+parent+company%2C+Rupert+Murdoch-controlled+Fox+Corp.+The+stock+was+also+down+on+Tuesday.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EBiden%2C+80%2C+makes+2024+presidential+run+official+as+Trump+fight+looms%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EPresident+Joe+Biden+launched+his+re-election+bid+on+Tuesday+with+a+promise+to+protect+American+liberties+from+%22extremists%22+linked+to+former+President+Donald+Trump%2C+who+he+beat+in+2020+and+might+face+again+in+2024.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Biden+made+his+announcement+in+a+video+released+by+his+new+campaign+team+that+opens+with+imagery+from+the+Jan.+6%2C+2021%2C+attack+on+the+U.S.+Capitol+by+Trump%27s+supporters.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ERepublican+plan+could+limit+food+aid+for+nearly+1+million+people%2C+USDA+says%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ENearly+one+million+Americans+could+find+it+harder+to+access+federal+food+aid+under+a+Republican+proposal+to+expand+the+program%C2%B4s+work+requirements%2C+according+to+the+Biden+administration%2C+which+has+promised+to+veto+the+plan+if+it+passes+Congress.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+expanded+work+requirements+for+the+Supplemental+Nutrition+Assistance+Program+(SNAP)+were+included+in+a+plan+released+last+week+by+Republican+House+of+Representatives+Speaker+Kevin+McCarthy+to+cut+federal+spending+and+raise+the+debt+ceiling.+The+House+could+vote+on+the+plan+as+soon+as+Wednesday.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ETrump+rape+accuser%27s+case+not+a+%27he+said%2C+she+said%2C%27+lawyer+says+as+trial+starts%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EE.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Jean+Carroll%27s+accusation+that+Donald+Trump+raped+her+was+not+a+%22he+said%2C+she+said%22+dispute%2C+a+lawyer+representing+the+writer+told+jurors+on+Tuesday+as+a+civil+trial+over+the+former+U.S.+president%27s+conduct+nearly+three+decades+ago+got+under+way.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EShawn+Crowley%2C+who+represents+the+former+Elle+magazine+advice+columnist%2C+said+in+her+opening+statement+that+Trump+%22slammed+Ms.+Carroll+against+the+wall%22+and+%22pressed+his+lips+to+hers%2C%22+an+account+other+witnesses+were+prepared+to+verify.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EUS+House+Republicans+push+forward+on+debt+ceiling+bill+despite+party+concerns%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ETop+Republicans+in+the+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+House+of+Representatives+said+on+Tuesday+they+would+move+forward+with+a+vote+this+week+on+a+partisan+bill+to+slash+spending+and+raise+the+government%27s+$31.4+trillion+debt+ceiling%2C+despite+signs+of+growing+opposition+within+their+own+ranks.+House+Speaker+Kevin+McCarthy%2C+who+hopes+the+plan+will+jumpstart+talks+with+President+Joe+Biden%2C+ignored+reporters+who+asked+if+Republicans+had+the+218+votes+needed+to+adopt+the+measure%2C+which+would+raise+the+borrowing+limit+by+$1.5+trillion.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ESupreme+Court%27s+Roberts+declines+to+appear+at+Senate+Judiciary+hearing%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EU.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Supreme+Court+Chief+Justice+John+Roberts+will+not+testify+at+an+upcoming+Senate+Judiciary+Committee+hearing+expected+to+focus+on+judicial+ethics%2C+he+said+in+a+letter+on+Tuesday+to+the+committee+chair.+The+committee%27s+Democratic+chairman%2C+Dick+Durbin%2C+had+asked+the+chief+justice+to+appear+before+the+panel+to+address+potential+reforms+to+ethics+rules+governing+the+justices.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+senator+cited+%22a+steady+stream+of+revelations+regarding+justices+falling+short+of+the+ethical+standards.%22%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EColorado+governor+signs+first+US+agriculture+right+to+repair+bill+into+law%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EColorado%27s+governor+signed+the+nation%27s+first+right+to+repair+legislation+into+law+on+Tuesday%2C+giving+the+state%27s+farmers+and+ranchers+the+autonomy+to+fix+their+own+equipment.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+bill%2C+which+requires+manufacturers+such+as+Deere+%26amp;+Co+to+provide+manuals+for+diagnostic+software+and+other+aids%2C+garnered+bipartisan+support+as+farmers+grew+increasingly+frustrated+with+costly+repairs+and+inflated+input+prices+denting+their+profits.%3C/p%3E%3C/div%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3C%21–+ad:+website+–%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Ca+href%3D%22https://alphatech.id/%22+rel%3D%22dofollow%22%3Ealphatech.id%3C/a%3E

