Top 10 Reasons Why Plug Power Is An Attractive Stock Right Now – Fundamental And Algorithmic Analysis

Confira nosso artigo (21/1/2015) no Seeking Alpha: Top 10 Reasons Why Plug Power Is An Attractive Stock Right Now – Fundamental And Algorithmic Analysis

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Acompanhe a performance de nossos artigos.

Summary

- The company is on the right track to success with revenues and gross profits increasing at a steady rate since 2013.

- Algorithmic analysis is very bullish about Plug in the short, medium, and long term.

- There are oil, competition, and industry risks involved with an investment in this name.

Why Fuel Cells Are a Viable Alternative to Oil and Batteries

Plug Power (NASDAQ:PLUG) has truly “proven itself the leader in delivering today’s alternative energy solution for tomorrow’s energy independence,” as stated on their website. The company’s revenues are derived from fuel cells, one of the frontline renewable energy technologies of the century. While a typical combustion engine is only about 25% energy efficient, fuel cells can reach 60% efficiency (and 85%-90% if the heat is captured as well). The applications are endless, but the profitable ones are very limited.

Hydrogen and batteries are in a tight race for the future of the automobile industry; however, hydrogen has one advantage batteries don’t: very fast charging times. In fact, fuel cells can produce electricity continuously for as long as these inputs are supplied, and Plug Power identified forklifts in logistic warehouses as the perfect market. It appears many large companies are agreeing with this and giants such as BMW (BAMFX), Wal-Mart (NYSE:WMT), Mercedes (OTCPK:DDAIF), and Kroger (NYSE:KR) have already incorporated hydrogen cells made by Plug Power into their forklifts.

Figure 1: Forklift with a GenDrive Plug Power fuel cell installation. (Source)

In the case of Tesla Motors (NASDAQ:TSLA), battery implementation as the main source of vehicle power is going to decide whether the company will rise or fall. However, just like the forklift, fuel cells have some applications where they are simply cheaper and more efficient than any other alternative, even oil prices at these levels. It is currently a high growth stock of a significantly underpriced asset, in a fundamentally solid company, working in a fast growing field, with a very well targeted niche market.

The Top 10 Reasons Why Plug Power Is a Strong Buy

Reason 1

Their financial position is improving. The last report listed revenues (September) for the first three quarters of $42.8m. In comparison to the same time last year ($18.6m) it represents a growth of 230%. During the same time, the stock price appreciated by just about half that; however, since September it has rebounded back down and is now significantly oversold. This happened after the company did not meet earning expectations, alongside the plunging oil prices. Their market capitalization of $462.24M is currently far below what it should be.

Reason 2

The company has been expanding and revenue expectations seem very positive. Their most recent contracts include a $20 million deal with SouthernLINC Wireless, a subsidiary of Southern Company (NYSE:SO). Plug’s CEO Andy Marsh announced expectations for the company to meet a revenue goal of $120 million in 2015. This would equate to almost fivefold growth from 2013 earnings. Considering this year’s growth, there is really nothing suggesting this is farfetched or over reaching. With less implied value and revenues, this very company was valued around $75 a share in 2006.

Figure 2: Plug’s stock price, annual operating revenue, annual gross profit and annual gross profit margin. (Source: Ycharts)

As can be seen from the table above, while the price of the stock is still very attractive the revenues are going up, gross profit is improving, and gross profit margin is trending up. Moreover, this year has seen significant improvements on a quarter to quarter basis.

Figure 3: Plug’s stock price, quarterly operating revenue, quarterly gross profit and quarterly gross profit margin. (Source: Ycharts)

As of Q3 2014, operating revenue reached an all-time high of $19.9m. Gross profit was only slightly negative at a $1.1m loss. Most importantly the profit margins are finally creeping up, and I expect them to already be operating in the green right now. As of now the price-to-sales ratio is 8.6. I expect Plug Power to increase revenues to the 120m target in 2015. With the current market cap the P/S would adjust to 3.85; however I believe the market will maintain the current P/S ratio. Assuming that holds true the new fair value for the stock would be just short of $6.

Reason 3

German manufacturers, and more specifically automakers, are so large that their bargaining powers often suppliers. Considering that many of Plug Power’s clients fit that description, and the knowledge that these companies have hundreds of suppliers fighting for single contracts, a few simple deductions can be made. In order to supply anything to them companies generally have the following qualifications.

