Nokia Corporation: A Bullish Algorithmic Perspective

Confira nosso último artigo (07/09/2014 )no Seeking Alpha: Nokia Corporation: A Bullish Algorithmic Perspective

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Nokia, a globally renowned brand in telecommunications, is known for the impressive annual revenues and global smartphone sales it boasted prior to 2007.

- With the dawn of 2008, however, Nokia experienced a massive drop in market share: its operating system was unpopular, its strategic decisions were termed questionable, and its competitors were fierce.

- While 2008 to 2013 was problematic, recent business developments (i.e., Nokia’s new mapping app HERE and its Samsung licensing deal) and a healthier balance sheet make Nokia worthy of consideration.

- I Know First predicts a strongly bullish forecast for NOK in the 1-month and 3-month timeframes.

Company Profile

Nokia (NYSE: NOK) is a Finnish corporation that has become a globally renowned brand; as a communications company specializing in Internet and software, Nokia has reported annual revenues of over €12.7 billion. NOK’s workforce and clientele are also considerably large: the company employs 90,000 people across 120 countries, and conducts sales in more than 150 countries. Given these impressive figures, it is not surprising that NOK was ranked the world’s 274th-largest company by revenue by Fortune in 2013.

The Downsides

Despite its seemingly impressive stature, Nokia has wavered in its success on several occasions. While Nokia was initially a go-to brand for smartphone users, Apple’s 2007 and 2008 successes – including the iPhone 3G – saw Nokiadrop 10% in worldwide market share from fourth-quarter 2007 to fourth-quarter 2008. Nokia’s operating system itself also suffered a decline in popularity – it dropped from 52.4% to 46.1% from 2008 to 2009.

While NOK’s overall market share in 2009 was still a healthy 40.8% even with these declines taken into consideration, 2010 proved to be a rough year.Android and iOS continued to make their presence known, with Android’s smartphone shipments growing 886% year-on-year in the second quarter of 2010. Struggling to hold on to its position in the market, NOK nevertheless came out with a new smartphone: the N8. While it was praised for its hardware, the device did not do much to better NOK’s situation: technology reviewers labeled its “hardware great, but software terrible“, citing Nokia’s Symbian 3 – the latest version of the Symbian operating system – as thereason for the device’s lack of popularity. By the end of 2010, Symbian’s market share had dropped further: from 46.1% in 2009 to 32% in 2010.

2011 through 2013 saw even worse times. When NOK’s CEO unveiled a new strategic alliance with Microsoft in early 2011, reactions were not positive: NOK’s share price dropped to about 14%, and sales went down – so much so, in fact, that the phone’s rank fell from first to tenth in sales over the course of the next two years. 2012 would see more difficulties, with aspects of NOK’s production and research being shut down, and massive employee layoffs. The situation grew so unfortunate that NOK’s executive faced a class-action lawsuitfor the corporation’s disappointing performance.

2013 was not much kinder, either, at first: analysts stated that Nokia showed no signs of recovery in the US market – with €4.1 billion worth of operating losses, the company seemed to have dug its grave.

The Short-Term Advantages

Even NOK, however, is not all bad. Despite an unimpressive recent track record, NOK has upcoming innovations planned that may generate success.

Firstly, there is the fact that NOK recently announced its release of a newmapping app by the name of HERE, geared at providing users with an alternative to existing map products. Specifically, the app – which is set to be released before the end of 2014 – will be geared at making maps available to consumers via a variety of devices (e.g., both Google and Apple devices). Its functions will be unique: one can use the app to download an entire map foroffline use, and can even search while being offline. Further, its pricing modelwill be slightly different from the norm: unlike Google (NASDAQ:GOOG), which uses advertising next to search results to support its maps, Nokia will be offering maps that seem entirely free of an advertising operation. In addition, HERE will offer information to over 190 countries. These maps are already frequently being used by companies like Yahoo! (NASDAQ:YHOO) and Amazon(NASDAQ:AMZN): a testament to their popularity.

NOK’s shares rose slightly, up 1.7%, directly after this announcement was made. More compellingly, however, Samsung Electronics Co. (OTC:SSNLF) took notice of NOK’s offerings, and signed a deal with the company in August 2014. NOK is now set to begin creating mapping applications for Samsung’sTizen operating system. Some analysts are calling this a winner deal, citing the fact that Nokia’s revenue will grow with Samsung’s successes; Zacks, for example, firmly believes that this deal will generate increased revenue for Nokia in the long run.

Secondly, NOK may now also be much safer now than it was in the last few years from a bottom-line perspective. The unit primarily responsible for NOK’s losses was its cell phone division, which it has now relinquished; analysts point to this in stating that NOK’s balance sheet is getting healthier, and that this, in combination with the abovementioned improving cash flow, lessens cause for alarm.

