Why Xilinx Is A Great Value Stock

Summary

- Xilinx’s stock price has fallen over the last year because of stagnant revenue growth, largely due to unforeseen headwinds.

- The company’s product offerings and financial health are incredibly strong, however, and revenue growth should begin by 2017 at the latest.

- Management has emphasized the company’s priority of returning value to shareholders, and recently increased the dividend for the 10th straight year.

- We believe that now is a perfect time to buy shares in the semiconductor company.

Xilinx Inc. (Nasdaq: XLNX) is the world’s largest fabless semiconductor company founded in Silicon Valley in 1984., and is subject to the same industry cycles as its rivals. After experiencing massive growth throughout the last decade in revenues, it has now tapered off over the last few years. This happens constantly in the semiconductor market, as companies overinvest when prices are good, causing an oversupply and prices fall. While market factors are harming the company’s short-term performance and outlook, the company is still financially healthy.

While Xilinx had experienced massive revenue growth, it has now tapered off, and the stock price has suffered because of it. Over the last year, the stock price has fallen over 20%, as projected revenue increases have not come to fruition. Some headwinds have played a part in stagnant revenue growth, but Xilinx is still an extremely strong company that is very attractive for investors seeking a reliable dividend stock. The semiconductor company is a technological leader in its field, has maintained robust gross margins over the last few years, and does an outstanding job of returning value to its shareholders.

Disappointing Top Line Returns

Xilinx reported its most recent earnings information on January 21st, and revenue figures were disappointing for investors. Sales of $593.5 million were actually up 1% from the same quarter the previous year, but they fell 2% sequentially and missed analysts’ estimates of $617 million. CFO Jon Olson explained that the revenue figures were harmed by a decline in wireless sales, which were impacted by weaker sales from non-China regions. Broadcast sales also declined because of weak purchasing activity from a couple of large customers.

The semiconductor company has not projected a turnaround in revenue for the current quarter, either. CEO Moshe Gavrielov summed up the company’s expectations for 2016 as planning for a flat to low rate growth environment. Xilinx is facing headwinds from aerospace and defense due to normal seasonality and program-related timing. Besides the expected declines in aerospace and defense, the company is facing uncertainty in global communication spending. The stock price fell 6% after the announcement, and concerns over the top line have held the stock price back.

Why Long Term Investors Should Buy This Stock

One of the main bright spots for Xilinx last quarter was the performance of its 28-nanometer products. This product, along with Xilinx’s early lead in technology for its 20nm and 16nm products, makes the company arguably the current technological leader in the semiconductor market. Its standing as a market leader in technology puts the company in good position to start growing revenue in the future, especially once the headwinds the company is currently facing subside.

During the December quarter, 28nm sales increased nearly 20% sequentially. This growth is extremely promising because this node is very early in its lifecycle, which is expected to be longer and have a higher peak than any of the company’s previous product nodes. Xilinx expects that this node will grow more than 30% in fiscal year 2016, which will already be a record for revenue of any of its previous products.

This is especially exciting considering how the majority of the revenue from this product is still to come in the future. So far, the 28nm node earns its revenues through the Wireless, as well as Test & Measurements and Consumer, markets. The node is now starting to be used for other markets, such as Automotive and Wired, which will increase revenues, and it will additionally be used for other fields like Broadcast further down the road.

Starting in 2017, if not earlier, the success of the 28nm will cause revenues for the company to grow from its current levels of roughly $2.4 billion, where it has been for the past few years. The company is also about a year ahead of its competitors in the 20nm node. Xilinx is the first semiconductor company to reach quality production for this node, which will complement the 28nm node well. When these products cause revenue to grow, the stock price will surely increase, as the company’s health is outstanding.