- Have a very high quality product that meets with their rigid standards.

- Be able to supply very large/small quantities in sudden bursts.

- Be the cheapest of all alternatives and be willing to accept a very small profit margin.

For Plug Power to hold these business relationships is indicative of a lot in itself. For one, the company will probably be profitable in 2015 after supplying to these manufacturers, meaning its low margin target clients are already able to sustain it. Their profit margins will significantly increase once smaller clients purchase fuel cells at much higher margins as their bargaining power is significantly lower than the above listed.

Reason 4

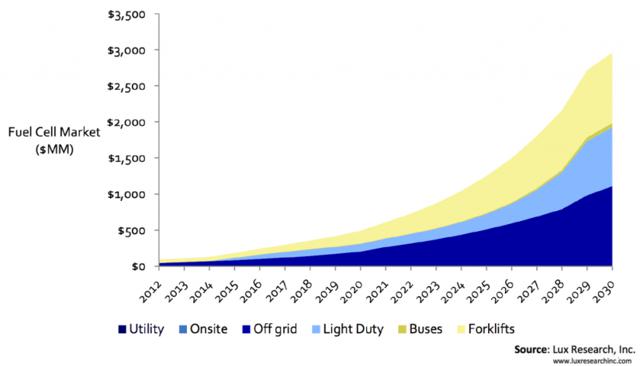

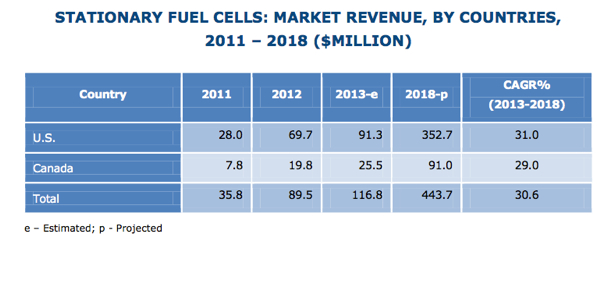

The company’s expected growth is above the market’s expected growth of 30%. This would mean Plug Power will gain market share over competitors. The estimation below projects a compounded annual growth rate of about 30% in North America for stationary fuel cells.

Figure 4: Stationary fuel cells market growth. (Source: Energy Manager Today)

However, it is worth a mention that the company is not expanding into all sectors, and its growth started from a very low point.

Reason 5

The innovative nature of the technology allows it to be integrated into almost any type of machinery. While Tesla Motors is aggressively marketing their battery technology, it does not necessarily threaten Plug Power as many might think. As can be clearly seen from the example of forklifts, sometimes fuel cells which can recharge very quickly or work continuously (as long as they continue having a fuel source) make a better and cheaper alternative to batteries.

Figure 5: Fuel cell market by type and industry. (Source: Lux Research)

Currently the company is expanding further into the material handling market, producing fuel cells for refrigerated trucks and vehicles used to haul luggage at airports. By focusing on very specific markets where fuel cell benefits simply outweigh battery benefits, the company sets itself apart from its competitors who will have to spend millions competing with battery technology.

Reason 6

Optimizing the supply chain is very important. By not only producing the fuel cells, but controlling the fuel charging station and even the fuel itself, Plug Power can secure revenue growth for years to come. Gen Fuel is Plug Power’s hydrogen fueling station that hit the market in January. Industry leaders such as Wal-Mart and FedEx are already on-board. The companies supply partner, Praxair (NYSE:PX), did not disclose the terms of the agreement; however, considering 2014 revenues it seems to be beneficial to Plug Power.

Reason 7

Transitioning from natural gas to hydrogen is great, and the disadvantages associated with it hold little ground. There are many ways in which a customer can save money by using fuel cells. A battery charge will generally take 15 minutes in comparison to a fuel cell’s 60 seconds charge time. For a 100 truck fleet operating year round this represents 18,000 hours which can be utilized in better activities.