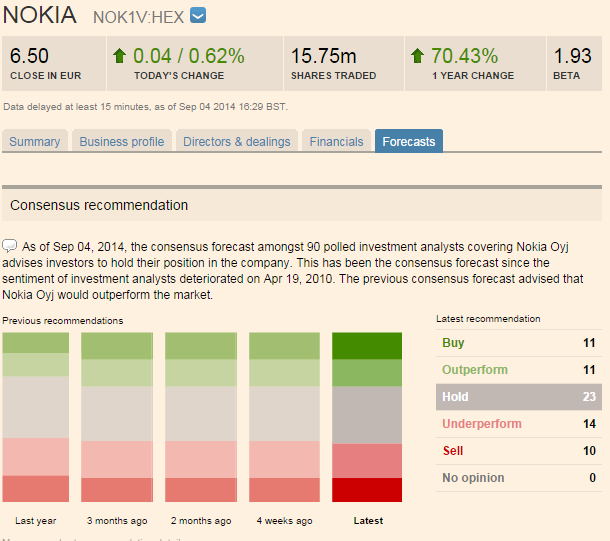

It is clear that these concepts are translating to increased analyst appreciation for NOK. While online sentiment previously echoed the notion that NOK has almost nothing good to contribute to investors, NOK is now a solid hold (Figures 1 and 2).

Figure 1. Last year, fewer analysts rated NOK a “buy”, and more rated it a “sell”. At present, NOK is a solid hold.

Figure 2. Yahoo! analysts are calling NOK a 2.6 (“hold”), where a 1.0 is a buy and a 5.0 is a sell.

Algorithmic Perspective: Bullish in the Short Term

I Know First uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to predict the flow of money in almost 2000 markets from 3-days to a year. This algorithm provides traders with a trend they can use to identify when to enter and exit the market; though it may be used for intra-day trading, the predictability of this trend becomes stronger in 1-month, 3-month, and 1-year forecasts; as such, it can – when coupled with traditional analysis and careful reasoning – effectively be used to analyze the value of such stocks as NOK.

In fact, I Know First has previously successfully predicted NOK’s progress on several occasions. Specifically, I Know First has twice recommended a strong bullish position for NOK for a period of 1 year: from August 23rd 2013 to August 23rd 2014, and from August 25th 2013 to August 25th 2014. Comparing these forecasts to NOK’s actual progress (Figures 3 and 4), we see that I Know First successfully predicted NOK’s progress twice: the stock’s performance from August 23rd 2013 to August 23rd 2014 was +111.37%, and the stock’s performance from August 25th 2013 to August 25th 2014 was +111.79%.

Figure 3. I Know First successfully predicted NOK’s strong bullish trend for 1 year in August 2013. I Know First’s August 23th forecast is shown on the left; NOK’s actual performance is shown on the right. Nokia’s ticker is boxed in magenta on the left.

Figure 4. I Know First successfully predicted NOK’s strong bullish trend for 1 year in August 2013. I Know First’s August 25th forecast is shown on the left; NOK’s actual performance is shown on the right. Nokia’s ticker is boxed in magenta on the left.

Note that both of these year-long forecasts were accurate, despite the fact that NOK is classified as a comparatively risky stock.

In addition, I Know First published on Sept. 3rd 2013, a bullish article in Seeking Alpha based on the latest algorithm’s signal. Since this forecast, NOK rose by 74%.

I Know First has even managed to accurately predict NOK’s daily performance across five months, as evidenced by the below chart (Figure 5).

Figure 5. I Know First’s predictions for NOK over the course of five months, from March 11th 2014 through August 12th 2014. Each point on the chart is taken from the actual daily forecast published that morning; actual price over time is shown in thick blue, and the prediction line is a dashed red.

The new forecast generated by the I Know First algorithm, updated on August 28th, is shown below (Figure 6). Bright green signifies a highly bullish signal; light green also indicates that the forecast is bullish, but not as strongly so. Bright red, in turn, signifies a bearish forecast; correspondingly, light red indicates a bearish forecast as well, but not as negative a forecast. Each compartment contains two numbers: the strength of the signal itself (represented by the number in the middle of each box, to the right), and itspredictability (found in the bottom left corner, this is the approximate level of confidence the algorithm has in the forecast). Taking all this into consideration, the ticker symbol for Nokia – “NOK” – may be seen as strongly bullish in the 1-month frame, and remains strongly bullish across the 3-month frames; this and predictability should be taken into consideration when this algorithmic perspective is used to inform traditional analytic tools.

Figure 6. I Know First’s most recent forecast for Nokia. NOK is boxed in blue, and shown to be strongly bullish. Please note that a negative predictability indicates high risk.

This strong bullish forecast for the short term coincides well with recent developments in NOK’s infrastructure, and its successful second-quarter earnings. Given analysts’ mean “Hold” recommendation, NOK’s activities in the last year, and I Know First Research’s success in its last NOK-related algorithmic prediction, it may be wise to consider keeping NOK in one’s portfolio until further change makes it either a buy or a sell.

Conclusion

While Nokia appears to be a stock that has inherent weaknesses, it also has several advantages. NOK’s HERE application is creating innovative ways to utilize mapping technology offline, and has consequently enjoyed success with the likes of Amazon and Yahoo! HERE’s potential is so large, in fact, that it has recently attracted the attention of Samsung in the form of a licensing deal. The presence of Nokia’s free apps on Samsung devices could greatly further Nokia’s reputation and revenue, increasing cash flow. Concurrently, NOK has essentially disposed of its cell phone division, which was dragging down its balance sheet – the corporation’s bottom line is consequently healthier, and the company’s name is no longer tied to its unprofitable handset business. These corporate development details, in combination with I Know First Research’s proven ability to predict NOK’s success, indicate that investors would be wise to consider NOK bullish in the 1-month and 3-month time frames.

Business relationship disclosure: I Know First Research is the analytic branch of I Know First, a financial start-up company that specializes in quantitatively predicting the stock market. This article was written by Sophia Glisch, an I Know First intern, and edited by Daniel Barankin. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.