Netflix: A Temporarily Overvalued Company With Real Potential

Confira nosso último artigo (10/06/2014 )no Seeking Alpha: Netflix: A Temporarily Overvalued Company With Real Potential

Clique aqui para ler o artigo diretamente no Seeking Alpha.

Summary

- Netflix may be an innovative company with strong growth prospects, but its recent rally has sent its stock price into overvalued territory.

- Netflix’s international growth prospects have been overweighted, while the potential risks of expansion and various domestic hurdles have been overlooked or marginalized.

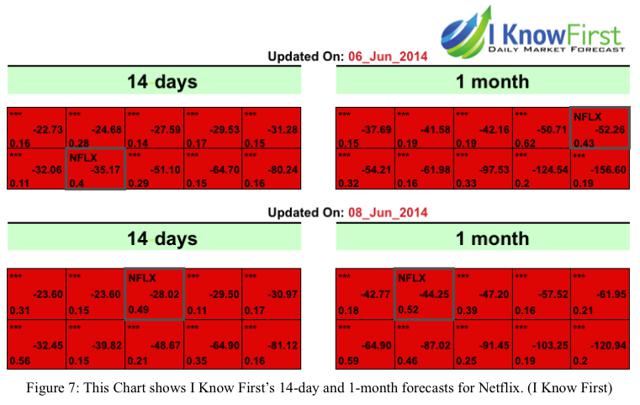

- I Know First’s algorithm forecasts a decrease in Netflix’s stock price in the 14-day and 1-month time horizons.

Netflix (NFLX) is a archetypal growth company. It’s forging its own market by disrupting the hegemony of existing multichannel video programming distributors (MVPD) including Cable and satellite service providers. It is growing at a fast pace, increasing its users both domestically and internationally, while increasing revenues and profits. And it’s aggressively pursuing novel strategies such as providing its own original programming, supplying the previous seasons of current popular television programs, and uploading TV episodes the day after they air. This innovation and concomitant growth has been reflected in its stock price, which has risen more than 1000% percent in the past five years. However, investors may become a bit too exuberant about Netflix’s growth prospects and attribute too much value to its plans to increase its domestic market share and grow internationally. Although Netflix has consistently posted strong earnings and growth reports, its stock price is prone to excessive speculation and ebullience. In one of last year’s letters to shareholders, Netflix CEO Reed Hastings even warned, “we had solid results compounded by momentum-investor-fueled euphoria.” I Know First, which correctly predicted that Netflix would continue to grow in its January 7th Seeking Alpha article, currently forecasts that Netflix will decrease in the short and medium-term time horizons. Many analysts have been attributing Netflix’s recent rally to its optimistic international growth forecasts; however, I believe that much of this potential had already been priced into the stock price. Additionally, Netflix is now vulnerable to increased variable costs as Internet service providers will be allowed to charge surplus fees to provide faster streaming capabilities to its subscribers. Therefore, now that the momentum of Netflix’s rally has begun to decelerate in the past week, I believe that Netflix’s stock will temporarily correct as the market realizes that it has overweighted the potential of international expansion, reacts to increased operating costs, and acknowledges other hurdles that Netflix will face.

