Stationary Batteries Will Power Tesla In The Future: An Algorithmic Analysis

Confira nosso artigo (7/5/2015) no Seeking Alpha: Stationary Batteries Will Power Tesla In The Future: An Algorithmic Analysis

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Stationary Batteries Will Power Tesla In The Future: An Algorithmic Analysis

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…)

Summary

- The larger losses and increased spending seem to be all investors are noticing after the most recent earnings report.

- Car sales appear like they will meet expectations for the year, signifying huge growth and positive cash flow will come in time.

- The stationary battery package has been a huge hit so far, with crazy demand signifying it could increase Tesla’s valuation in the long-term.

- I Know First is bullish on Tesla in the long-term, while it acknowledges the stock will struggle in the short-term before the Model X is released and the Gigafactory is.

Tesla Motors (NASDAQ: TSLA) released its most recent earnings report yesterday, where losses widened while sales and production increased. The stock price has increased 26% since May 11th, 2014, when I Know Firstpublished a bullish forecast on Tesla. Even with the stock’s great performance, the widening losses seem to be all that is being paid attention to in the aftermath of the earnings report, as the stock continues to trade below where it was trading at the start of the day on Wednesday. However, the increased sales, the fact that the new Model X and overall sales appear to be on target, and the excitement around the new battery powered stationary storage units mean that the stock price is bullish over the long term, although the company is likely to struggle in the upcoming quarter.

Auto Sales On Track

During the last quarter, deliveries of the Model S rose 55% to 10,045 vehicles, ahead of the update prediction of 10,030. Tesla plans to sell at least that many vehicles during the upcoming quarter, with projections for quarter 2 at 10,000 to 11,000 vehicle deliveries. More importantly, the company remains on track to deliver 55,000 vehicles during the current fiscal year, a mark that CEO Elon Musk had previously set for 2015.

In order to do so, releasing the Model X on time will be key, and Musk said during the earnings call that he believes Tesla will start delivering the newest SUV model by the end of the third quarter. While bearish investors for this stock point to the increased losses the company took this year, the Model X has a large part to do with this. Capex is likely to increase as the company continues to spend on tools for the new model, increases capacity to be able to build it, and continues to build the Gigafactory to better be able to meet demand in the future.

Figure 1. Tesla Model X. Source: teslamotors.com

Excitement around the stock is sure to build when the Model X is released to the public, and Musk praised the performance of the test vehicles that he has been able to drive so far. Musk also disclosed that the company will build a captive fleet of Model X SUVs before they are actually available for sale, matching how traditional car companies release new models. While sales will likely begin in the third quarter, it is not yet certain when production will ramp up, driving material sales growth.

Musk did offer a hint when he mentioned that production volume could double in the fourth quarter. While demand for the S Models continue to build up, driven by the better portfolio of options for consumer, sales in the fourth quarter could be huge, and will need to be in order to meet the expectations for 55,000 deliveries this year. Musk did mention that the company will show off the Model 3 in March before it hits the market in 2017, but this did not attract too much attention and is still a ways away.

What is important to take away from the automotive sales is that the company’s production continues to scale, as it takes less and less man-hours to build a vehicle, and the costs continue to fall. With demand rising, costs falling, and a new model being added to the portfolio of offerings, vehicle sales very well could outperform the 55,000 prediction, as Tesla should be able to produce almost 62,000 vehicles this year if its increased efficiency keeps up, thanks to its increased spending.

Cash Flow

A major problem for this stock has been its negative cash flow, which fell to $1.5 billion at the end of the first quarter. This is down from $1.9 billion at the end of the previous quarter and from $2.4 billion a year earlier. Musk addressed these concerns, saying he believes the cash flow will be positive during the fourth-quarter. He did admit that the timing is hard to pinpoint right now, as the ramping up of Model X production will play a key role.