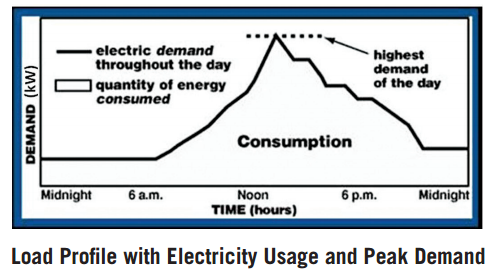

Figure 6: Peak hours cause an increase in electricity costs. (Source:EnergySmart)

Another significant advantage is that fuel cells are completely unaffected by peak hours. When the demand for power goes up you simply consume more hydrogen, however you don’t need to account for any extra infrastructure orcosts (except for the hydrogen) associated with these peaks in demand. This furthermore makes cost accounting much simpler, as it is very clear what costs are distributed to what vehicles at what times. Also, the hydrogen costs are currently only slightly higher than the electricity costs associated with charging the batteries in the US, with faster expectation in the decline of costs through 2020. There are many more benefits and cost reductions associated with switching from batteries or oil to fuel cells in these specific industries.

Reason 8

Many think oil prices will stay down, and they are wrong. I say this with full confidence. It might take several months, but be sure oil prices are going up. No oil producer is happy with the prices as low as they are — and this includes all OPEC members with no exception. Sure, market share restructuring and crushing renewable energy companies is a short-term benefit, but prices will go back up eventually. Either OPEC reduces supply and prices go up, or high cost producers default, supply decreases, and prices go up. It really doesn’t matter how you look at it, the prices will go back up, and with it the price of all renewable industries including solar, and of course in our case fuel cell companies.

You can find much more detailed reasoning for this as we have been closely following oil in our algorithmic articles, including “Oil Forecast For 2015 Based On A Predictive Algorithm.” When this happens, this long position will immediately recover any loss in value caused by the decline in oil. However, this by no means is a winning argument, rather a bonus in case prices go up. It is possible the price recovery will take over a year as most big oil consumers are currently hedged at higher prices, meaning the high cost producers can still operate for another 4-6 months before they have to shut down.

Reason 9

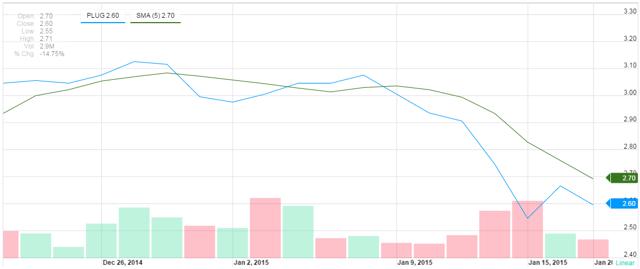

In his extensive analysis I Know First’s algorithm designer Dr. Roitman identified the optimal entry point (assuming there are very strong bullish signals from the algorithm) as the point when the closing price is above the five-day simple moving average (NYSE:SMA).

Figure 7: Plug Power’s stock price and five-day SMA (Source: Yahoo Finance)

As of Tuesdays close the price is at $2.60. In order to avoid entering too early I would follow the stock through Wednesday’s trading, and not buy before the price moves above the five-day SMA.

Reason 10

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm predicts the flow of money in almost 2000 markets across a range of time frames (e.g., 3-day, 1-month, 1-year). The algorithm’s predictability becomes stronger in the 1-month, 3-month, and 1-year horizons, so it is particularly useful as a long investment tool, albeit that it can also be used for intraday trading. The algorithm is our way of identifying two non-correlating indicators which point in the same direction.

While Plug Power’s fundamental analysis and technical analysis looked good coming into 2014, the algorithm strongly correlated Plug Energy with oil. Its strong bearish forecast for oil (which eventually declined 50%), resulted in astrong bearish signal for Plug, which saw its stock lose 12.5% through 2014 in accordance with the algorithm. Right now the algorithm is very bullish on PLUG in the short, medium and long term.

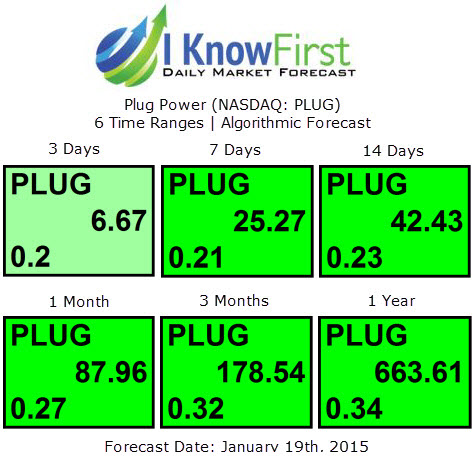

Figure 8: I Know First algorithmic forecast for PLUG | 6 time ranges | Jan. 18th 2015

Why this forecast is so significant?