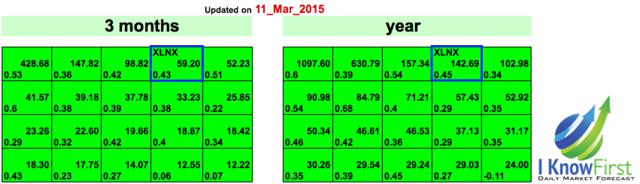

(click to enlarge) Figure 1. 5 Year Graph Of XLNX Gross Margins Compared To Main Rivals.

Figure 1. 5 Year Graph Of XLNX Gross Margins Compared To Main Rivals.

Xilinx’s gross margins have continued to be extremely strong even as its top line has been sluggish. Xilinx has had market leading gross margins of 68 to 70% over the last few years, and that continued during the last quarter. Its gross margin of 69.7% was at the high end of this range. Operating income of 32% was also better than expected, as the company’s operating expenses were only $224 million, $6 million less than expected. These income figures contributed to rather strong earnings per share of $0.62.

Looking ahead to 2016, headwinds will likely keep revenue flat, but the gross margins will continue to lead the industry. Along with the eventual revenue growth as a result of Xilinx’s products and the lower stock price caused by headwinds the company is currently facing, now would be a good time to buy the stock. What puts it over the top and should cause every investor to add it to their portfolio is the company’s commitment to return value to its shareholders.

The company’s strong profit margins help it have a strong balance sheet and cash flow, giving the company the financial flexibility to undertake shareholder-friendly initiatives. Xilinx recently announced a hike to its quarterly cash dividend, increasing it 2 cents to 31 cents per share. The yearly dividend payout of $1.24 per share reflects a dividend yield of roughly 3%. And this dividend yield will grow further in the future, as the company has increased its dividend every year since the company started paying a dividend of 5 cents per share in fiscal 2004. This represents a compounded annual growth of 18%.

Figure 2. 10-Year Graph Of XLNX Dividend Growth.

The dividend is the first part of the company’s strategy to return value to shareholder, and share buybacks are the second. During the first three quarters of fiscal 2015, Xilinx returned approximately $476 million to investors in share buybacks, along with the $230.6 million it paid out in dividends. Moreover, Xilinx has repurchased approximately $1.8 billion in common stock since 2010. Amazingly, the company has returned roughly 100% of its operating cash flow over the last 10 years to investors, including about 120% of the operating cash flow from the first three quarters of fiscal year 2015.

Algorithmic Analysis

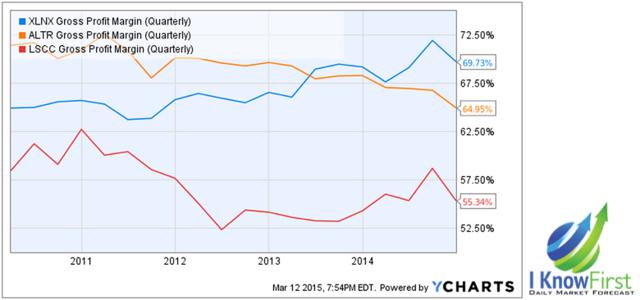

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

The signal represents the predicted movement direction or trend, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength with strongest up signals at the top, while down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal and red indicates a negative signal. A deeper color means a stronger signal and a lighter color equals a weaker signal.

The predictability indicator measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically the predictability ranges from minus one to plus one. The higher this number is the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

Figure 3. Algorithmic Analysis of XLNX For 3-Month And 1-Year Time Horizons.

The algorithmic forecast for Xilinx is very bullish, with strong signal strengths of 59.20 and 142.69 in the 3-month and 1-year time horizons, respectively. The rather bullish outlook from the algorithm makes sense considering how the stock price has fallen drastically over the last year. The price decrease is only because of current market headwinds, and the company’s financial health and business plan are both exceedingly strong. What makes the company truly attractive to investors, though, is its solid commitment to returning value to its shareholders. The company’s executive team continues to stress this importance whenever given the chance, and its confidence in its future means the company is sure to continue to increase its dividend and a further increase in shareholder value.

I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Aaron Tallan. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.