Innovative Company with Solid Growth

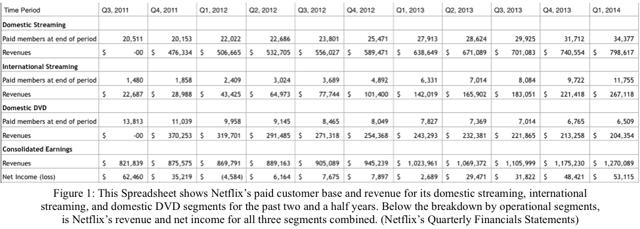

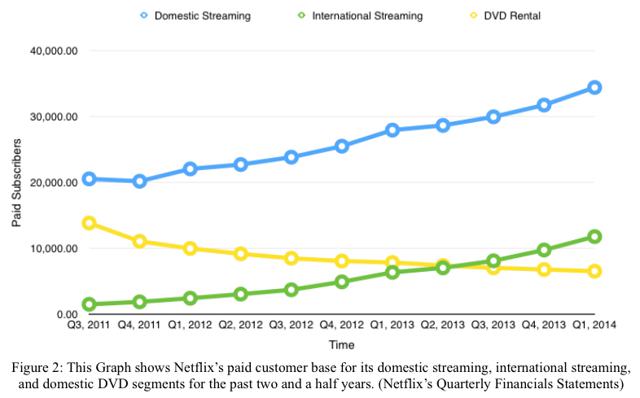

There is no doubt that Netflix is an innovative company that has been growing at an exceptionable pace in the past decade. It is also an adaptable company that has been able to transition away from its flagship DVD rental business and successfully pivot toward an online streaming business. Figures 1 and 2 clearly show how Netflix managed to increase its revenue by growing its domestic and international streaming businesses, despite decreasing revenues from its original domestic DVD rental business.

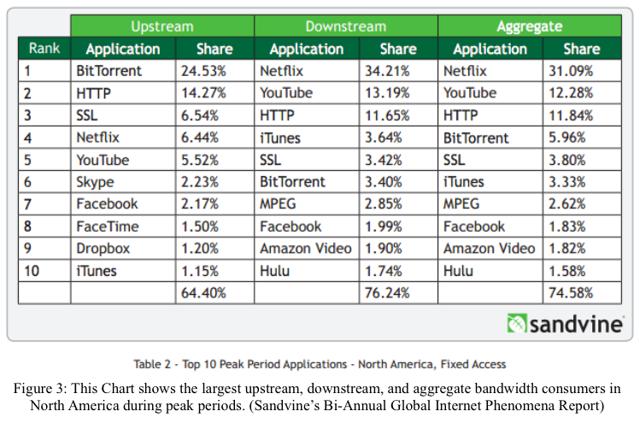

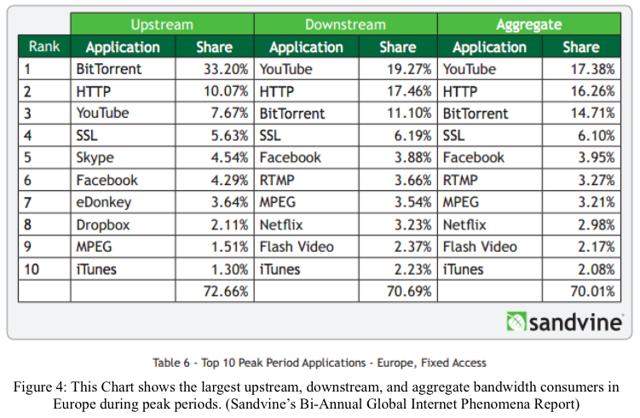

Additionally Netflix has been generating increased downstream Internet traffic, indicating that more subscribers are watching more videos on its online streaming platform. Figure 3 shows the Canadian network equipment company Sandvine’s data for the total peak period, fixed access Internet bandwidth consumptions. Netflix’s downstream share has increased from 31.62% in the second half of 2013 to 34.21% in the first half of 2014. Netflix’s increased bandwidth consumption coupled with file-sharing websites such as BitTorrent’s decrease in bandwidth consumption, seems to indicate a trend that media consumers are shying away from downloading and streaming content illegally and turning to legitimate sources instead. This trend is good news for Netflix’s expansion into Europe, which currently downloads more media content illegally (as can be seen by BitTorrent’s greater traffic share in Figure 4), presumably because it has fewer legitimate sources that provide desired content.

