Tesla Stock Forecast Based On Predictive Analytics

Confira nosso último artigo (11/06/2014 )no Seeking Alpha: Tesla Stock Forecast Based On Predictive Analytics

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Some key patents may become available to automakers if they accept Tesla’s terms such as agreeing with the business model and not charge people to charge their EV (no pun).

- Model S orders exceed expectations in the U.K.

- Self-learning algorithm denotes a bullish signal for Tesla in the 1-month, 3-month & 1-year time horizon.

Last week, Tesla Motors (TSLA) CEO Elon Musk announced that he was considering doing something “fairly controversial” with the company’s patents. There is speculation that in order to speed up development of electric vehicles, Musk is considering releasing some of the company’s patented technology. Your first reaction may have been that Mr. Musk may be succumbing to the pressure of his position or that he may be too willing to take too big of a risk. After all, Tesla has a strong foothold on the high-end long-range electric vehicles and there is clearly great potential with its more affordable third generation that will become available in the upcoming years. So what is actually going on here? Well, as a pioneer of the electric car, they have the advantage of setting the tone for developing the infrastructure.

Concurrently, Tesla debuted the company’s first right-side drive versions of the Model S in London. This award winning electric vehicle was recently introduced to the far-east market of China as the company has been expanding its presence in Europe. Tesla has two new models being developed and 2-3 Gigafactories being planned that will produce the batteries needed to increase production.

Tesla’s direct sales model strategy has made automobile dealership associations very nervous, as Tesla’s sales strategy threatens their way of conducting business. These dealers have been lobbying local state governments to disallow the direct sales model, and have succeeded so far in five states. Missouri was the latest state to attempt to block the Tesla but House Bill 1124 did not pass. Republican Majority Leader John Diehlstated that lawmakers were concerned that the bill would impede the free-market forces and thus result in unintended negative consequences if passed by the House. Influential players have chimed in on this matter, such as General Motors (GM) considers Tesla to be “circumvent[ing] long-established legal precedent[s] on how new motor vehicles are marketed…” Employees from Federal Trade Commissionhave publicly stated “very likely harming both competition and consumers” and that “House Bill 1124 would amplify the adverse effects of the current prohibition…[and] discourage innovation.” Muskstated in the Tesla blog that “dealers are again trying to ram through a provision under the cover of darkness and without public debate. The people of Missouri deserve better from their elected officials.” There are a lot of opinions on this heated issue and only time will tell how this will ultimately play out.

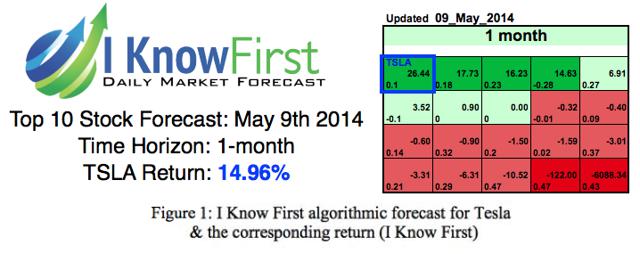

Shortly after Tesla Motors posted earnings the stock fell, reaching the $180 benchmark as predicted by our advanced self-learning algorithm. At I Know First, we promote algorithmic trading as a way to mitigate risk and optimize returns utilizing a market prediction system developed by our research team of mathematicians and scientists. In my previous Tesla article on Seeking Alpha, Algorithmic Forecast Indicates Tesla Is A Buy, TSLA shares rose 11% since publication. Figure 1 shows the algorithmic forecast shared in this article delineating a “buy” signal for the 1-month time horizon on May 9th. I will explain exactly how to read this very easy color-coded algorithmic forecast later when analyzing the most contemporary forecasts.

The discretion between the two returns just mentioned is because the 11% gain is from publication date in Seeking Alpha, May 11th and the charts return above is from one month exactly from the forecast date (May 9th). This market prediction system is not perfect and not every single forecast is accurate, so we never recommend blindly purchasing recommended assets. Instead, professional and retail investors use these algorithmic predictions as a tool to enhance portfolio performance, double-check their own analysis and act on market opportunities faster.

