With Turnaround Complete, Lululemon Is Bullish Based On Revenue Growth

Summary

- Lululemon has bounced back from its tumble in 2014 after a solid fourth quarter earnings report.

- Gross margins have been squeezed in the past few years, but will soon turn around and the cause is easily explainable.

- Revenue has ample room to increase as the athleisure trend continues to grow in popularity and the company is extremely popular with young females.

- We are bullish on Lululemon in the one-month and three-month time horizons.

Over the past six months, the stock price of Lululemon Athletica Inc. (NASDAQ: LULU) has increased 41%. This comes after the company had a rough 2013, having to recall many of their products and company founder and former CEO Chip Wilson not handling the resulting blowback well.

The current leadership team has done a good job of turning the company around, but some negative factors could have investors worried, such as falling profit margins. However, these issues are easily addressed, and Lululemon is currently bullish as revenue will continue to grow, the athleisure trend continues to gain popularity, and the valuation is not as high as it seems.

Falling Profit Margins Are Fine, Temporary

During the past fiscal year, Lululemon’s gross profit margins fell to 50.9% from 52.8% in the previous fiscal year. This is the third straight year that the company’s profit margins fell, as gross margins were 56.9% in fiscal 2012. Investors should obviously take note of this troubling sign, but by looking deeper, it becomes clear it is not worthy of concern.

One of the main culprits for the decreasing gross margins was the costly recall the company had to make in 2013. Problems in the supply chain led to the recall, and Lululemon has invested heavily to address the operational issues since then. This heavy investment has paid off, as gross margins should start stabilizing during the current quarter.

There are some other headwinds that the company is still facing, such as currency fluctuations. A shutdown at multiple West Coast ports have also harmed profit margins, as it increased the cost of shipping and caused a slower flow of inventory to sales. While this port standoff is now over, it could continue to have an effect due to a backlog.

These factors might continue to hurt gross margins in the short-term, but overall, they should start turning around during the upcoming quarters. The supply chain investments will help going forward, as will decreased airfreight costs as a result of continued operations at the West Coast ports.

More importantly, the company continues to roll out new stores, which increases occupancy costs. Lululemon opened 48 new stores during the past fiscal year, with 13 of them being opened during the fourth quarter. These stores will start making revenue during the upcoming year, helping margins balance out. While margins might be hurt in the short term, it will help drive growth that makes the company a good value.

Revenue Grows As Athleisure Becomes More Popular

During the most recent quarter, revenue increased 15.6% from the year earlier period to $602.5 million. This included a 6% increase in same-store sales during the quarter. This trend should continue going forward after the company worked to solve the issues that arose in 2013.

Lululemon helped start the athleisure movement with their yoga pants, which are extremely popular with young females. Instead of wearing denim or other products, people are now wearing athletic clothes for nonathletic activities. For example, girls wear yoga pants to go to class, workout, and then to go out and grab some drinks.

This movement has become mainstream, with designers like Alexander Wang and Tom Ford embracing the trend during the past few quarters. Lululemon is positioned to take advantage of the growing trend it helped create, as the company is making a comeback with teens.

A Piper Jaffray survey of teens found that “athletic-leisure, preppy, leggings and jogging pants are among the top teen fashion trends.” Lululemon, after not appearing in the 2014 survey, was the number three favorite of upper-income teens in activewear, and was the number one uptrending brand for teens.

Besides the brands core product’s popularity, the company is also making progress in new fields to continue revenue growth in the future. The men’s business grew 16% during the past quarter, driven by a strong response to its ABC pants. The pants look like normal casual wear, but provide more comfort for active people.

Figure 1. Source: Business Insider. ABC Pants For Men.

Even more impressive, the Ivviva brand had sales growth of 51% during the most recent quarter, and 13% for the fiscal year. The brand targets girls ages four to 14, providing athletic wear for a younger generation. The large growth in this segment is a good sign, as it provides another driver of revenue growth while exposing young females to the company’s product, potentially turning them into customers of its yoga pants in the future.

A further driver of potential revenue growth in the future is international expansion. During the earnings call after the most recent earnings call, CEO Laurent Potdevin claimed that the international business could eventually exceed revenues from North America. The company plans to ramp up this business, and aims to have 20 stores in both Asia and Europe by the end of 2017.

The Stock Is Currently A Good Price To Buy

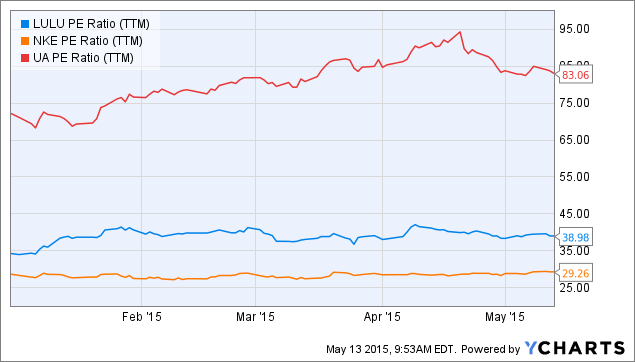

Even though the stock price has jumped over 40% in the last six months, the company’s valuation is still good and attractive for investors. Lululemon currently has a TTM P/E ratio of just over 39. This might sound like a fairly high ratio considering the current pressure on margins, but is actually pretty impressive when compared to some of its peers.

Figure 2. Source: Y Charts. TTM P/E Ratio For Lululemon Compared To NKE and UA.

When compared to Nike, Inc. (NYSE:NKE) and Under Armour, Inc. (NYSE:UA), the valuation looks like a bargain. The company has much more room to grow than Nike, obviously due to Nike’s more mature business, and is traded at a major discount compared to Under Armour.

Analysts agree that the stock is currently undervalued, as many have recently weighed in on the stock. Analysts from Sterne Agee CRT upgraded the stock, giving it a price target of $77. Analysts at RBC Capital also recently initiated coverage of the stock. The firm gave the stock an “outperform” rating and also set a price target of $77. Currently trading at $64.23, this represents solid upside for the stock.

Algorithmic Analysis

I Know First supplies financial services, mainly through stock forecasts via our predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The algorithm has more data to forecast within the long term and, naturally, outputs a more accurate predication in that time frame. Having said that, intraday traders, along with short-term players, will also benefit by taking the algorithmic perspective into consideration.

The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

Having explained the algorithm, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company.

Figure 3. Algorithmic Forecast For Lululemon.

Lululemon has solid signal strengths of over 35 in both the one-month and three-month time horizons, indicating the algorithm believes the stock is currently undervalued. Profit margins will stabilize during the upcoming quarters before turning around due to spending on improving the supply chain. Revenue will continue to grow due to the athleisure trend, while the company adds to this revenue growth with its men’s and Ivviva brands. The turnaround performed in 2014 is remarkable, and I would recommend buying this stock while it is still relatively cheap.

I Know First Research is the analytic branch of I Know First, a financial start up company that specializes in quantitatively predicting the stock market. This article was written by Aaron Tallan. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.