Tesla Motors – Summative And Algorithmic Evaluation

Confira nosso último artigo (03/11/2014 )no Seeking Alpha: Tesla Motors – Summative And Algorithmic Evaluation

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- Why the true automobile innovation of our decade is the plug-in electric vehicle (PEV) vs. the technologically outdated Hybrid Electric Vehicle (HEV).

- Elon Musk is another layer of risk mitigation when investing in Tesla, often not taken into account.

- What is the importance of Tesla’s oversized production factory and Panasonic partnership for battery production?

- I Know First state of the art market algorithm predictions for the 3 months and 1 year time horizons.

Introduction

Tesla Motors, Inc. (NASDAQ: TSLA) is not just a stock with a symbol; it is the stock of what could possibly become the most disruptive company of this decade. The company gave up profits and rejected producing hybrid electric vehicles (HEV) to produce an all-electric vehicle fleet (EV). The company currently stands at the top of the electric car industry with its flagship theTesla Roadster, the Model S Sedan, the upcoming Model X Crossover SUV, and the announced mass market model III. For these reasons, it is not surprising that Tesla is one of the most watched stocks on the market. From a microeconomic perspective many analysts have projected both bullish and bearish forecasts; however, none of these perspectives took the time to look at the reduced risk through the big picture. Just take a step back and look at Tesla for what it is: the future of mobility. For the last two decades, we knew we must find an alternative to our reliability on gasoline, and this company finally did it. This article analyzes why Tesla can’t fail from three unusual perspectives. The first is the astonishing progress Tesla made in such a short time as a start up in one of the most competitive, entry barrier infected industries. Second is the guardian angel Elon Musk, who as a CEO does not only see Tesla as his business, but his life’s work. And finally, the incredible growth strategy Tesla had, and why the real revenues are just around the corner.

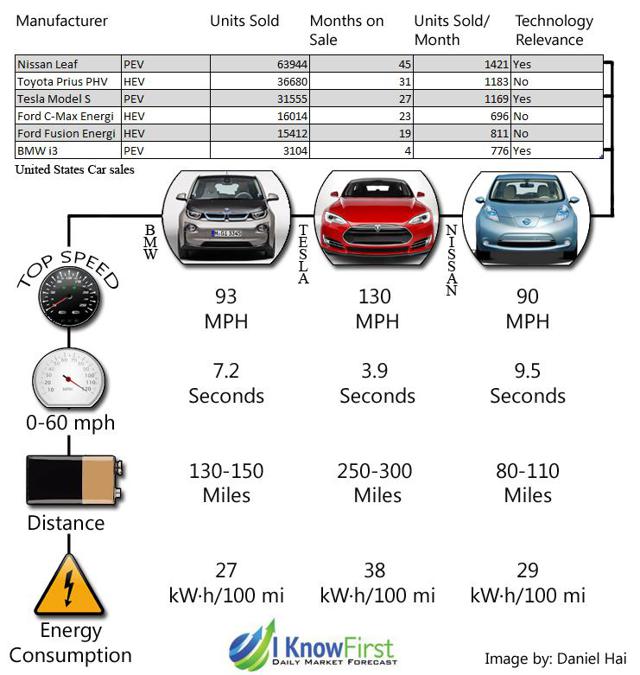

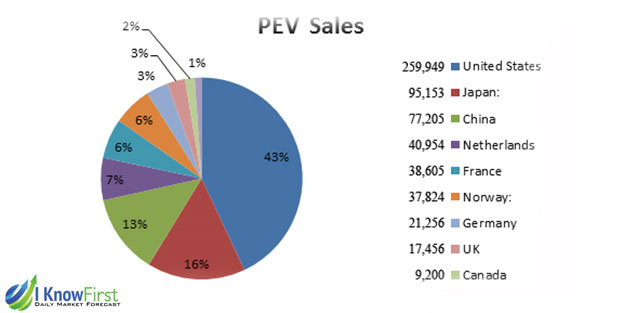

While other companies are competing to convert from VCR to DVD, Tesla has begun the production of Blu-ray

Electric Vehicles are the future of mankind. Many people confuse the 1997 Toyota Prius as the “hybrid that started it all”; however, Ferdinand Porsche(founder of the Porsche) began experimenting with HEVs as early as 1900. The true automobile innovation of our century is the plug-in electric vehicle (PEV) sometimes referred to as battery electric vehicle (BEV). Decades of failed attempts due to lack of motivation, funding, and strong lobbying (such as the recent dealership conflict) kept the electric car industry from progressing. Despite of all that, Tesla invested millions of dollars only to prove that true electric power is not a myth with the Roadster; however, people still doubted the US could ever change its fuel consumption habits. PEVs already have massive growth in Europe; in 2011 Norway saw a 306% growth in electric car registration followed by 209% in 2012 and 229% in 2013. People are beginning to realize that Europe will endorse electric cars, yet they fail to realize that the US is growing, and fast. The US represents today 43% of all electric car sales, as of September 2014 the numbers look as such:

Figure 1: Plug-in electric vehicle cumulative sales.