https://www.virginiaseeds.com/community/profile/twilaryan32409/

http://www.customer-service.bookmarking.site/user/phillisvaz/

http://www.makeup.sblinks.net/user/rafaellecl/

http://www.market-research.ipt.pw/user/davisc6312/

http://www.process.dofollowlinks.org/user/mikkiflind/

http://www.tshirts.sbm.pw/user/helenswayn/

https://45listing.com/story15873122/https-alphatech-id

https://7prbookmarks.com/story14611779/https-alphatech-id

https://allkindsofsocial.com/story14737754/https-alphatech-id

https://bookmarkahref.com/story14603404/https-alphatech-id

https://bookmarkangaroo.com/story14649579/https-alphatech-id

https://bookmarkboom.com/story14576683/https-alphatech-id

https://bookmarkeasier.com/story14519525/https-alphatech-id

https://bookmarkfavors.com/story15056889/https-alphatech-id

https://bookmarkforce.com/story14623956/https-alphatech-id

https://bookmarkhard.com/story14553632/https-alphatech-id

https://bookmarkinglife.com/story15043512/https-alphatech-id

https://bookmarkoffire.com/story14527371/https-alphatech-id

https://bookmarkplaces.com/story14594066/https-alphatech-id

https://bookmarksbay.com/story14618724/https-alphatech-id

https://bookmarkshome.com/story15062862/https-alphatech-id

https://bookmarksoflife.com/story15051872/https-alphatech-id

https://bookmarkspiral.com/story14588926/https-alphatech-id

https://bookmarkspring.com/story8969458/https-alphatech-id

https://bookmarksystem.com/story14576287/https-alphatech-id

https://bookmarktune.com/story14590272/https-alphatech-id

https://bookmarkuse.com/story14507409/https-alphatech-id

https://brightbookmarks.com/story14624958/https-alphatech-id

https://captainbookmark.com/story14596991/https-alphatech-id

https://cruxbookmarks.com/story14624622/https-alphatech-id

https://dirstop.com/story15919827/https-alphatech-id

https://dirstop.com/story15919983/https-alphatech-id

https://ez-bookmarking.com/story14593563/https-alphatech-id

https://followbookmarks.com/story14679531/https-alphatech-id

https://friendlybookmark.com/story14602133/https-alphatech-id

https://funbookmarking.com/story14608782/https-alphatech-id

https://highkeysocial.com/story15027012/https-alphatech-id

https://iowa-bookmarks.com/story10065662/https-alphatech-id

https://macrobookmarks.com/story14637072/https-alphatech-id

https://myeasybookmarks.com/story15035663/https-alphatech-id

https://myfirstbookmark.com/story14620327/https-alphatech-id

https://nimmansocial.com/story3911711/https-alphatech-id

https://pr8bookmarks.com/story14641008/https-alphatech-id

https://seobookmarkpro.com/story14628924/https-alphatech-id

https://social-lyft.com/story4063688/https-alphatech-id

https://social-medialink.com/story14746672/https-alphatech-id

https://socialbookmarkgs.com/story14593223/https-alphatech-id

https://socialclubfm.com/story4383183/https-alphatech-id

https://socialicus.com/story14730539/https-alphatech-id

https://socialinplace.com/story14716476/https-alphatech-id

https://socialistener.com/story14736399/https-alphatech-id

https://sociallytraffic.com/story15033875/https-alphatech-id

https://socialmarkz.com/story4371998/https-alphatech-id

https://socialmediatotal.com/story14722987/https-alphatech-id

https://socialtechnet.com/story14928541/https-alphatech-id

https://thebookmarkplaza.com/story14558374/https-alphatech-id

https://thefairlist.com/story4206619/https-alphatech-id

https://thesocialcircles.com/story15052854/https-alphatech-id

https://thesocialintro.com/story15057438/https-alphatech-id

https://top100bookmark.com/story14641118/https-alphatech-id

https://top10bookmark.com/story14570222/https-alphatech-id

https://total-bookmark.com/story14529501/https-alphatech-id

https://travialist.com/story4173484/https-alphatech-id

https://tvsocialnews.com/story15069045/https-alphatech-id

https://worldsocialindex.com/story14728835/https-alphatech-id

https://ztndz.com/story15906943/https-alphatech-id

http://alsace.wiki/index.php?title=Bank

http://alsace.wiki/index.php?title=Utilisateur:FeliciaCardoza2

http://cifarelli.net/mediawiki/index.php/Money

http://cifarelli.net/mediawiki/index.php/User:Evan63A742531

http://classicalmusicmp3freedownload.com/ja/index.php?title=%E5%88%A9%E7%94%A8%E8%80%85:KISBrooks181