- The algorithm is capable of predicting waves (bearish short term bullish long term), and thus the 3 day bullish forecast is very important. It means the stock will go up in the next few days, and continue doing so in the next several months. This significantly reduces the short term risk of the investment.

- The signals are very strong. Generally the 1 year forecast would have a strong signal range of 50-150. As can be seen above the signal of 663 places it among the 10 strongest 1 year signals (at this time point) for the 1 year time horizon of all 2000 assets we track.

- The more volatility and smaller market cap a stock has, the harder it is to predict. However, as can be seen from the 0.34 predictability under the 1 year time horizon forecast, the algorithm has been accurately able to predict the stock historically, raising the confidence level in the future forecast.

- The signal is independent of the fundamental or technical analysis, and is created purely on an algorithmic analysis basis. The advantage is that it is not affected by any bias towards or against the stock, rather, purely an analytical breakdown of money movements in and out of Plug Power and any correlating assets and markets.

As can be seen above, these are 10 reasons which are mostly non-correlated, each pointing in the same direction. The stock offers an over 100% upside potential, with very little downside risk; however, as always this slight risk has to be accounted for.

Risks for Plug Power

The company competes in a very innovative field. As is always the case with these types of companies, a disruptive technology wipes them off the market in a matter of months. However, in this case it seems very unlikely as the fuel cells are the disruptive technology trying to enter the market.

This risk should be obvious, but it still worth a mention. The company’s $462 million market capitalization is vulnerable to market fluctuations and can lose value just as fast as it gains it. Secondly the current price of $2.67 is also very low; every 2.5 cents is reflective of a 1% change in value.

Although I don’t believe this to be a significant risk, oil can still decline. While it seems unlikely some analysts suggest it could go as low as $40 a barrel (which would mean another 20% decline). This is likely to damage Plug Power’s ability to market fuel cell power to new potential customers currently contemplating between various alternatives. However, because battery technology is affected by the same relationship with Oil prices, the Fuel Cell/Battery relationship (which is more important to Plug Power for the reasons mentioned above) is not affected at all.

Lastly, and perhaps the most important is that Plug Power faces some significant competition, below are the most important players in terms of direct risk to Plug Power.

- Ballard Power Systems (NASDAQ:BLDP) earned a total of $53.1 million in their first three quarters, and their market capitalization is $206.7 million. The company specializes in proton exchange membrane (PEM) fuel cells which have gained some momentum. Their major fall is selling their automotive fuel cell assets to Daimler AG and Ford Motor Company which really cuts them from markets Plug can still enter.

- FuelCell Energy (NASDAQ:FCEL) earned 125.9 million (three quarter adjustment), supported by a market cap of 322 million. They focus primarily as fuel cell power plants, and currently operate over 50 of them worldwide; however, they are far behind in optimizing them to be operative in vehicles and transportable technology, which is the main focus of Plug power.

- Hydrogenics Corporation (NASDAQ:HYGS) manufactures fuel cells based on water electrolysis and PEM technology. The currently own sites in Europe (Germany), Canada, and the US. Their market cap is similar to FuelCell Energy at around 139.63M, and their nine month revenue is at 29.9 million.

- Oorja Protonics Inc is a private company and possibly the largest threat to Plug. They currently design, manufacture and commercialize direct methanol fuel cells for application in the logistics, automotive, distributed generation (micro-grid), and telecommunication industries. They have been growing rapidly with both contracts and sales offices all over the world. Methanol is used in a chemical process to produce pure hydrogen gas. While this solves the problem of having to store a pressurized hydrogen tank on the vehicle because you can continuously convert methanol to hydrogen, it does not solve the risk complications involved with it. Methanol is a toxic and flammable material. On top of it the conversion process produces environmentally harmful byproducts (less than oil), making it a less attractive option.

- While competitor’s P/S ratio is currently at around 2-3, Plug Power’s is currently at 8. This suggests that the company is doing a good job, and investors are obviously willing to pay a premium for this. However, it is also more expansive than competitors

When comparing the overwhelming benefits against the relatively small risks, I recommend to long Plug Power as soon as the closing price moves above five-day simple moving average.