Netflix Is Still A Good Value: An Algorithmic Analysis

Summary

- Netflix has been the top performing stock since the beginning of the year, climbing over 66%.

- Some have argued that the company’s costs for original content and international expansion are too high, but all that matters right now is subscriber growth.

- The television market will be set up in the future to allow streaming services like Netflix, with quality original content and a large number of potential subscribers.

- The I Know First algorithm is bullish on Netflix for both the three-month and one-year time horizons.

Netflix (NASDAQ: NFLX) has been the top performing stock in the S&P 500 during 2015, with the stock price increasing over 66% since the beginning of the year. I Know First published a bullish forecast predicting that the stock price would climb back above its previous all-time high on January 9th, and the past couple of earnings reports have caused this prediction to come to fruition. After Bank of America Merrill Lynch moved its rating of the stock from underperform to buy, the stock price moved to a new all-time high on Tuesday.

Investors might be tempted to sell their shares of the stock and new investors might not believe that now is the time to buy shares of this company. However, the stock price is likely to only continue to climb higher as the company’s strategy to drive subscription growth, its main focus, is still on track. While some analysts complain about the company’s lack of transparency about international subscribers by region and viewers of its content, it is very transparent about its growth plans, and they fit perfectly with the changing landscape of television.

Netflix Subscriber Growth Strategy

Netflix bears have complained about the lack of transparency when it comes to revealing how many subscribers are actually watching its shows, especially the original content that the service likes to brag about such as Orange is the New Black. Variety recently released some data based off of a sample size of 2,500 viewers using computers, laptops and smartphones. While far from scientific, it did reveal that Netflix’s new show, Daredevil, was its most popular release so far.

Figure 1. Source: Netflix.com

While the streaming service won’t confirm or comment on the data, it is still rather transparent about its overall vision and strategy for the company, which I view to be much more important. Netflix CEO Reed Hastings has made it clear that subscriber growth is the company’s main focus for the time being, eschewing increased profitability and operating margins. The company’s strategy to drive this revenue growth also was made abundantly clear: international expansion and increased quality, original content.

Netflix plans to finish its expansion to 200 countries by the end of 2016 while maintaining low profits during that time. During the last quarter, the streaming service was introduced in Cuba, Australia and New Zealand, while advertising costs were moved to international accounts as the executive team focuses on growing international subscribers. This strategy paid off as 2.6 million subscribers were added internationally.

With more international expansion and an emphasis on adding international subscribers, the possible base for subscribers will grow. Turning those potential subscribers into actual subscribers will be reliant on the original content provided by Netflix, which brings up the other complaint about the company constantly made by detractors: the rising cost of content. Netflix is making a move to make itself more like the other main streaming service it will compete with in the future – HBO.

This subsidiary of Time Warner Cable Inc. (NYSE: TWC) recently released its own streaming service, HBO Now. Hastings recently announced that Netflix will now attempt to own more of its original content, as opposed to its current practice of licensing original content that’s owned by other studios. This will increase the costs of the content in the short term, but it will make it cheaper to own the content in all of its markets as it expands internationally. This is important, as Netflix actually doesn’t own the rights for its show House of Cards in certain international markets.

Netflix Set Up For Future Television Model

While these two strategies are likely to keep profits low until at least the end of 2016 and possibly longer, with content costs continuing to be a larger portion of revenue compared to its peers, the stock price will not be affected because Hastings and the executive team have made clear that this would be the case. That is why subscriber growth is all that matters at this point in time for the stock. While some might think that this is a poor strategy, it is in fact perfect for the changing television landscape, something that Hastings has in mind.

Coming back to HBO and its new streaming service, some believe that it could be a rival of Netflix. In fact, the two streaming services that provide original content, as well as a backlog of popular movies and television shows, will actually be compliments in the future. Hastings’ goal is not to beat HBO, but to beat the current television setup.