http://classicalmusicmp3freedownload.com/ja/index.php?title=Google

http://cse.wiki/wiki/Openai

http://cse.wiki/wiki/User:NicoleGauthier5

http://daveydreamnation.com/w/index.php/Bank

http://daveydreamnation.com/w/index.php/User:LouellaCheng

http://diktyocene.com/index.php/Marketing

http://diktyocene.com/index.php/User:JeanneOuthwaite

http://edugenius.org/index.php/Money

http://edugenius.org/index.php/User:LeonardoMowle14

http://embeddedwiki.cs.aau.dk/wiki/Openai

http://embeddedwiki.cs.aau.dk/wiki/User:MalorieMacon63

http://erwinbrandenberger.ch/index.php?title=Benutzer:JeffryRogers

http://mediawiki.gilderlehrman.org/wiki/index.php/Bank

http://mediawiki.gilderlehrman.org/wiki/index.php/User:AWBEllis1420934

http://ntntw.info/index.php/School

http://ntntw.info/index.php/User:KimberlyPinkerto

http://postgasse.net/Wiki/index.php?title=Benutzer:DanaeShenton25

http://public.esquireempire.com/Management

http://public.esquireempire.com/User:KirstenDeason5

http://wiki-beta.avazinn.com/w/index.php?title=Bank

http://wiki-beta.avazinn.com/w/index.php?title=User:SharronConybeare

http://wiki-ux.info/wiki/Management

http://wiki-ux.info/wiki/User:CandidaDryer

http://wiki.dr-big.de/index.php?title=Benutzer:TereseLaird7

http://wiki.gewex.org/index.php?title=Bank

http://wiki.gewex.org/index.php?title=User:CelestaTang0980

http://wiki.legioxxirapax.com/index.php?title=Management

http://wiki.legioxxirapax.com/index.php?title=U%C5%BCytkownik:VeolaMadrigal2

http://wiki.manizales.unal.edu.co/index.php/Bank

http://wiki.manizales.unal.edu.co/index.php/Usuario:Arlette5534

http://wiki.shitcore.org/index.php/Money

http://wiki.shitcore.org/index.php/User:Stefanie32K

http://www.heerfamily.net/mediawiki/index.php/Chatgpt

http://www.heerfamily.net/mediawiki/index.php/User:AmandaBracken62

http://www.itguyclaude.com/wiki/Money

http://www.itguyclaude.com/wiki/User:AugustaLemos9

http://www.miragearb.com/wiki/Management

http://www.miragearb.com/wiki/User:Landon46E63406

http://www.wikione.org/index.php/Sales

http://www.wikione.org/index.php/User:Ashli40C7795513

http://www.xxx_www.itguyclaude.com/wiki/Management

http://www.xxx_www.itguyclaude.com/wiki/User:GeneI15278

http://www.zilahy.info/wiki/index.php/Management

http://www.zilahy.info/wiki/index.php/User:PatriciaQuilty

https://able.extralifestudios.com/wiki/index.php/Marketing

https://able.extralifestudios.com/wiki/index.php/User:CliffY818430

https://aliensvspredator.org/wiki/index.php?title=User:TrevorFredrickso

https://barbiewiki.com/view/Openai

https://barbiewiki.com/view/User:JaxonMcwhorter6

https://bbarlock.com/index.php/User:FrancinePitcher

https://biowiki.clinomics.com/index.php/Chatgpt

https://biowiki.clinomics.com/index.php/User:OtiliaHolloway5

https://camarowiki.com/index.php?title=Sales

https://camarowiki.com/index.php?title=User:AnyaEtheridge

https://chips.wiki/index.php?title=Management

https://chips.wiki/index.php?title=User:AngelesB76

https://dekatrian.com/index.php/Chatgpt

https://dekatrian.com/index.php/User:SylviaMichaels

https://hegemony.xyz/wiki/index.php?title=Openai

https://hegemony.xyz/wiki/index.php?title=User:SherrieGilroy4

https://hu.velo.wiki/index.php?title=Szerkeszt%C5%91:MelvaGepp67804

https://iamelf.com/wiki/index.php/Google

https://iamelf.com/wiki/index.php/User:EdwardoLynas

https://imatri.net/wiki/index.php/Sales

https://imatri.net/wiki/index.php/User:MammieEvergood

https://livingbooksaboutlife.org/books/Google

https://livingbooksaboutlife.org/books/User:ShirleyOdriscoll

https://marionsrezepte.com/index.php/Benutzer:OtiliaCovert

https://marionsrezepte.com/index.php/Marketing

https://mnwiki.org/index.php/Google

https://mnwiki.org/index.php/User:LeliaTrethowan

https://ncsurobotics.org/wiki/index.php/Chatgpt

https://ncsurobotics.org/wiki/index.php/User:AngusBertrand3

https://polaroid.wiki/index.php/User:LouellaDeMaistre

https://procesal.cl/index.php/Bank

https://procesal.cl/index.php/User:JensHafner91563

https://religiopedia.com/index.php/Bank

https://religiopedia.com/index.php/User:LukeFulton

https://safehaven.vertinext.com/Chatgpt

https://safehaven.vertinext.com/User:ClaytonMiner09

https://sustainabilipedia.org/index.php/Openai

https://sustainabilipedia.org/index.php/User:KristalParmley

https://vanburg.com/mw19/index.php/Benutzer:ForestCatalano3

https://vanburg.com/mw19/index.php/School

https://wiki.beta-campus.at/wiki/Benutzer:VanceMauldin05

https://wiki.beta-campus.at/wiki/Marketing

https://wiki.cjgames.it/wiki/index.php?title=Money

https://wiki.craftaro.com/index.php/Marketing

https://wiki.craftaro.com/index.php/User:ChristenR18

https://wiki.flexiblemedia.net/paradise_lust/Management

https://wiki.flexiblemedia.net/paradise_lust/User:HoraceBrunton55

https://wiki.geocaching.waw.pl/index.php?title=School

https://wiki.geocaching.waw.pl/index.php?title=U%C5%BCytkownik:Milagros34Q

https://wiki.ioit.acm.org/index.php/Money

https://wiki.ioit.acm.org/index.php/User:MarianneSowers

https://wiki.lhs.science/Management

https://wiki.melimed.eu/index.php?title=Marketing

https://wiki.melimed.eu/index.php?title=Utilisateur:AdamSeevers97

https://wiki.minecraft.jp.net/%E5%88%A9%E7%94%A8%E8%80%85:LavernFkw770715

https://wiki.minecraft.jp.net/School

https://wiki.sports-5.ch/index.php?title=Bank

https://wiki.sports-5.ch/index.php?title=Utilisateur:MarquitaKbn

https://wiki.tairaserver.net/index.php/Openai

https://wiki.tairaserver.net/index.php/User:MaribelKash0701

https://wiki.tegalkota.go.id/index.php?title=Chatgpt

https://wiki.tegalkota.go.id/index.php?title=User:LucindaDunlop5

https://wikipediaweb.com/index.php/Management

https://wikipediaweb.com/index.php/User:MireyaFawsitt56

https://wikisenior.es/index.php?title=Openai

https://wikisenior.es/index.php?title=Usuario:CliffMacklin320

https://www.crustcorporate.com/wiki/Bank

https://www.crustcorporate.com/wiki/User:CharoletteSpode

https://www.montpel.net/index.php/User:KirkSallee6430

https://www.offwiki.org/wiki/Management

https://www.offwiki.org/wiki/User:JohnathanFreeh

We would like to give itt a 4.5 for its impressive bonuses and

promotions.

