Under Armour’s Growth Makes It A Great Long-Term Investment

Confira nosso artigo (9/6/2015) no Seeking Alpha: Under Armour’s Growth Makes It A Great Long-Term Investment

Clique aqui para ler, comentar, e opinar diretamente no Seeking Alpha.

Summary

- Under Armour has experienced massive growth over the last five years, achieving over 20% revenue growth for 20 straight quarters.

- The stock price has plateaued since the most recent earnings report, and investors should take the chance to initiate a long-term position in the stock.

- The next earnings report will act as a catalyst for this stock, as the company’s revenue growth, profitability, and guidance will improve.

- I Know First algorithm is bullish on Under Armour in the long-term.

Under Armour, Inc. (NYSE: UA) is an American sports clothing and footwear company that recently became the second largest athletic retailer on the planet by sales. The company’s stock price has increased roughly 45% in the last year, as the company has continued to post incredible revenue growth. The stock price has fallen around 7.75% since its most recent earnings reports on April 21st, however, as revenue growth did not quite meet expectations, and guidance was slightly lower than expected as well.

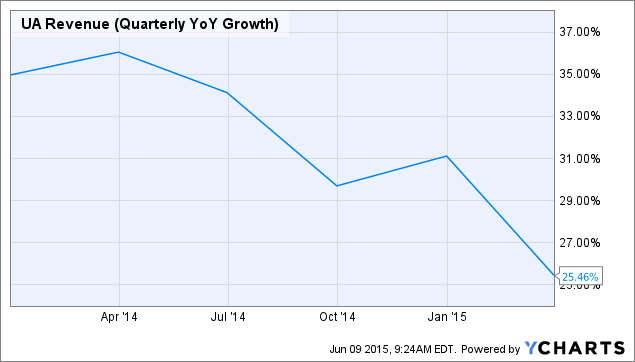

Figure 1. Source: YCharts

The resulting sell-off in the stock price can be partially attributed to the company’s high current P/E ratio of 87.02. However, the stock price should increase over the next year, as the next earnings report should act as a catalyst to the stock. The company’s revenue growth will continue to impress, more than justifying Under Armour’s current valuation. It will do so with its athletic endorsements, including Stephen Curry, and international sales. The company is also set up well for the future of the athletic apparel industry with its digital health and fitness community.

Outstanding Growth

The “disappointing” growth I mentioned in the introduction shows just how quickly this company has grown over the past five years. For the most recent quarter, Under Armour posted revenue growth of 25%, while investors had come to expect 30% growth over the past year. Investors look to revenue growth as a key sign for the company’s stock price, as high marks are necessary to justify the high valuation the company currently has.

Under Armour’s profitability also decreased during the previous quarter, falling 13% to $11.7 million. Both of these marks should improve during the upcoming quarter, though, acting as a catalyst for the stock price to climb higher. The 25% growth in sales last quarter was still rather impressive, and the stock price should have continued to rise since then. This was the 20th straight quarter that Under Armour posted revenue growth of over 20%, a truly remarkable feat.

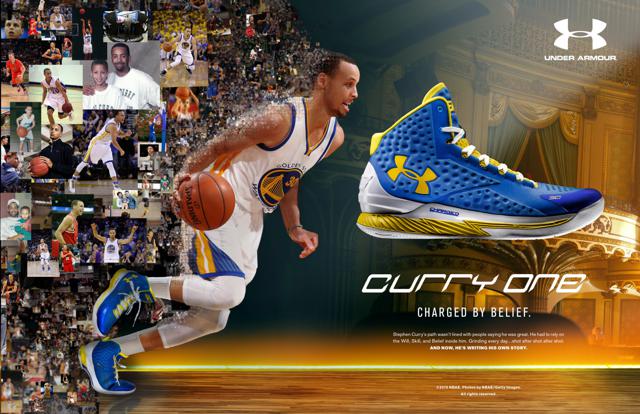

And it is fair to expect that revenue growth will be closer to 30% during the upcoming quarter. Some of the poor performance can be blamed on seasonal factors, while the company has had success with its celebrity endorsers during the current quarter. Stephen Curry is currently in the NBA Finals and is the MVP of the league, while Jordan Spieth won the Masters tournament and looks like the future face of golf. Both are sponsored by Under Armour and have provided huge advertising for the company.