Tesla In Europe

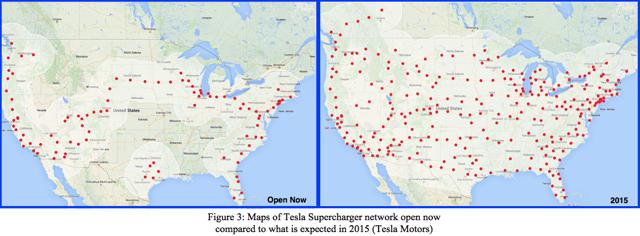

Last year, 52,729 electric vehicles were sold on the European continent short of the 78,079 in the United States in 2013 (as of the end of October). The top five European countries for electric vehicle sales in 2013 are France, Norway, Germany, the U.K. and the Netherlands in that order. Hybrids are still more popular than full electric vehicles but perhaps right-side drive versions of the Model S will be able to change this trend. Figure 2 compares the number of registrations in the United Kingdom between hybrids and electric vehicles.

According to this chart it would seem that hybrids are well ahead than their plug-in counterparts. Well as many TSLA shareholders already know, demand has not been the problem for Tesla. In the U.K., the situation is the same. Pre-orders for Tesla’s Model S is are exceeding the company’s expectations and future Tesla owners will have to wait 4-month’s for delivery. Multiple Supercharger stations are anticipated to be throughout London and more throughout the outlying areas and highways.

The U.K. could become Tesla’s biggest European market and probably one of the top five in the world according to Musk during the launch event in London. Currently Norway is the biggest (non-US) market, but the company expects the United Kingdom to surpass the Nordic country. Musk is an advisor to the U.K. government on electric car strategy and is confident that Britain’s larger population will drive sales in the Westfield Stratford store and online.

It was confirmed that the United Kingdom would be the base for a brand new Tesla R&D center. Musk stated, “It makes more sense to have [a plant] in the U.K. once we’re producing more than 500,000 units,” then he continued by stating, “The first thing we’d do in the U.K. would be an engineering R&D center rather than a factory. We’d first do a European factory in continental Europe and then as the volume builds up, that’s when we’d look at a factory in the United Kingdom.”

Tesla has set its sights high for developing the Supercharging station network across the United Kingdom. By the end of the year, Tesla plans allow drivers to cover a majority of England, Wales and some parts of Scotland by fitting Superchargers in Bristol, Exeter, Edinburgh, Leeds, Portsmouth and key motorway service stations. After this is accomplished, new points in East Anglia, the North East, Aberdeen, as well as Dublin, Belfast, Cork, and Galway are being organized, in order to ensure that drivers with the lower range models can move across the British Isles. Tesla expects to spend tens of millions of dollars on the U.K. over the next year, a necessary expense that must be made in order to ensure value for Tesla drivers. Musk said that they are not paying much for Supercharger sites and in some cases even being paid to use the land.

The U.K. network is expected to cover a key section of the entire European network. It is even possible that other car companies could become involved as Musk stated, “we’d be happy to accommodate any other manufacturer that is interested in using them. They need to be able to accept the power level of the Superchargers, which is 135kW and rising. And they’d need to agree with the business model in that we don’t charge people.” Other interested companies would also have to share some of the capital and maintenance costs of constructing the charging network. Superchargers will always be free according to Musk as it does not cost much to charge the car as well as the maintenance is fairly low as well.

Tesla Supercharger Patents

Why should Tesla be willing to share the wealth when the EV company is well positioned in the fast-growing, nascent electric vehicle market? Sharing key patents would encourage other companies to develop electric cars. The downside is pretty clear. Some of these EV’s would compete with the Model S, the upcoming Model X, and third generation sedan. The potentially tremendous upside is there could be more drivers using the Tesla’s Supercharger network. This conceivable profit can outweigh the prospective downside. Tesla has the prospective ability to benefit from energy infrastructure and as an electric vehicle manufacturer. Many analysts have only considered EV sales when evaluating future potential, however Tesla’s business model can evolve by utilizing the Supercharger network to its advantage by standardizing how electric vehicles charge regardless of the manufacturer.