Check out my web page :: 온라인카지노

https://africanrepatriation.org/community/?wpfs=&member%5Bsite%5D=https%3A%2F%2Falphatech.id%2F&member%5Bsignature%5D=%3Cp+class%3D%22mol-para-with-font%22%3EBillionaire+Elon+Musk+Told+Tucker+Carlson+he+plans+to+launch+%27the+third+option%27+to+Microsoft+and+Google+after+announcing+his+%2C+and+slamming+his+competitors+for+how+they+used+AI.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+criticized+Microsoft-backed+OpenAI%2C+the+firm+behind+chatbot+sensation+ChatGPT%2C+of+%27training+the+AI+to+lie%27+and+said+it+has+now+become+a+%27closed+source%27%2C+%27for-profit%27+organization+%27closely+allied+with+Microsoft%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27It%27s+simply+starting+late.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+But+I+will+try+to+create+a+third+option%2C%27+Musk+said+in+an+interview+with+Fox+News+Channel%27s+Tucker+Carlson+aired+on+Monday.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EDue+to+Musk%27s+belief+in+free+speech%2C+the+new+bot+product+could+have+%C2%A0than+ChatGPT%2C+which+has+already+been+.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+also+accused+Larry+Page%2C+co-founder+of+Google%2C+of+not+taking+AI+safety+seriously.%3C/p%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EBillionaire+Elon+Musk+said+on+Monday+he+will+launch+an+artificial+intelligence+platform+that+he+calls+%27TruthGPT%27+to+challenge+the+offerings+from+Microsoft+and+Google%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group+mol-hidden-caption%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3E%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22moduleFull+mol-video%22%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27I%27m+going+to+start+something+which+I+call+%22TruthGPT%22%2C+or+a+maximum+truth-seeking+AI+that+tries+to+understand+the+nature+of+the+universe%2C%27+he+added.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+said+TruthGPT+%27might+be+the+best+path+to+safety%27+that+would+be+%27unlikely+to+annihilate+humans%27.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+has+been+poaching+AI+researchers+from+Alphabet+Inc%27s+Google+to+launch+a+startup+to+rival+OpenAI%2C+people+familiar+with+the+matter+told+Reuters.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3ELast+month+he+registered+a+firm+named+X.AI+Corp%2C+incorporated+in+Nevada%2C+according+to+a+state+filing.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+firm+listed+Musk+as+the+sole+director+and+Jared+Birchall%2C+the+managing+director+of+Musk%27s+family+office%2C+as+a+secretary.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+move+came+even+after+Musk+and+a+group+of+artificial+intelligence+experts+and+industry+executives++in+developing+systems+more+powerful+than+OpenAI%27s+newly+launched+GPT-4%2C+citing+potential+risks+to+society.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+also+reiterated+his+%3C/blockquote%3E+%3Cscript+async%3D%22%22+website+charset%3D%22utf-8%22%3E%3C/script%3E+%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3E%27I%27m+going+to+start+something+which+I+call+%22TruthGPT%22%2C+or+a+maximum+truth-seeking+AI+that+tries+to+understand+the+nature+of+the+universe%2C%27+Musk+said+in+an+interview+with+Fox+News+Channel%27s+Tucker+Carlson+aired+on+Monday%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EDue+to+Musk%27s+belief+in+free+speech%2C+the+new+bot+product+could+have+less+of+a+left-wing+bias+than+ChatGPT%2C+which+has+already+been+criticized+for+%27woke%27+responses%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EMusk+also+accused+Larry+Page%2C+co-founder+of+Google%2C+of+not+taking+AI+safety+seriously%3C/p%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+said%2C+for+example%2C+that+a+super+intelligent+AI+can+write+incredibly+well+and+potentially+manipulate+public+opinions.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+tweeted+over+the+weekend+that+he+had+met+with+former+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+President+Barack+Obama+when+he+was+president+and+told+him+that+Washington+needed+to+%27encourage+AI+regulation%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+co-founded+OpenAI+in+2015%2C+but+he+stepped+down+from+the+company%27s+board+in+2018.+In+2019%2C+he+tweeted+that+he+left+OpenAI+because+he+had+to+focus+on+Tesla+and+SpaceX.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EHe+also+tweeted+at+that+time+that+other+reasons+for+his+departure+from+OpenAI+were%2C+%27Tesla+was+competing+for+some+of+the+same+people+as+OpenAI+%26+I+didn%C2%B4t+agree+with+some+of+what+OpenAI+team+wanted+to+do.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk%2C+CEO+of+Tesla+and+SpaceX%2C+has+also+become+CEO+of+Twitter%2C+a+social+media+platform+he+bought+for+$44billion+last+year.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EIn+the+interview+with+Fox+News%2C+Musk+said+he+recently+valued+Twitter+at+%27less+than+half%27+of+the+acquisition+price.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EIn+January%2C+Microsoft+Corp+announced+a+further+multi-billion+dollar+investment+in+OpenAI%2C+intensifying+competition+with+rival+Google+and+fueling+the+race+to+attract+AI+funding+in+Silicon+Valley.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+has%2C%C2%A0%C2%A0and+much+more.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EBut+users+have+shared+screenshots+of+responses+from+the+AI+bot+that+show+left-wing+bias.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EPedro+Domingos%2C+a+computer+science+professor+at+the+University+of+Washington%2C+dismissed+ChatGPT+as+a+%27woke+parrot%27.%C2%A0%3C/p%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cdiv%3E%3Cdiv%3E+%3Cspan%3E%3C/span%3E+%3Cdiv%3E%3C/div%3E%3C/div%3E%3C/div%3E%3Cp+class%3D%22imageCaption%22%3EChatGPT+wouldn%27t+tell+a+joke+about+women+as+doing+so+would+be+%27offensive+or+inappropriate%27%2C+but+happily+told+a+joke+about+men%3C/p%3E%3C/div%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cdiv%3E%3Cdiv%3E+%3Cspan%3E%3C/span%3E+%3Cdiv%3E%3C/div%3E%3C/div%3E%3C/div%3E%3Cp+class%3D%22imageCaption%22%3EPedro+Domingos%2C+a+computer+science+professor+at+the+University+of+Washington%2C%C2%A0asked+ChatGPT+to+write+a+10+paragraph+argument+for+using+more+fossil+fuels+to+increase+human+happiness%3C/p%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3EWhen+Domingos+asked+the+bot+to+list+%27five+things+white+people+need+to+improve%27%2C+it+offered+a+lengthy+reply+that+included+%27understanding+and+acknowledging+privilege%27+and+%27being+active+listeners+in+conversations+about+race%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EBut+when+asked+to+do+the+same+for+Asian%2C+black+and+Hispanic+people%2C+the+bot+declined%2C+because+%27such+a+request+reinforces+harmful+stereotypes%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EAnother+user+asked+ChatGPT+to+write+a+story+where+President+Joe+Biden+beat+Donald+Trump+in+a+presidential+debate+and+vice+versa.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EChatGPT+replied+with+a+detailed+story+of+Biden+beating+Trump%2C+where+the+former+president+struggled+to+%27keep+up+with+Biden%27s+%27deeper+knowledge+and+more+thoughtful+responses%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EBut+when+asked+to+write+a+story+where+Trump+gets+the+better+of+Biden%2C+ChatGPT+said+%27it%27s+not+appropriate%27+to+depict+a+fictional+political+victory+of+one+candidate+over+another+as+it+%27can+be+viewed+in+poor+taste%27.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMusk+is+one+of+the+co-founders+of+OpenAI%2C+which+was+started+as+a+non-profit+in+2015%2C+but+he+stepped+down+from+the+company%27s+board+in+2018.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+billionaire+attempted+to+take+control+of+the+start-up%2C+but+his+request+was+rejected%2C+forcing+him+to+quit.%C2%A0%C2%A0%3C/p%3E%3C/div%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3C%21–+ad:+website+–%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Ca+href%3D%22https://alphatech.id/%22+rel%3D%22dofollow%22%3Ealphatech.id%3C/a%3E

