Nokia: Can The Phoenix Rise Again?

Summary

- Increasing revenue via signing rewarding royalty contracts with major mobile phone companies.

- Partnership with India’s largest mobile phone manufacturer.

- All set on re-entering the mobile phone manufacturing market in 2016.

- Analysts are confidently predicting NOK’s share to rise.

- I Know First’s algorithm is bullish on Nokia.

Nokia (NYSE:NOK) used to be the world’s largest phone maker, but, with the advent of smartphones in the early 2000s, the Finnish multinational has experienced a colossal decline. Recently, Nokia have churned out streams of good news and prospective deals – prompting RBC Capital to inform investors that Nokia’s stock has the, “highest potential return in its large cap coverage considering the numerous catalysts ahead.” The series of recent news regarding Nokia could allow the company to attempt to regain some of its former glory.

Royalty Fees

Nokia has roughly 30,000 patents related to 2G, 3G and 4G technology and Nokia’s patents are high in demand from mobile phone companies seeking to produce high quality products, which effectively makes their patents an extremely valuable asset.

Back in mid-June, Nokia signed a deal in which LG Electronics (OTC:LGEAF), the world’s fifth biggest vendor of smartphones, agreed to pay royalty fees in return for using some of their patented technology. This deal is very similar to the five-year deal Nokia signed with Samsung two years ago in which Samsung also agreed to pay Nokia royalty fees for their patented technology.

These deals illustrate the significant backstage role Nokia is increasingly seeking to play in the smartphone market. Whilst the company does not currently manufacture smartphones, it allows others to use their patented technology in return for royalty fees. Royalty fees for patented products is a fantastic source of secure and guaranteed revenue and has almost no downside for Nokia. They cannot make any financial loss on the deal should the product fail to sell to the mass market and have therefore commendably created for themselves a win-win scenario in which they will enjoy a constant stream of revenue without putting their neck on the line.

Partnership with Bharti Airtel

On June 30th, Nokia signed a deal with India’s largest mobile phone operator, Bharti Airtel, in which Nokia would supply the Indian company with 3G wireless network gear covering some of the most populous regions in the second most heavily populated country in the world. Nokia would supply these regions with software, hardware, network management and radio antennas.

Expansion in the sub-continent is significant, as the region contributed one-third of Nokia’s worldwide business sales of $3 billion during the first quarter of 2015. As a region, the sub-continent has thus become the largest contributor to the company’s results.

India has been Nokia’s best performing market in terms of sales in recent quarters and has been instrumental in helping the company turn around net losses of nearly $5 Billion at the end of the 2012 fiscal year to profits of $4.2 Billion by the end of the 2014 fiscal year.

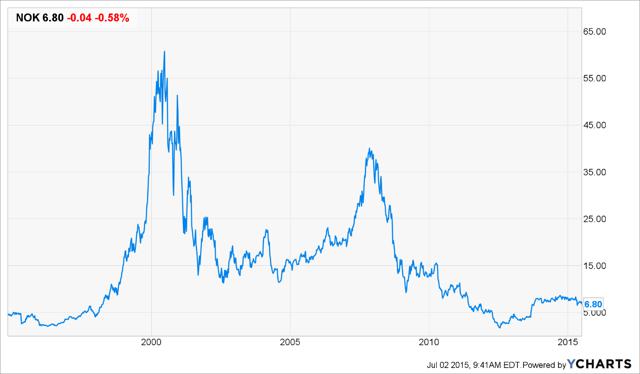

(Source: YCharts)

The new collaboration with Bharti Airtel will exponentially increase Nokia’s revenue in their most lucrative market even further, which could only be good news for shareholders ahead of the concluding quarters.

Designing Phones Again

One of the stipulations of Microsoft’s (NASDAQ:MSFT) $7 billion buyout of Nokia’s phone business in 2014, was that Nokia would have to stay out of the mobile phone market until 2016. Microsoft hoped that the elimination of Nokia from the cell phone industry would help it break into the Samsung (OTC:SSNLF)-Apple (NASDAQ:AAPL) monopoly was a colossal fail and they only managed to accumulate 3% of the market share pulling up loss after loss.

Now with 2016 on the horizon, Nokia will soon be allowed to re-enter the cell phone market and a recent interview by CEO, Rajeev Suri, indicates that Nokia plans to do exactly that. Nokia’s CEO Rajeev Suri recently informed the German business magazine, Manager Magazin, that the company plans on designing mobile phones again and elaborated that Nokia “will look for suitable partners” in order to help resurrect the company back into the mobile phone manufacturing industry.

Confirming Nokia’s return, Suri added, “Microsoft makes mobile phones. We would simply design them and make the brand name available to license.” Only the most optimistic or disillusioned analysis would believe that Nokia’s re-entry in the market would push their share price back to the June 2000 high when they were a market force (as illustrated below).

(Source: YCharts)

However, Nokia now knows where their strengths and weaknesses are. Nokia executives are not naïve enough to believe they actually could break into the Samsung-Apple monopoly and are therefore sticking chiefly to the designing and branding aspects of the mobile phone market. Taiwanese multinational, Foxconn, is presently manufacturing the Nokia N1 tablet, which means that it is likely that the two companies would collaborate again in future. Nokia N1 is the first commercial gadget developed by Nokia and was a staggering success in the Chinese market, which resulted in the devices rapidly selling out. It not only won the best Android Tablet award in China, but accumulated so much praise that production spread to Taiwan – prompting Nokia to develop plans to expand the Nokia N1 tablet to other international markets.

Realistically, Nokia shares would never break the $50 mark again, however if their designing and branding is successful, one could expect their revenues to improve. Improving revenue results throughout 2016 could perhaps push their stock value back towards the $25 region (last seen in 2008) in the later parts of 2016.

Analysts’ Opinion

Since April 21st, a variety of research groups including Swedbank, Bernstein, Exane BNP Paribas and Kepler have all upgraded their recommendations. Kepler have upgraded from “sell” to “buy” and Exane BNP Paribas and Bernstein have upgraded from “market performance” and “neutral” to “outperform.”

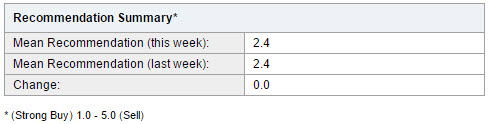

Likewise, the mean recommendation for the past two weeks has been inclined towards the buy-side of the scale with a recommendation of 2.4.

(Source: Yahoo Finance)

The low price target is $7.00 and the median price target is $9.25 – both visibly higher than the current share price of $6.73. In the short term, I would agree with these targets, however in the long term, as a result of all the recent optimistic news, I would argue that these price targets are highly conservative and Nokia shares can potentially surpass $12.50 within a year.

The fact that the consensus amongst analysts assesses Nokia with a bullish evaluation strongly correlates with the upbeat fundamental analysis and makes Nokia’s stock to be a safe bet for an investor.

Conclusion

Nokia is not the giant it formerly was and it is highly unlikely it will become a market force in the mobile phone market again. However, strong inroads into the Indian and other Eastern markets demonstrate Nokia’s ability to expand.

Additionally, as of 2016, they will be allowed to produce mobile phones again and lucrative royalty deals with Samsung and LG illustrate their high aspirations for that market. Nokia’s long-term future looks increasingly promising and I Know First‘s algorithmic analysis echoes the bullish stance of the fundamental analysis – particularly in the long-run. Both set of analyses indicate that there is currently a profitable opportunity for investors with long-term strategies who could see a phoenix-esque return of Nokia

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Eli Fletcher, one of our interns. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.