Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis

Confira nosso artigo (31/3/2015) no Seeking Alpha: Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Tata Motors recently announced a rights offering to raise $1.2 billion, which will be used to fund new models in the coming years.

- The company is set to benefit from a growing economy in India with its commercial vehicle sales.

- A joint venture for a new plant in China and a new premium compact modelwill allow Jaguar to increase demand in China and boost sales.

- I Know First’s algorithm is bullish on Tata Motors for the long-term time horizon.

Tata Motors Limited (NYSE: TTM) is the largest automobile company in India. The multinational manufacturing company’s products include passenger cars, trucks, coaches, vans, buses, construction equipment, and military vehicles. The company acquired the British car maker Jaguar Land Rover, the maker of the luxury car brands Jaguar and Land Rover (JLR), in 2008 from Ford Motor Co. (NYSE:F). Tata Motors is the 17th-largest motor vehicle manufacturing company, fourth-largest truck manufacturer, and second-largest bus manufacturer by volume in the world.

The company released its most recent earnings report on February 5th of this year. The results were a mixed bag, as revenues increased 9.6% year-over-year, while profits before taxes declined 6.4%. The company’s underwhelming performance was driven by the rupee appreciation against the euro and slipping sales of its JLR business. But 2015 is a transition year for Tata Motors, after which the company should be well positioned for the future. Increased cash on hand to fund the business, stronger performance in the medium and heavy commercial vehicle (M&HCV) segment, and better sales of JLR make the stock attractive for long-term investors.

New Rights Offering Will Help Investors

The company announced on March 25th that it will give investors a new rights offering, through which it will raise roughly $1.2 billion. This extra cash on hand will allow the company to reduce the debt on its balance sheet. After the rights issue, in which stocks will be sold to investors at a premium of over 15%, Tata Motors will be able to decrease its net debt 32%. For FY16, the net debt to equity ratio for the company will decrease to 0.8 from 1.9, giving the company more flexibility in the future.

The extra cash will also be used for capital expenditure. Tata Motors plans to introduce ten new models by the end of the decade, including six new Sport Utility Vehicle (SUV) models in the next three to four years. The automobile manufacture is planning an aggressive charge in order to regain a strong foothold in this segment, which has grown rapidly in recent years. The new offerings will include compact SUVs meant for urban markets, rugged models targeting rural markets, and premium crossovers.

The company’s renewed focus on the SUV segment has a good chance for success and is a sound strategy because of low competition compared to other segments. Further, this segment has higher margins and will offer a quick path to recovery for the core company, whose market share has slipped in the past few years. These models are expected to start hitting the market early in 2016, and the new models along with its existing vehicles will give Tata Motors the largest portfolios of SUVs in India, where they are very popular.

Promising Growth Coming In M&HCV Segment

While the extra cash on hand will help Tata Motors’ performance with passenger vehicles, its performance in commercial vehicles will also improve over the next few years. The India business environment has been growing at a healthy pace and is expected to continue this trend going forward. As the economy improves, there will be a pick up in activity in the mining and infrastructure segments. This will cause truck fleet operators to add more trucks to their fleets, as truck fleet utilization increases.

This trend is already being seen in recent sales data. In February, the company’s M&HCV sales rose 34% year-over-year. But this increase is being driven by fleet owners purchasing new vehicles to replace old ones that have already been paid off. This growth should be sustainable going forward as fleet owners need to add more vehicles to their fleets.

Tata Motors should also be boosted by a recovery in the light commercial vehicle (LCV) segment. Although its business declined in line with the rest of the market, sales are expected to start recovering in FY16. Sales for the segment are expected to increase 10% then, and Tata Motors is positioned to benefit greatly as the largest player in this market. The company is also ramping up its presence in the pick-up segment, launching new products to increase its segment market share.

JLR Performance Set To Recover

As I mentioned earlier, the sales of the Jaguar Land Rover business has slipped recently, falling 0.6% during the last quarter. This trend should reverse going forward, though. The British carmaker entered a joint venture production plant in China with Cherry Automobiles, which will have a capacity 75,000 units per year. This plant will commence operations by the end of FY15 and should have a significant impact in the company’s sales.

JLR will roll out its locally built Range Rover Evoque and will follow up with two other models within the next 18 months. Local production will allow the company to avoid China’s 25% import tax, making its vehicles much more affordable in comparison to other locally built luxury vehicles. The resultant price decrease of somewhere near 15% should allow the company to increase its market share while actually increasing its margins in the China market, which formed 26% of JLR’s net volume sales last year.

Jaguar is also set to release its compact sedan XE in the first quarter of FY16, its first premium compact model in over 5 years. The XE will be a entry level, high volume model for Jaguar, competing with vehicles like the Audi A3 and BMW 3-series in the lower-end of the premium vehicle market. This model will also help drive sales for JLR, as it plans to increase its production capacity to 680,000 vehicles by the end of FY16. This is a large jump for the company, as it sold 462,678 vehicles worldwide last year. All told, JLR sales could improve by more than 20% next year and continue to grow from there.

Analyst Opinion and Algorithmic Analysis

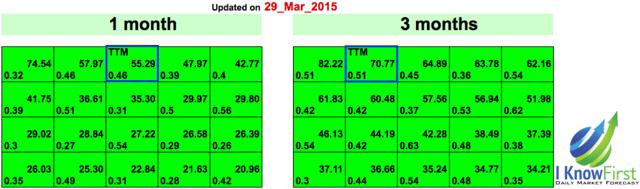

Market analysts are currently very bullish regarding Tata Motors. Of the 42 analysts giving an opinion on this stock on Reuters, 19 of them give a recommendation of buy, while 18 of them give it a ranking of outperform. Meanwhile, only one analyst believes it will underperform. The consensus opinion on this stock is buy, agreeing with the fundamental analysis above.

Figure 1. Analyst Opinion. Source: Reuters.com

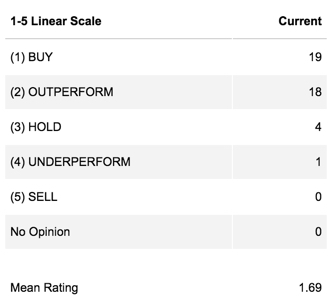

Our algorithm is similarly bullish on Tata Motors in the long-term. I Know Firstis a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

The signal represents the predicted movement direction or trend, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength with strongest up signals at the top, while down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal and red indicates a negative signal. A deeper color means a stronger signal and a lighter color equals a weaker signal.

The predictability indicator measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically the predictability ranges from minus one to plus one. The higher this number is the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

Figure 2. Algorithmic Analysis of TTM For 1-Month And 3-Month Time Horizons.

With exceptionally strong signals of 55.29 and 70.77 for the 1-month and 3-month time horizons, respectively, Tata Motors appears to be greatly undervalued at this point in time. Now is a great time to buy this stock for investors with a long-term strategy in mind, as the company’s stock prices appears set to increase considerably in the future due to strong management, an improving economy in India, and stronger performance in China.