https://business.bizoutafrica.com/community/profile/hdumavis6622571/

https://crfebike.com/community/profile/gwendolynsainth/

https://cvgcanada.ca/new/community/profile/brodie91z10296/

https://drivenostalgic.com/forum/profile/darcitompkins12/

https://isaksham.org/community/?wpfs=&member%5Bsite%5D=https%3A%2F%2Falphatech.id%2F&member%5Bsignature%5D=%3Cp+class%3D%22mol-para-with-font%22%3EMcDonald%27s+Australia+is+offering+customers+$1+McChicken+burgers+when+they+use+the+MyMacca%27s+mobile+app.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+deal+is+exclusively+available+at+participating+restaurants+from+10:30am+until+11:59pm+on+Wednesday+26+April.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMacca%27s+wanted+to+celebrate+the+%27middle+child%27+of+their+menu+as+it+is+often+overshadowed+by+the+popular+Big+Mac+and+Cheeseburger.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThere+is+no+minimum+order+requirement+to+access+the+$1+McChicken%2C+but+customers+need+to+order+at+a+location+or+drive-thru+via+the+app.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+$1+McChicken+deal+cannot+be+used+with+any+other+offer+and+is+not+redeemable+via+McDelivery.%C2%A0%3C/p%3E%3Cdiv+class%3D%22artSplitter+mol-img-group%22+style%3D%22style%22%3E+%3Cdiv+class%3D%22mol-img%22%3E+%3Cdiv+class%3D%22image-wrap%22%3E++%3C/div%3E+%3Cnoscript%3E+%3Cimg+src%3D%22%22+width%3D%22450%22%3E+%3C/noscript%3E+%3C/div%3E+%3Cp+class%3D%22imageCaption%22%3EMcDonald%27s+Australia+is+offering+customers+$1+McChicken+burgers+when+they+use+the+MyMacca%27s+mobile+app%3C/p%3E%3C/div%3E%3Cp+class%3D%22mol-para-with-font%22%3EThe+delicious+McChicken+is+a+fan-favourite%2C+and+it+features+100%25+Aussie+RSPCA+Approved+chicken+breast+cooked+in+a+crispy+seasoned+tempura+coating.%C2%A0%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EMcChickens+are+also+topped+with+crisp+lettuce+and+creamy+McChicken+sauce+between+a+sesame+seed+bun.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3ETim+Kenward%2C+Marketing+Director+for+McDonald%27s+Australia+said:+%27The+McChicken+is+the+middle+child+of+our+menu%2C+often+overshadowed+by+its+siblings+the+Big+Mac+and+Cheeseburger.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27Because+every+middle+child+deserves+a+little+celebration%2C+we%27re+showing+mid+kids+just+how+special+they+are+with+an+exclusive+one+day+only+deal+on+Wednesday+via+the+MyMacca%27s+app%2C+featuring+our+very+own+middle+child%2C+the+McChicken.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3E%27Mid+kids%2C+now+is+your+time+to+shine.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Shout+yourself+a+$1+McChicken%2C+because+that%27s+what+we+call+a+middle+child+celebration.%27%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3ECustomers+will+earn+100+MyMacca%27s+Rewards+points+for+every+$1+spent+on+McDonald%27s+via+the+app.%3C/p%3E%3Cp+class%3D%22mol-para-with-font%22%3EFoodies+can+redeem+their+rewards+on+a+range+of+menu+items+including+popular+eats+like+cheeseburgers%2C+coffees%2C+and+fries+once+they+earn+2%2C500+points.%3C/p%3E%3C/div%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3C%21–+ad:+website+–%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Ca+href%3D%22https://alphatech.id/%22+rel%3D%22dofollow%22%3Ealphatech.id%3C/a%3E