Germany and the United States present an interesting observation. Germany is well known for a strong commitment and government sponsored pressure towards green energy; however, this does not seem to reflect in electric cars. Adjusting for the population difference, the US sold 66,289 PEVs, 311% higher than Germany’s 21,256. While most think the US is trailing behind on green energy, in the PEV sector they are simply wrong. Most assume Tesla is another player in the PEV market; however, it is by far the industry leader, at least in the US. Hybrid cars are an outdated technology, producing new HEVs is the equivalent of the old video players supporting both VCRs and DVDs. Surprisingly Tesla is even ahead of HEV manufacturers in sales, competing with companies such as Chevrolet, Toyota, and Nissan who have decades of experience over them. In order to demonstrate this we adjust sales to time on market below.

Figure 2: Comparison of the top HEV/PEV cars / stat breakdown of the top 3 PEVs.

As previously mentioned, still manufacturing hybrid cars is equivalent to “supporting both VCRs and DVDs,” which is the reason we did not include them in the graphic comparison. However, as Figure 2 demonstrates, by taking monthly sales instead of total sales, Tesla S proves to be a solid contender to its competition, the Nissan Leaf and BMW i3. What catches the eye is that the Tesla S is already such a large step ahead of the industry. The statistics confirm a tremendous difference in the most important stats to any potential car buyer (Top Speed, Acceleration and Distance). If we are to continue with our analogy, it would be fair to say that while BMW and Nissan have taken the leap to producing stand-alone DVD players, Tesla has already dumped that technology for producing Blu-Ray technology. The company is looking to take the position Apple once had in the tech field to the car industry by becoming an innovations leader in electric car manufacturing.

Who is Elon Musk and why you should care.

Figure 3: Elon Musk, current CEO and main investor at Tesla Motors. Source:ABC News.

Elon Musk is nothing less than a money magnet. His first start up “zip2” was sold to Compaq for $341 million, of which Musk received 7% ($22 million). His next venture, x.com, merged with PayPal just one year later and sold just two years later to eBay for $1.5 billion, of which Musk’s 11.5% ownership netted him $165 million. His next project, Space X (Space transport company), has an estimated market value of $1 billion. In 2006, he co-founded Solar City, which today is the largest provider of solar power systems in the United States. Finally there is Tesla Motors, a company whose goal is to “get the electric car revolution started”. Musk became involved with the company as a series A majority investor ($7.5 million) back in February 2004. He then led the series B ($13 million) and Series C ($40 million) investment rounds in 2006. The fourth round of $45 million was in 2007 and brought the total investment to over $105 million. Following the financial crisis in 2008 and a high cash burn rate, Tesla was having extreme difficulty raising funds. Believing in his vision of an electric car future, Musk claims to have invested his “last $35 million” in Tesla. By now, Musk had contributed $70 million of his own money. Five years later, Musk’s stake in the now-profitable Tesla is worth about $2.5 billion. If you think these are risk to return calculated business decisions, you are probably wrong. What you have here is a high-risk investor with his baby (Tesla), which he will save at all costs. Expanding on that, in 2013 Musk borrowed another $100 million from Goldman Sachs to purchase a share of the $880 million stock offering Tesla issued in 2013. From a non-analytical perspective, this means Tesla Motors has a guardian angel looking over it; it is fair to assume Musk will go bankrupt before he lets Tesla fail, because for him it is his opportunity to change the world, or possibly become the next Steve Jobs. So if you fear Tesla might run into financial trouble and have difficulties raising funds, think again, because when it comes down to it, if investors won’t put up the funds, Elon Musk will.

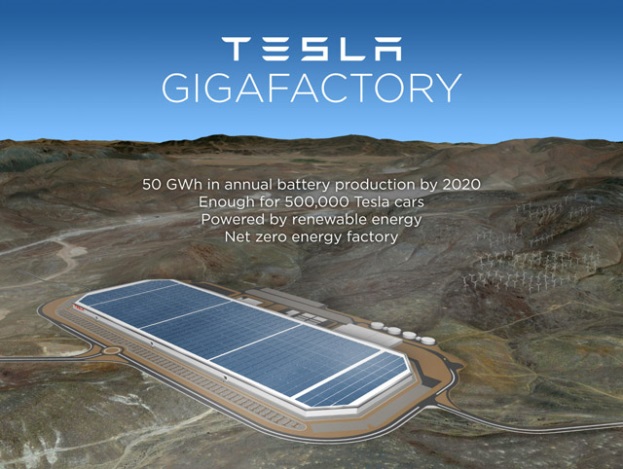

What is the importance of Tesla’s oversized production factory and Panasonic partnership for battery production?