But even if the company is not able to become cash flow positive until the first quarter of next year, it should have no problem funding its growth plan without share sales or convertible bond offerings. Once the production for the newest product offering has ramped up and deliveries start being made, the company will be fine with cash, even as its sales of regulatory credits to other automotive companies decrease compared to quarter 1.

Stationary Battery Dominates Call

With the upcoming release of the Model X and new information about the timing of the more affordable Model 3 sedan, as well as the improved performance of the Model S offerings, it was surprising just how much the stationary battery offerings dominated the earnings call. It makes more sense, however, when taking into account that this market really isn’t built into most models for this company so far. Musk revealed that demand for these products has been crazy so far, with reservations from the first week outnumbering what the company will be able to supply through the first half of next year.

There was even a question about if Tesla could become a stationary battery company primarily, ahead of its automotive business. While I wouldn’t go that far, the market for these stationary battery packs could be far greater than previously estimated, as it appears like it could catch on in the mainstream when the company starts mass producing them in its Gigafactory. Musk said that the market size for the batteries “is enormous and much easier to scale globally than vehicle sales.”

With demand far outweighing supply so far, being able to increase production of these batteries will be key. The Gigafactory that the company is building in Nevada is now expected to start producing batteries in 2016, which is earlier than previously expected. Musk and Tesla face a difficult decision in deciding how much of this new facility to dedicate to batteries for automobiles compared to stationary batteries, but demand and production for both will climb rapidly, making this stock bullish over the long-term.

Algorithmic Analysis

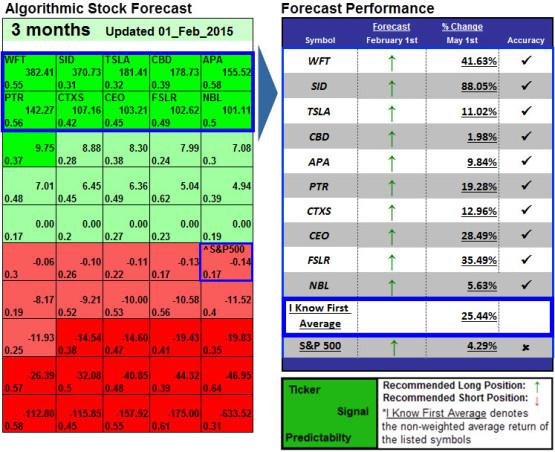

I Know First self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

The algorithm was correctly able to predict the rise of Tesla’s stock price over the past three months. In this forecast from February 1st, 2014, Tesla was included as one of the top 10 stocks to buy in the three-month time horizon. The company had a signal strength of 181.41 and a predictability indicator of 0.32. In accordance with the algorithm’s prediction, the stock price increased 11.02% since that time.

Figure 2. The Algorithmic Forecast For Tesla From Feb 1.

Having explained how I Know First’s algorithm works and demonstrated its success in predicting the stock’s behavior in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company.

Figure 3. Short-Term Algorithmic Forecast For Tesla.

The figure above includes short-term forecasts for the 14-day and one-month time horizons for Tesla from May 6th, 2015. In both forecasts, the company has a weak negative signal, indicating the algorithm is slightly bearish for the stock in these time horizons. This makes sense considering how the Model X SUV will not be released until the third quarter, and the losses and decreased cash flow will only get worse next quarter.

Figure 4. Long-Term Algorithmic Forecast For Tesla.

The next forecast is for the long-term time horizons of three months and one year. These forecasts are bullish, especially the one-year forecast with a strong signal strength of 193.02 and predictability of 0.52. When the Model X ramps up production and the stationary battery market comes more into focus, the stock price will soar. While this point in time might not be perfect for this stock, investors should be prepared to buy it ahead of the release of the Model X, as the resulting excitement and increased sales will cause the stock price to soar, just as the company’s Gigafactory vastly increases production capabilities.

I Know First Research is the analytic branch of I Know First, a financial start up company that specializes in quantitatively predicting the stock market. This article was written by Aaron Tallan. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.