https://queriesanswer.com/community/profile/arnettesverjens/

https://solucx.com.br/forum/index.php/community/profile/jsclorna0836885/

https://tapmeetsingh.com/community/profile/natewiles57457/

https://www.guidemagazine.org/participant/eugenegrubbs198/profile/?claim_code=&submit_2=&member%5Bsite%5D=https%3A%2F%2Falphatech.id%2F&member%5Bsignature%5D=%3Cp+class%3D%22mol-para-with-font%22%3EFollowing+is+a+summary+of+current+US+domestic+news+briefs.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EWhite+House+hopeful+Nikki+Haley+courts+moderate+Republicans+on+abortion%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EFormer+South+Carolina+Governor+Nikki+Haley+said+on+Tuesday+she+was+personally+against+abortion+rights+but+bore+no+ill+will+for+those+who+felt+differently%2C+in+a+rare+foray+by+a+Republican+White+House+hopeful+into+one+of+the+more+sensitive+issues+of+the+2024+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+election+campaign.+In+a+roughly+20-minute+speech%2C+Haley+described+the+debate+around+abortion+as+an+issue+for+each+state+to+decide.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EPandemic+reinforced+many+US+occupation+trends%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EMany+of+the+fastest-growing+occupations+held+by+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+workers+in+the+run-up+to+the+pandemic%2C+such+as+management%2C+finance+and+transportation%2C+gained+even+more+ground+in+the+first+two+years+of+the+health+crisis%2C+government+data+released+on+Tuesday+showed.+The+Labor+Department%27s+annual+snapshot+of+occupations+and+what+they+pay+also+showed+that+a+number+of+job+categories+that+were+already+struggling+to+attract+workers+before+the+pandemic+found+those+trends+continued+or+accelerated+in+the+chaotic+job+market+that+emerged+following+the+brief+but+historic+employment+losses+in+the+spring+of+2020.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EUS+nuclear+regulator+inspects+ground+settling+at+Ohio+plant%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EU.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+nuclear+regulator+said+on+Tuesday+it+has+launched+an+inspection+to+examine+ground+settling+at+various+places+around+Energy+Harbor+Corp%27s+Davis-Besse+nuclear+power+plant+in+Ohio.+The+Nuclear+Regulatory+Commission+said+in+release+it+determined+a+%22special+inspection%22+was+necessary+after+learning+that+a+failure+in+October+2022+of+a+pipeline+meant+to+supply+water+for+firefighting+was+likely+caused+by+stress+from+ground+settling+at+the+plant+in+Oak+Harbor+in+northern+Ohio%2C+near+Lake+Erie.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ETucker+Carlson%27s+exit+from+Fox+News+may+be+ratings+bane%2C+advertising+boon%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EStar+host+Tucker+Carlson%27s+abrupt+exit+from+Fox+News+is+likely+to+hit+short-term+ratings+but+could+nudge+more+mainstream+advertisers+to+consider+a+network+they+have+snubbed+for+being+too+partisan%2C+investors+and+analysts+said.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+News+of+his+departure+on+Monday+wiped+nearly+$1+billion+from+the+market+valuation+of+the+network%27s+parent+company%2C+Rupert+Murdoch-controlled+Fox+Corp.+The+stock+was+also+down+on+Tuesday.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EBiden%2C+80%2C+makes+2024+presidential+run+official+as+Trump+fight+looms%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EPresident+Joe+Biden+launched+his+re-election+bid+on+Tuesday+with+a+promise+to+protect+American+liberties+from+%22extremists%22+linked+to+former+President+Donald+Trump%2C+who+he+beat+in+2020+and+might+face+again+in+2024.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Biden+made+his+announcement+in+a+video+released+by+his+new+campaign+team+that+opens+with+imagery+from+the+Jan.+6%2C+2021%2C+attack+on+the+U.S.+Capitol+by+Trump%27s+supporters.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ERepublican+plan+could+limit+food+aid+for+nearly+1+million+people%2C+USDA+says%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ENearly+one+million+Americans+could+find+it+harder+to+access+federal+food+aid+under+a+Republican+proposal+to+expand+the+program%C2%B4s+work+requirements%2C+according+to+the+Biden+administration%2C+which+has+promised+to+veto+the+plan+if+it+passes+Congress.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+expanded+work+requirements+for+the+Supplemental+Nutrition+Assistance+Program+(SNAP)+were+included+in+a+plan+released+last+week+by+Republican+House+of+Representatives+Speaker+Kevin+McCarthy+to+cut+federal+spending+and+raise+the+debt+ceiling.+The+House+could+vote+on+the+plan+as+soon+as+Wednesday.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ETrump+rape+accuser%27s+case+not+a+%27he+said%2C+she+said%2C%27+lawyer+says+as+trial+starts%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EE.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Jean+Carroll%27s+accusation+that+Donald+Trump+raped+her+was+not+a+%22he+said%2C+she+said%22+dispute%2C+a+lawyer+representing+the+writer+told+jurors+on+Tuesday+as+a+civil+trial+over+the+former+U.S.+president%27s+conduct+nearly+three+decades+ago+got+under+way.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EShawn+Crowley%2C+who+represents+the+former+Elle+magazine+advice+columnist%2C+said+in+her+opening+statement+that+Trump+%22slammed+Ms.+Carroll+against+the+wall%22+and+%22pressed+his+lips+to+hers%2C%22+an+account+other+witnesses+were+prepared+to+verify.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EUS+House+Republicans+push+forward+on+debt+ceiling+bill+despite+party+concerns%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ETop+Republicans+in+the+U.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+House+of+Representatives+said+on+Tuesday+they+would+move+forward+with+a+vote+this+week+on+a+partisan+bill+to+slash+spending+and+raise+the+government%27s+$31.4+trillion+debt+ceiling%2C+despite+signs+of+growing+opposition+within+their+own+ranks.+House+Speaker+Kevin+McCarthy%2C+who+hopes+the+plan+will+jumpstart+talks+with+President+Joe+Biden%2C+ignored+reporters+who+asked+if+Republicans+had+the+218+votes+needed+to+adopt+the+measure%2C+which+would+raise+the+borrowing+limit+by+$1.5+trillion.%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3ESupreme+Court%27s+Roberts+declines+to+appear+at+Senate+Judiciary+hearing%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EU.S.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+Supreme+Court+Chief+Justice+John+Roberts+will+not+testify+at+an+upcoming+Senate+Judiciary+Committee+hearing+expected+to+focus+on+judicial+ethics%2C+he+said+in+a+letter+on+Tuesday+to+the+committee+chair.+The+committee%27s+Democratic+chairman%2C+Dick+Durbin%2C+had+asked+the+chief+justice+to+appear+before+the+panel+to+address+potential+reforms+to+ethics+rules+governing+the+justices.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+senator+cited+%22a+steady+stream+of+revelations+regarding+justices+falling+short+of+the+ethical+standards.%22%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EColorado+governor+signs+first+US+agriculture+right+to+repair+bill+into+law%3C/p%3E+%3Cp+class%3D%22mol-para-with-font%22%3EColorado%27s+governor+signed+the+nation%27s+first+right+to+repair+legislation+into+law+on+Tuesday%2C+giving+the+state%27s+farmers+and+ranchers+the+autonomy+to+fix+their+own+equipment.%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+The+bill%2C+which+requires+manufacturers+such+as+Deere+%26amp;+Co+to+provide+manuals+for+diagnostic+software+and+other+aids%2C+garnered+bipartisan+support+as+farmers+grew+increasingly+frustrated+with+costly+repairs+and+inflated+input+prices+denting+their+profits.%3C/p%3E%3C/div%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3C%21–+ad:+website+–%3E%3Cp%3E%26nbsp;%3C/p%3E%3Cp%3E%26nbsp;%3C/p%3E+%3Ca+href%3D%22https://alphatech.id/%22+rel%3D%22dofollow%22%3Ealphatech.id%3C/a%3E