Why International Growth is No Surprise

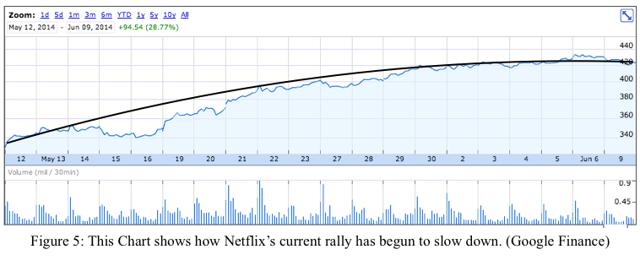

Netflix seems to be in a solid position for further growth both domestically and internationally as it has been gradually increasing its market share and revenue in both markets and has been investing heavily in expansion. Moreover, Netflix’s CEO Reed Hastings announced in his April 21st letter to shareholders that he “anticipate[s] over 50% y/y growth in Q2” in Netflix’s international revenue. Hastings’ growth forecast is pretty standard, if not conservative relative to Netflix’s international growth in the past two years as shown in Figure 1. However, despite this seemingly typical growth forecast, many analysts, including JPMorgan’s Doug Anmuth, have been emphasizing Netflix’s international potential as its primary reason for continued stock gain. I believe the overweighed importance of Netflix’s international expansion has been the main reason for its stock’s 30% increase in the past month. Now that the overly-optimistic forecasts of Netflix’s international growth potential should have already been priced into its stock, and the stock’s growth seems to be decelerating, as shown in Figure 5, I believe that Netflix’s stock will experience a brief correction in the next month.

Potential Hurdles for Netflix

The stock market is currently extremely bullish on Netflix and seems to have priced in the most optimistic forecast of Netflix’s future growth while pricing out many potential hurdles and risks. Netflix will have to compete with burgeoning domestic competitors that are establishing their own streaming services. European growth will likely be weighed down by regulation and established local competitors. And Internet service providers are in the process of charging Netflix surplus expenses in exchange for faster Internet connections that will eat into Netflix’s bottom line. Any of these potential complications could cause Netflix’s stock price to fall temporarily.

Since Netflix was a pioneer in Internet streaming, it was able to purchase the rights to stream various TV programs and movies early on at low costs; however, now that there are more companies offering streaming services, Netflix will likely have to pay higher prices to stream the same content. Although Netflix has long maintained that “since much of the content on Netflix and Amazon (AMZN) Prime (as well as Hulu in the U.S.) is mutually exclusive, many consumers see value in subscribing to all three networks,” Netflix will still have to pay more for its content. Additionally, Netflix itselfclaimed that its “biggest long-term competitor for entertainment time remains the MVPDs improving through TV Everywhere, as they are doing with HBO Go.” Perhaps as these traditional content creators create their own streaming services, they will stop allowing Netflix to stream their content altogether. While Netflix has established itself as an early leader in the domestic online streaming business, there is no guarantee that its growth will continue.

Although Netflix has been gradually growing its international presence in the past few years, entering the mainland European market will most likely be much more difficult than expanding into Canada, the UK, and Ireland. Of course there are the linguistic hurdles, but there are important cultural and legal hurdles as well, as Mark Scott explains in his May 21st New York Timesarticle. Many European pay-television channels have exclusive rights to air some of Netflix’s most popular content; most notably, Netflix will be unable to provide its most popular original series, “House of Cards” in France because it has already sold the rights to another television network. According to current French laws, Netflix will also have to wait three years before offering movies that are shown in theaters. Additionally, many of Europe’s largest television networks already have their own popular streaming services that have stronger brand recognition in their home markets. Expanding into Europe will also be expensive and will probably take significant time to achieve significant profits. There is undoubtedly much potential in the European market, but it currently seems investors are factoring only optimistic scenarios into Netflix’s stock price without accounting for any of the risk involved in its international ventures.