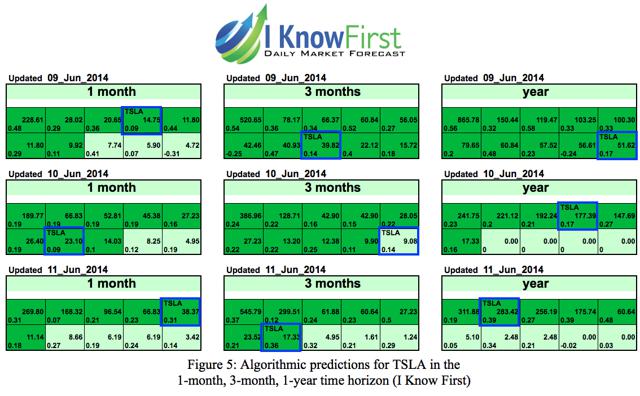

Non-Tesla electric vehicle owners will also need charging stations on the road. Tesla’s Supercharger network is vast and growing rapidly. Not only this, but the Supercharger stations are the fastest in the industry. Second generation superchargers can charge an 85-kilowatt-hour Model S to half capacity in 20 minutes. Since a majority of public chargers are considerably slower, other automakers providing electric vehicles would benefit from allowing customers at least the option to use Tesla’s Supercharger network. Figure 3 compares Superchargers open now versus what is expected in 2015 according to Tesla’s website.

The company’s goal is to have 98% of the U.S. covered by the end of 2015. In Europe, Norway has been covered and plans to move throughout Western Europe are unfolding now. There are three stations in China so far, where Tesla recently started selling the Model S in the Far East nation. This open-source approach to charging EV’s faster is a smart move to encourage growth of the acceptance of electric vehicles. However we have yet to see if other companies will accept Tesla’s terms.

Analysis of Market Prediction System Forecast For TSLA

According to Musk at the annual shareholder meeting last week, the CEO believes the company is a buy. Of course there is bias and the tremendous investment he has made must be put into consideration, but for you is now a good time to purchase TSLA shares? Well that depends on many factors. If you are a shortsighted investor there are other better market opportunitiesthat you can profit from. Much of the stock’s valuation is based on the markets confidence in the company’s future execution, making the TSLA shares more volatile. As this is a growth stock, volatility is unavoidable. What really matters is that the company is taking the necessary steps, making appropriate investments and achieving objectives that will fulfill the overall goal. Currently, I Know First has a bullish forecast for TSLA in the 1-month, 3-month & 1-year time horizon.