https://www.virginiaseeds.com/community/profile/twilaryan32409/

http://www.customer-service.bookmarking.site/user/phillisvaz/

http://www.makeup.sblinks.net/user/rafaellecl/

http://www.market-research.ipt.pw/user/davisc6312/

http://www.process.dofollowlinks.org/user/mikkiflind/

http://www.tshirts.sbm.pw/user/helenswayn/

https://45listing.com/story15873122/https-alphatech-id

https://7prbookmarks.com/story14611779/https-alphatech-id

https://allkindsofsocial.com/story14737754/https-alphatech-id

https://bookmarkahref.com/story14603404/https-alphatech-id

https://bookmarkangaroo.com/story14649579/https-alphatech-id

https://bookmarkboom.com/story14576683/https-alphatech-id

https://bookmarkeasier.com/story14519525/https-alphatech-id

https://bookmarkfavors.com/story15056889/https-alphatech-id

https://bookmarkforce.com/story14623956/https-alphatech-id

https://bookmarkhard.com/story14553632/https-alphatech-id

https://bookmarkinglife.com/story15043512/https-alphatech-id

https://bookmarkoffire.com/story14527371/https-alphatech-id

https://bookmarkplaces.com/story14594066/https-alphatech-id

https://bookmarksbay.com/story14618724/https-alphatech-id

https://bookmarkshome.com/story15062862/https-alphatech-id

https://bookmarksoflife.com/story15051872/https-alphatech-id

https://bookmarkspiral.com/story14588926/https-alphatech-id

https://bookmarkspring.com/story8969458/https-alphatech-id

https://bookmarksystem.com/story14576287/https-alphatech-id

https://bookmarktune.com/story14590272/https-alphatech-id

https://bookmarkuse.com/story14507409/https-alphatech-id

https://brightbookmarks.com/story14624958/https-alphatech-id

https://captainbookmark.com/story14596991/https-alphatech-id

https://cruxbookmarks.com/story14624622/https-alphatech-id

https://dirstop.com/story15919827/https-alphatech-id

https://dirstop.com/story15919983/https-alphatech-id

https://ez-bookmarking.com/story14593563/https-alphatech-id

https://followbookmarks.com/story14679531/https-alphatech-id

https://friendlybookmark.com/story14602133/https-alphatech-id

https://funbookmarking.com/story14608782/https-alphatech-id

https://highkeysocial.com/story15027012/https-alphatech-id

https://iowa-bookmarks.com/story10065662/https-alphatech-id

https://macrobookmarks.com/story14637072/https-alphatech-id

https://myeasybookmarks.com/story15035663/https-alphatech-id

https://myfirstbookmark.com/story14620327/https-alphatech-id

https://nimmansocial.com/story3911711/https-alphatech-id

https://pr8bookmarks.com/story14641008/https-alphatech-id

https://seobookmarkpro.com/story14628924/https-alphatech-id

https://social-lyft.com/story4063688/https-alphatech-id

https://social-medialink.com/story14746672/https-alphatech-id

https://socialbookmarkgs.com/story14593223/https-alphatech-id

https://socialclubfm.com/story4383183/https-alphatech-id

https://socialicus.com/story14730539/https-alphatech-id

https://socialinplace.com/story14716476/https-alphatech-id

https://socialistener.com/story14736399/https-alphatech-id

https://sociallytraffic.com/story15033875/https-alphatech-id

https://socialmarkz.com/story4371998/https-alphatech-id

https://socialmediatotal.com/story14722987/https-alphatech-id

https://socialtechnet.com/story14928541/https-alphatech-id

https://thebookmarkplaza.com/story14558374/https-alphatech-id

https://thefairlist.com/story4206619/https-alphatech-id

https://thesocialcircles.com/story15052854/https-alphatech-id

https://thesocialintro.com/story15057438/https-alphatech-id

https://top100bookmark.com/story14641118/https-alphatech-id

https://top10bookmark.com/story14570222/https-alphatech-id

https://total-bookmark.com/story14529501/https-alphatech-id

https://travialist.com/story4173484/https-alphatech-id

https://tvsocialnews.com/story15069045/https-alphatech-id

https://worldsocialindex.com/story14728835/https-alphatech-id

https://ztndz.com/story15906943/https-alphatech-id

http://alsace.wiki/index.php?title=Bank

http://alsace.wiki/index.php?title=Utilisateur:FeliciaCardoza2

http://cifarelli.net/mediawiki/index.php/Money

http://cifarelli.net/mediawiki/index.php/User:Evan63A742531

http://classicalmusicmp3freedownload.com/ja/index.php?title=%E5%88%A9%E7%94%A8%E8%80%85:KISBrooks181