In February 2014, Musk announced plans for a $5 billion “Gigafactory,” which would produce enough battery packs by 2020 to power as many as 500,000 vehicles. Tesla has already announced that Panasonic will be its battery partner for the Gigafactory; moreover, it was expected that Panasonic’s investment will be in the billions. Rumors were confirmed after Panasonic established “Panasonic Energy Corporation of North America,” a new manufacturing company of lithium-ion batteries, in Sparks, Nevada, where Tesla’s Gigafactory will be located. This has significant impact for Tesla. The first is larger control of their supply chain, which will reduce future battery costs by 30%. The second is the repositioning of the company from being an EV (Electric Vehicle) manufacturer, to a parts supplier as well. In a future of battery powered vehicles, controlling the battery supply is a big advantage. To make things even more attractive, the company managed to negotiate themselves into a strong position with Nevada lawmakers. According to thebusiness times, “Tesla is exempt from all but municipal franchise fees (the money businesses pay for stuff like drainage and utilities) through 2023. In 2024 the company will start to pay local and state property taxes and the MBT, a business tax. It won’t pay sales tax until 2035.”

.

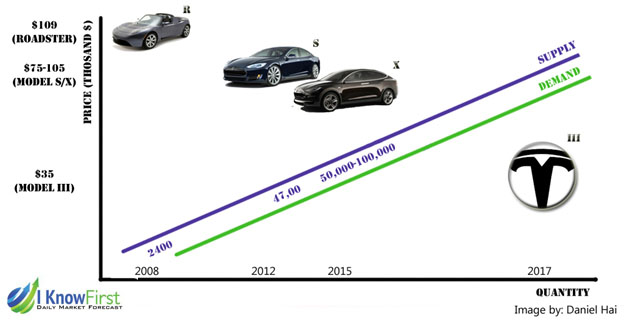

Figure 4: An illustration of Tesla Motors’ proposed Gigafactory for batteries outside Reno, Nev. (Tesla Motors photo) Source: MarketWatch

The current Tesla factory fronts the 880 Freeway in Fremont on the east side of the San Francisco Bay. The factory co-housed Toyota and GM production facilities since 1984. After purchasing it, Tesla renovated the facility to produce an efficient production process (over the entire factory); however, Tesla is only utilizing about one-quarter of the factory. The reason behind this is the pre-anticipation for Tesla’s future models, with a preset plan to increase production yearly by offering larger market appeal models (Such as the model III depicted below – 2017 release date). This was the idea behind the Tesla Roadster, followed by the cheaper Tesla S. With the increased market share and name, the company is attempting to enter the crossover SUV market with the model X (coming 2015). The EV revolution will however only start when the fully electric car matches the price and performance of a gasoline car. Investors must recognize that all three models (the Roadster, S and X) are merely showcasing the power of EVs and gaining attention to Tesla. This is when the mass market model III will come in and tap into the $900 billion car industry market share. Because of this pre-planned growth (showing in the chart below), the factory is already equipped (and sized) to be able to take in the increase in production demand, meaning the company does not need to spend unnecessary time and resources on upcoming models.

Figure 5: Telsa’s proposed growth plan and matrix placement of the various Tesla cars.

Algorithmic Analysis

I Know First is a financial company that uses an advanced self-learning algorithm based on artificial intelligence, machine learning, and artificial neural networks to analyze, model and predict the stock market. Every day the algorithm analyzes raw data to generate a stock market prediction using a predictability and signal indicator. In a previous research article on October 21st “Trading Algorithm Beats Analysts Again: The Tesla Motors Case,” we discussed how the algorithm outperformed analysts by a significant margin (Analyst yield = -11%, Algorithm yield = 46%). The 13th of June 3 months forecast was bullish on Tesla, and investing clients made returns of 37.19%. Going against analysts the algorithm’s September 11th 1 month forecast was bearish on Tesla, shorting the stock at the time would have yielded 15.72%. As of October 30th, 2014, the algorithm is bullish on Tesla for the 3 months and 1 year time periods. In the boxes below, Tesla’s future forecast has a green background. Green indicates a forecast of appreciating stock price prediction (While red indicates a depreciating forecast). The positive number in the middle of the above mentioned boxes (signal strength) represents the direction and magnitude by which the algorithm predicts the stock will move. The bottom number (predictability) represents the confidence level.

(click to enlarge) Figure 6: Most actual Tesla stock prediction by I Know First Algorithm for the 3 month and 1 year periods.

Figure 6: Most actual Tesla stock prediction by I Know First Algorithm for the 3 month and 1 year periods.

Conclusion

Factors such as changing technologies in the car industry, or the intentions of people are invisible to an algorithm; however, through the aggregation of a stock’s entire history, and continuous monitoring of money movements between all markets, the algorithm is able to anticipate markets behaviors towards a particular stock. The algorithm has zero bias and can only predict according to the data it receives from the market. When you combine the creative mind of financial analysts with the strict financial algorithm, and both agree on the same thing, you have a powerful forecast. Following our analysis of the car industry, Elon Musk’s role in Tesla, and current company structure and future plans, alongside with the algorithms bullish 3 months and 1 year forecast, we recommend Tesla stock as a strong bullish long-term investment.

I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Daniel Hai, one of our interns. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.