Figure 2. Source: YCharts

The success of Stephen Curry helped the company achieve 41% growth in its footwear business during the past quarter with the Curry One. Sales in the footwear department should continue to accelerate due to Curry’s popularity and a focus on expanding internationally. Curry’s popularity will give Under Armour a solid base to enter into the Chinese market, where the NBA is extremely popular.

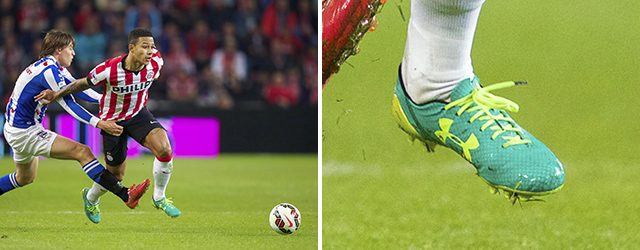

International sales should continue to post robust growth after increasing 74% in the past quarter. The company is opening up 100 stores outside the US in 2015, and has also started making soccer cleats, which endorser Memphis Depay wears. He is one of the bright up-and-coming players in his sport, and Under Armour has shown a knack for identifying talent at a young age in the past. Depay will play for Manchester United next season, one of the most popular clubs on the planet, and will offer a great chance to market the new cleats internationally.

Figure 3. Source: WorldSoccerShop.com

Profits should also improve during the coming quarter. Much of the fall in profits was due to one-time acquisition cost of $6.3 million for the Connected Fitness acquisitions. Operating income for the first quarter had actually increased 3%, and the net income figure should rebound during the next quarter.

The acquisitions of the Connected Fitness companies are bullish for the company in the long-term. Under Armour now gets 130 million unique global users on its apps, up over 10 million compared to the previous quarter. As the company looks to build a more global brand to compete in the footwear and apparel markets, Under Armour can gain valuable insights into its potential customers through these apps.

The effects from the investments in the overall digital health and fitness community won’t be seen for a couple of years, but Under Armour is already planning on ways to take advantage of a growing market. While spending money on apps that monitor personal fitness in hopes of selling more of its athletic gear, the company is growing its digital team from 60 employees to 500 by the end of the year, mainly through the acquisitions. This market is growing rapidly and Under Armour is now a leading player, offering another reason to hold onto this stock as a long-term investment.

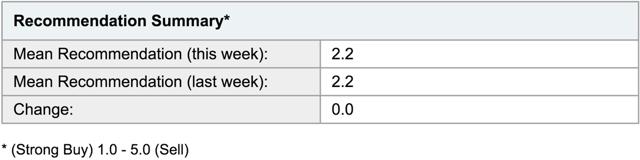

Analyst Opinion

Analysts tend to agree with the bullish fundamental analysis of the company. Most recently, DA Davidson analyst Andrew Burns upgraded the stock from neutral to buy, setting a target price of $91. The buy recommendation is in line with the average recommendation from analysts according to Yahoo! Finance, which have a consensus rating of buy for the stock.

Figure 4. Source: Yahoo! Finance

The mean target price set by the analysts who are covering the stock is $85.81, which is low in my opinion and will move up over the next few months. However, it still offers around 6% upside value for the stock.

Conclusion

The fall in Under Armour’s stock price since its last earnings report offers a solid opportunity for investors to buy this rapid growth company. The high valuation should be embraced, as the company’s 30% annualized revenue growth quarter after quarter should continue to occur over the next year. At that rate, the current price will be a bargain to long-term investors who have the foresight to buy the stock now.

Figure 5. Source: WarriorsWorld.net

Under Armour has shown the ability to identify and endorse up-and-coming athletes, including Stephen Curry, Jordan Spieth, Clayton Kershaw, Bryce Harper, and Memphis Depay. These endorsers will allow the company to grow its revenue in multiple sports as the company continues to focus on leisurely athletic footwear and apparel, while also continuing to focus on its technologically advanced athletic equipment. At this price level, the I Know First algorithm is bullish on Under Armour for the 3-month and 1-year time horizons, with a bullish algorithmic forecast over that time.