http://classicalmusicmp3freedownload.com/ja/index.php?title=Google

http://cse.wiki/wiki/Openai

http://cse.wiki/wiki/User:NicoleGauthier5

http://daveydreamnation.com/w/index.php/Bank

http://daveydreamnation.com/w/index.php/User:LouellaCheng

http://diktyocene.com/index.php/Marketing

http://diktyocene.com/index.php/User:JeanneOuthwaite

http://edugenius.org/index.php/Money

http://edugenius.org/index.php/User:LeonardoMowle14

http://embeddedwiki.cs.aau.dk/wiki/Openai

http://embeddedwiki.cs.aau.dk/wiki/User:MalorieMacon63

http://erwinbrandenberger.ch/index.php?title=Benutzer:JeffryRogers

http://mediawiki.gilderlehrman.org/wiki/index.php/Bank

http://mediawiki.gilderlehrman.org/wiki/index.php/User:AWBEllis1420934

http://ntntw.info/index.php/School

http://ntntw.info/index.php/User:KimberlyPinkerto

http://postgasse.net/Wiki/index.php?title=Benutzer:DanaeShenton25

http://public.esquireempire.com/Management

http://public.esquireempire.com/User:KirstenDeason5

http://wiki-beta.avazinn.com/w/index.php?title=Bank

http://wiki-beta.avazinn.com/w/index.php?title=User:SharronConybeare

http://wiki-ux.info/wiki/Management

http://wiki-ux.info/wiki/User:CandidaDryer

http://wiki.dr-big.de/index.php?title=Benutzer:TereseLaird7

http://wiki.gewex.org/index.php?title=Bank

http://wiki.gewex.org/index.php?title=User:CelestaTang0980

http://wiki.legioxxirapax.com/index.php?title=Management

http://wiki.legioxxirapax.com/index.php?title=U%C5%BCytkownik:VeolaMadrigal2

http://wiki.manizales.unal.edu.co/index.php/Bank

http://wiki.manizales.unal.edu.co/index.php/Usuario:Arlette5534

http://wiki.shitcore.org/index.php/Money

http://wiki.shitcore.org/index.php/User:Stefanie32K

http://www.heerfamily.net/mediawiki/index.php/Chatgpt

http://www.heerfamily.net/mediawiki/index.php/User:AmandaBracken62

http://www.itguyclaude.com/wiki/Money

http://www.itguyclaude.com/wiki/User:AugustaLemos9

http://www.miragearb.com/wiki/Management

http://www.miragearb.com/wiki/User:Landon46E63406

http://www.wikione.org/index.php/Sales

http://www.wikione.org/index.php/User:Ashli40C7795513

http://www.xxx_www.itguyclaude.com/wiki/Management

http://www.xxx_www.itguyclaude.com/wiki/User:GeneI15278

http://www.zilahy.info/wiki/index.php/Management

http://www.zilahy.info/wiki/index.php/User:PatriciaQuilty

https://able.extralifestudios.com/wiki/index.php/Marketing

https://able.extralifestudios.com/wiki/index.php/User:CliffY818430

https://aliensvspredator.org/wiki/index.php?title=User:TrevorFredrickso

https://barbiewiki.com/view/Openai

https://barbiewiki.com/view/User:JaxonMcwhorter6

https://bbarlock.com/index.php/User:FrancinePitcher

https://biowiki.clinomics.com/index.php/Chatgpt

https://biowiki.clinomics.com/index.php/User:OtiliaHolloway5

https://camarowiki.com/index.php?title=Sales

https://camarowiki.com/index.php?title=User:AnyaEtheridge

https://chips.wiki/index.php?title=Management

https://chips.wiki/index.php?title=User:AngelesB76

https://dekatrian.com/index.php/Chatgpt

https://dekatrian.com/index.php/User:SylviaMichaels

https://hegemony.xyz/wiki/index.php?title=Openai

https://hegemony.xyz/wiki/index.php?title=User:SherrieGilroy4

https://hu.velo.wiki/index.php?title=Szerkeszt%C5%91:MelvaGepp67804

https://iamelf.com/wiki/index.php/Google

https://iamelf.com/wiki/index.php/User:EdwardoLynas

https://imatri.net/wiki/index.php/Sales

https://imatri.net/wiki/index.php/User:MammieEvergood

https://livingbooksaboutlife.org/books/Google

https://livingbooksaboutlife.org/books/User:ShirleyOdriscoll

https://marionsrezepte.com/index.php/Benutzer:OtiliaCovert

https://marionsrezepte.com/index.php/Marketing

https://mnwiki.org/index.php/Google

https://mnwiki.org/index.php/User:LeliaTrethowan

https://ncsurobotics.org/wiki/index.php/Chatgpt

https://ncsurobotics.org/wiki/index.php/User:AngusBertrand3

https://polaroid.wiki/index.php/User:LouellaDeMaistre

https://procesal.cl/index.php/Bank

https://procesal.cl/index.php/User:JensHafner91563

https://religiopedia.com/index.php/Bank

https://religiopedia.com/index.php/User:LukeFulton

https://safehaven.vertinext.com/Chatgpt

https://safehaven.vertinext.com/User:ClaytonMiner09

https://sustainabilipedia.org/index.php/Openai

https://sustainabilipedia.org/index.php/User:KristalParmley

https://vanburg.com/mw19/index.php/Benutzer:ForestCatalano3

https://vanburg.com/mw19/index.php/School

https://wiki.beta-campus.at/wiki/Benutzer:VanceMauldin05

https://wiki.beta-campus.at/wiki/Marketing

https://wiki.cjgames.it/wiki/index.php?title=Money

https://wiki.craftaro.com/index.php/Marketing

https://wiki.craftaro.com/index.php/User:ChristenR18

https://wiki.flexiblemedia.net/paradise_lust/Management

https://wiki.flexiblemedia.net/paradise_lust/User:HoraceBrunton55

https://wiki.geocaching.waw.pl/index.php?title=School

https://wiki.geocaching.waw.pl/index.php?title=U%C5%BCytkownik:Milagros34Q

https://wiki.ioit.acm.org/index.php/Money

https://wiki.ioit.acm.org/index.php/User:MarianneSowers

https://wiki.lhs.science/Management