During the most recent earnings call, Hastings said, “Linear TV has been on an amazing 50 year run, (but) Internet TV is starting to grow. Clearly over the next 20 years Internet TV is going to replace linear TV… Internet TV is the way that people will consume video in the future.” This goes along well with comments made recently by Apple (NASDAQ:AAPL) CEO Tim Cook during his company’s earnings call, when he said that “major, major changes in media that are going to be really great for consumers” and that he expected Apple to be part of it.

The major changes that Cook was referring to were about its new Apple TV product, which could be launched as early as next month at its World Wide Developers Conference. The future of television will allow consumers to pick which channels they want to have, instead of the current model where channels are bundled together, causing people to pay for channels they don’t really want.

Figure 2. Source: videotips.jimdo.com

Streaming services like Netflix and HBO will be major beneficiaries of this change in the market. Consumers will no longer have to pay for channels that don’t have quality programming that they want, giving them more money to pay for streaming services like Netflix that do have content they desire. Netflix also has a headstart over other streaming services in this field, as it has been streaming for longer and has a better content library.

By the time that this new television market becomes a reality, Netflix will have finished its international expansion and will have more original content to attract and retain subscribers. It will then be time to switch the focus to increasing profits, and the growing popularity of the streaming market, along with the continuing growth of international subscribers, will make this achievable for the company.

Algorithmic Analysis

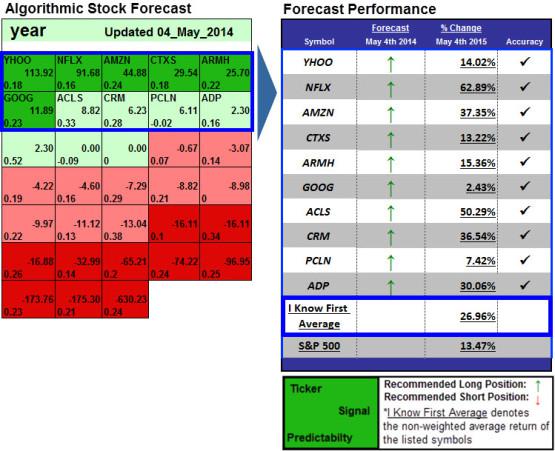

I Know First self learning algorithm was correctly able to predict the rise of Netflix’s stock price over the past year. In this forecast from May 4th, 2014, Netflix was included as one of the top 10 tech stocks to buy in the one-year time horizon. The company had a signal strength of 91.68 and a predictability indicator of 0.16. In accordance with the algorithm’s prediction, the stock price increased 62.89% since that time.

Figure 3. 1-Year Algorithmic Performance For Netflix.

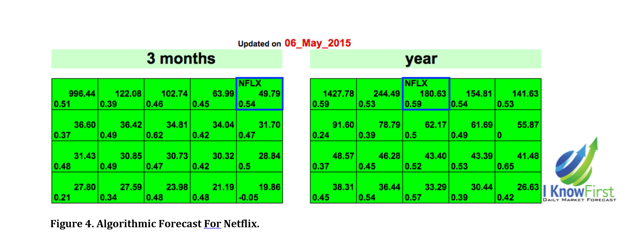

Having explained how I Know First’s algorithm works and demonstrated its success in predicting the stock’s behavior in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The figure below includes the three-month and one-year forecasts for Netflix from May 6th, 2015. In both forecasts, the company has a strong positive signal, indicating the algorithm is bullish for the stock.

Figure 4. Algorithmic Forecast For Netflix.

The algorithmic analysis is in agreement with the bullish fundamental outlook of the company. While profitability will continue to be underwhelming for the next couple of years, subscriber growth will cause the stock price to continue to climb, especially as momentum continues to build. When the international expansion is completed, the company will be in perfect position to grow profits in a new television market more suited for its business model. Netflix executives learned from their mistakes when it caused the stock price to crash in 2011 and will avoid upsetting consumers. The stock price will continue to soar, and is still a good value even with how much it has climbed already this year.

I Know First Research is the analytic branch of I Know First, a financial start up company that specializes in quantitatively predicting the stock market. This article was written by Aaron Tallan. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.