Netflix Stock Forecast For 2015 Based On A Predictive Algorithm, Part II

Confira nosso artigo (21/1/2015) no Seeking Alpha: Netflix Stock Forecast For 2015 Based On A Predictive Algorithm, Part II

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- NFLX is up more than 18% Wednesday after its Tuesday earnings report.

- Strong subscription growth has been made possible because of international expansion.

- Netflix will complete its global expansion in the next two years, remaining profitable over that period.

- I Know First published a bullish forecast for Netflix on January 9th.

Netflix (NASDAQ:NFLX) released its earnings report on Tuesday, triggering an after hours rally and, as of midday Wednesday, a more than 18% increase in its stock price to $412.66.

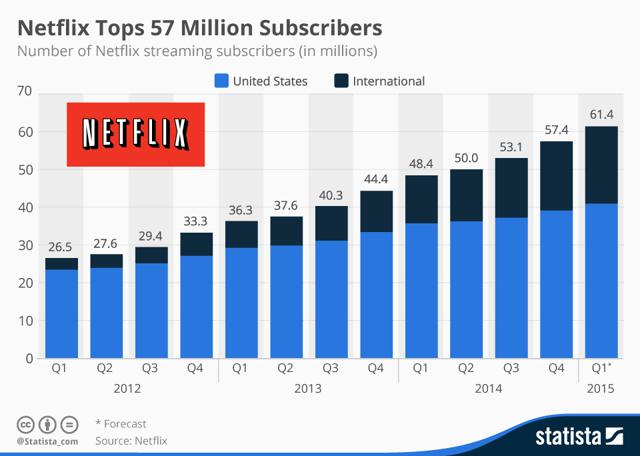

In the fourth quarter of 2014, Netflix earned $1.48 billion in revenue and reported a profit of $83.4 million. The streaming service added 1.9 million net subscribers in the US to edge its guidance of 1.85 million and the consensus view of 1.83 million. Its international subscriber growth did even better, adding 2.43 million, beating its 2.15 million guidance and the 2.17 million consensus expectation.

I Know First published an article on Seeking Alpha about Netflix roughly two weeks ago. The article expressed a bullish forecast for 2015 using both fundamental and algorithmic analysis. The circumstances surrounding Netflix’s stock price dropping after the third quarter earnings report, when it fell nearly 20% overnight, were compared to what caused the stock price to fall precipitously in 2011.

In both cases, a price increase, international expansion and growing content costs caused investors to become concerned about the company’s health. The price fell after an earnings report where consumer growth did not meet expectations in both instances. After the stock price fall of 2011, it took roughly two years for the stock price to rebound, as Netflix underestimated the effect a roughly 60% price increase would have on consumers. Netflix lost 800,000 subscribers during the next quarter, and it took until the beginning of 2013 for the company to ease investors concerns.

In the article published on January 9th, I Know First claimed it would not take as long for the stock price to rebound this time, and that investors should be on the lookout for the earnings report released on January 20th.

Reasons For The Strong Earnings Report

As explained in the original article, the price increase for streaming services in this instance was only a dollar, and Netflix conducted extensive research and testing unlike in 2011. We expected consumer growth to return back to normal very quickly, as Netflix is now the definitive number one location to watch TV shows and movies online. About 1.9 million Americans signed up for Netflix during the previous quarter, slightly down from a year prior.

This could be seen as discouraging, but Netflix now has 39 million domestic subscribers and CEO Reed Hastings still believes the company will reach its goal of 60 million to 90 million domestic subscribers. He stated in the earnings call transcript that the company is still adding over five million domestic subscribers a year, so the trajectory remained promising. He also stated, “If you step back and you say is Internet video going to be in every home in America in 10 years, that’s a pretty clear yes. So, tons of potential there and we’re very excited about just continuing to improve our service.”

International expansion was another reason we expected better than projected subscription growth. Netflix recently expanded into European countries such as Germany and France, and now offers the service in about 50 countries. The new markets were more abundant with high-speed broadband service than any of the other markets it had expanded into and would provide abundant growth opportunities in the future. Netflix does not specifically discuss subscription growth in individual markets for competitive reasons. The company did announce that 2.43 million non-US viewers signed up for Netflix in the quarter, a 40% increase since the same period a year earlier.

Source: Statista.com

The international expansion has startup costs that will eat into profits, which concerned investors. Some believed that Netflix’s model of international expansion was impractical, as it was losing money. However, we believed that the startup costs would decline over the next few years, agreeing with MoffettNathanson analyst Michael Nathanson. He claimed that losses would decline over the next couple of years before breaking even in 2016 or 2017 and becoming profitable by 2018. Hastings announced in the earnings report that Netflix plans to complete its global expansion over the next two years while staying profitable. The company then intends to make material global profits from that point forward.

Investors’ biggest concern will continue to be content costs, as streaming content obligations have swollen to $9.5 billion from $7.3 billion a year ago. The cash-intensive phase of content costs is likely to continue for quite a while, but Netflix will offer 320 hours of original programming this year, more than three times the amount it did in 2014. The video streaming company spends roughly $300 million a year producing its own content, but this amount is paid up front. Much of the licensing costs for others’ content is paid in installments over time. The original content costs will eat into profitability, but will help Netflix remain the premier video streaming service.

Netflix continues to not be threatened by competitor streaming services, believing that they are complimentary to each other in the long run. Consumers are moving away from cable and traditional television packages, as many viewers are cutting the cord and moving towards streaming exclusively. As competitors become stronger and more options become available through streaming, Netflix will benefit, as more consumers will sign up for their service as well.

Conclusion

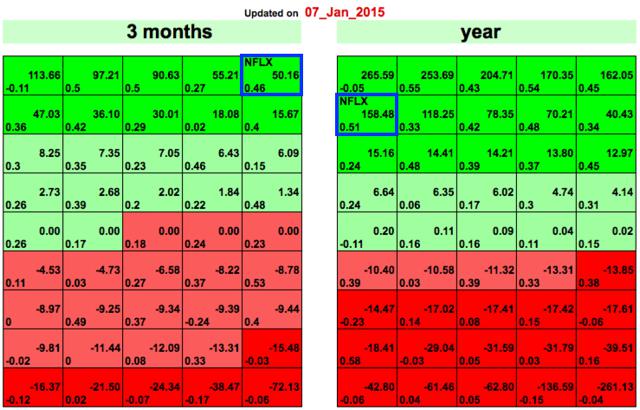

The original article on Netflix included the algorithmic forecast made on January 7th by the I Know First algorithm, shown below.

I Know First is an investment firm that uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to supplement its fundamental analyses. In doing so, it predicts the flow of money in almost 2,000 markets across a range of time frames (e.g., 3-days, 1-month, 1-year). It should be noted that the algorithm’s predictability (i.e., its accuracy) becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – most effectively be used to analyze both short-term and long-term trends, but is not as convenient where intraday trading is concerned.

Since the article asserting a bullish stance on Netflix was posted, the stock price has increased over 20%, as investors regained confidence in the stock after the fourth quarter earnings report was released yesterday. The arguments for a bullish outlook on Netflix came to fruition in the report.

I Know First continues to be bullish on Netflix, believing that the company’s strategy of international expansion and new, exciting original content will drive the company’s growth. The stock is likely to stay volatile, like all companies that put expansion and growth before profit. However, the company will be profitable in the long term, and the overall health of the company looks very promising. While the chance to buy the stock at a premium price might have passed for the moment, the stock still has room to grow, and will move even higher before the end of the year.