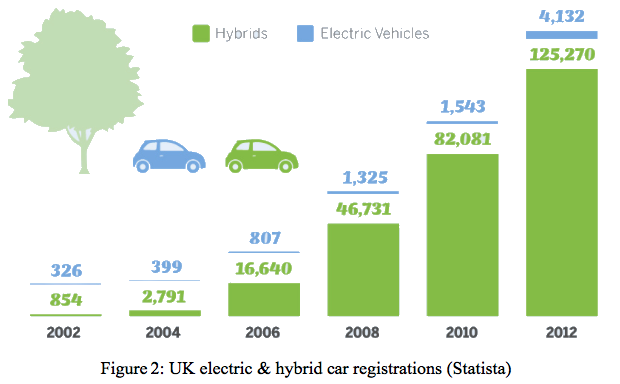

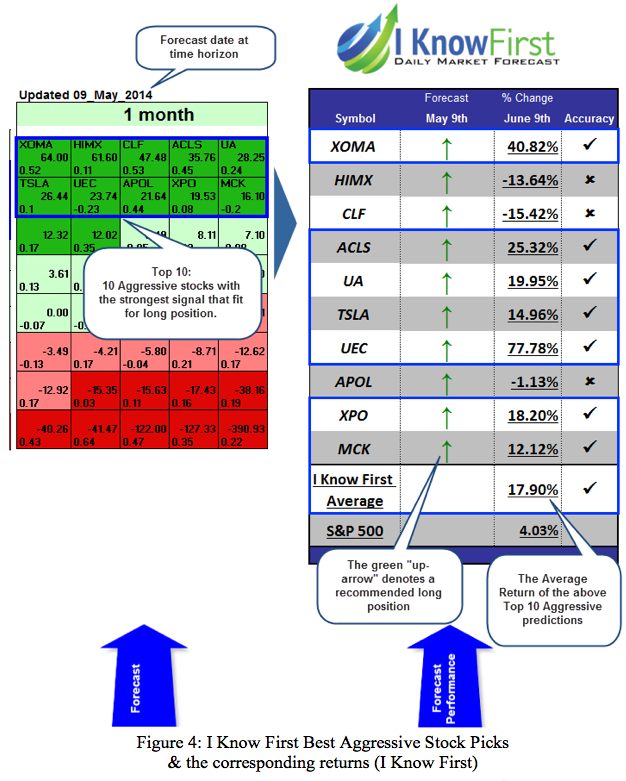

I Know First utilizes an advanced self-learning algorithm based on Artificial Intelligence (AI), Machine Learning, and incorporates elements of Artificial Neural Networks and Genetic Algorithms in order to model and predict the flow of money in almost 2,000 markets from 3-days to a year. It separates the predictable part from stochastic (random) noise and then creates a model that projects the future trajectory of the given market in the multi-dimensional space of other markets. The algorithm outputs the predicted trend as a number, which in turn, is used by traders to identify when to enter and exit the market. While the algorithm can be used for intra-day trading, the predictability tends to become stronger over longer time-horizons such as the 1-month, 3-month and 1-year forecasts. Algorithmic forecasts are intended to be utilized in conjunction with traditional forms of analysis in order to reduce risk and optimize returns. Figure 4 displays a recent forecast including TSLA as one of the Top Aggressive Stock Picks by the algorithm utilized by algorithmic traders using the I Know First market prediction system.

(click to enlarge)

We determine our aggressive stock picks by screening our database daily for higher volatility stocks that recently moved often strongly up or down. These aggressive stocks present more opportunities, but are also more risky. The forecast is color-coded, where green indicates a bullish signal and red indicates a bearish signal. Deeper greens signify that the algorithm is very bullish and vice-versa for deeper reds. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset, while the predictability is the historical correlation between the prediction and the actual market movements. In other words, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence. Ticker symbols for other assets have been removed; however, you can still see their signal and predictability.

Comparing the algorithmic performance of May 9th’s 1-month forecast to the most contemporary forecast is an excellent strategy for rationalizing your expectations utilizing algorithmic trading as one tool in your analysis toolbox. Figure 5 displays the most contemporary algorithmic forecasts for Tesla Motors in the 1-month, 3-month and 1-year time horizons.

While TSLA is a growth stock that is more susceptible to volatility, the algorithm’s confidence in its bullish prediction has jumped in today’s forecast. This is evident with the predictability indicator in each time horizon. From June 9ths and June 10ths forecast the predictability increased from 0.09 to 0.31. Generally speaking, a predictability of 0.2 or higher is preferable. TSLA remains in a deeper green box in each forecast and time horizon except one, elucidating the bullishness of the market prediction system in Tesla.

When analyzing algorithmic forecasts, it helps to recognize if the signal and predictability grow stronger or weaker with each daily forecast. In the 1-month time horizon the signal increases from 14.75 on June 9th, to 23.10 on June 10th and all the way to 38.37 on June 11th. TSLA’s signal on May 9th in figure 4 above was 15.63. In the 3-month time horizon the signal seems to move erratically but in the 1-year time horizon the signal increases from 51.62, to 177.39 then 283.42 in today’s forecast. The algorithm seemed to be unsure about the magnitude of TSLA’s bullish movement in the 3-month time horizon, however the predictability becomes much stronger in today’s forecast, which means the algorithm is more confident in this prediction.

These bullish signals should give investors some assurance that TSLA shares will rise further over the stated time-horizons. Algorithmic traders utilize these daily forecasts as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. We never recommend blindly purchasing assets that are endorsed by the algorithm without your own additional analysis.

Conclusion

For Tesla to open source some of its technology to the competition is risky but also carries a huge reward if executed correctly. Musk has validated that he can recognize business opportunities and utilize them as a competitive advantage. The prospective financial upside outweighs the downside and investors should trust his judgment. If done appropriately, Tesla’s revenue stream could benefit drastically from automakers developing EV’s based on Tesla’s patents and using battery packs. Other automakers could benefit as well utilizing Tesla’s growing Supercharger network. Currently there are 94Supercharger stations in the U.S., 20 in Europe and 3 in China. If automakers decide to utilize this growing network, it will provide value to their EV’s as well. The question remains whether competing auto manufacturers will accept Tesla’s terms.

Tesla is a great buy and ideal for long term investors who are willing to accept the associated risks. The direct-sales ban in Missouri did not succeed but the National Automobile Dealer Association will continue to wage its battle against Tesla’s sales model. There is even more risk as Tesla is responsible for building a tremendous Supercharger network and build the expensive Gigafactories. However both of these factors are absolutely necessary for the company to succeed and thrive down the road, making them mandatory expenses. These are the necessary steps that must be taken in order to achieve the overall goal. Shareholders will benefit, as Tesla will continue to accomplish objectives and evolve its business model to become a dominating force in the automotive industry.

Business disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. Joshua Martin, an I Know First Research analyst wrote this article. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.