Time To Consider Ford Is Now: Real Gains On The Way

Confira nosso artigo (18/6/2015) no Seeking Alpha: Time To Consider Ford Is Now: Real Gains On The Way

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Ford has been building toward the second half of the year, and now is the right time to buy the stock.

- Its F-150 sales will pick up much faster than anticipated during the rest of 2015, as increased capacity will meet pent up demand.

- European sales will also continue to improve and beat expectations, as it has done well there before introducing its new fleet of cars.

- With the Asia-Pacific region driving revenue growth in the future, the stock’s long-term outlook is strong, and I Know First algorithm is bullish on this stock.

Ford Motor Co. (NYSE: F) has had a rough few months, with the stock price falling roughly 7.50%. Traders of this stock complain about how it trades sideways, even when the company gets good news like improved sales or profits. This is largely true, as the stock has mostly traded in a range of $13.00 to $17.50 for more than two years now.

The stock could now be set up to break through this range to the upside during the second half of the year. Many of Ford’s initiatives that will drive the stock price are finally set to take place, and the recent fall of the stock price makes it an attractive option for investors. Efforts with the F-150 and Europe will cause the stock price to climb upwards during the next year, and an increased presence in growth markets make Ford a solid long-term investment.

Figure 1. Source: YCharts

F-150 Production Finally Ramped Up

After remodeling its F-150 model to use an aluminum body, Ford has been working to ramp up its production to meet the demand for the extremely popular truck. Ford’s plant in Dearborn, Michigan was upgraded to be able to produce these trucks earlier this year, and its plant in Kansas City has now been upgraded as well. The upgrade met Ford’s predicted timeline of being completed before the end of June.

The fact that both plants have been upgraded and are now at full production of the new aluminum-bodies trucks will improve sales during the second half of the year. The company’s sales of America’s most popular vehicle have fallen so far this year, but this is not due to a lack of demand. Now that the production ramp-up has been completed, the company has faced some issues with suppliers, mainly with having enough frames to complete production.

This is a common problem when ramping up operations, and should be solved quickly. This will pave the way for increased production and, as a result, increased sales. Sales of the F-150 fell 9.7% in May compared to a year earlier, and sales for the year so far are down 1.1%. With a second plant running at capacity, Ford will be able to fully meet demand during the second half of the year, when demand will be pent up. This will increase sales and improve the company’s performance during the coming quarters.

Figure 2. Source: kansascity.com

The poor performance of the F-150 so far this year explains the poor performance of the stock. The fact that the stock hasn’t fallen further is a bullish sign for the future outlook, as the improved performance of the second year will act as a strong bullish catalyst. The presence of demand for these vehicles is made clear by Ford’s decision to shorten its break in production this summer from two weeks to one.

The new trucks are also demanding higher prices, which will improve the company’s bottom line. The price of F-150 trucks has been raised $3,300 compared to last year, even as 37% of current sales are made up of old models. By meeting demand, Ford’s revenues and profits will jump during the second half of the year, and this will cause huge year-over-year improvements in the company’s financials. Watch for F-150 sales to lead to the stock price making a significant jump.

European Models Hitting The Market

Another reason the stock price could be set to jump during the second half of the year is the company’s performance in Europe. The economy has recovered faster than expected in Europe, a bullish sign for automakers. In the month of May, Ford’s sales in the region increased 1.5% from a year ago. This continues the trend for the year so far, as sales have increased 9.7% in the first five months compared to a year ago, compared to growth of 7.2% for the industry as a whole.

These numbers are quite spectacular considering they will only improve during the second half of the year. Ford is introducing a number of new vehicles into the market during the rest of year, starting in the beginning of July. The new vehicles are highlighted by the Ford Mustang, which are expected to be in European dealerships in the first week of July. The company is also releasing new models that are popular in Europe, including the Mondeo Vingale, a high-end sedan similar to the Ford’s Lincoln offerings in the US.

The success of the new vehicles is a big part of the company’s strategy as it works to increase its market share in the region. So far, Ford has increased its sales in the region through its commercial vehicles, which have picked up as a result of an improving economy. However, Ford can’t solely rely on this market, and introducing its new vehicles, including the iconic Ford Mustang should help the company’s results. With improved sales that should outpace the larger market, European results should further boost the stock price during the second half of the year.

China Strategy Will Improve Future Outlook

Ford is also planning on how to drive further future growth beyond the second half of the year, increasing its emphasis on emerging car markets in China and India. The company will release 18 new vehicles in China this year and will have six assembly plants in the country by next year. This comes even as the country’s economy is slowing.

While GDP growth might be falling, the company’s middle class continues to expand. Ford management believes it can drive its revenue growth in this market, as seen by its rapid expansion in the area. China had auto sales of 23 million in 2013, but this number is expected to hit 32 million vehicles in 2020. Even with the slowing economy, Ford has continued to invest heavily in the area to build up its capacity.

A big step for Ford in the market is increasing the popularity of its luxury brand Lincoln. Ford is increasing the amount of Lincoln dealerships in the market from 14 to 25 this year, and will further expand to 60 dealers next year. In all, Ford expects for as much as 60% of its revenue growth to come from the Asia-Pacific region, which also includes India. This market will also grow during that time period.

While Ford continues to increase its presence in the Chinese market, it has stated that it will not lower prices in this market. Instead, it will slow production, as it does not want to sacrifice its margins. In the long run, Ford’s increased presence in these markets will offer plenty of growth to help the company’s sales improve.

Analyst Opinion

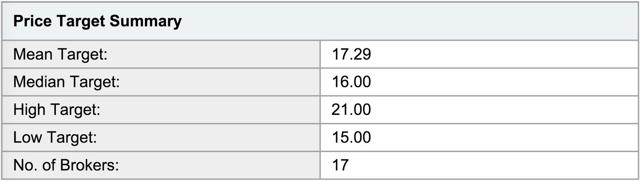

A number of analysts have offered their opinions on Ford’s stock recently, and the mean price estimate for the stock offers substantial upside potential to investors. According to Yahoo! Finance, Ford has a mean target price of $17.29, offering a 14% return to investors.

Figure 3. Source: Yahoo! Finance

UBS analyst Colin Langan recently offered an update on this stock, maintaining his recommendation of buy. He set a target price of $19.00 for the stock. In general, analysts have maintained their ratings for this stock, but with better performance coming during second half of the year, look for analysts to raise their target prices.

Conclusion

Ford’s stock price has had a rough go of it during the first half of the year, but that is all set to turn around now. Its efforts to ramp up production of the F-150 have finally come to fruition and will improve the company’s performance during the second half of the year. With the introduction of new vehicles in Europe, the company’s performance during the second half of the year should easily beat expectations and will overwhelm investors. The stock price will jump, and the future growth outlook for the company looks strong because of its investments in the Asia-Pacific region. I Know First is bullish on this stock as a long-term investment with support of our algorithmic analysis, and believe the company’s financial performance during the second half of the year will act as a catalyst for this stock.