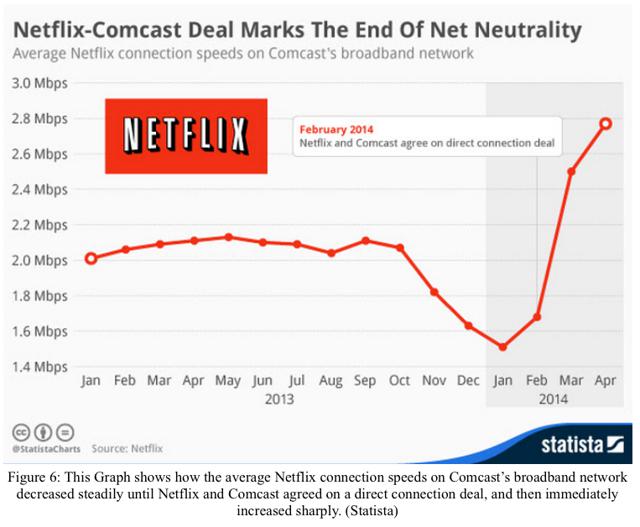

The January F.C.C. ruling that struck down net neutrality will also drive up Netflix’s operating costs as it is forced to negotiate higher prices for “faster”Internet connections. After more than 100 technology companies opposedthe F.C.C.’s position, the F.C.C. agreed to reopen the issue for debate. However, the current composition of the five-member F.C.C. panel seems unlikely to change its current position. Figure 6 shows how Comcast, one of the largest Internet service providers, decreased the Internet connection speeds of Netflix’s users until Netflix agreed to pay it additional fees for “faster” connections.

Immediately after reaching a deal, Netflix customers who use Comcast’s (CMCSA) broadband network saw their Netflix connection speeds increase by more than 80%. Netflix also agreed to pay Verizon (VZ) surcharges for fasterInternet connection in April, but aggressively accused it of being responsible for recent slow connection speeds. These additional fees to Internet service providers will increase Netflix’s operating costs, but don’t yet appear to have been factored into Netflix’s stock price.

I Know First’s Algorithmic Netflix Forecast

I Know First is a financial startup that provides daily investment foresightbased on an advanced self-learning algorithm. The financial algorithm is based on artificial intelligence and machine learning and also incorporates elements of artificial neural networks and genetic algorithms. This unique financial market-forecasting algorithm analyzes, models, and predicts over 1,400 markets in the short, medium, and long-term time horizons. I Know First’s forecasts cover stocks, ETFs, world indices, commodities, currencies, and interest rates.

I Know First specializes in longer-term algotrading, a market neutral strategy that is suitable for most investors. Its algorithm analyzes the structure and trends of the market, finds predicable patterns, and recommends tradesbased upon its machine-derived forecasts. Algorithms objectively value stocks and protect investors against irrational psychological pressures, volatility, risks, and high transaction costs.

I Know First’s analytic branch, I Know First Research, released an article on Seeking Alpha this past January that was bullish on Netflix – Netflix has since risen about 18%. However, now that Netflix’s stock has increased more than 30% in the past month, I Know First’s algorithm indicates that Netflix is currently overvalued and likely to fall in the 14-day and 1-month time horizons, as shown in Figure 7. The dark red hues indicate “strongly bearish” sentiments and the pinkish hues indicate “moderately bearish” sentiments. The negative number in the middle of the box labeled NFLX is the stock’s signal that represents the direction and magnitude the algorithm believes the stock will move. The decimal number on the bottom of that box is the stock’s predictability quotient, a relative indicator of how likely the stock will move in the predicted direction.

When analyzing a stock’s signal and predictability it is important to compare its present signal and predictability to its own historical signals and predictabilities and then track their daily changes. For example, if we compare Friday’s 14-day and 1-month Netflix predictability quotients of 0.40 and 0.43 respectively to Sunday’s 14-day and 1-month Netflix predictability quotients of 0.49 and 0.52 respectively, we can see that I Know First’s algorithm is becoming more confident in its negative forecast.

Conclusion

Netflix may be a fundamentally strong growth company bound for sustained substantial success; however, it is important to consider the various risks and hurdles it will face. Since Netflix offers a familiar and popular product, its stock has garnered a lot of public interest and has thus become highly speculative. Oftentimes its investors are also avid users of its products who can irrationally conflate product satisfaction with stock growth potential, thus continually inflating its fair-valued stock price. I believe Netflix investors’ current exuberance about international growth has been overweighted and the many risks it faces including increased competition domestically and abroad, increased operational costs, and various expansion hurdles are being overlooked or marginalized. As Netflix’s stock growth has recently decelerated and even decreased yesterday, it would seem that its month-long rally has started to come to an end. Now that its most optimistic international growth forecasts have driven up its price, and considering that there are many potential negative catalysts, I believe that Netflix’s stock will correct itself in the short to medium-term time horizon.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Ethan Fried (Harvard College ’16) one of our analysts. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.